Groww, India’s largest stockbroker and mutual fund investment platform, is making headlines as it prepares to file updated IPO papers with the Securities and Exchange Board of India (SEBI) this week, targeting a valuation of approximately ₹80,000 crore and a potential listing in November 2025.

This landmark IPO marks a significant milestone in the booming Indian fintech ecosystem, with Groww’s active user base exceeding 15 million investors.

As Groww expands its footprint, CAs across India face increasing demand to accurately and efficiently manage share market transactions originating from this platform.

Recording Groww purchase entries in accounting software like Tally is vital, but can be daunting due to complex transaction data with multiple charges, order numbers, and regulatory compliance requirements.

This guide is designed to equip CAs with practical, actionable steps to post Groww share market entries in Tally seamlessly.

Leveraging data mapping and automation tools, CAs can ensure accuracy, maintain audit trails, and remain compliant with evolving GST and SEBI regulations, while significantly reducing manual effort and errors.

Understanding the Industry Challenges for CAs

CAs managing share transactions face several key hurdles:

- Data Entry Complexity: Share market transactions carry multiple details such as stock names, ISINs, order numbers, execution dates, brokerage, and stamp duties. Manual input of this multifaceted data into Tally increases the risk of errors and omissions.

- High Transaction Volumes: Bulk trading activity necessitates efficient processing, as manual reconciliation slows closing cycles and increases operational overhead.

- Audit Trail Requirements: Regulatory bodies mandate detailed record-keeping, including order numbers and execution timestamps for traceability.

- Regulatory Compliance: Ensuring GST classification of charges and meeting SEBI reporting standards demands precision and constant updates.

- Evolving Broker Formats: Growing platforms like Groww periodically update their Excel reports, necessitating adaptable mapping frameworks for seamless data uploads.

These challenges call for leveraging digital automation integrated with Tally to maintain accuracy while improving productivity and compliance.

Preparing Your Groww Purchase Excel Sheet: Formatting Essentials

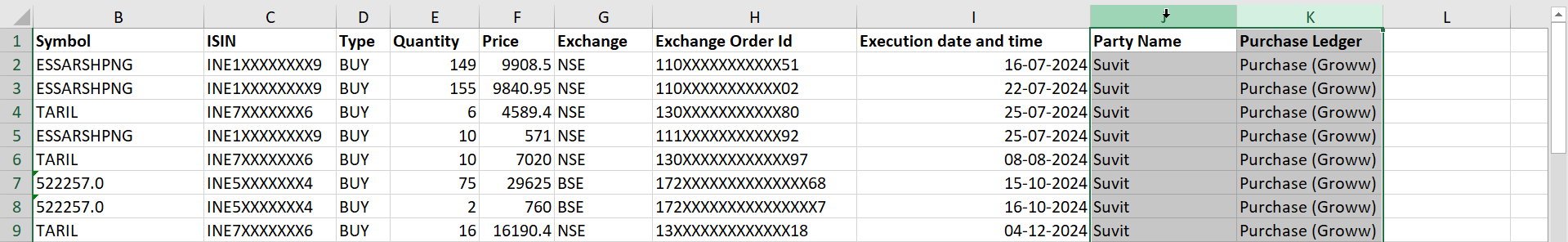

Before import, cleaning and standardizing the Groww purchase Excel sheet is important for smooth processing:

- Retain Relevant Data Only: Strip down the file to purchase-related columns, excluding sales or unrelated fields that might confuse the accounting input system.

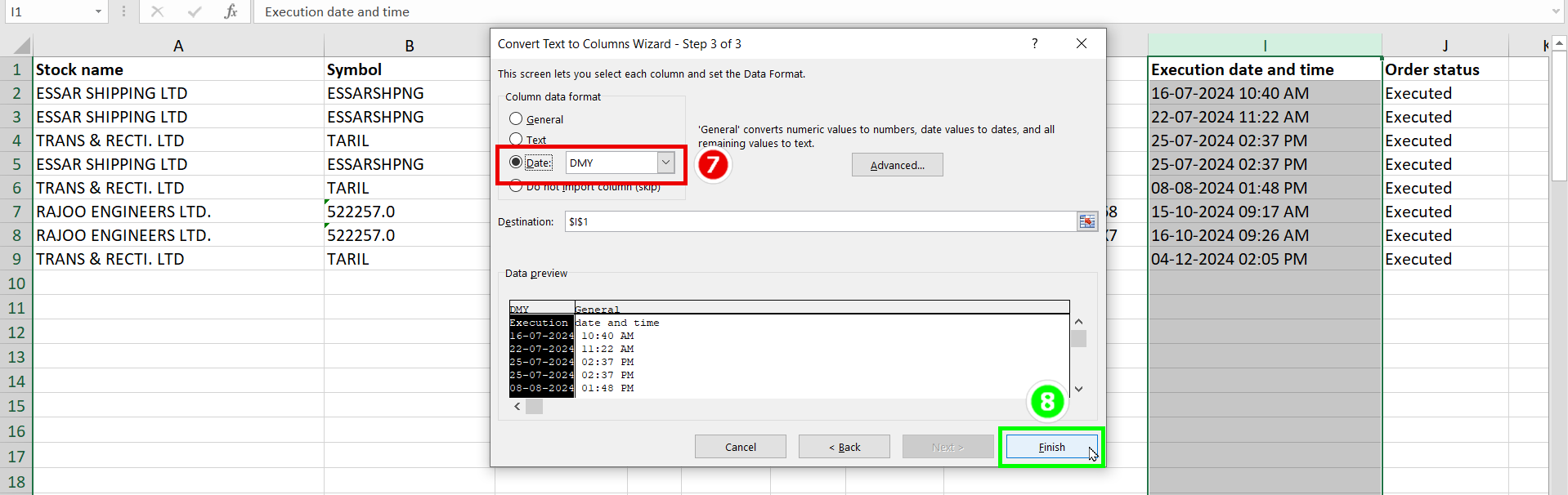

- Standardize Date Formats:

Align all date fields (especially execution date and time) to the accepted Tally format (preferably DD-MM-YYYY).

- Ensure Required Fields Are Present:

Essential fields include stock name, ISIN, type, quantity, price, exchange order ID, execution date, and party name for accurate ledger mapping.

- Validate Numeric Entries: Check quantities and rates for correctness to prevent posting mismatches.

Careful preprocessing ensures the upload mechanism communicates correctly with Tally’s ledger structure and eliminates errors from the outset.

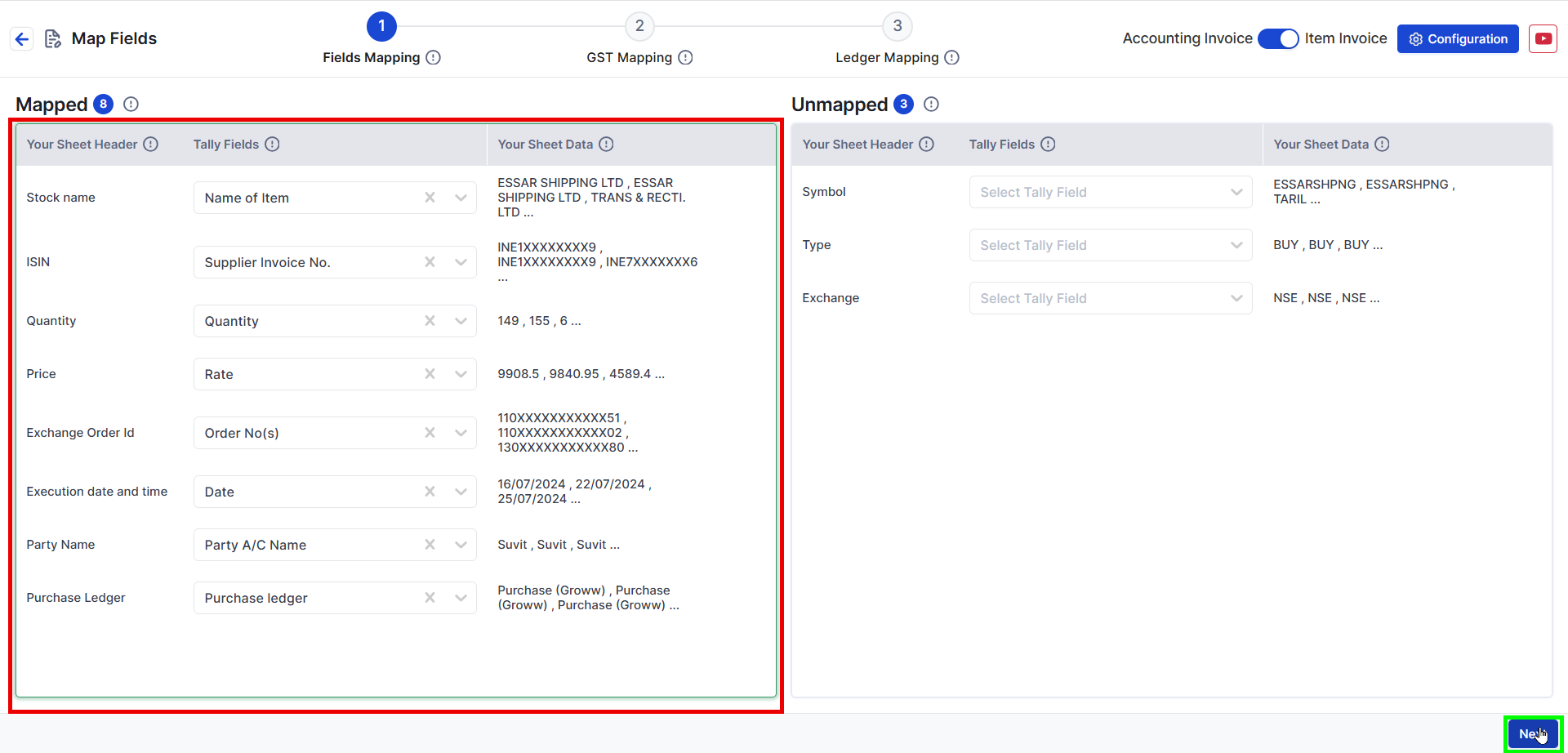

Mapping Excel Columns for Seamless Posting into Tally

Accurate field mapping between the Groww Excel sheet and Tally is foundational to successful automation. Typical mapping is as follows:

| Excel Sheet Heading | Mapped Column in Suvit/Tally |

|---|---|

| Stock name | Name of Item |

| ISIN | Supplier Invoice No. |

| Type | Purchase Ledger |

| Quantity | Quantity |

| Price | Rate |

| Exchange Order Id | Order No(s) |

| Execution date and time | Date |

| Party Name | Party A/C Name |

Mapping must align with both Tally’s accounting ledger structure and the data format Suvit requires for automation. Additionally, charges such as brokerage, stamp duty, and other transaction fees should be mapped carefully to the corresponding levy ledgers using dropdown search options for consistency.

Step-by-Step Practical Workflow for Uploading in Tally through Suvit

-

Save the Prepared Excel Sheet: After thorough data cleanup and verification, save the Excel file retaining the Groww format.

-

Enable Order Number in Tally: Navigate to Configuration → Order Details and enable the Order Number option to maintain audit trail integrity.

-

Upload Using Suvit:

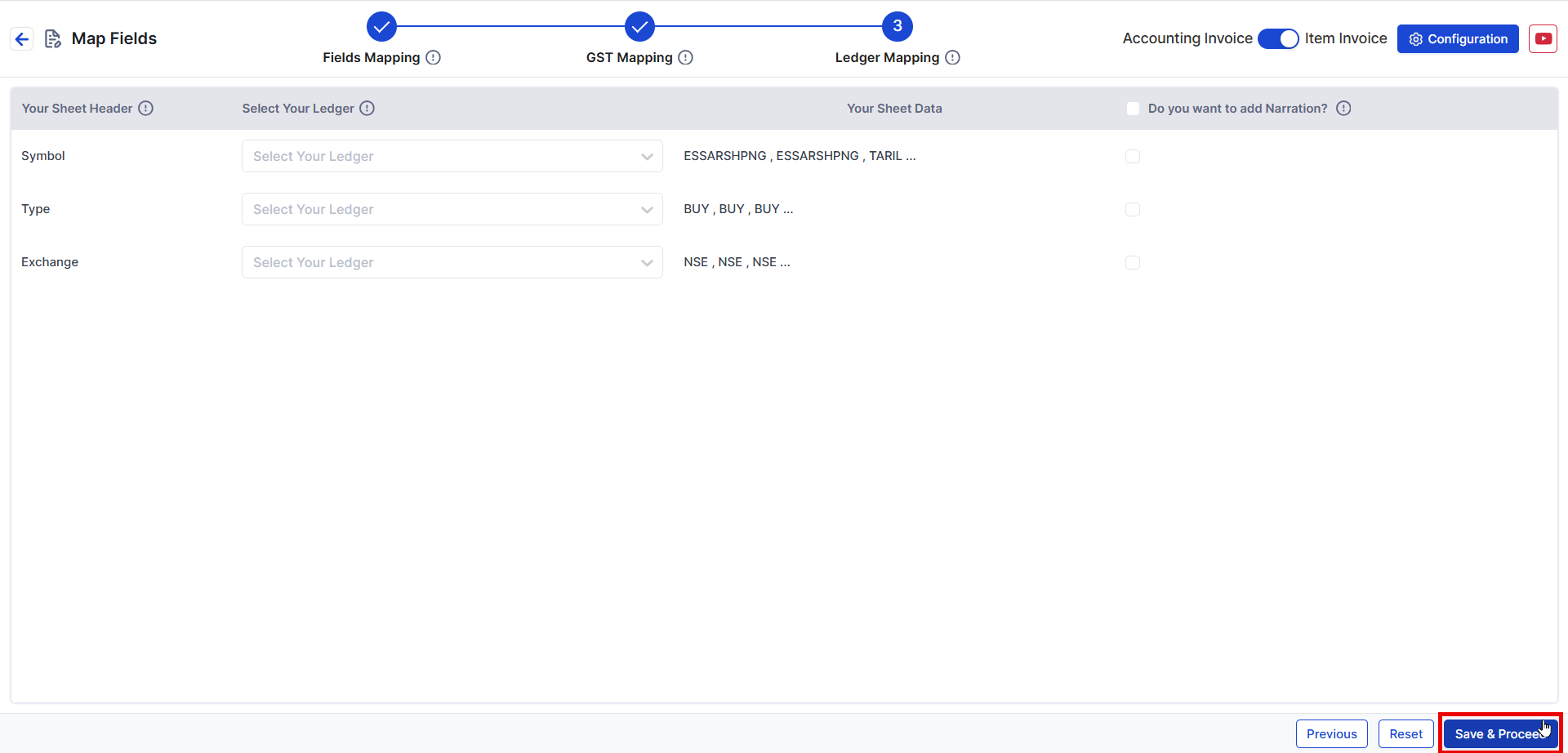

Access Suvit’s interface to upload the Excel file. Then, map each column using the fields table above to ensure congruity between Groww data and Tally ledgers.

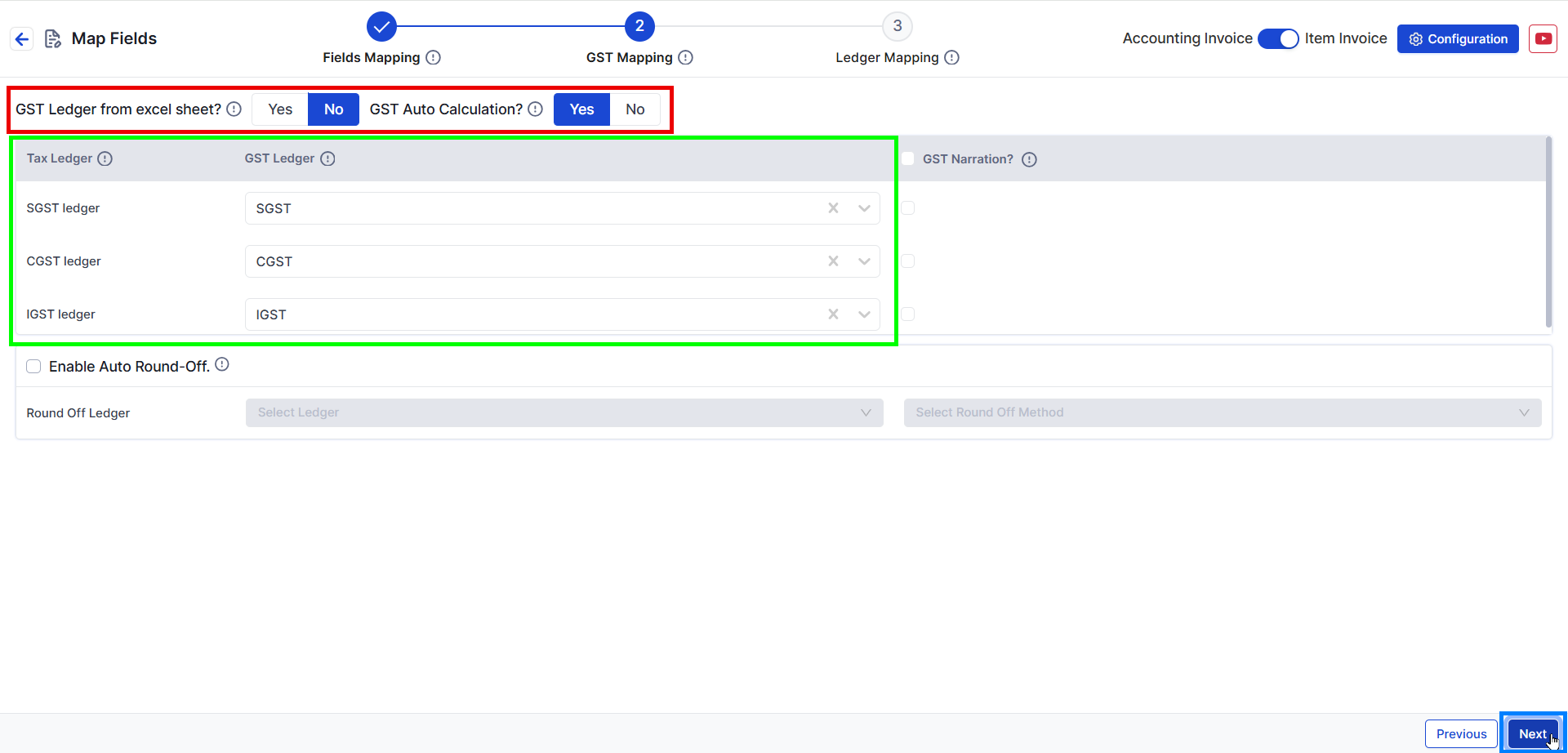

- Assign Charges to Proper Ledgers: Select appropriate ledgers for additional costs such as brokerage, SEBI charges, stamp duty, and GST through dropdown lists.

- Validate and Save: Cross-verify mapped data for completeness before final submission.

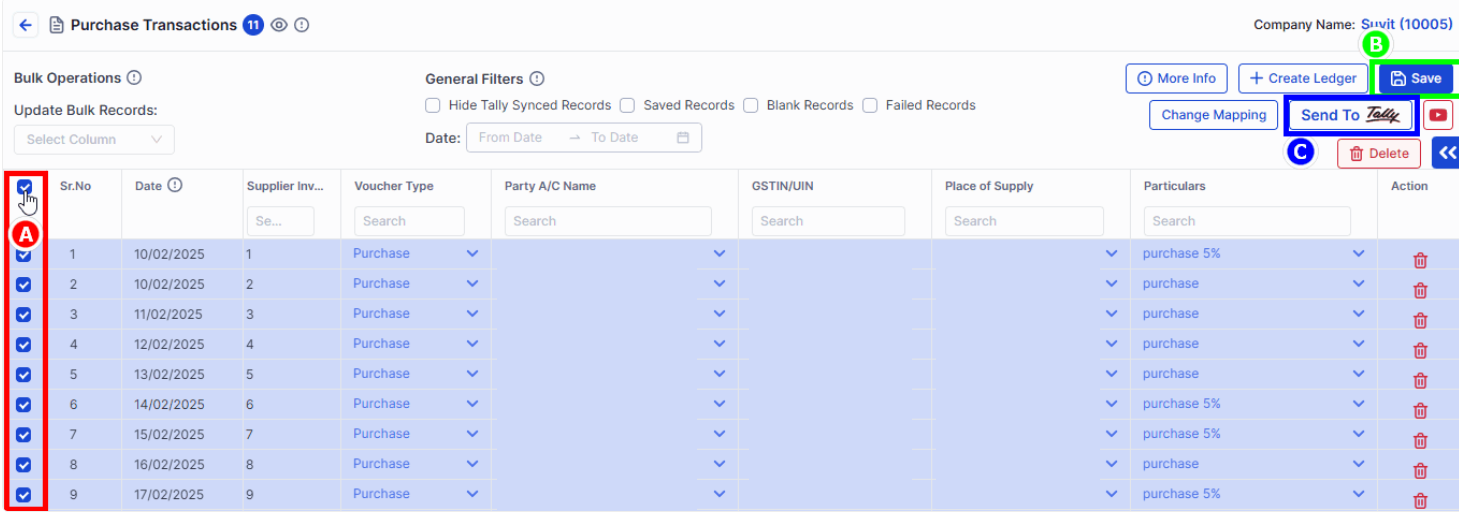

- Send Data to Tally:

Select your purchase transaction, save it, and click 'Send to Tally' to transfer the data.

- Routine Review: Regularly reconcile uploaded entries against broker statements and watch for any changes in Groww Excel formats requiring adjustments in mapping.

This method drastically reduces human error and manual intervention, allowing Chartered Accountants to focus on analysis rather than data entry.

Actionable Tips for Chartered Accountants

- Maintain Up-To-Date Mapping Templates: As platforms like Groww periodically update Excel formats, ensure you have updated field maps to avoid disruptions.

- Leverage Automation Tools: Utilize tools like Suvit that integrate seamlessly with Tally to automate bulk uploads, saving time and increasing data accuracy.

- Regular Reconciliation: Despite automation, reconcile posted entries monthly with Groww records for correctness and to spot discrepancies early.

- Stay Abreast of Regulatory Changes: Keep updated on GST rules, SEBI norms, and audit mandates affecting share market accounting to ensure compliance.

- Implement Robust Data Backup: Secure digital backups of Excel sheets and Tally entries prevent data loss and facilitate audits.

Following these practices helps CAs deliver timely, reliable, and regulation-compliant accounting services.

The CA’s Playbook for Accurate Groww Share Market Accounting in Tally

Posting Groww share market entries into Tally need not be an heavy, error-prone task for CAs anymore.

By systematically preparing the Groww purchase Excel, mapping fields correctly using platforms like Suvit, and adhering to a streamlined upload process, CAs can ensure data accuracy, compliance, and audit readiness.

Leveraging automation saves valuable time and reduces reconciliation issues, enabling professionals to meet India’s dynamic regulatory landscape confidently.

Staying updated with regulatory norms and utilizing innovative accounting technology will empower Chartered Accountants to serve clients with precision and efficiency in the evolving share market domain.

FAQs

Q1: Why is mapping fields like Order Number and Execution Date important when posting Groww entries in Tally?

Mapping Order Number and Execution Date maintains audit trail integrity, ensures precise reconciliation with broker reports, and supports regulatory compliance.

Q2: Can CAs automate the import of Groww purchase Excel sheets into Tally?

Yes, using automation tools like Suvit, CAs can seamlessly upload and map Groww purchase Excel sheets to Tally, reducing manual errors and saving time.

Q3: How should additional charges like brokerage and stamp duty be posted in Tally from Groww data?

Such charges should be accurately mapped to their respective ledgers with GST implications considered to ensure correct tax compliance and reporting.

Q4: What common challenges do CAs face while posting Groww share market entries manually in Tally?

Manual entries risk high errors due to complex data, multiple charges, large transaction volumes, and evolving broker formats, making automation essential.