In today's competitive business landscape, efficient expense management is the key to financial success. By tracking and controlling expenses diligently, businesses can gain valuable insights into their cash flow, identify areas for cost optimization, and make informed decisions that drive growth.

Tally, a leading accounting software, offers a comprehensive suite of features to streamline expense management processes and enhance financial efficiency. By automating accounting tasks, providing real-time insights, and ensuring compliance, Tally empowers businesses of all sizes to take charge of their finances and achieve their financial goals.

In this blog post, we will explore the critical significance of expense management and how Tally can be leveraged to streamline financial workflows and drive business success. We will also delve into the key features of Tally for expense management and how they can benefit businesses of all sizes.

Understanding Expense Management

Expense management is the process of tracking, controlling, and optimizing the various costs incurred by a business in its day-to-day operations. It involves identifying, recording, and categorizing expenses, as well as developing and implementing strategies to reduce costs and improve financial efficiency.

Why is expense management important?

Effective expense management is essential for businesses of all sizes, regardless of industry or location. It helps businesses to:

- Improved financial stability: By tracking and controlling expenses effectively, businesses can ensure that they have enough cash flow to meet their financial obligations. This helps to avoid financial distress and bankruptcy.

- Reduced costs: By identifying and implementing cost-saving measures, businesses can save money without sacrificing quality or productivity. This can lead to significant savings over time.

- Improved decision-making: Real-time insights into expenses can help businesses make informed decisions about their operations, investments, and growth strategies.

- Increased profitability: By reducing costs and improving financial efficiency, businesses can increase their profitability.

Expense Management Process

The expense management process typically involves the following steps:

- Identify expenses: The first step is to identify all of the expenses that a business incurs. This can be done by reviewing financial statements, bank statement entries, and credit card statements.

- Record expenses: Once expenses have been identified, they need to be recorded accurately and completely. This can be done manually or using an accounting software program.

- Categorize expenses: Expenses should be categorized into specific groups, such as travel, office supplies, and utilities. This helps to track spending patterns and identify areas for cost optimization.

- Analyze expenses: Once expenses have been categorized, they should be analysed to identify trends and patterns. This can help to identify areas where costs can be reduced.

- Develop and implement cost-saving strategies: Based on the analysis of expenses, businesses can develop and implement strategies to reduce costs and improve financial efficiency.

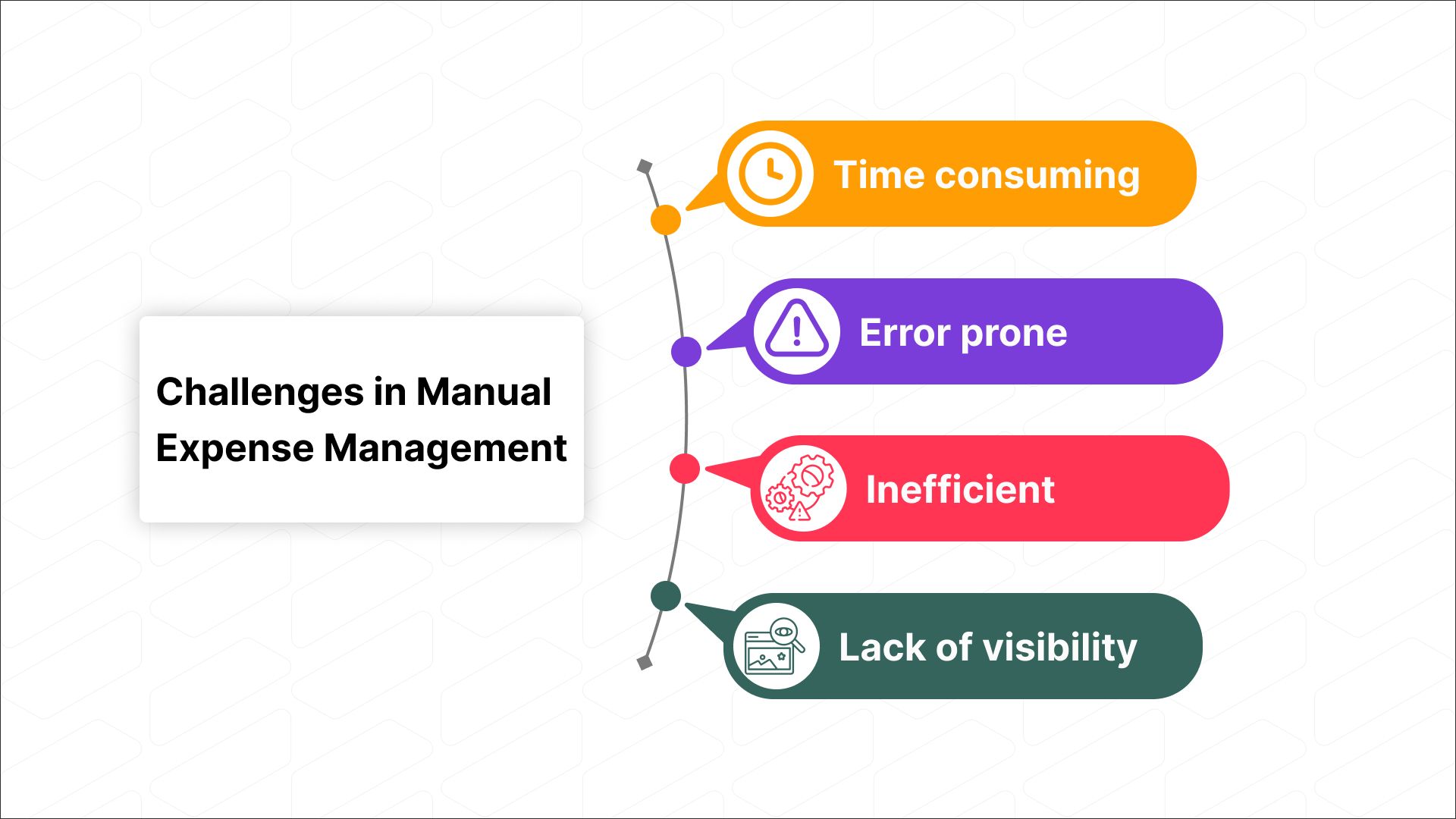

Challenges in Manual Expense Management

Manual expense management is the traditional approach to tracking and managing expenses. It involves using paper-based receipts, spreadsheets, and email to record and process expenses. While manual expense management can be effective for small businesses with limited transactions, it can be time-consuming, error-prone, and inefficient for businesses of all sizes.

Some of the key challenges of manual expense management include:

- Time-consuming: Manual expense management can be very time-consuming, especially for businesses with a high volume of transactions. Employees need to manually collect, record, and categorize expenses, which can take away from their core job duties.

- Error-prone: Manual expense management is prone to errors, such as data entry errors, miscalculations, and lost receipts. These errors can lead to inaccurate financial reports and costly mistakes.

- Inefficient: Manual expense management can be inefficient, especially for businesses with multiple employees and departments. Approvals can get lost in the shuffle, and reimbursements can take a long time to process.

- Lack of visibility: Manual expense management can make it difficult to gain real-time visibility into spending patterns and identify areas for cost optimization.

The Role of Tally in Expense Management

Tally is a comprehensive accounting software program that offers a wide range of features for expense management. It can help businesses of all sizes to automate expense recording, categorize expenses, generate reports, and budget for future expenses.

Key Features of Tally for Expense Management

Tally offers a wide range of features that can help businesses effectively manage their expenses. Some of the key features include:

- Expense categorization: Tally allows users to categorize their expenses into different categories, such as travel, marketing, and salaries. This makes it easy to track and analyze spending patterns over time. For example, a business owner can use this feature to identify which marketing campaigns are the most effective or which departments are overspending on travel.

- Budgeting: Tally can be used to create and manage budgets for different departments and projects. This helps businesses stay within their spending limits and avoid overspending. For example, a sales manager can use this feature to create a budget for their team's travel expenses and then track their spending against that budget.

- Expense reporting: Tally offers a variety of expense reports that can be used to track and analyze spending in detail. These reports can be used to identify areas where costs can be reduced and to make more informed financial decisions. For example, an accountant can use this feature to generate a report that shows how much the company is spending on different types of insurance and then identify areas where they can negotiate lower rates.

- Integration with other accounting software: Tally can be integrated with other accounting software, such as payroll and CRM systems. This helps to streamline business processes and improve data accuracy. For example, a business can integrate Tally with its payroll system to automatically create and submit expense reports for employees.

Also Read: Best Accounting & Auditing Automation Tool for Indian Tax Professionals

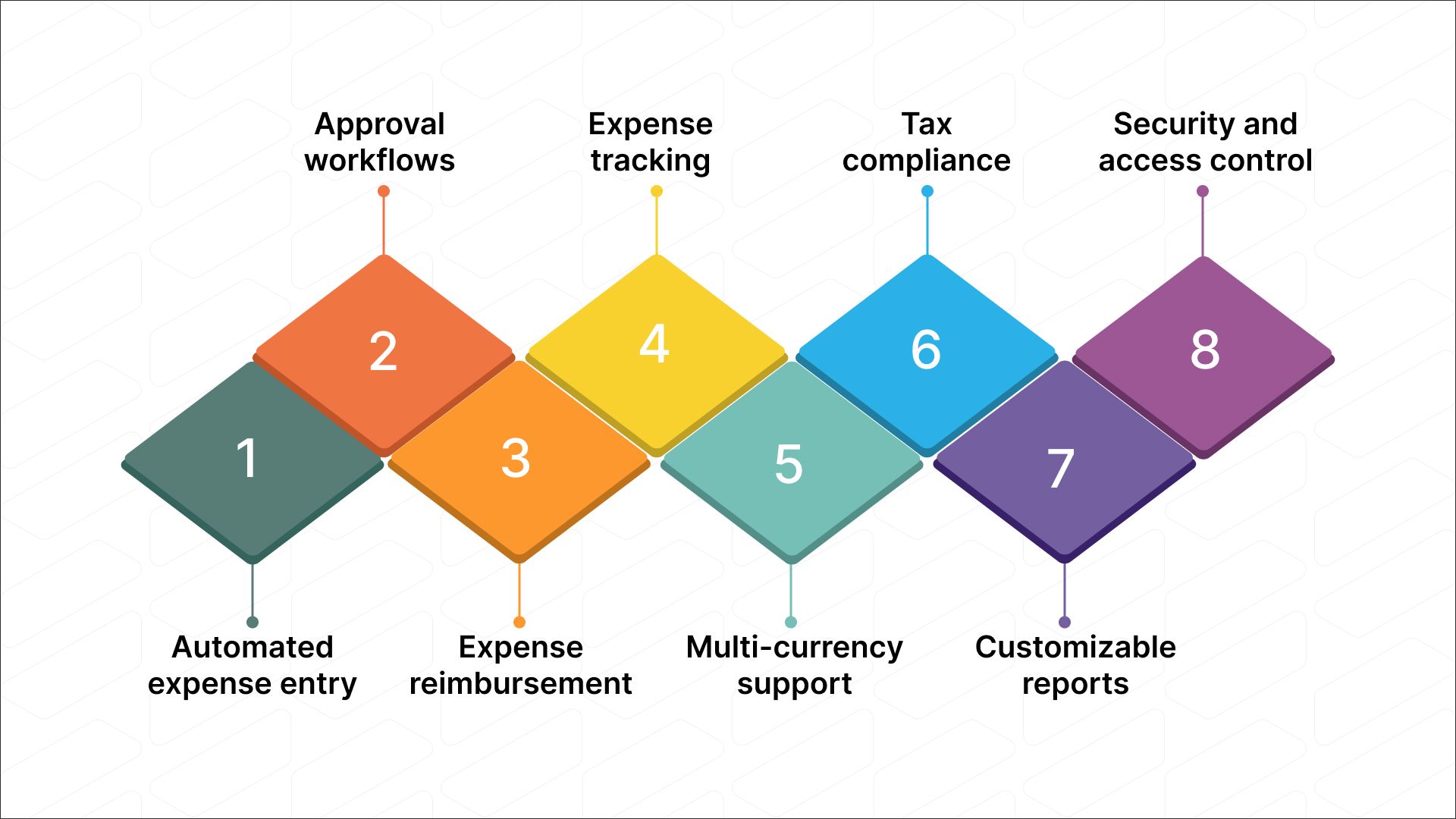

How Tally Streamlines Expense Management

- Automated expense entry: Tally can be used to automate the entry of expenses, such as recurring bills and employee travel expenses. This saves time and reduces the risk of errors. For example, a business can set up Tally to automatically create and submit an expense report for a monthly rent payment.

- Approval workflows: Tally can be used to create approval workflows for expenses. This helps to ensure that expenses are properly authorized before they are paid. For example, a business can set up a workflow that requires all expenses over a certain amount to be approved by a manager.

- Expense reimbursement: Tally can be used to reimburse employees for their expenses. This can be done automatically or manually. For example, a business can set up Tally to automatically reimburse employees for their travel expenses when they submit their expense reports.

- Expense tracking: Tally provides real-time expense tracking, so businesses can see how much they are spending and where their money is going. This helps businesses to stay on top of their expenses and avoid overspending. For example, a business owner can use this feature to see how much they are spending on marketing each month and then make adjustments to their budget as needed.

In addition to these key features, Tally also offers a number of other features that can help businesses manage their expenses more effectively, such as:

- Multi-currency support: Tally supports multiple currencies, making it easy for businesses to manage their expenses in different countries.

- Tax compliance: Tally helps businesses to comply with complex tax laws and regulations.

- Customizable reports: Tally offers a variety of customizable reports that businesses can use to track their expenses in the way that best meets their needs.

- Security and access control: Tally offers a variety of security and access control features to protect businesses' financial data.

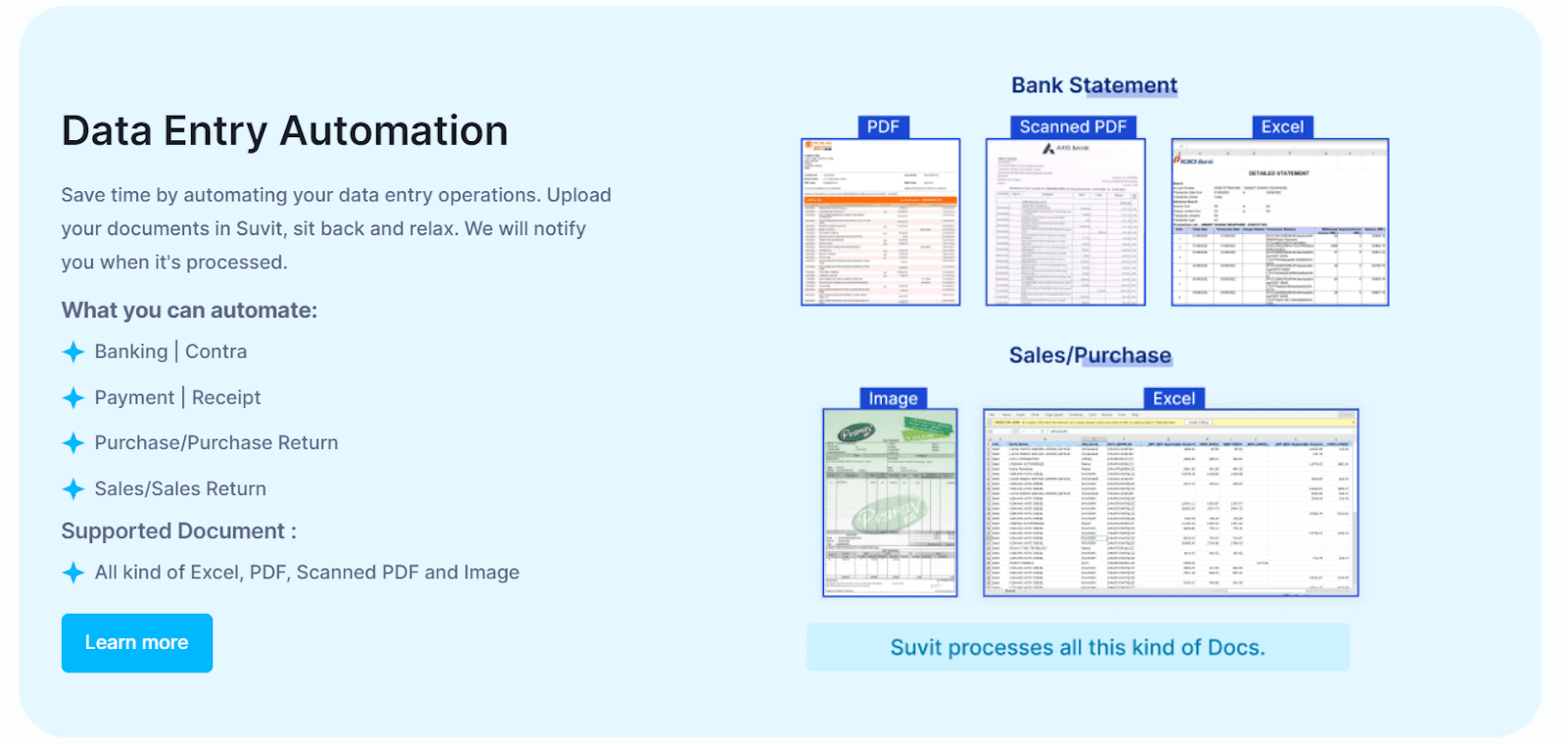

Automate and Improve Your Tally Game With Vyapar TaxOne

Vyapar TaxOne is an AI-powered accounting automation software that helps businesses automate their accounting tasks, including data entry, reconciliation, and reporting. It can be integrated with Tally, a popular accounting software used by businesses in India, to automate the entire accounting process.

Here are some ways that Vyapar TaxOne can help automate Tally accounts:

- Import data from Excel, PDFs, and scanned PDFs to Tally: Vyapar TaxOne can directly import data from Excel, PDFs, and scanned PDFs into Tally, eliminating the need for manual data entry. This can save businesses a significant amount of time and effort, and also reduce the risk of errors.

- Automate journal entries: Vyapar TaxOne can automatically create journal entries in Tally based on data imported from Excel, PDFs, or scanned PDFs. This can save businesses even more time and effort, and also ensure that their accounting records are always up-to-date.

- Reconcile bank statements: Vyapar TaxOne can automatically reconcile bank statements in Tally, identifying and correcting any discrepancies. This can help businesses to save time and ensure that their financial records are accurate.

- Generate reports: Vyapar TaxOne can generate a variety of reports from Tally data, including profit and loss statements, balance sheets, and cash flow statements. This can help businesses to track their financial performance and make informed decisions.

Here are some specific examples of how Vyapar TaxOne can be used to automate Tally accounts:

- A business can use Vyapar TaxOne to automatically import their bank statements into Tally, which will then automatically create journal entries. This would eliminate the need for the business to manually enter their bank transactions into Tally.

- A business can use Vyapar TaxOne to automatically reconcile their bank statements in Tally, which would help them to identify and correct any discrepancies. This would help the business to ensure that their financial records are accurate.

- A business can use Vyapar TaxOne to generate a variety of reports from Tally data, such as profit and loss statements, balance sheets, and cash flow statements. This would help the business to track their financial performance and make informed decisions.

Also Read: A Guide to Managerial Accounting and the Ways It Can Streamline Your Business

Ready to streamline your expense management and take charge of your finances?

Effective expense management is essential for businesses of all sizes. By tracking and controlling expenses effectively, you can maintain financial stability, identify cost-saving opportunities, make informed decisions, and improve profitability.

By automating repetitive tasks, providing real-time insights, and ensuring compliance, Tally empowers you to take charge of your finances and achieve financial goals.

However, manual expense management tasks can still be time-consuming and error-prone, even with Tally. Vyapar TaxOne, an accounting automation tool, can help you further streamline your expense management processes and improve efficiency.

Vyapar TaxOne can automate a variety of Tally tasks, such as data entry, expense categorization, bank reconciliation, and GST compliance. This can free up employees to focus on their core job duties and improve the overall efficiency of expense management workflows.

If you are looking to take your expense management to the next level, try Vyapar TaxOne today for free and experience the benefits of accounting automation!