If you want seamless income tax e-filing in India for 2025, perfect compliance starts here: PAN-Aadhaar linking is now non-negotiable. Miss the deadline, and your financial life hits a roadblock, expect delayed refunds, a frozen PAN, and tighter banking restrictions.

In a sea of advice, get clarity, actionable steps, and straight answers. Here’s your ultimate guide on why and how to link your PAN with Aadhaar.

What’s Changed: PAN-Aadhaar Linking Rules & Deadlines for 2025

As digital India matures, PAN-Aadhaar linkage is more than just a government formality; it’s the backbone of your tax identity.

Here’s the latest you need to know:

-

Last Date to Link:

- 31st December 2025: Applicable only for individuals who received their PAN based on Aadhaar enrolment ID between 1st October 2024 and 31st December 2025.

- 31st May 2024: Was the last date for everyone else. If you missed it and your PAN is still inoperative, speedy action is critical to reactivate it and avoid financial interruptions.

-

Who Must Link:

All resident individuals (Indian citizens) with an active PAN, unless exempted (e.g., NRIs, those aged 80+, some foreign nationals).

- Consequences of Missing the Deadline:

Your PAN turns inoperative, halting tax refunds, triggering higher TDS, freezing bank transactions, and blocking mutual fund or property deals.

Methods to Link PAN with Aadhaar: Which Is Right for You?

| Method | Steps | Time Needed | Best For |

|---|---|---|---|

| e-Filing Portal | Online form submission | 5–10 min | Most users, tech-savvy |

| SMS | Text message process | 2–3 min | On-the-go, tech-lite |

| Offline (Centre) | Visit NSDL/UTIITSL kiosk | Half-day | Bulk/firm/case issues |

Choose the route that best matches your convenience, internet access, and volume.

Step-by-Step Guide: Link PAN with Aadhaar via Income Tax Portal

1. Visit the Official Portal:

Head to the Income Tax e-filing portal.

2. Find ‘Link Aadhaar’:

On the homepage’s left panel under ‘Quick Links.’ Click it.

3. Enter Your Details:

Enter your PAN and Aadhaar numbers, along with your name and mobile number exactly as per Aadhaar records.

4. Pay Late Fee If Prompted:

If linking after the deadline, you’ll be prompted to pay a penalty of ₹1,000 via the e-Pay Tax service.

5. Validate with OTP:

Enter the 6-digit OTP sent to your Aadhaar-linked mobile. Submit.

6. Confirmation:

On successful linking, you get an acknowledgement message. Save this or take a screenshot.

7. How to Check Linking Status:

On the same portal, use ‘Check Aadhaar PAN Link Status’ under Quick Links to instantly view your status.

Troubleshooting Routine Hiccups:

- Name or date-of-birth mismatches? Update through UIDAI (for Aadhaar) or your nearest NSDL/UTIITSL centre (for PAN).

- Didn’t get an OTP? Verify that your mobile number is linked to your Aadhaar through UIDAI.

Alternate Ways: SMS & Offline Linking

A. Linking via SMS

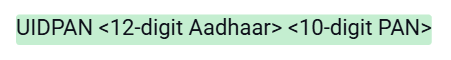

- Format:

Send it to 567678 or 56161 using your registered mobile number.

- You’ll get a confirmation reply. If details mismatch, process fails; double-check data before retrying.

B. Offline Linking (NSDL/UTIITSL Centres)

- Bring your original PAN and Aadhaar, along with self-attested copies of both.

- Fill out Form Annexure-I and pay the applicable fee.

- Suitable for bulk linking, tech-challenged, or where online data corrections are needed.

Must-Know Pro Tips for a Smooth Linking

- Check Details Before Starting:

Ensure your name, DOB, and gender match on both documents. Fix discrepancies ahead of time.

- Keep Proof:

Store your linkage acknowledgement/challan. If you’re an accounting professional, digital document management makes retrieval easy during audits.

- Reminder Strategy:

Tax consultants using workflow tools like Suvit can automate client reminders about linkage deadlines and keep compliance on track.

- For Firms Handling Multiple Clients:

While actual PAN-Aadhaar status checks are done externally, use practice management software to log documents, assign tasks, and store acknowledgements in one digital vault; no lost paperwork, no missed deadlines.

What Happens If You Don’t Link?

- Immediate: PAN becomes inoperative, no e-filing, refunds, or significant financial transactions.

- Ongoing: Higher TDS, penalties, delayed or denied credit.

- Recovery: Reactive linking reactivates your PAN, but with potential penalty and processing delays.

Frequently Asked Questions (FAQ)

Who is exempt?

NRIs, individuals aged 80+, residents of select Northeastern states, and foreign nationals (check latest government guidelines).

Is there a fee for late linking?

Yes, ₹1,000 payable while linking after the deadline.

My PAN is already inoperative. What should I do?

Link it using the portal immediately; reactivation usually follows after payment and confirmation.

How do I verify if my PAN is linked?

Use the Income Tax portal’s status checker.

Can I link a new PAN issued after October 2024?

Yes, you have until 31st December 2025 to do so.

Workflow Insights: How Modern Accounting Firms Make Life Simple

“While the PAN-Aadhaar linking itself must be completed on the government portal, modern accounting professionals rely on tools like Suvit to keep supporting documents at their fingertips and automate client reminders, no more manual follow-ups or lost paperwork.”

If you’re a CA or consultant overseeing multiple client compliances, set up digital checklists, document storage, and scheduled reminders. Let the tools handle the routine so that you can focus on valuable client work instead of admin headaches.

Stay Linked, Stay Compliant

Regulator deadlines move fast, and compliance isn’t optional. Whether you’re linking for yourself or hundreds of clients, the new e-filing age in India demands focus, accuracy, and a smart process.

Use this guide, double-check your data, and get it done today; your financial peace and client satisfaction are just one link away.