Managing share market transactions efficiently is a critical task for CAs in India, especially when handling stock purchases from platforms like Zerodha.

With the increasing complexity of financial data and regulatory requirements, CAs must ensure that clients' stock transactions are accurately recorded in Tally.

In this blog, we will explore how to post Zerodha purchase share market entries in Tally.

This process ensures compliance with regulatory frameworks, such as GST and SEBI, while improving the accuracy and efficiency of financial reporting.

Whether you're a Chartered Accountant managing individual portfolios or handling multiple clients, this guide will provide practical insights for smooth integration.

Understanding the Challenges of Recording Share Market Entries

Data Complexity and Manual Entry Risks

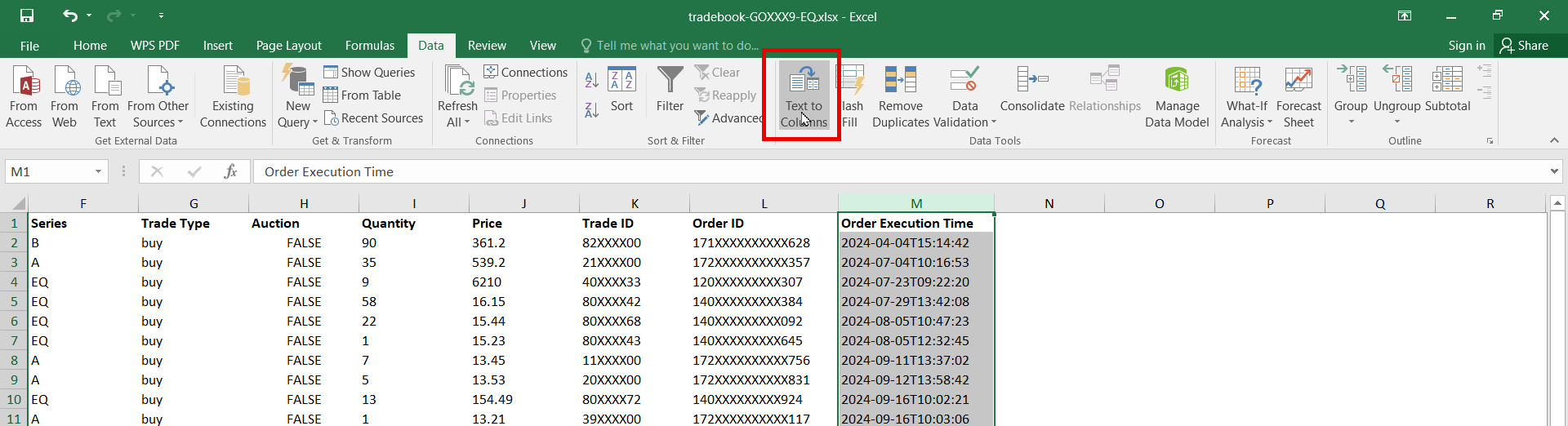

Zerodha provides its users with detailed trade data in an Excel format, which can be overwhelming for CAs who need to post these entries into Tally. These reports, which include information such as order number, execution date, stock names, and prices, require proper mapping to Tally’s ledger structure.

The manual entry of this data introduces the risk of human error, which can lead to inaccuracies in financial reporting.

Compliance Concerns

Maintaining compliance with tax regulations like GST and income tax is essential for the smooth operation of share market transactions in Tally. Inaccurate recording can lead to audit issues and may result in penalties or non-compliance with industry standards.

This is particularly relevant for CAs managing investment portfolios for clients in different sectors.

Step-by-Step Guide to Posting Zerodha Purchase Entries in Tally

1. Preparing Data from Zerodha

Accessing and Downloading the Tax P&L Report

The first step in the process is downloading the relevant data from Zerodha.

To do this, Log in to the Zerodha Console (console.zerodha.com), go to Reports > Tradebook, select the segment and date range, then click the arrow to load the report.

Next, click the Download button next to the XLSX or CSV icons to save the tradebook in your preferred format. This report provides important details like stock name, ISIN, quantity, Exchange, and order ID etc tabs. These details will be essential for correctly posting the entries in Tally.

Key Data Points to Focus On

Ensure the data includes the following key components:

- Order ID: To link the purchase with specific transactions.

- Stock Name and ISIN: To identify the stock in the ledger.

- Quantity and Price: The number of shares purchased and their respective price.

2. Configuring Tally for Stock Market Entries

Set Up the Company in Tally

To begin posting Zerodha purchase entries in Tally, ensure that the company setup allows for both "Accounts with Inventory" and "Maintain Stock" options. These settings will enable Tally to track stocks and manage financial transactions related to them.

Ledger Creation

Proper ledger creation is fundamental for organizing stock market entries in Tally. The following ledgers should be created:

- Investment Ledgers: Create separate ledgers under the 'Investments' group for each stock purchased. This will help you track each stock’s transactions.

- Expense Ledgers: Set up expense accounts for brokerage, stamp duty, and GST. These ledgers will help in accurately recording any charges associated with the stock purchase.

- Tax Ledgers: Ensure you create separate ledgers for GST and other taxes applicable to stock market transactions.

Inventory Configuration

In Tally, stock items must be defined for each stock purchased. Ensure that the "Maintain Stock" and "Maintain Quantity" options are enabled, as this will allow you to track the purchase and sale of stocks in real-time.

3. Importing Data into Tally

Using Tally's Import Feature

Tally offers an import feature that automates the process of importing share market entries. To use this feature:

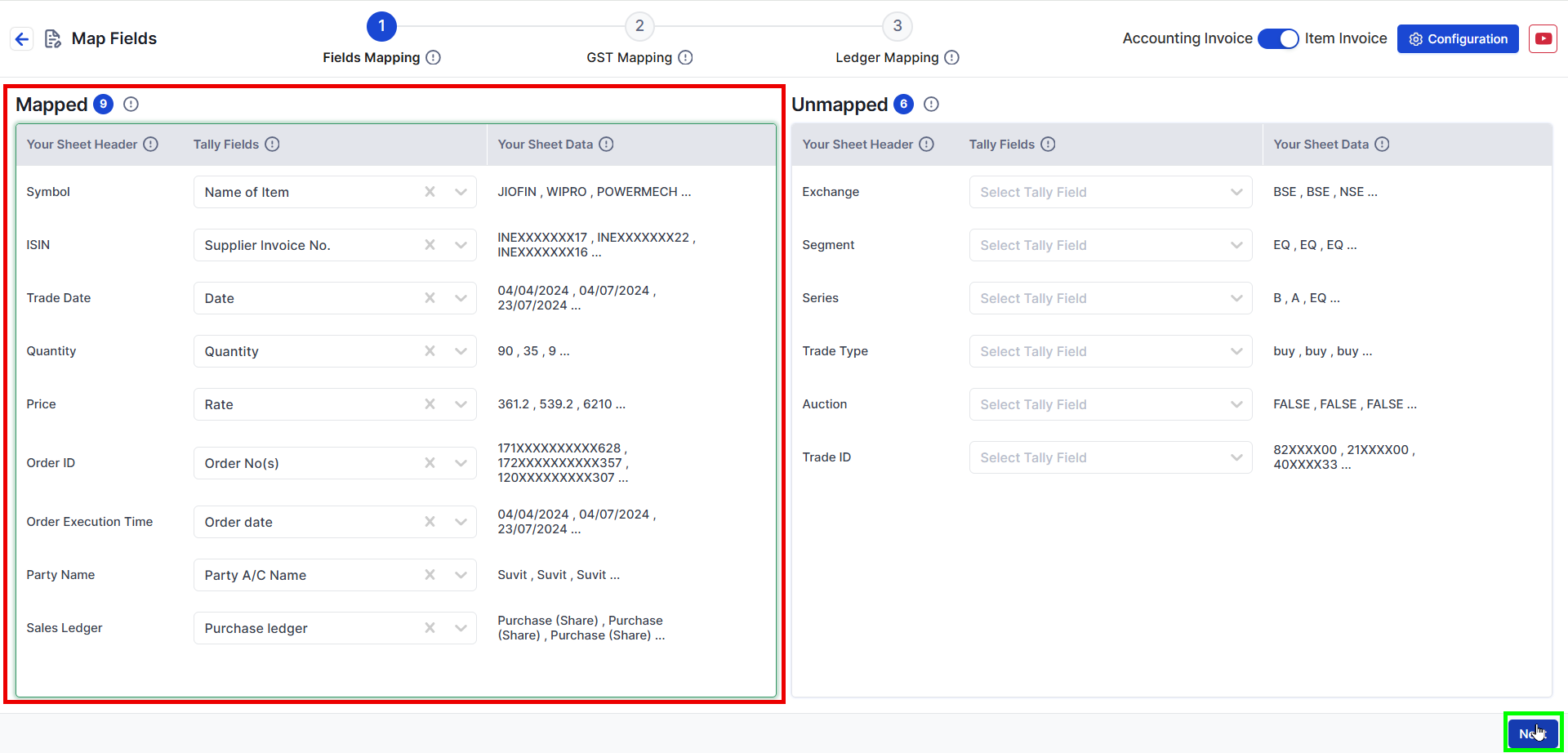

- Mapping Template: Create a mapping template in Tally to match the Excel columns from Zerodha’s report to Tally fields. For example, stock names should align with item names, and dates should match the transaction date in Tally.

- Import Process: Navigate to 'Alt+O' > 'Import' > 'Masters' or 'Transactions', select the Excel file, and use the template to upload the entries.

Third-Party Automation Tools

For more efficiency, use Suvit, which offers automated solutions to import Zerodha data into Tally with minimal manual intervention.

Suvit reduces the likelihood of errors and saves time in the data entry process.

4. Recording Purchase Entries in Tally

Choose the Appropriate Voucher Type

For posting stock market purchases, use the Journal Voucher type in Tally. This type of voucher allows you to record investments and charges in one transaction entry.

Entry Details

When recording the entry, the following details should be included:

- Debit: The stock item (e.g., TATA Steel) with the quantity purchased and the respective price.

- Credit: The bank or demat account from which the payment for the stocks was made.

- Narration: It’s crucial to add a clear narration to the entry. This should include the order number, execution date, stock name, and any associated charges like brokerage.

5. Handling Additional Charges

Recording Brokerage and Taxes

In addition to the stock purchase, several additional charges need to be recorded, including:

- Brokerage: Debit the brokerage expense account, and credit the brokerage payable account.

- GST: Debit the GST expense account, and credit the GST payable account.

- Stamp Duty: Debit the stamp duty expense account, and credit the stamp duty payable account.

These entries ensure that all related costs are accurately accounted for in the financial statements.

Best Practices for Chartered Accountants

Regular Reconciliation

To ensure the accuracy of stock transactions, it’s advisable to perform regular reconciliation of stock holdings and associated expenses. This will help identify discrepancies early and ensure that financial records are always up-to-date.

Maintaining an Audit Trail

Tally allows you to include details like the order number and execution date in the transaction entries, providing a robust audit trail. This is particularly important for compliance and audit readiness.

Client Communication

Chartered Accountants should regularly communicate with clients, providing them with clear, detailed reports about their investment portfolio. This not only ensures transparency but also builds client trust.

Streamlining Zerodha Purchase Entries in Tally for CAs

Recording Zerodha share market purchase entries in Tally can be a streamlined process with the proper steps in place.

By preparing data correctly, configuring Tally appropriately, and using automated tools, Chartered Accountants can save time, reduce errors, and ensure compliance with regulatory standards.

By adopting these practices, CAs can enhance the efficiency of managing share market transactions for clients, ensuring accurate financial reporting and a smoother audit process.

Also Read: Post Groww Share Market Entries in Tally

FAQs

1. How can I import Zerodha purchase data into Tally?

You can import Zerodha purchase data into Tally by downloading the ‘Tradebook’ report from Zerodha, creating a mapping template in Tally, and using the import feature to upload the Excel file. Automation tools like Suvit can streamline this process.

2. What ledgers should I create in Tally for stock market entries?

Create investment ledgers under the 'Investments' group for each stock, and expense ledgers for brokerage, stamp duty, and GST. These ledgers will help track stock purchases and associated costs.

3. Can I automate the process of posting Zerodha purchase entries in Tally?

Yes, third-party tools like Suvit can automate the import and posting of Zerodha purchase entries in Tally, reducing manual data entry and the risk of errors.

4. How do I handle additional charges like brokerage and GST in Tally?

For additional charges, create separate expense accounts for brokerage, GST, and stamp duty. Debit the appropriate expense account and credit the corresponding payable account for each charge.