Spending late nights wrestling with spreadsheets, missed GST filing deadlines, and compliance chaos?

In the current turbocharged, rule-changing time, holding on to manual processes is like navigating compliance on a unicycle, possible, but unnecessarily hard!

Automating GST filing isn’t just a nice-to-have anymore; it’s the new norm for forward-thinking CA firms looking to save time, reduce errors, and thrive in 2025 and beyond.

Let’s break down the top platforms revolutionizing GST filing and compliance, so you can pick the best fit for your CA practice and watch your worries melt away.

Why Automate GST Filing in 2025? 🚀

- Rule Changes, Real Consequences: July 2025 ushers in non-editable GSTR-3B filings and stricter audit trails. One missed step? Penalties, notices, and compliance headaches.

- Bulk Data = Bulk Risks: Manual processing multiplies risks of ITC mismatches, invoice errors, and missed deadlines.

- Client Expectations Skyrocket: Modern clients want transparent processes, timely filings, and digital convenience.

- Teamwork Gets Tougher: Scattered tasks, duplicate entries, and last-minute chases become productivity nightmares.

The fix? Smart automation built for Indian CAs, with real-time reconciliation, compliance alerts, and zero-chaos dashboards.

Top 10 Platforms for Automating GST Filing and Compliance

1. Suvit ~ The AI-Powered GST Automation Gold Standard

-

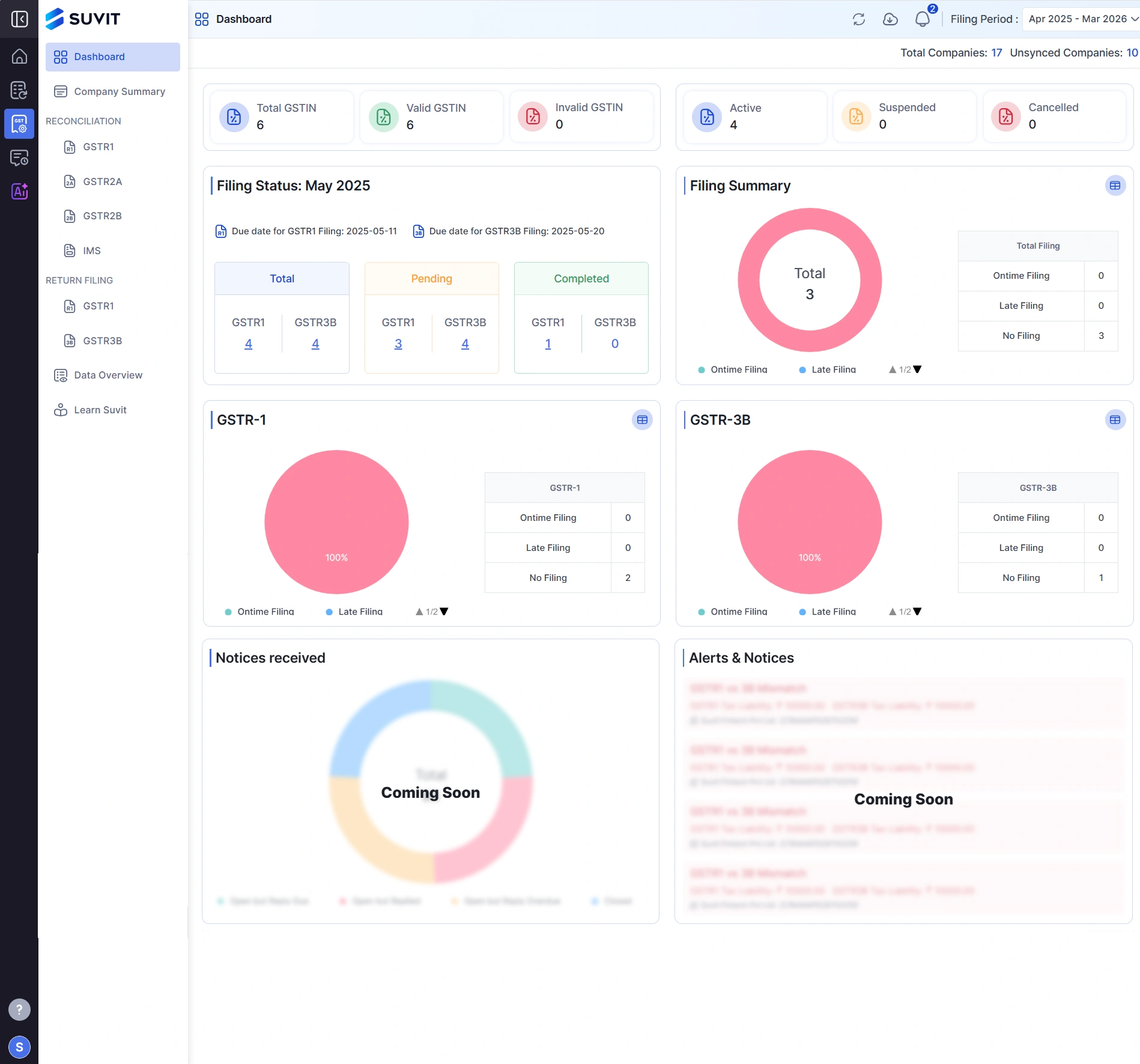

Why firms love it: Purpose-built for Indian Chartered Accountants and tax pros, Suvit knocks out manual data entry with AI, delivers instant GST reconciliation, and transforms GST compliance into a breeze.

-

Core Features:

-

Automated GSTR-1, GSTR-2A, GSTR-2B reconciliation & show filing status

-

30+ data validations, ITC mismatch resolution, Smart error alerts

-

One-click Tally, Vyapar & Excel data imports

-

Best for: Fast-growing firms, audit-ready pros, anyone fed up with manual errors.

2. ClearTax GST ~ Trusted by Enterprises & CAs Nationwide

-

What sets it apart: End-to-end GST compliance, powerful analytics, and integrations with 100+ ERPs.

-

Key Features:

- Automated returns (GSTR-1 to 9), cloud onboarding, and bulk filing

- Match 6,000 invoices/minute via AI.

- Smart compliance reminders, notifications

-

Perfect for: Large and SME firms wanting reliability plus scale.

3. TallyPrime ~ In-Depth Accounting with GST Integration

-

Why it’s popular: India’s household name for accounting brings GST invoicing, instant return filing, and robust reconciliation in a friendly, offline-ready package.

-

Key Features:

- GST invoice creation (HSN/SAC-coded)

- Sign and track returns, audit trails, and inventory linkage.

-

Best for: Firms that want classic accounting plus modern GST tools.

4. Zoho Books ~ Cloud-Based, End-to-End GST Compliance

-

What makes it unique: Cloud-first, startup-friendly GST automation coupled with the strength of Zoho’s business ecosystem.

-

Key Features:

- Automated GST calculations & reporting

- GST-ready invoice templates, audit logs

- Free plans for startups, easy integrations (CRM, Inventory)

-

Best for: Digital-first CA firms, fast-scaling small businesses.

5. Vyapar GST ~ Small Business, Big Impact

-

Why it rocks: GST compliance in your pocket! User-friendly mobile + desktop apps, GST invoicing, and inventory features geared for Indian SMEs and traders.

-

Key Features:

- On-the-go GST billing, returns, and inventory

- Offline mode, automated tax calculations

-

Perfect for: Retailers, service providers, digital natives.

6. Marg GST ~ Inventory & Compliance, Simplified

-

What makes it stand out: Perfect for fast-moving retailers/distributors needing barcode integration, GST-ready billing, and real-time GST updates.

-

Key Features:

- E-invoicing, automated tax rate updates

- Inventory alignment, error spotter

-

Best for: Distributors, big-volume CA practices.

7. QuickBooks GST ~ Familiar, Efficient, Integrated

-

Why CAs use it: Trusted brand, seamless GST calculations and reporting for SMEs and accountants, including HSN/SAC code automation.

-

Key Features:

- GST billing, auto tax calculation, multi-device access

-

Perfect for: Firms needing fast onboarding and familiar workflows.

8. HostBooks GST ~ Cloud Convenience, Mismatch Alerts

-

Why it’s trending: Cloud-based, easy to use, with multi-template billing and automatic mismatch alerts built for small firms and startups.

-

Key Features:

- GSTR filing, bulk import, and error detection

-

Best for: Tech-friendly CAs looking for value.

9. GSTHero ~ ERP Integrations & Enterprise-Grade Filing

-

What’s special: Tight ERP integrations (Tally, SAP, Oracle), AI reconciliation, and robust e-waybill features.

-

Key Features:

- Bulk invoice upload, real-time error checks, cloud e-invoicing

-

Best for: Large enterprises and CAs handling complex client portfolios.

10. Commenda ~ Custom Workflows with Smart Analytics

-

Why CAs pick it: Audit-ready dashboards, customizable workflows, and advanced analytics for mid-to-large businesses.

-

Key Features:

- End-to-end return filing, reconciliation, and audit trail

-

Perfect for: Firms prioritizing compliance, transparency and control.

Feature Comparison Table

| Platform | Auto Filing | AI Recon. | Platform | Auto Filing | AI Recon. | AI Recon. |

|---|---|---|---|---|---|---|

| Suvit | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| ClearTax | ✅ | ✅ | ✅ | ✅ | 🔸 | ✅ |

| TallyPrime | ✅ | ✅ | ✅ | ✅ | 🔸 | ✅ |

| Zoho Books | ✅ | ✅ | ✅ | ✅ | 🔸 | ✅ |

| Vyapar | ✅ | ✅ | ✅ | 🔸 | 🔸 | ✅ |

| Marg GST | ✅ | ✅ | ✅ | ✅ | 🔸 | ✅ |

| QuickBooks | ✅ | ✅ | ✅ | ✅ | 🔸 | ✅ |

| HostBooks | ✅ | ✅ | ✅ | ✅ | 🔸 | ✅ |

| GSTHero | ✅ | ✅ | ✅ | ✅ | 🔸 | ✅ |

| Commenda | ✅ | ✅ | ✅ | ✅ | 🔸 | ✅ |

✅ = Fully Supported | 🔸 = Limited/Partial Support

Major GST Compliance Trends in 2025

- E-Invoicing Expansion: Over 90% of businesses now use e-invoicing for GST returns, with expanded regulations covering enterprises above ₹1 crore and likely all MSMEs soon.

- AI-Driven GST Compliance: Automation platforms leverage AI to reconcile invoices, track ITC, predict compliance risks, and flag discrepancies, drastically reducing errors and audit risk.

- Cloud & Mobile Access: Platforms with cloud dashboards and robust mobile apps let teams work anytime, anywhere, enabling true remote CA collaboration.

- Digital Incentives & Tax Tech: Government incentives reward businesses that fully digitize GST processes. Blockchain and audit trails help prevent fraud and simplify audits.

- July 2025 Filing Rule Changes: GSTR-3B is now auto-populated and non-editable for certain tables, increasing automation’s critical role in compliance management.

Tips for Effortless GST Compliance Automation

- Automate Bulk Tasks: Let your platform handle large-scale reconciliation, ITC checks, and multi-GSTIN filings.

- Stay Updated: Pick solutions that push automatic regulatory updates.

- Centralised Data: Use tools that import from Tally, Vyapar, Excel, and integrate with client ERPs for single-screen control.

- Enhance Collaboration: Look for real-time dashboards, audit trails, and WhatsApp integration for seamless communication.

TL;DR

- Manual GST filing = headaches, errors, and missed opportunities

- Top platforms automate bulk filing, reconciliation, and ITC, all in a few clicks.

- Compliance, analytics, and audit readiness in one dashboard.

- Pick the right tool and future-proof your CA practice for accuracy, efficiency, and client wow-factor.

Future-proof your GST compliance, ditch the chaos, automate your filings, and turn your CA firm into a compliance powerhouse!

Ready to scale, stay compliant, and delight your clients? Explore top platforms and Try Suvit’s intelligent GST Reconciliation for free, revolutionizing automation for India’s Chartered Accountants.