E-invoicing, or electronic invoicing, is the digital exchange of invoices between businesses. It is a system in which B2B invoices are authenticated electronically by the Goods and Services Tax Network (GSTN) for further use on the common GST portal.

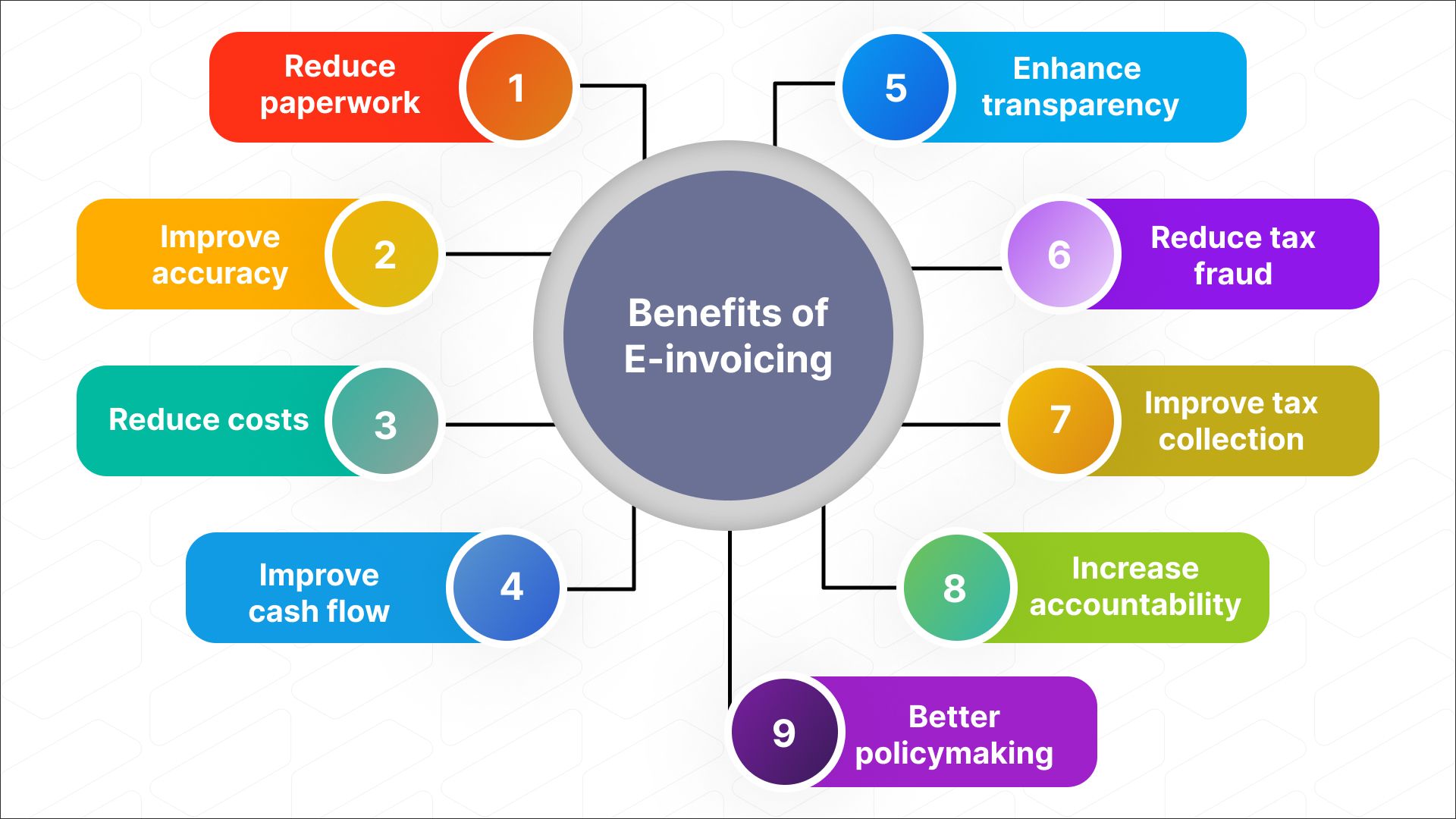

E-invoicing has many benefits for both businesses and the government. For businesses, e-invoicing can reduce paperwork and manual processing, improve efficiency and accuracy, reduce costs, improve cash flow, and enhance transparency and compliance.

For the government, e-invoicing can help to reduce tax evasion and fraud, improve tax collection, and increase transparency and accountability in the tax system.

In this blog post, we will discuss everything you need to know about e-invoicing in India, including:

- What is e-invoicing?

- Benefits of e-invoicing

- Previous invoicing vs. e-invoicing system in India

- How does e-invoicing work?

- How will e-invoicing aid in preventing tax fraud?

- Has e-invoicing become mandatory?

- How to generate e-invoices

- Does the government tax portal create invoices directly?

If you are a business in India, it is important to understand the basics of e-invoicing and how it will impact your business. This blog post will provide you with all the information you need to get started with e-invoicing.

So, let’s get started!

What is E-invoicing? Understanding the Meaning

E-invoicing, or electronic invoicing, is the digital exchange of invoices between businesses. It is a system in which B2B invoices are authenticated electronically by the Goods and Services Tax Network (GSTN) for further use on the common GST portal.

E-invoices are generated in a standard electronic format, known as the e-invoice schema. This schema is prescribed by the GSTN and ensures that all e-invoices contain the same information. This makes it easier for businesses to exchange invoices and for the government to track the movement of goods and services.

Once an e-invoice is generated, it is sent to the GSTN for authentication. If the invoice is valid, the GSTN generates a unique Invoice Reference Number (IRN) and assigns it to the invoice. The IRN is then sent back to the supplier, who can then share the e-invoice with the buyer.

The buyer can then import the e-invoice into their accounting software. This eliminates the need for manual data entry and reduces the risk of errors.

E-invoicing has a number of benefits for both businesses and the government.

E-invoicing has become mandatory for businesses in India with an annual turnover of more than Rs. 50 crore.

Also Read: Understanding e-Invoicing Under GST: Applicability, Limits & Implementation Date

Benefits of E-invoicing

Benefits of E-Invoicing for Businesses

- Reduce paperwork and manual processing: E-invoicing eliminates the need to print, mail, and store invoices. This can save businesses a significant amount of time and money.

- Improve efficiency and accuracy: E-invoicing automates the invoicing process, which can help to improve efficiency and accuracy. This can free up employees to focus on other tasks, such as sales and customer service.

- Reduce costs: E-invoicing can help to reduce costs in a number of ways, such as reducing the cost of paper, postage, and storage.

- Improve cash flow: E-invoices are typically processed and paid faster than traditional paper invoices. This can help to improve businesses' cash flow.

- Enhance transparency and compliance: E-invoicing can help businesses enhance transparency and compliance by providing a secure and auditable record of all invoices.

Benefits of E-Invoicing for the Government

- Reduce tax evasion and fraud: E-invoicing can help to reduce tax evasion and fraud by making it more difficult for businesses to create fake invoices and claim false input tax credit (ITC).

- Improve tax collection: E-invoicing can help to improve tax collection by making it easier for the government to track the movement of goods and services.

- Increase transparency and accountability in the tax system: E-invoicing can help to increase transparency and accountability in the tax system by providing the government with a real-time view of all invoices.

- Facilitate better policymaking: E-invoicing can help to facilitate better policymaking by providing the government with valuable data on the economy.

In addition to the benefits listed above, e-invoicing can also help to:

- Protect the environment by reducing the use of paper.

- Improve customer satisfaction by providing a faster and more efficient way to invoice customers.

- Make it easier to integrate with other business systems.

Overall, e-invoicing is a modern and efficient way to invoice customers and suppliers. It has many benefits for both businesses and the government.

Also Read: e-Invoice Limit for Indian Taxpayers

Previous invoicing vs. e-invoicing system in India

In the past, businesses in India typically used manual or paper-based invoicing systems. This was a time-consuming and inefficient process, and it was also prone to errors.

Under the manual invoicing system, businesses would generate invoices by hand or using a typewriter. The invoices would then be printed and mailed to customers. Customers would then have to manually enter the invoice data into their accounting systems.

This process was time-consuming for both businesses and customers. It was also prone to errors, such as typographical errors and data entry errors.

Comparison of Previous Invoicing and E-Invoicing Systems

| Feature | Previous Invoicing System | E-invoicing System |

|---|---|---|

| Format | Manual or paper-based | Electronic |

| Processing | Manual | Automated |

| Accuracy | Prone to errors | Accurate |

| Security | Less secure | More secure |

| Efficiency | Time-consuming | Faster |

| Cost | More expensive | Less expensive |

Benefits of E-Invoicing over Previous Invoicing System

E-invoicing has many benefits over the previous invoicing system, including:

- Reduced paperwork and manual processing: E-invoicing eliminates the need to print, mail, and store invoices. This can save businesses a significant amount of time and money.

- Improved efficiency and accuracy: E-invoicing automates the invoicing process, which can help to improve efficiency and accuracy. This can free up employees to focus on other tasks, such as sales and customer service.

- Reduced costs: E-invoicing can help to reduce costs in a number of ways, such as reducing the cost of paper, postage, and storage.

- Improved cash flow: E-invoices are typically processed and paid faster than traditional paper invoices. This can help to improve businesses' cash flow.

- Enhanced transparency and compliance: E-invoicing can help businesses enhance transparency and compliance by providing a secure and auditable record of all invoices.

How does e-invoicing work?

E-invoicing, or electronic invoicing, is the digital exchange of invoices between businesses. It is a system in which B2B invoices are authenticated electronically by the Goods and Services Tax Network (GSTN) for further use on the common GST portal.

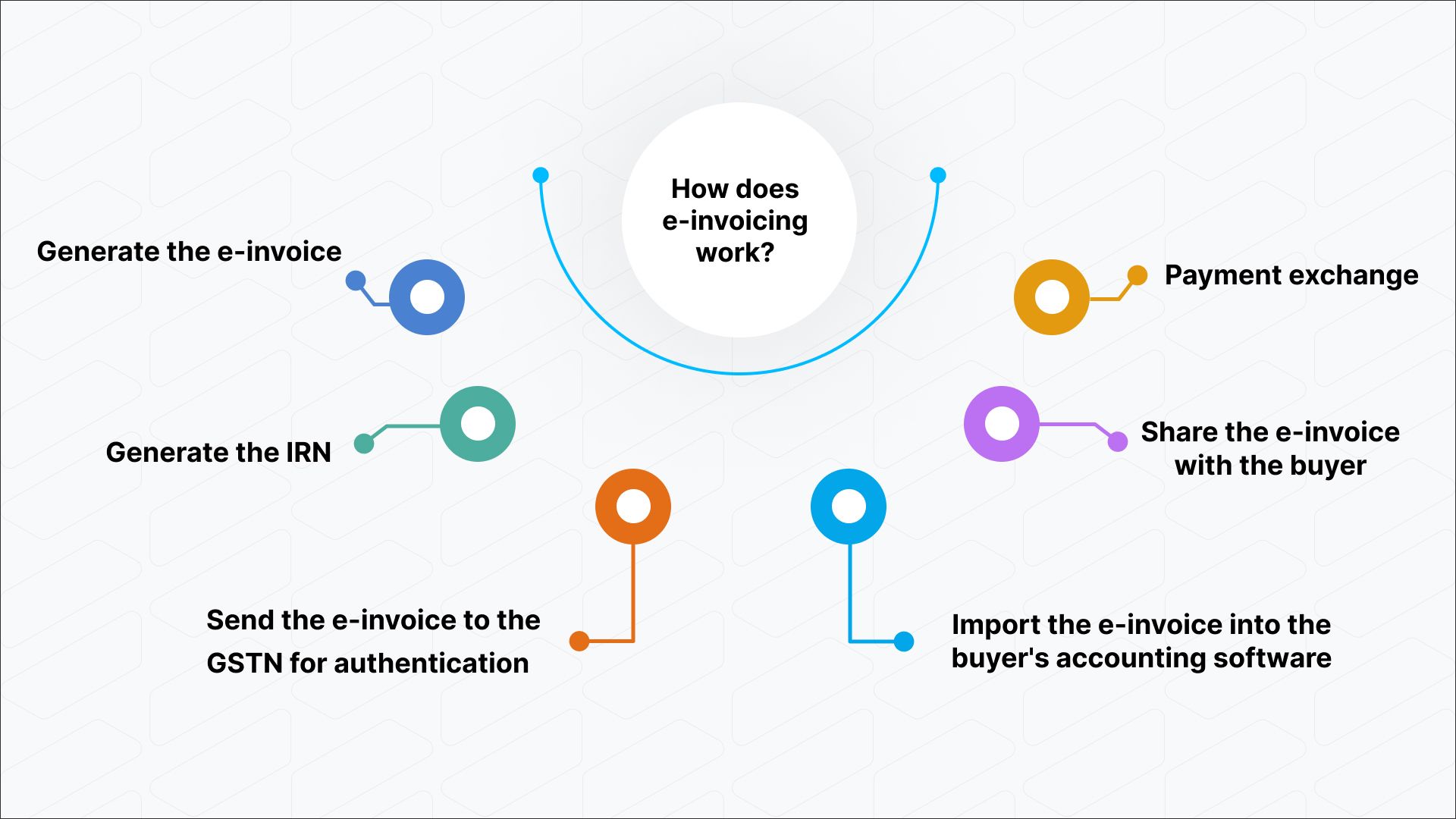

Here is a step-by-step explanation of how e-invoicing works:

Step 1: Generating the e-invoice

The supplier generates the e-invoice in their accounting software. The e-invoice must be in the standard e-invoice schema prescribed by the GSTN. The e-invoice schema ensures that all e-invoices contain the same information, such as the supplier's GSTIN, the buyer's GSTIN, the invoice date, the invoice amount, and the items invoiced.

Step 2: Sending the e-invoice to the GSTN for authentication

Once the e-invoice is generated, it is sent to the GSTN for authentication. The GSTN will validate the e-invoice to ensure that it is in the correct format and that all of the required information is present.

Step 3: Generating the IRN

If the e-invoice is valid, the GSTN will generate an IRN and assign it to the invoice. The IRN is a unique number that is used to identify the e-invoice.

Step 4: Sharing the e-invoice with the buyer

The supplier then shares the e-invoice with the buyer. The e-invoice can be shared electronically via email or through a file sharing service.

Step 5: Importing the e-invoice into the buyer's accounting software

The buyer imports the e-invoice into their accounting software. This eliminates the need for manual data entry and reduces the risk of errors.

Step 6: Making the payment

The buyer then makes the payment to the supplier. The payment can be made electronically or through a traditional method, such as cheque or cash.

Recommended Read: Tally Solutions vs. Traditional Accounting: Why Tally is the Future

How will e-invoicing aid in preventing tax fraud?

E-invoicing can aid in preventing tax fraud in a number of ways, including:

- Making it more difficult to create fake invoices: E-invoices are generated electronically and authenticated by the GSTN. This makes it more difficult for businesses to create fake invoices.

- Making it easier to track the movement of goods and services: E-invoices are linked to the GST portal. This makes it easier for the government to track the movement of goods and services and identify any suspicious activity.

- Making it more difficult to claim false input tax credit (ITC): Businesses need to have valid e-invoices to claim ITC. This makes it more difficult for businesses to claim false ITC.

Here are some specific examples of how e-invoicing can help to prevent tax fraud:

- Fake invoice detection: E-invoicing systems can be used to detect fake invoices by comparing them to a database of valid invoices. This can help to identify businesses that are creating fake invoices to evade taxes.

- Input tax credit fraud detection: E-invoicing systems can be used to detect input tax credit fraud by comparing the ITC claimed by businesses to the e-invoices that they have received. This can help to identify businesses that are claiming false ITC.

- Tax evasion detection: E-invoicing systems can be used to detect tax evasion by tracking the movement of goods and services and identifying any businesses that are not paying their taxes correctly.

Has e-invoicing become mandatory?

YES, Businesses with a yearly income above Rs. 5 crore must generate e-invoices starting August 1, 2023, as stipulated by the Central Board of Direct Taxes in Notification No. 10/2023–Central Tax dated May 10, 2023.

Businesses that are required to comply with e-invoicing must generate e-invoices for all B2B transactions. E-invoices must be generated in the standard e-invoice schema prescribed by the Goods and Services Tax Network (GSTN).

How to generate e-invoices?

To generate e-invoices, businesses can use their own accounting software or a third-party e-invoicing solution.

If you are using your own accounting software, you will need to make sure that it is compatible with the e-invoice schema prescribed by the Goods and Services Tax Network (GSTN). If not, you will need to upgrade your software or switch to a different accounting solution.

If you are using a third-party e-invoicing solution, you will need to create an account and then follow the instructions provided by the solution provider.

Once you have chosen a method for generating e-invoices, you will need to follow these steps:

- Create the invoice in your accounting software or e-invoicing solution.

- Ensure that the invoice contains all of the required information, such as the supplier's GSTIN, the buyer's GSTIN, the invoice date, the invoice amount, and the items invoiced.

- Generate the e-invoice in the standard e-invoice schema.

- Send the e-invoice to the GSTN for authentication.

- If the e-invoice is valid, the GSTN will generate an Invoice Reference Number (IRN) and assign it to the invoice.

- The IRN will be sent back to you along with the authenticated e-invoice.

- Share the authenticated e-invoice with the buyer.

- The buyer of the e-invoice can then import the invoice into their accounting software. This eliminates the need for manual data entry and reduces the risk of errors.

Here are some additional tips for generating e-invoices:

- Make sure that your accounting software or e-invoicing solution is always up to date with the latest e-invoice schema.

- Validate the e-invoice before sending it to the GSTN for authentication. This will help to reduce the risk of errors and ensure that the invoice is accepted by the GSTN.

- Keep a record of all e-invoices that you generate and send. This will help you to track your invoices and troubleshoot any problems that may arise.

Does the government tax portal create invoices directly?

No, the government tax portal does not create invoices directly. Businesses are responsible for generating their own e-invoices. The government tax portal only provides a platform for businesses to authenticate their e-invoices and generate Invoice Reference Numbers (IRNs).

To generate an e-invoice, businesses can use their own accounting software or a third-party e-invoicing solution. Once an e-invoice is generated, it must be sent to the government tax portal for authentication.

If the e-invoice is valid, the government tax portal will generate an IRN and assign it to the invoice. The IRN must be included on the e-invoice and must be shared with the buyer.

The buyer of the e-invoice can then import the invoice into their accounting software.

E-invoicing Sorted - But, What About the Bigger Picture?

As we move towards easier invoicing, it's also worth thinking about bigger accounting challenges - and how they can be solved. A buzzing topic is about automation - about tools that help automate basic accounting tasks like data entry, so that you can streamline your overall financial process.

While e-invoicing is streamlining billing, there are also accounting automation tools out there that are making the rest of financial management a breeze.

So, if you are interested in learning more about accounting automation, we, at Vyapar TaxOne, have got a whole lot of useful resources waiting for you in our blog section!