No manual entry required!

Every Month-end or Quarter-end, accountants must collect bank statements and details about all the transactions from their clients.

Clients hand over more information in pdf, images, excel files, or hard copies. Once the accountants get all the details, they manually do bank statement entries in Tally.

Bank Statements are summary of financial transactions which have been recorded over a specific period.

Traditionally, Bank statements were printed on papers and bank statements were mailed directly to the account holder.

Over a period of time, there has been a shift towards paperless, electronic statements! So now you can get your bank statements as an e-statement or you can download them from the respective accounting software of the bank.

The Process of Bank Entry in Tally is based on ⤵

The traditional way of bank statement entries in tally is boring! 🥱

At the same time, it wastes your time and effort.

You can do the same process with automation in 80% less time.

With its advanced technology, automated accounting software reduces all your repetitive clerical work. You can replace all the manual work with automation.

How Can Vyapar TaxOne’s Tally Automation Do Bank Entries in Tally?

Vyapar TaxOne uses AI and Deep Machine Learning concepts to automate the whole process.

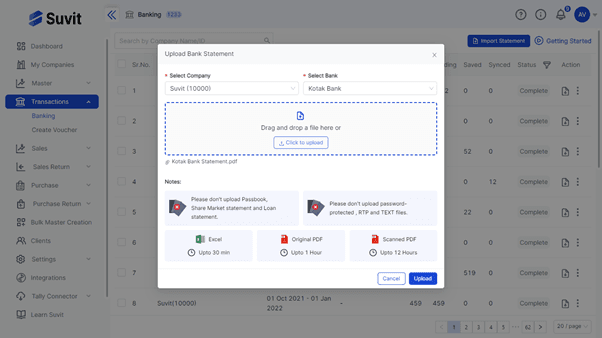

With the help of advanced technology, Automation software can directly fetch the text and numbers from the image, pdf, or excel.

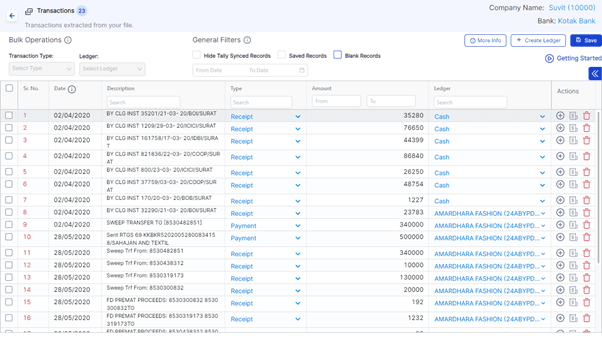

The software will bring all the data, you just need to specify a ledger, and once it is done, you’re good to go!

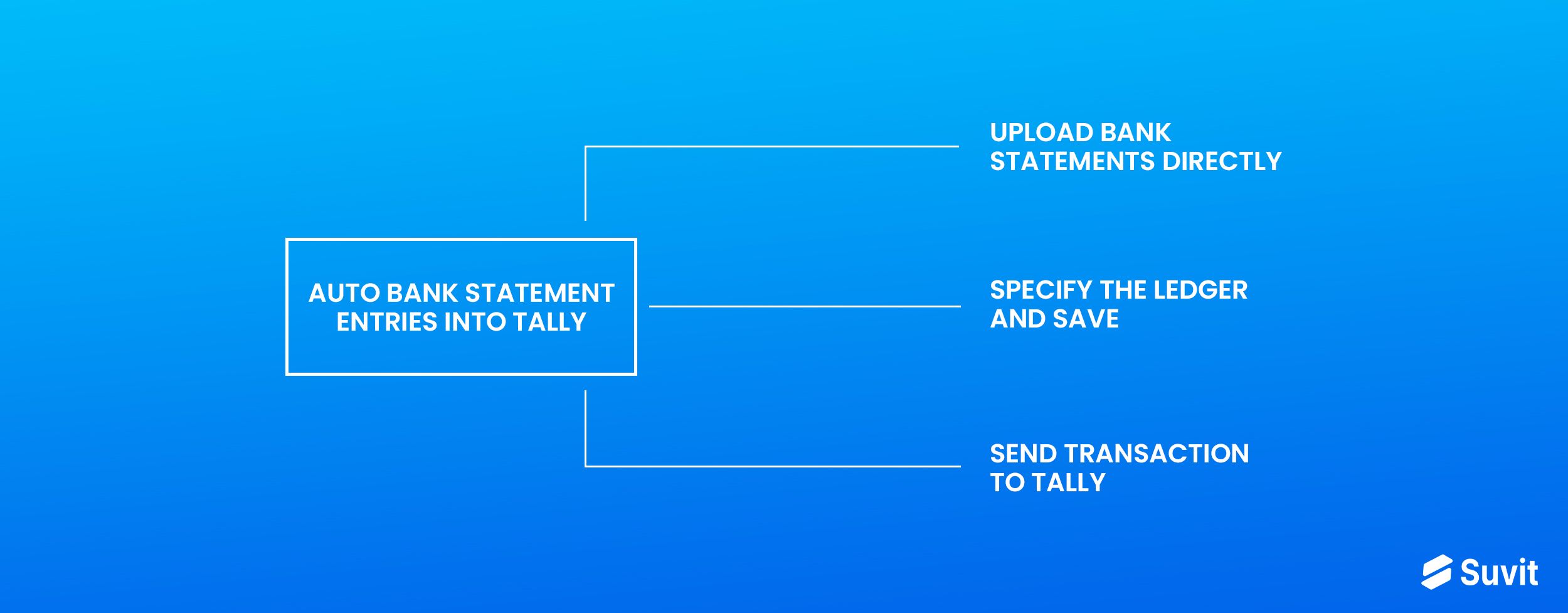

How can you automatically transfer bank statement entries to Tally with Vyapar TaxOne?

With a month of research and technology expertise and integrating various accounting and tax programs into a single office environment, Vyapar TaxOne has initiated a Tally automation for bank entries.

With Vyapar TaxOne,

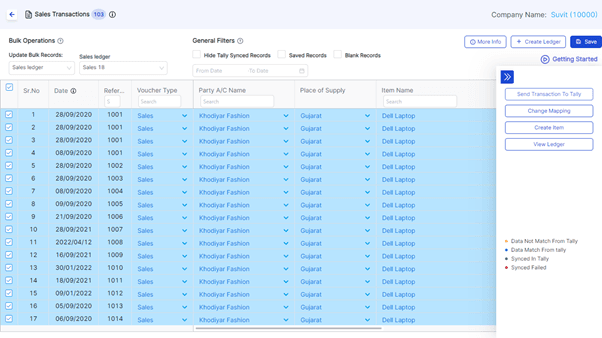

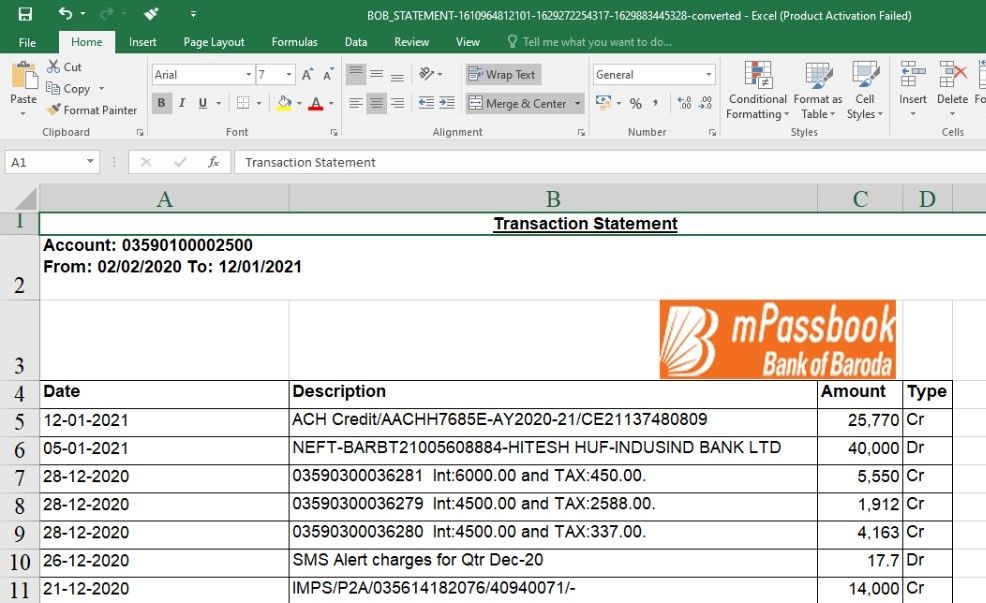

1. Upload your bank statement in PDF, Scanned PDF, or Excel format.

2. Assign ledgers and create a new ledger if needed.

3. Save all the changes

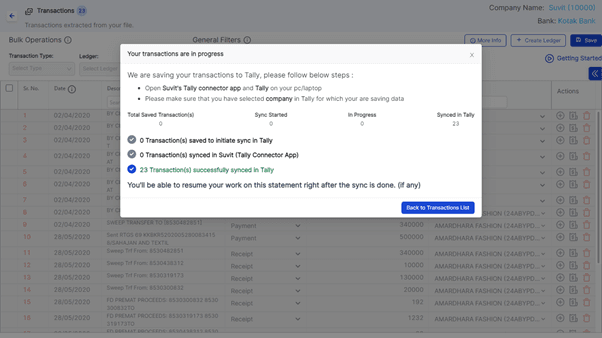

4. Send Transaction to Tally

Yay! It’s done in 4 easy steps with minimal human effort. 🤖 Know more.

Benefits of Auto Bank Statement Entry In Tally

Apart from saving time and human effort, there are other benefits of auto bank statement entry in tally too.

-

Accountants do not have to worry about hard copies of the client’s data. They can directly ask for the bank statements digitally.

-

No need to assign the ledger individually.Assign the ledger to multiple entries simultaneously by searching for a typical pattern.

-

Zero Errors! Automated accounting software is made using advanced technology to capture the data from the documents that guarantee 100% accuracy.

-

No need to have data entry specialists in the office. An accountant can only do it by himself. It saves money too!💸

Read More: Top 5 Benefits Of Data Entry Automation For Freelance Accountants

Why Choose Vyapar TaxOne?

Vyapar TaxOne reduces all your clerical work by automating most of the accounting work.

When using Vyapar TaxOne,

- You won’t need to hire more people for data entry jobs.

- Save money to invest in a larger office space with more people.

- Go error-free!

- No need to enter repetitive data. AI and machine learning concepts will automatically fetch those data.

- You can make data-driven decisions from data analytics.

- Access data remotely and share controlled access with your team members.

If you want to avail all these benefits, give automation accounting a try!

FAQs

1. What is a bank statement entry?

A bank statement entry is usually a list of all the transactions for a bank account over a certain period of time, Usually a month. These statement entries can be deposits, charges, withdrawals and the balance of your bank account.

2. What is Contra entry?

This entry is recorded when debit card and credit card both affect the same parent bank account and that results in a zero effect in an account.

3. What is the excel format for bank statements?

You can upload any bank statement in excel format but make sure the bank statement should have headers with mandatory fields (Date, Description ,Type ,Amount, Balance).

4. How can I add bank account details in Tally prime?

Press Alt+O (Import)> Bank Details. The Import Bank Details screen opens. Specify the File path and the File to Import (Excel). Press Enter to import the beneficiary details.