In 2025, Chartered Accountants in India are facing an increasingly complex environment, driven by changing regulations, growing client demands, and the need for digital transformation.

The rise of Practice Management Software (PMS) has become a critical tool for CAs looking to streamline their operations, ensure compliance, and enhance client service.

This blog will explore the best practice management software available for Indian Chartered Accountants in 2025.

Why Indian CAs Need Practice Management Software

As a CA in India, managing a multitude of compliance tasks, client requirements, and internal operations can be overwhelming. The right Practice Management Software (PMS) helps address the following challenges:

1. Complex Compliance Landscape

India’s tax and accounting tree is growing complex, with frequent updates to GST, ITR, and TDS filings. Without a robust PMS, manual management of compliance tasks can lead to costly mistakes and missed deadlines.

Practice Management Software automates these processes, ensuring that your firm remains compliant with Indian tax laws and regulatory standards.

2. Client Expectations

Modern clients demand transparency, timely updates, and personalized services. Meeting these expectations requires seamless communication, easy access to financial data, and the ability to respond to queries quickly.

A comprehensive PMS helps streamline client management, allowing CAs to track communication histories, automate responses, and offer high-quality services efficiently.

3. Operational Efficiency

Manual systems often result in inefficiencies and increased workloads. By automating routine tasks such as document management, task assignments, and deadlines, a Practice Management Software for CAs can save time, reduce errors, and improve overall productivity within the firm.

4. Remote Work Dynamics

With the rise of hybrid work models, having a cloud-based PMS allows CA teams to collaborate from any location, ensuring business continuity while maintaining secure access to client data and documents.

Essential Features of Practice Management Software for CAs

When choosing a PMS for your CA firm, it’s essential to look for the following key features:

1. Automated Task & Deadline Management

- Automate Repetitive Tasks: Automate recurring tasks such as filing GST returns, auditing, and compliance checks.

- Assign and Track Deadlines: Assign tasks to team members and track their progress to ensure timely completion.

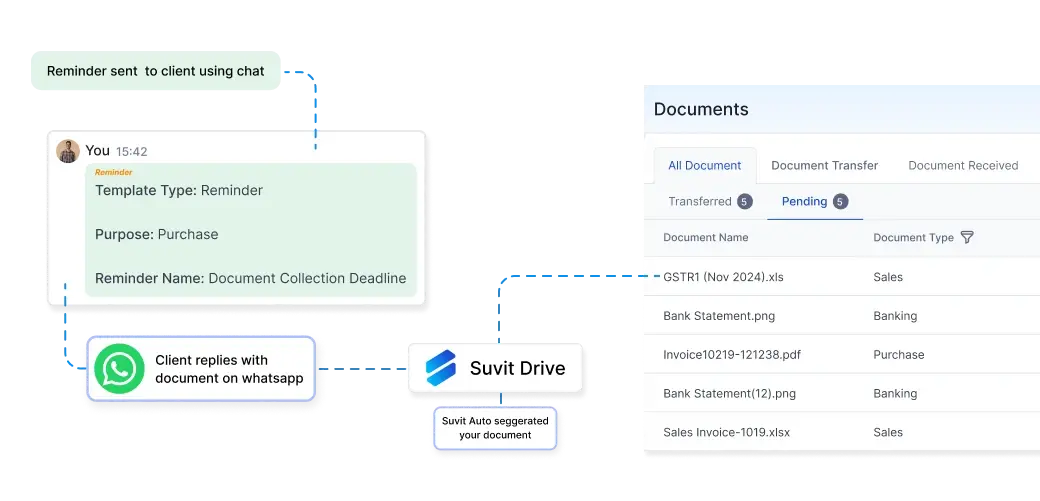

- Alerts and Reminders: Receive automated alerts for deadlines to prevent missed filings and late submissions.

2. Client Communication Module

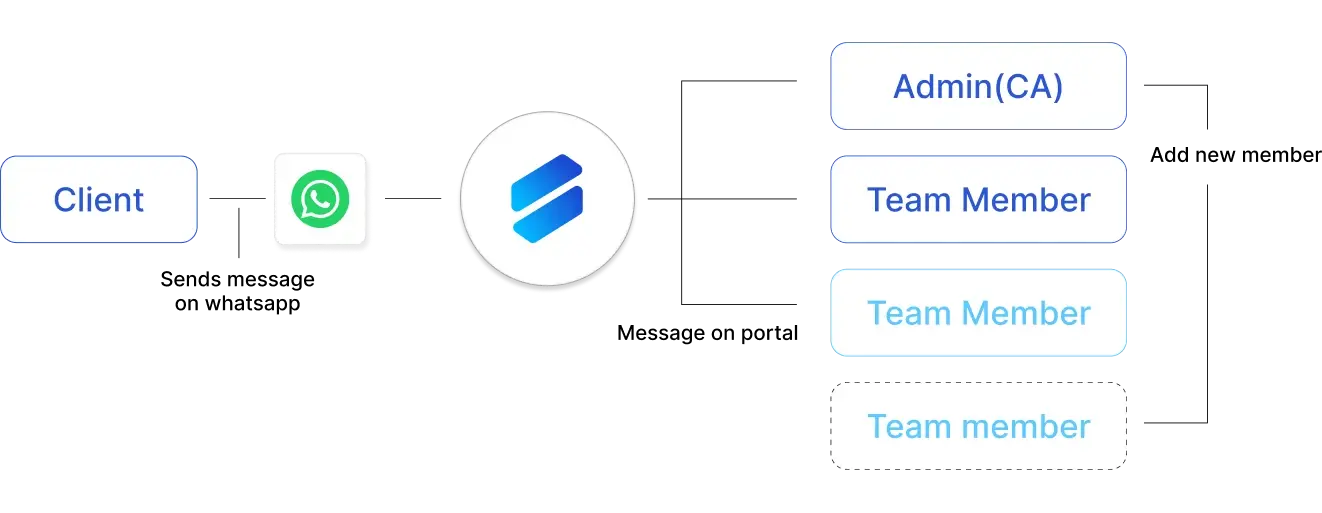

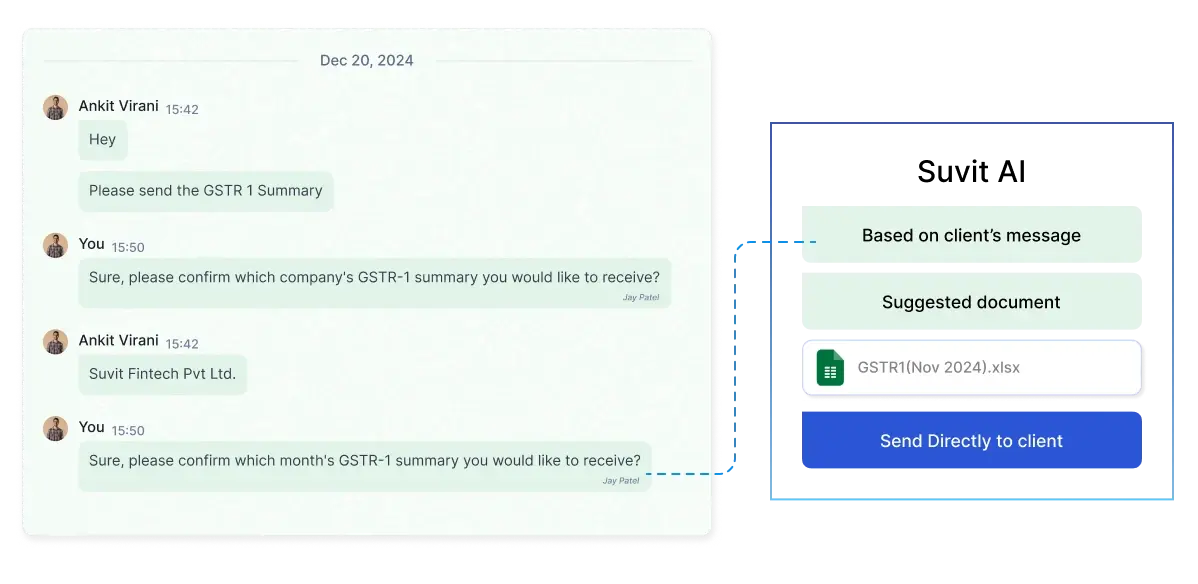

- Centralized Communication: Track all communications with clients from a single platform to improve client relationships.

- Seamless Integrations: Integrate messaging apps like WhatsApp for easy, real-time communication.

- Transparent Client Updates: Utilize the communication module to deliver clients with timely updates on their financial status and compliance progress.

3. Seamless Document Collection & Management

- AI-Based Document Recognition: Use AI-driven systems to automate the collection and categorization of documents.

- Secure Cloud Storage: Store documents securely with version control, ensuring access is granted only to authorized team members.

- Integration with Accounting Tools: Sync data seamlessly with accounting tools like Tally or Zoho Books for real-time financial updates.

4. Smart Dashboards & Reporting

- Real-Time Financial Insights: Access real-time dashboards showing key performance indicators (KPIs) for your firm’s financial health.

- Customizable Reports: Generate detailed reports for both internal analysis and client presentations, helping you make data-driven decisions.

- Performance Monitoring: Track team performance and workload distribution to ensure balanced workloads and productivity.

5. Compliance Tracking & Audit Trails

- Audit Trails: Keep track of document access and modifications, ensuring accountability and transparency.

- Built-In Compliance Checks: Ensure your firm remains in compliance with Indian tax regulations through built-in checks for GST, ITR, and TDS.

- Timely Alerts: Receive alerts for compliance-related deadlines, renewals, and filings, helping you stay on top of statutory requirements.

Top Practice Management Software for Indian CAs in 2025

1. Suvit: The Ideal Solution for Indian CA Firms

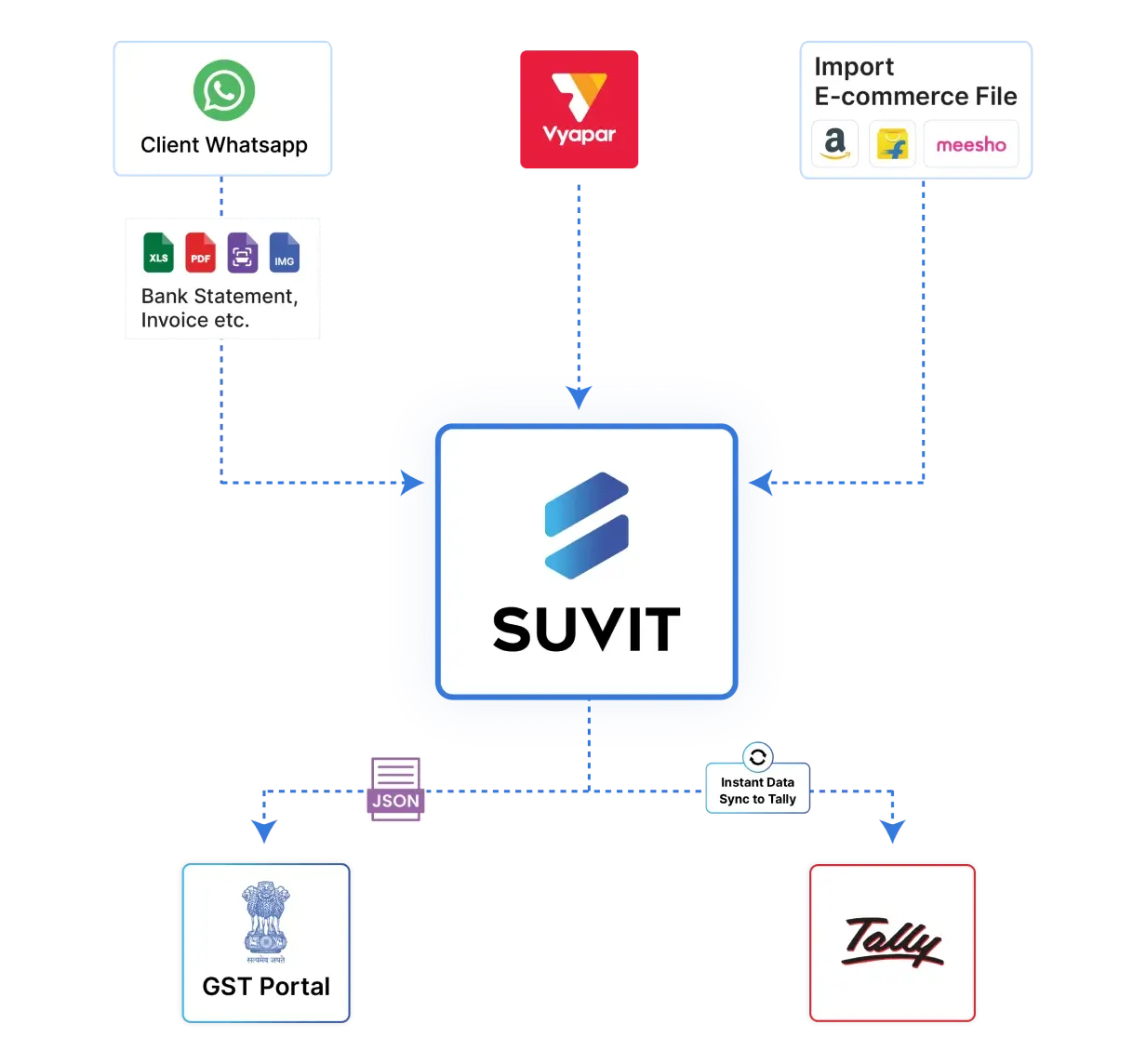

Suvit is a modern, cloud-based Practice Management Software designed to meet the specific needs of CAs in India. Suvit integrates multiple features like task automation, compliance tracking, and real-time document management to improve the efficiency and effectiveness of CA firms.

Key Features of Suvit

-

Cloud-Based Platform: Provides secure, remote access to your data, enabling seamless collaboration among team members.

-

Workflow Automation:

Automates repetitive tasks and workflows to reduce manual errors and free up time for high-priority work.

- Client Relationship Management (CRM):

Organize and manage client interactions, track communication history, and enhance customer service.

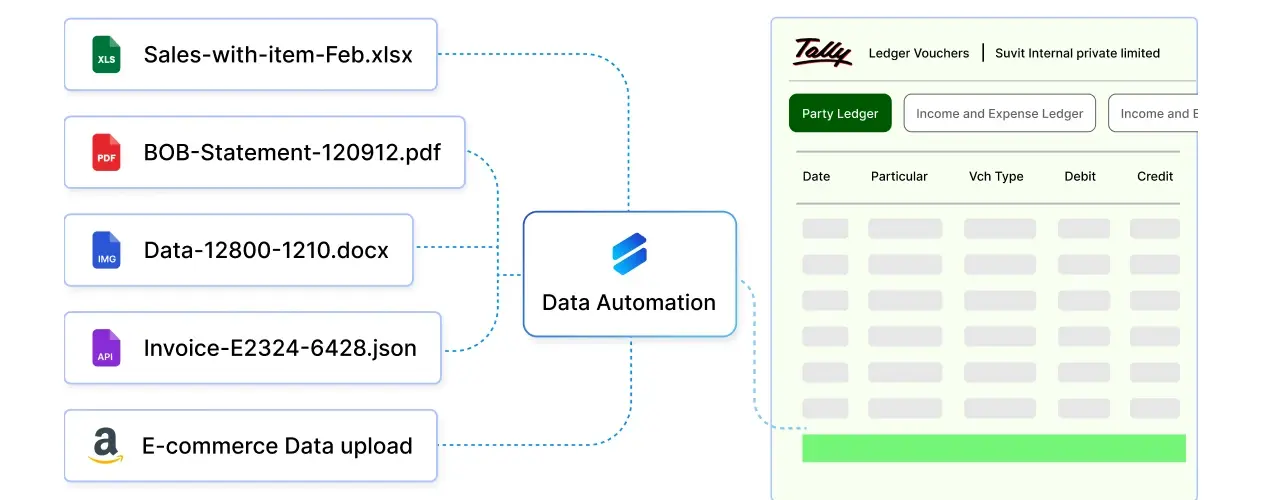

- Document Management System:

Store, organize, and track client documents securely, with AI-based recognition and tagging.

- Compliance Alerts:

Stay ahead of deadlines with automatic reminders for GST filings, tax returns, and other compliance requirements.

- Integration with Accounting Tools:

Sync financial data with tools like Tally and Vyapar, ensuring accurate and up-to-date records.

Why Suvit is Perfect for Indian CAs

- Tailored for Indian Regulations: Explicitly designed to meet the needs of Indian CA firms, Suvit ensures compliance with all local tax laws and regulatory standards.

- Scalable & Customizable: Whether you are a solo practitioner or part of a large CA firm, Suvit scales with your business needs.

- User-Friendly: With a simple interface, Suvit reduces the learning curve and helps your team get up to speed quickly.

2. ICAI Practice Management Software

Developed by the Institute of Chartered Accountants of India (ICAI), this PMS offers a comprehensive suite of tools designed for CA firms.

-

Key Features:

- Task and employee management.

- Workflow automation tailored to CA firm needs.

- Secure cloud hosting and compliance with Indian regulatory standards.

3. ERPCA

ERPCA is a powerful, cloud-based platform designed for CA firms and consultancy practices.

-

Key Features:

- Mobile app for easy management.

- Automated client onboarding.

- Payment tracking and invoicing tools.

4. Zoho Practice

Zoho Practice is an all-in-one software platform for client management, document storage, and task automation, making it a solid choice for CA firms looking for a flexible and scalable solution.

-

Key Features:

- Integration with Zoho accounting tools.

- Client and task management automation.

- Customizable workflows for improved productivity.

Integration with AI Tools: Elevating Efficiency

Integrating AI tools with PMS helps further enhance the efficiency of Chartered Accountant firms:

- Automated Data Entry: AI can automatically capture data from bank statements, invoices, and receipts, reducing manual entry.

- Real-Time Analytics: AI-driven insights into financial performance, providing actionable data for better decision-making.

- Intelligent Document Categorization: AI tools can recognize, sort, and categorize financial documents, saving time and improving accuracy.

For instance, Suvit integrates AI-powered features, like automated document recognition and intelligent financial analytics, streamlining accounting tasks and reducing human error.

Implementation Tips for CA Firms

When adopting a Practice Management Software like Suvit, keep these tips in mind to ensure a smooth implementation:

- Pilot Testing: Before fully implementing the software, conduct a pilot test with a small team or department to iron out any issues.

- Training: Ensure that your team is trained on the features and functionalities of the new system to maximize its potential.

- Customization: Tailor the software to meet the unique needs of your firm. This includes setting up workflows, document storage, and client management systems.

- Customer Support: Choose a software provider that offers strong customer support and regular updates to ensure ongoing improvements.

Practice Management Software is Must for Indian CAs in 2025

As the role of Chartered Accountants continues to evolve in 2025, adopting the right Practice Management Software is more important than ever.

Suvit stands out as a top choice for Indian CA firms, offering a comprehensive, cloud-based solution that streamlines tasks, enhances compliance, and improves client service. With the right PMS, your firm can thrive in a competitive, technology-driven landscape.

FAQs

Q1: What is Practice Management Software?

Practice Management Software is a tool designed to streamline various aspects of a CA practice, including client management, task automation, document storage, and compliance tracking, helping to improve overall efficiency and reduce errors.

Q2: How does Suvit enhance my CA practice?

Suvit offers cloud-based access, AI-powered task automation, integrated document management, and compliance tracking, making it an ideal solution for CA firms looking to streamline operations and enhance client service.

Q3: Is Suvit customizable?

Yes, Suvit allows you to customize workflows, task assignments, and reporting features to fit the specific needs of your firm.

Q4: Is Suvit compliant with Indian tax laws?

Yes, Suvit is specifically designed to comply with Indian tax laws and regulations, ensuring your firm remains compliant with ICAI, GST, and TDS requirements.