PwC India recently introduced the Navigate Tax Hub, a cutting-edge platform powered by generative AI to help organizations manage their tax and regulatory functions more efficiently and effectively.

While large-scale firms are transforming their enterprise-level operations, individual Chartered Accountants can also benefit immensely from specialized AI and digital applications.

By leveraging the top 10 practical ICAI applications designed specifically for accounting professionals, every CA can harness technology to automate day-to-day tasks, streamline workflows, and deliver superior client service, all while staying compliant with regulatory standards.

This blog highlights these essential ICAI apps for accountants in India, offering actionable insights into how they address current industry challenges and empower professionals at every scale.

1. Emotion Aware Attendance System

Overview

An AI-driven attendance management system that detects user presence and emotional states during attendance marking. This innovative tool enhances reliability in managing employee attendance by automating the tracking process.

Benefits for Chartered Accountants

- Reduces manual attendance errors and fraudulent reporting.

- Facilitates efficient workforce management in remote or hybrid work settings.

- Ensures transparent and accurate attendance records, vital for audit trails.

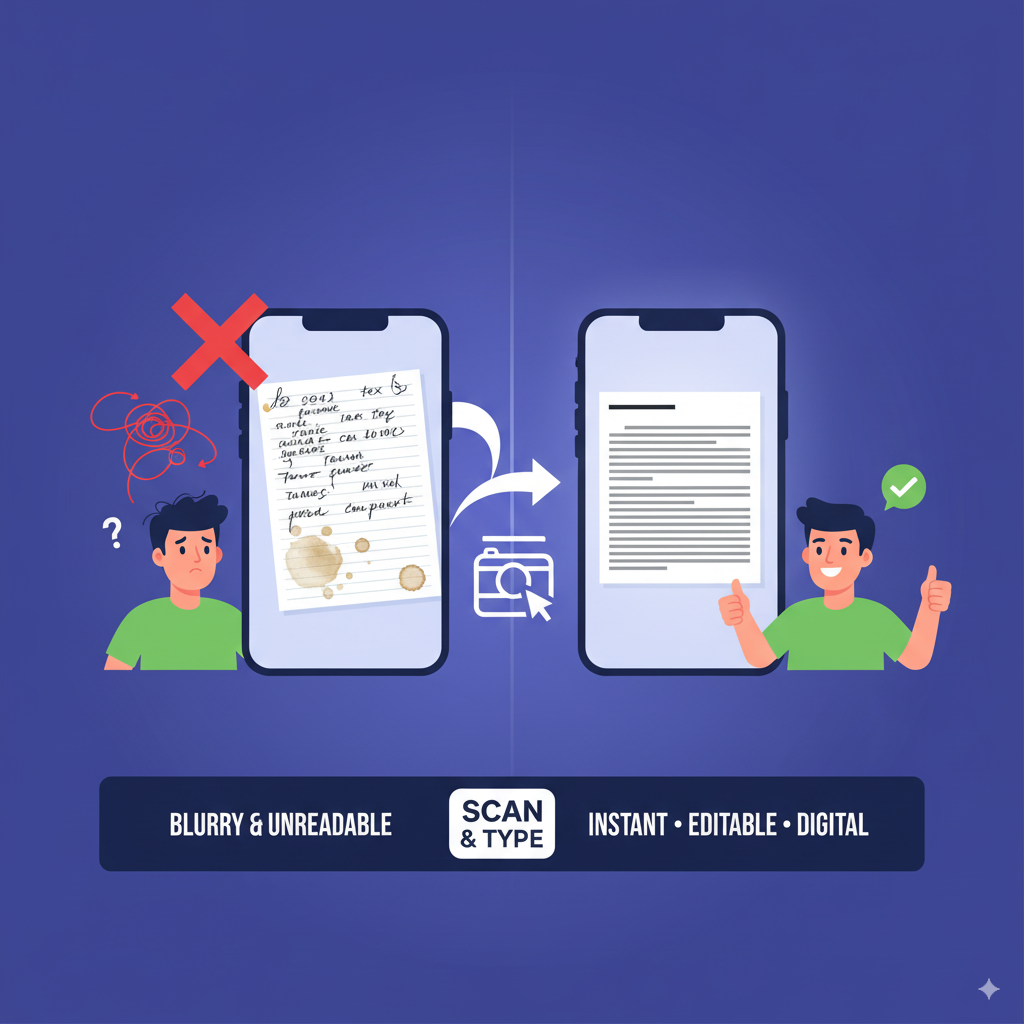

2. Image to Text Generator

Overview

This app converts scanned images or handwritten documents into editable digital text using Optical Character Recognition (OCR) powered by AI.

Benefits for Chartered Accountants

- Streamlines data entry from physical or scanned documents.

- Improves record digitization, making retrieval and audit processes faster.

- Assists in the swift processing of financial documents, invoices, and reports.

3. ITGC Opportunities App

Overview

Focuses on identifying Information Technology General Controls (ITGC) gaps and opportunities within client audits or internal controls evaluations.

Benefits for Chartered Accountants

- Helps ensure compliance with IT control standards critical for audit integrity.

- Enables structured and automated assessment of IT risks.

- Enhances audit scope with integrated IT audit considerations.

4. Inventory MIS Dashboard Tool

Overview

Provides a dynamic dashboard solution for monitoring inventory levels, movements, and value across client businesses.

Benefits for Chartered Accountants

- Real-time insights into inventory metrics aid better advisory and management.

- Reduces discrepancies with automated inventory control reports.

- Supports clients in inventory-intensive sectors by improving data-driven decisions.

5. ITR Tracker App

Overview

Facilitates centralized tracking of Income Tax Return (ITR) filing statuses for multiple clients, integrated with deadline reminders.

Benefits for Chartered Accountants

- Mitigates risk of late filings and penalties through timely alerts.

- Simplifies portfolio management of multiple client returns.

- Enhances client communication and compliance adherence.

6. Invoice Generator

Overview

An app to generate GST-compliant, professional invoices tailored for accounting services and client billing.

Benefits for Chartered Accountants

- Accelerates billing cycle and improves cash flow management.

- Ensures invoices meet statutory requirements, minimizing tax audit risks.

- Provides consistency and professionalism in client invoicing.

7. KYC and Onboarding App

Overview

Streamlines client onboarding with built-in Know Your Customer (KYC) regulatory checks and document verification using AI techniques.

Benefits for Chartered Accountants

- Reduces time and errors in client onboarding processes.

- Helps comply with anti-money laundering and regulatory requirements.

- Provides centralized document management and verification.

8. Sampling for Transporters

Overview

An audit sampling application explicitly designed for transport-related industries, automating sample selection based on defined criteria.

Benefits for Chartered Accountants

- Ensures systematic and replicable audit sampling.

- Saves time and enhances audit accuracy by minimizing human bias.

- Addresses sector-specific audit needs with tailored criteria.

9. Log of Computer Activity Generator

Overview

Monitors digital activities on computers, providing logs useful for IT audits and compliance verifications.

Benefits for Chartered Accountants

- Supports IT audit controls and detection of unauthorized access.

- Enhances compliance with data security and governance policies.

- Facilitates investigation and audit trails of system usage.

10. Financial Statement Analyzer

Overview

Utilizes AI to automate the analysis of financial statements through ratio computations, trend analysis, and visualization.

Benefits for Chartered Accountants

- Provides more profound insights into the client's financial health and performance.

- Speeds up identification of anomalies and financial risks.

- Enables more informed decision-making in audits and advisory roles.

Practical Insights on Leveraging ICAI Apps

- These apps collectively support automation of mundane tasks such as attendance tracking, invoicing, and data capture, freeing CAs to focus on strategic analysis and client counsel.

- By integrating compliance aids like KYC onboarding, ITGC evaluations, and ITR tracking, CAs can better mitigate regulatory risks and avoid penalties.

- Tools such as the Inventory MIS Dashboards and Financial Statement Analyzer enhance data-driven advisory, thereby boosting client trust and engagement.

- Adoption of sector-specific apps like Sampling for Transporters demonstrates ICAI’s intent to provide customized AI solutions tailored to niche markets.

- Security and audit trail management through apps like the Log of Computer Activity Generator underscore the importance of governance and ethics in digital transformation.

Why ICAI-Provided Apps Are Essential for Modern CAs

The advancement of AI-based tools by ICAI reflects a broader industry focus on digital transformation in accounting and finance. CAs who leverage these applications benefit from increased efficiency, accuracy, and speed in execution, which are important in an evolving financial environment.

Moreover, embracing such AI tools enables CAs to remain relevant and competitive by delivering higher value services, improving compliance standards, and fostering better client relationships.

As taxation laws, audit norms, and technology continue to evolve, these apps ensure that Indian accountants stay ahead of the curve.

Lead Your CA Practice with ICAI’s Top 10 AI Apps

The Institute of Chartered Accountants of India has taken a significant step in empowering the country’s accounting professionals with a comprehensive suite of AI-driven apps tailored to meet contemporary challenges.

From attendance tracking to advanced financial analysis, these tools provide an integrated ecosystem that enhances productivity, compliance, and client service.

Every CA in India is encouraged to explore and incorporate these apps into their practice to unlock the full potential of technology.

Staying informed and adopting ICAI's AI-based applications will not only streamline day-to-day accounting tasks but also position Chartered Accountants as leaders in the digital finance revolution.

Additionally, Suvit, an AI-powered accounting automation platform widely recognized by ICAI under the Committee for Members in Practice, offers Chartered Accountants exclusive discounts and powerful tools for streamlining accounting, GST reconciliation, and compliance, further enhancing productivity and accuracy in daily operations.

Try Suvit for free for a week!

FAQs

Q1: Are these ICAI apps free for all Chartered Accountants in India?

A1: Most ICAI-provided apps are accessible to members either free or at a nominal cost, with some offering subscription-based advanced features.

Q2: Can these apps be used for auditing and compliance purposes?

A2: Yes, many tools like the ITGC Opportunities App, Financial Statement Analyzer, and Log of Computer Activity Generator are specifically developed to support audit and compliance activities.

Q3: How do ICAI apps help in reducing manual workload for CAs?

A3: These apps automate routine tasks such as attendance tracking, invoice generation, document digitization, and tax filing status monitoring, allowing CAs to focus more on advisory and client management.

Q4: What benefits does Suvit software, recognized by ICAI under CMP, offer?

A4: Suvit offers AI-powered accounting automation and GST reconciliation, providing CMP members with discounted rates and facilitating faster, error-free financial accounting and compliance processing.