Are you a business owner looking to change the way you manage your finances? Have you heard about Tally banking and wondered how it can benefit your business?

In this blog, we’ll dive deep into the world of Tally banking, providing you with practical insights and step-by-step instructions on how to leverage this powerful feature seamlessly integrated within Tally ERP 9.

Get ready to discover how Tally banking can transform your financial operations, streamline cash flow management, and enhance overall efficiency.

Getting to Know Tally Banking Basics

Tally banking is a special tool that connects your bank accounts to Tally ERP 9, a widely used accounting software in Bharat. It works like a super-fast bridge that lets you see your bank transactions right away and organizes how your money moves around.

- Streamlined Expense Tracking: With Tally banking, monitoring expenses becomes a breeze. It automatically categorizes and records your expenditures, providing a clear overview of where your money is going.

- Multi-Bank Account Integration: Seamlessly connect multiple bank accounts with Tally ERP 9. This means you can manage all your financial transactions from different accounts in one centralized platform.

- Currency Management for International Transactions: For businesses engaged in global trade, Tally banking simplifies currency conversions and ensures accurate recording of international transactions, keeping your financial records precise and hassle-free.

- Alerts for Important Transactions: Stay in the loop with instant alerts for significant transactions. Whether it's a big sale or an unexpected expense, Tally Banking keeps you informed in real-time.

- Scheduled Payment Reminders: Avoid late payment penalties with the handy payment scheduler. Set up reminders for due dates, ensuring timely payments and nurturing positive vendor relationships.

- Budgeting and Forecasting Tools: Take control of your financial future with Tally Banking's budgeting and forecasting features. Plan for upcoming expenses, revenue targets, and track your progress effortlessly.

- Compliance and Tax Filing Assistance: Tally banking goes the extra mile by offering features that help businesses stay compliant with tax regulations. It aids in the preparation of GST returns, ensuring a smooth tax filing process.

- User-Friendly Interface for Easy Navigation: Tally ERP 9 and Tally banking is designed with user-friendliness in mind. Navigating through the software is intuitive, even for those less familiar with accounting terminology.

- Backup and Data Recovery: Your financial data is invaluable. Tally banking includes robust backup and recovery options, providing peace of mind knowing that your information is safe and accessible in case of any unforeseen events.

- Scalability for Growing Businesses: As your business expands, Tally Banking grows with you. It can easily adapt to the changing needs and complexities of a growing enterprise, making it a long-term solution for financial management.

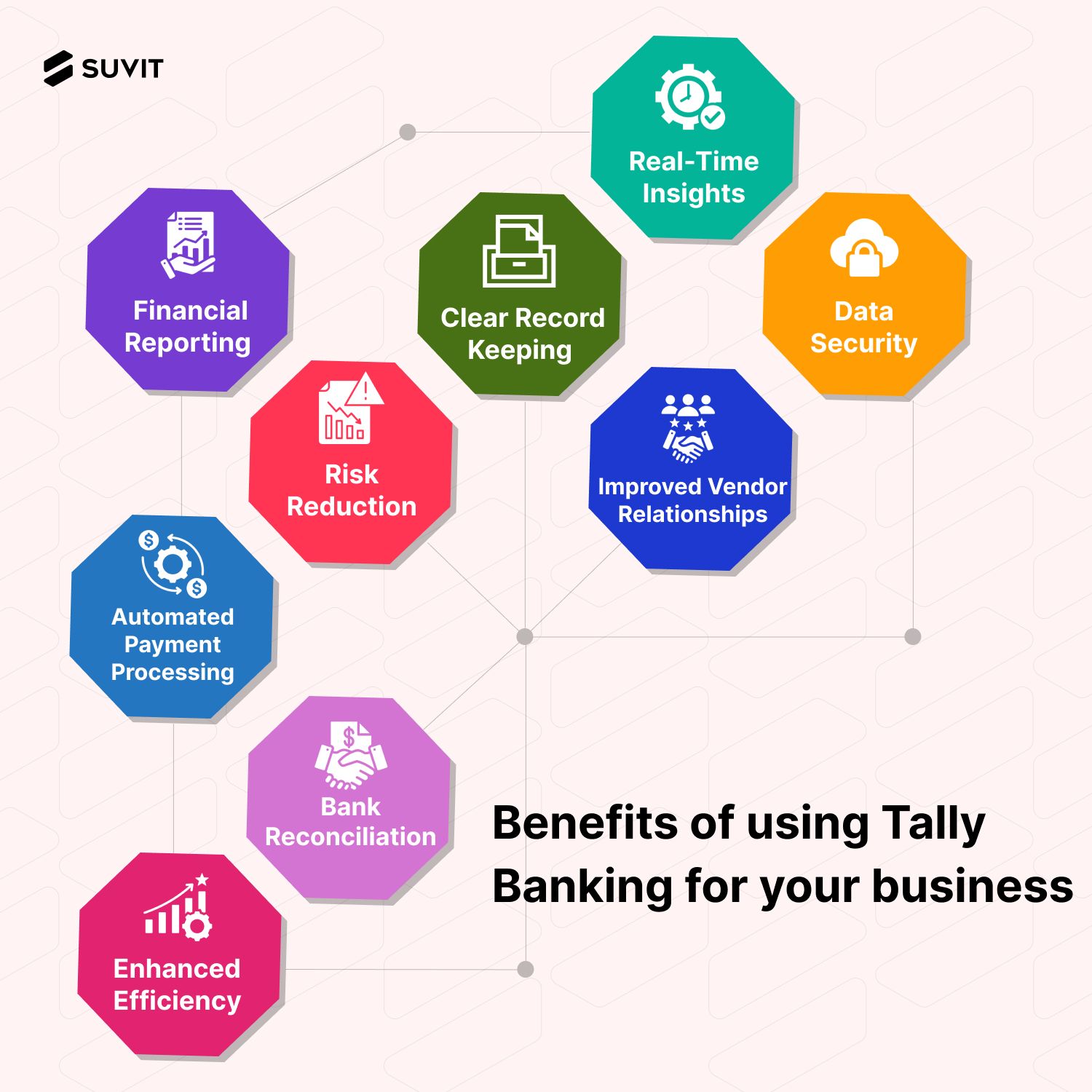

Benefits of using Tally banking for your business

- Enhanced Efficiency and Productivity: Tally banking acts like a swift assistant, handling data entry tasks quickly. This means fewer mistakes and more time for important tasks.

- Seamless Bank Reconciliation: Matching up transactions used to be a big hassle, but with Tally banking, it's a smooth process. This keeps your financial records accurate and makes audits much easier.

- Real-Time Financial Insights: Tally banking lets you instantly check important financial info. It's like having a special compass that shows you exactly where your money is going and coming from.

- Automated Payment Processing for Reliability: By setting up automatic payments, you ensure that you never miss a due date. This makes your vendors happy and builds trust in your business dealings.

- Empowered Cash Flow Management: Understand exactly how money moves in and out of your business. This helps you plan well so that you always have enough for your day-to-day operations.

- Risk Reduction and Compliance: Tally banking helps keep your financial records accurate, which reduces the risk of errors. This also makes it easier to follow the rules and regulations set by the government.

- Improved Vendor Relationships: Paying on time using automatic processes can really strengthen your relationships with vendors. It shows them that you're reliable and can lead to better deals and partnerships.

- Customized Financial Reporting: Tally Banking lets you make reports that fit your business perfectly. This means you get exactly the information you need to make smart decisions.

- Clear Record Keeping for Accountability: Tally banking keeps a detailed record of all your financial transactions. This is super helpful for internal checks, external audits, and for making sure you're following all the financial rules.

- Data Security and Confidentiality: Tally banking makes sure your sensitive financial info stays protected. It uses special codes and controls to keep it confidential and safe from people who shouldn't see it.

Putting Tally Banking to Work

- Connecting Your Bank Accounts: The initial step is to link your bank accounts with Tally.ERP 9. This process is straightforward. You provide your bank details and then allow the connection.

- Keeping Your Tally.ERP 9 Updated: It's crucial to ensure your Tally.ERP 9 software is always up-to-date. This ensures you have access to the latest features and security enhancements. Think of it as giving your software a little power boost!

- Safeguarding Access to Your Financial Info: Grant access only to authorized personnel. This essential measure ensures that only the right people can view and manage your sensitive financial information.

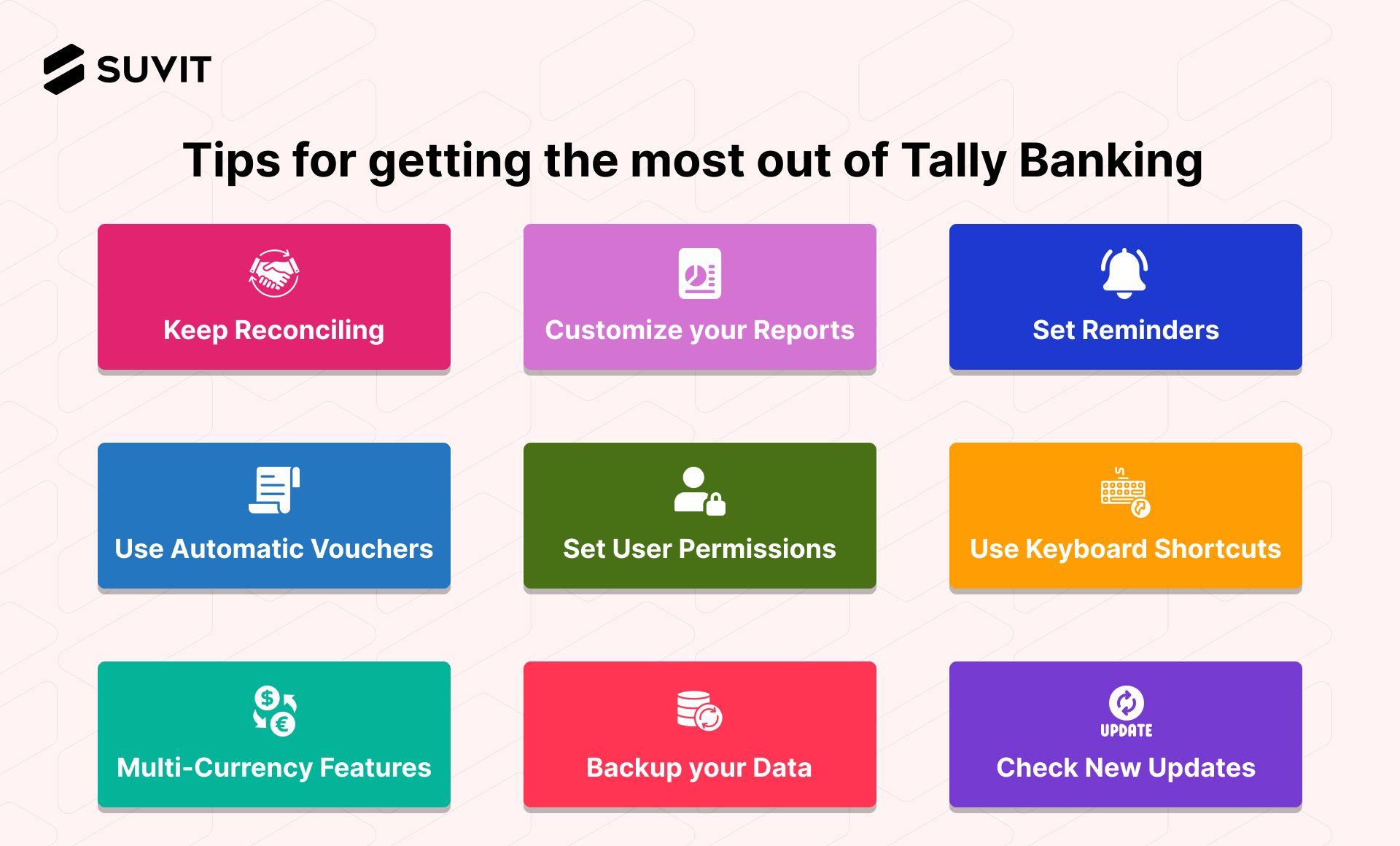

Tips for Getting the Most Out of Tally Banking

- Keep Reconciling: Regularly match up your bank transactions. It keeps your records perfect and helps catch any mistakes early.

- Use Automatic Vouchers: Let Tally Banking handle payments and receipts for you. It's fast and foolproof.

- Customize Your Reports: Make reports that suit your business. This way, you'll get the exact info you need.

- Utilize Categories for Expenses and Income: Organize your transactions by categorizing expenses and income. This allows for a clearer overview of your financial activities and facilitates accurate reporting.

- Set Reminders for Important Financial Dates: Use Tally Banking's reminder feature to stay on top of crucial financial dates, such as payment due dates, tax deadlines, and financial reporting periods.

- Set User Permissions and Roles: Assign specific roles and permissions within Tally ERP 9 to ensure that only authorized personnel have access to sensitive financial data. This enhances security and prevents unauthorized access.

- Take Advantage of Keyboard Shortcuts: Familiarize yourself with Tally ERP 9's keyboard shortcuts to navigate the software more efficiently. This can significantly speed up data entry and other tasks.

- Explore Data Export Options: Tally ERP 9 allows you to export financial data in various formats. Utilize this feature to generate reports or share information with clients in a format that suits their needs.

- Utilize Multi-Currency Features for International Transactions: If your business deals with international transactions, make use of Tally Banking's multi-currency capabilities. This ensures accurate recording and reporting of foreign exchange transactions.

- Regularly Back Up Your Data: Implement a routine for backing up your financial data to safeguard against any potential data loss. This is crucial for maintaining the integrity of your financial records.

- Stay Informed About Updates and New Features: Keep yourself updated with the latest releases and features of Tally ERP 9. New updates often come with enhanced functionalities and improvements that can further streamline your financial operations.

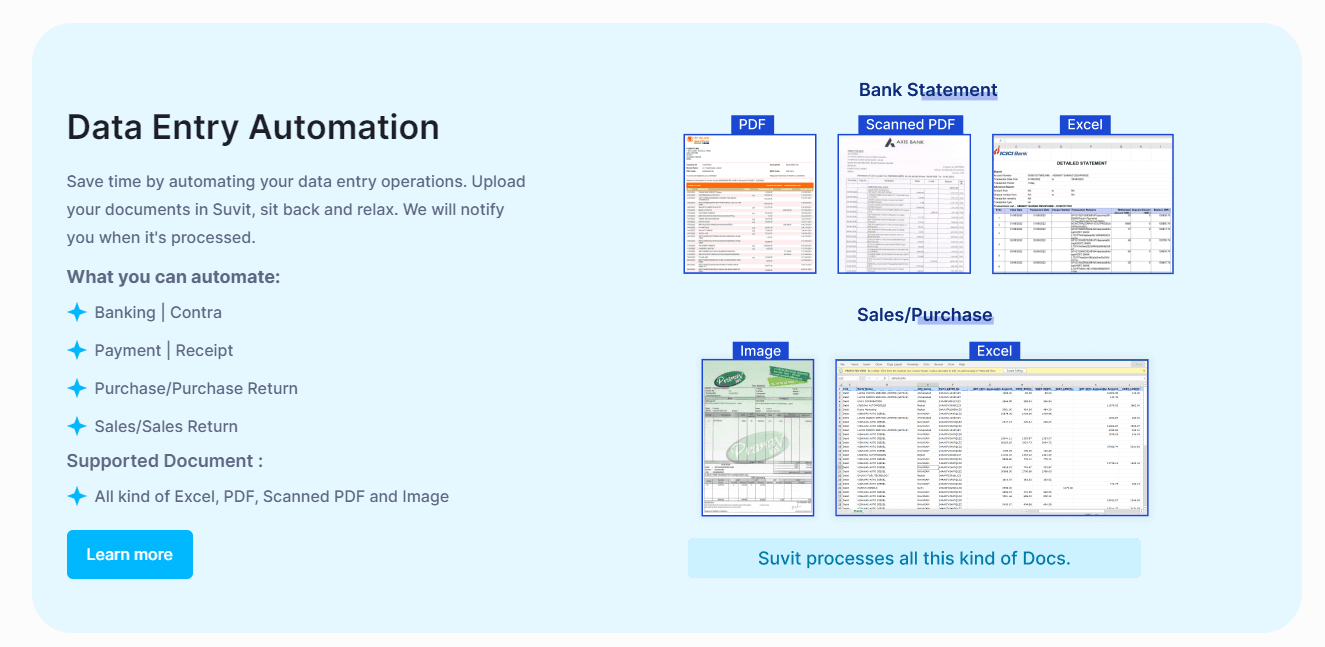

Automate Your Tally Banking With Suvit

Suvit is an AI-powered accounting automation software that helps accountants, tax consultants, and other finance professionals save time and improve accuracy. It can automate a variety of tasks, such as data entry, reconciliation, and reporting. Suvit also integrates with Tally and helps import transactions from Excel or PDF files into Tally, generate reports from Tally data, manage customers and suppliers, track inventory, and generate invoices and bills!

It eliminates the need to even put entries manually into Tally. As soon as you upload your Excel or PDF files, it will fetch all the data and make the transactions ready to be copied to Tally. In this case, you won’t be required to extensively learn about Tally, just basic knowledge would help!

Here are some of the key features of Suvit:

- Automates data entry, reconciliation, and reporting

- Integrates with Tally

- Supports multiple languages

- Provides real-time insights into financial data

- Cloud-based for easy access from anywhere

- Affordable and easy to use

Suvit is a powerful tool that can help businesses of all sizes improve their accounting processes. If you are looking for a way to save time and improve accuracy, Suvit is a great option to consider. Sign up today.