In India, the Goods and Services Tax (GST) has transformed how businesses operate, including ecommerce sellers. With the ecommerce industry experiencing rapid growth, understanding and complying with GST regulations has become critical for sellers to avoid penalties, fines, and legal complications.

Samir Kumar, Country Manager at Amazon India, highlights the remarkable evolution of ecommerce in the country:

As ecommerce continues to expand, sellers need to navigate GST compliance seamlessly.

This blog will provide a step-by-step guide on how to file GST, ensuring your business remains compliant and operates without disruptions.

From GST registration to final submission of returns, we’ll cover it all and address common challenges faced by ecommerce sellers during the filing process.

Understanding GST for Ecommerce Sellers

What is GST?

GST, or Goods and Services Tax, is a single tax system that replaced multiple indirect taxes in India. It is applied to the sale of goods and services and is aimed at simplifying the tax structure for businesses across the country.

For ecommerce sellers, GST is essential to manage tax liabilities on sales, purchases, and services offered through online platforms.

Key Considerations for Ecommerce Sellers:

- Sales Transactions: GST applies to both intra-state and inter-state sales made through ecommerce platforms.

- Service Tax: Any services provided along with goods, such as delivery or packaging services, are also subject to GST.

GST Registration for Ecommerce Sellers

GST registration is mandatory for ecommerce sellers if their turnover exceeds the prescribed threshold limit. This registration allows sellers to collect and remit GST on sales, as well as claim input tax credit (ITC) on business purchases.

- Threshold Limit: For most ecommerce sellers, GST registration is mandatory if the aggregate turnover exceeds ₹40 lakhs for goods and ₹20 lakhs for services.

- Voluntary Registration: Sellers below the threshold limit may opt for voluntary GST registration to claim ITC on business expenses.

Steps to File GST for Ecommerce Sellers

1. Collect Required Information and Documents

Before filing GST, ecommerce sellers must gather the necessary documents to ensure a smooth filing process.

Key Documents to Collect:

- GSTIN: A unique identification number issued after GST registration.

- Sales Invoices: Detailed records of goods or services sold.

- Purchase Records: Documents that show the purchases made from suppliers.

- Bank Statements: For reconciliation purposes.

- Previous GST Returns: GSTR-3B, GSTR-1, or any other relevant filings.

2. Choose the Right GST Return Form

Ecommerce sellers must file specific GST return forms depending on their business operations.

Below are the most commonly used forms for ecommerce sellers:

-

GSTR-1: This form reports outward supplies (sales) made by the business.

- Filing Frequency: Monthly or quarterly, depending on turnover.

-

GSTR-3B: This is a summary return that reports both outward and inward supplies, tax liabilities, and input tax credits (ITC).

- Filing Frequency: Monthly.

-

GSTR-8: If you're an ecommerce platform (like Amazon, Flipkart), you must file this form for TCS (Tax Collected at Source) from the sellers.

-

GSTR-9: This is the annual return that consolidates all your monthly/quarterly filings.

3. Understand GST Payment Deadlines

It is essential to adhere to GST filing deadlines to avoid penalties. The following are important dates ecommerce sellers should be aware of:

- Monthly Returns (GSTR-3B and GSTR-1): Due by the 20th of each month.

- Quarterly Returns: Due by the 22nd or 24th of the month following the quarter.

- Annual Return (GSTR-9): Due by December 31st for the preceding financial year.

Late filing of returns will attract a penalty and interest, which may increase over time if the delay continues.

4. Filing GST Returns

How to File GSTR-1:

- Report sales details for both intra-state and inter-state transactions.

- Mention the invoice number, date, and the GST rate applied to each sale.

- Ensure accurate data for exempt and nil-rated supplies.

How to File GSTR-3B:

- Report your tax liabilities, detailing both outward and inward supplies.

- Input details of the ITC (Input Tax Credit) you’ve claimed on eligible purchases.

- Ensure all data is reconciled accurately to avoid discrepancies.

Common Issues During Filing:

- Discrepancies between sales and purchase records.

- Misreporting of tax liabilities or input tax credit (ITC).

5. Reconciliation and Reporting

Once all the details are entered, it is crucial to reconcile the data in your GST returns with the actual sales invoices and purchase records. This helps in identifying errors or mismatches that may lead to incorrect tax filings.

- Sales Invoices: Ensure that all sales are reported correctly, including export sales, interstate transactions, and any discounts or returns.

- Input Tax Credit (ITC): Verify that the ITC claimed aligns with the purchase invoices.

6. Paying GST

After filing your returns, you need to make the payment for the taxes owed. This can be done through the GST portal by selecting the appropriate payment method. The total amount payable includes both the output tax (GST on sales) and the reduction for input tax credit.

Challenges Faced by Ecommerce Sellers in Filing GST

Complexity of GST Laws

The nuances of GST, such as multiple tax rates, exemptions, and the classification of products and services, can be overwhelming for ecommerce sellers. Sellers who deal with both goods and services must be particularly cautious while categorizing items under the correct tax brackets.

Managing Returns and Compliance

Managing returns across multiple platforms, such as Amazon, Flipkart, and your own website, can be challenging. Sellers often face issues like:

- Inconsistent data across different platforms.

- Non-compliance due to a misunderstanding of platform-specific tax requirements.

Technical Issues with GST Portal

Technical glitches on the GST portal can disrupt the filing process. Common issues include server downtimes, errors in data submission, and delays in processing refunds or credits.

Tips for Ensuring GST Filing Compliance

1. Automate GST Filing with Software Tools

Using automated GST filing software can significantly reduce errors and simplify the process. Many ecommerce-specific platforms provide GST filing solutions that integrate directly with sales data from online marketplaces, allowing for easier reconciliation and faster filing.

2. Regular Monitoring of GST Payments and Returns

Keep track of your GST filings and ensure regular reconciliation of your accounts. Proactive monitoring will prevent last-minute issues and ensure that your GST returns are filed correctly.

3. Consult a Tax Professional

If your business is growing and handling multiple tax complexities, it is wise to consult a GST professional. An expert can help navigate the various tax requirements, especially in cases of cross-border ecommerce transactions, product categorization, or complicated tax filings.

Streamline Ecommerce Accounting with Suvit

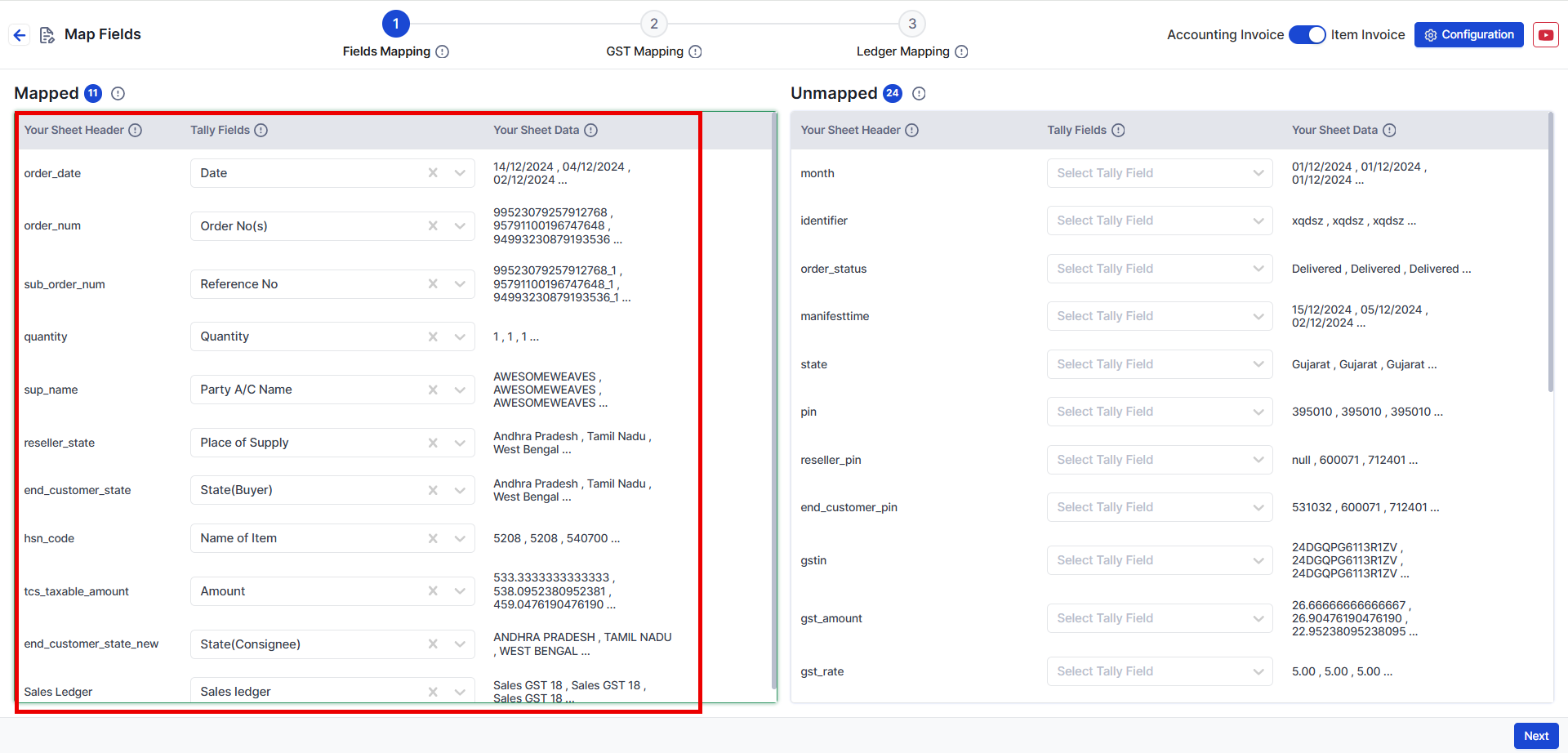

Suvit offers ecommerce accounting automation that simplifies the process for online sellers.

By simply uploading your ecommerce sales file and mapping the data, Suvit seamlessly integrates with Tally to automatically sync your financial records.

This streamlined approach eliminates manual data entry, ensuring accuracy, saving time, and improving overall accounting efficiency for ecommerce businesses.

Simplifying GST Filing for Ecommerce Sellers

Filing GST as an ecommerce seller may seem complex, but with proper planning, the right tools, and diligent monitoring, it becomes a manageable process.

By following the steps outlined in this guide, ecommerce businesses can ensure compliance, avoid penalties, and focus on scaling their operations. Regularly updating your knowledge on GST laws and maintaining accurate records will also help keep your business in good standing with tax authorities.

If you're unsure about any aspect of GST filing, consider seeking the help of a qualified professional to ensure everything is filed correctly.

By optimizing your GST filing process and adhering to the latest regulations, you can ensure that your ecommerce business stays compliant and grows successfully in a competitive marketplace.

FAQs

1: Do ecommerce sellers need to register for GST?

Yes, ecommerce sellers must register for GST if their annual turnover exceeds the prescribed limit (₹40 lakh for goods and ₹20 lakh for services). Voluntary registration is also an option for businesses below the threshold.

2: What are the main GST return forms for ecommerce sellers?

Ecommerce sellers typically file GSTR-1 (for outward supplies), GSTR-3B (for summary of sales and purchases), and GSTR-8 (for TCS if selling on platforms like Amazon or Flipkart).

3: What is Input Tax Credit (ITC) and how does it work for ecommerce sellers?

ITC allows ecommerce sellers to claim credit for the tax paid on business-related purchases. This helps reduce the overall tax liability, provided the purchases are GST-compliant.

4: Can ecommerce sellers automate their GST filing process?

Yes, ecommerce sellers can automate their GST filing using software tools like Suvit, which allows easy integration with Tally by uploading sales files and mapping data for seamless tax filing.