Managing extensive paperwork is a common challenge for accountants and chartered accountants (CAs). One particularly difficult task is extracting invoices from documents. But fear not—there is a simple method that will make this laborious task seem easy.

The Manual Approach - A Time-Consuming Route

In the past, accountants and chartered accountants have utilized manual techniques to obtain data from invoices. This involves looking over each document and noting important information like dates, amounts, and payee details. Even though this approach was traditional, it is incredibly ineffective in the rapidly evolving digital world of today.

Navigating Invoice Extraction: A Modern Approach

In the complex world of finance, invoices provide a paper trail of financial activities and are a vital record of transactions. It can take a while and exact attention to detail to extract the important information from these documents. But what if sorting through the deluge of data and statistics could be done more easily?

Enter Automation - A Game-Changing Fuel

Automation has changed the financial industry in recent years, and invoice extraction is no different. Modern accounting software can now be used by tax professionals to automate the extraction process, saving time and reducing the possibility of mistakes that come with manual techniques.

How Does Invoice Extraction Software Work?

Imagine a tool that could quickly and efficiently sort through mountains of invoices to find and extract relevant information. Advanced Optical Character Recognition (OCR) technology is used by invoice extraction software to identify text and numbers on invoices. Important information like invoice numbers, dates, line items, and more can be identified by it.

A Stellar Solution: Vyapar TaxOne, Not Your Cliché Invoice Extractor, But A Bridge To Tally

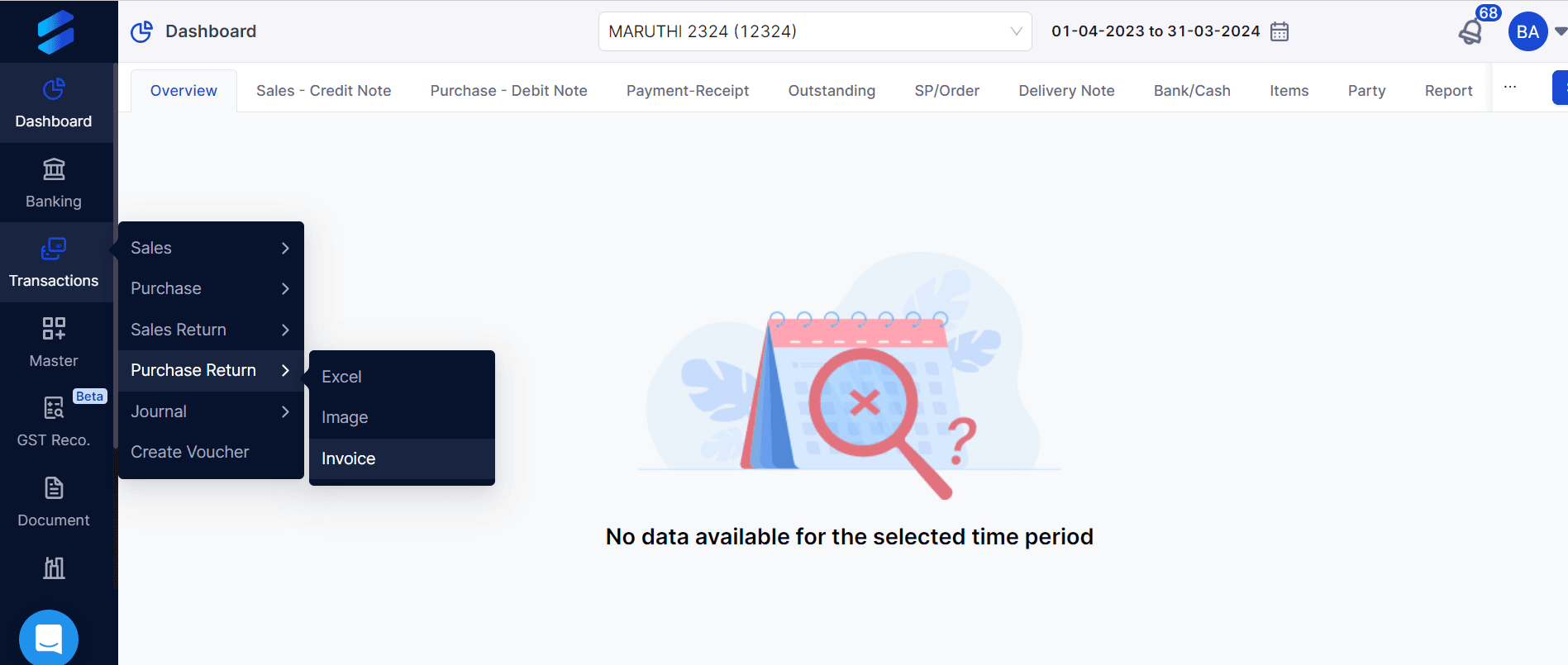

Using Vyapar TaxOne as an Invoice extractor is as simple as cutting a cake. Vyapar TaxOne not only extracts the data from your invoice, but it directly sends it to Tally in a few minutes! Can’t believe it? See here how you can use Vyapar TaxOne to extract data from invoice: After signing in Vyapar TaxOne, follow the steps as shown:

Step 1: Open the desired transaction and then go to the Invoice tab.

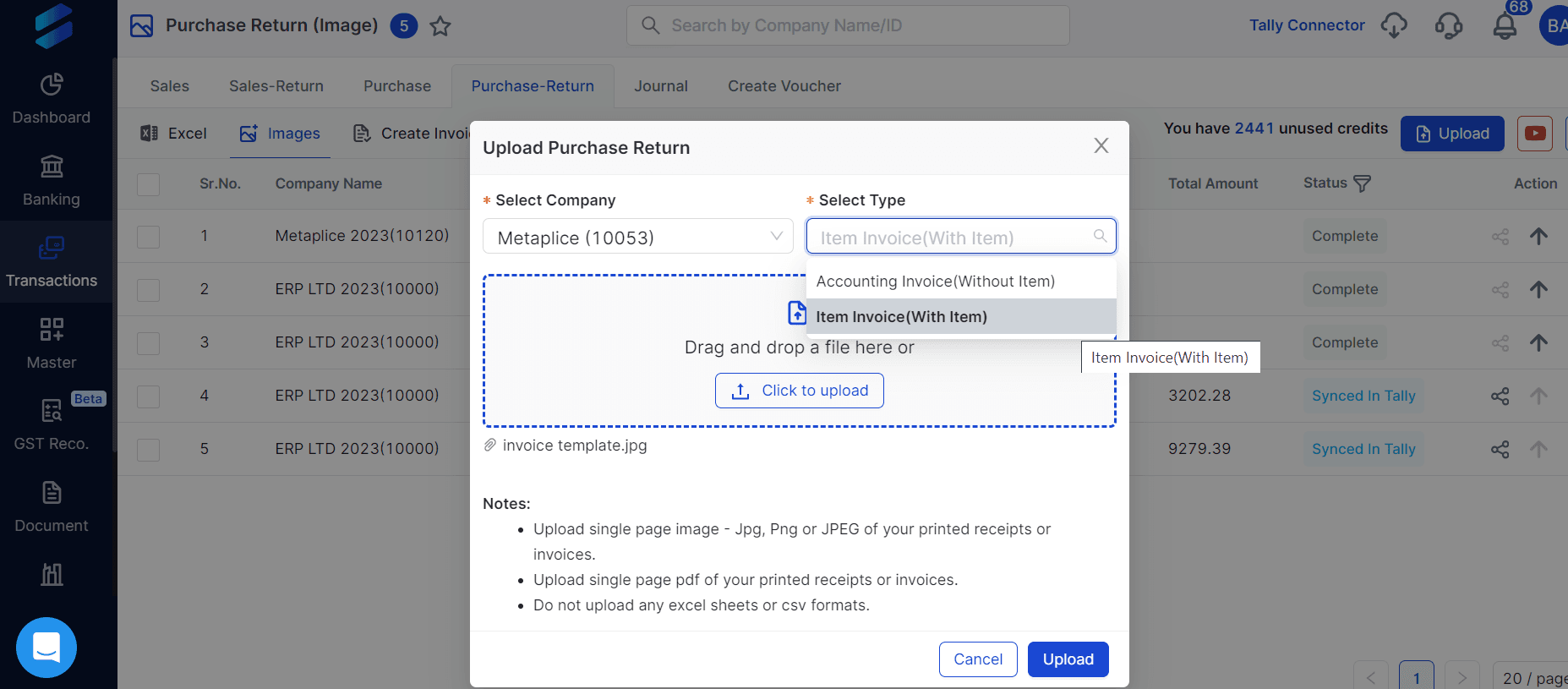

Step2: You will see a Upload button in top right corner, clicking on it you will have a screen something like this:

In this, choose the company and the type of invoice you want to proceed with. Then, upload an image of the invoice.

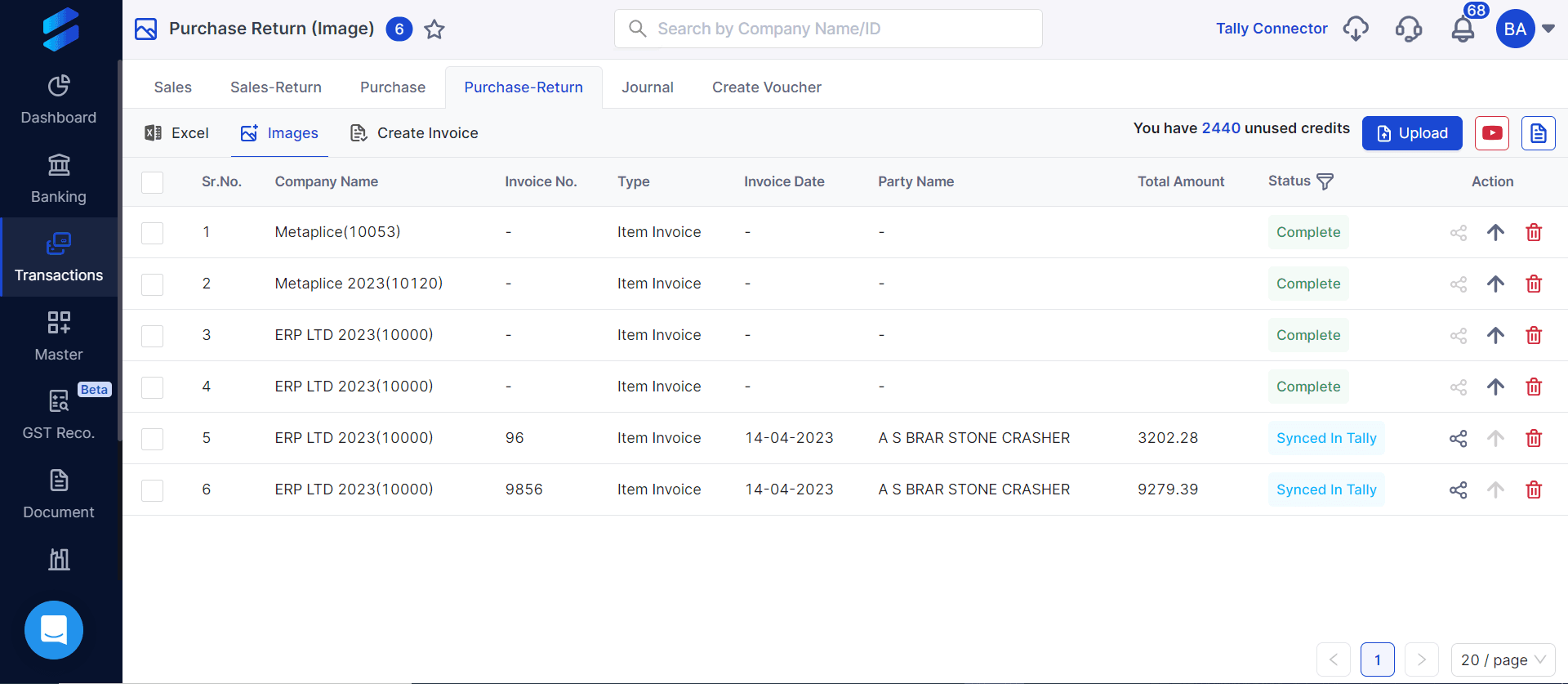

Step 3: To modify your details further, click on your company from the list as shown:

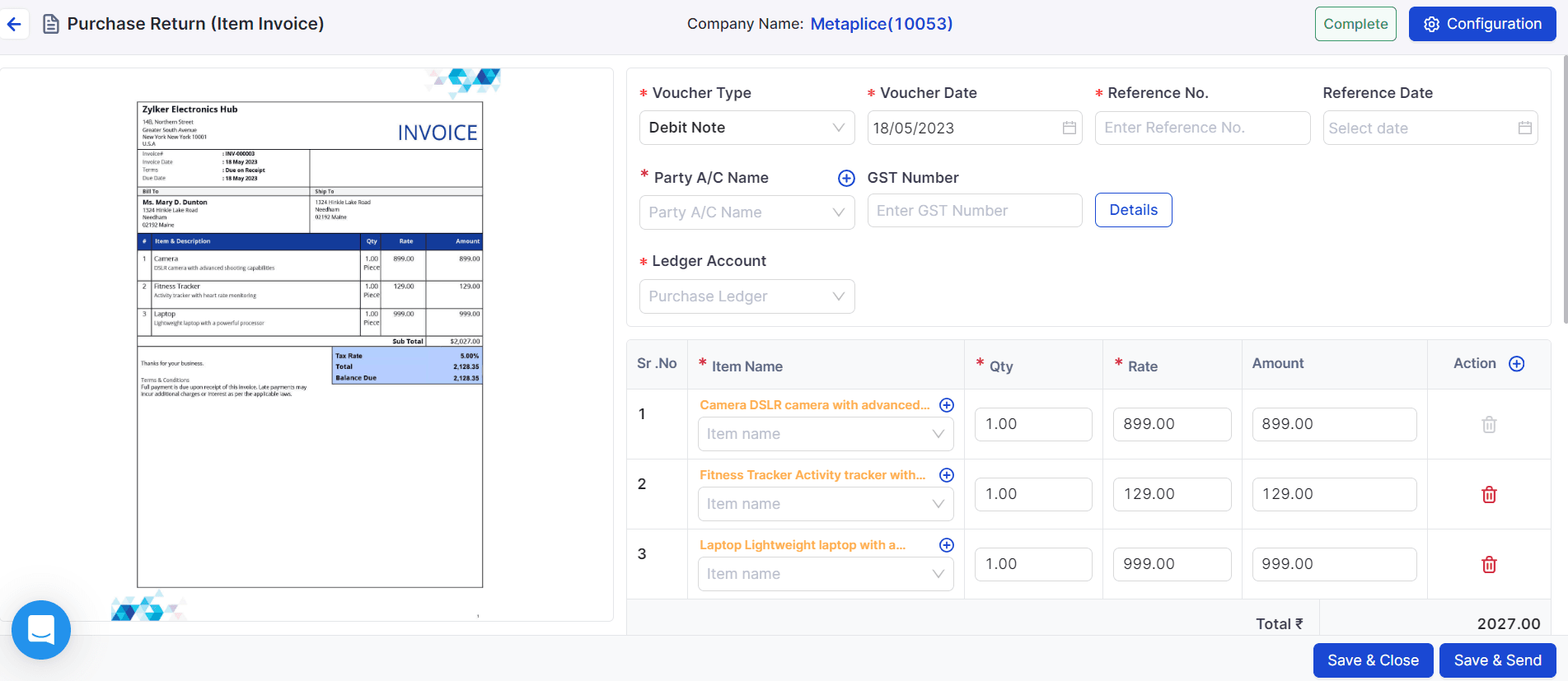

Upon clicking, your screen will have an invoice on one side and the details on the other side.

Upon clicking, your screen will have an invoice on one side and the details on the other side.

Vyapar TaxOne will fetch up the data from your invoice. But, still you get an option if you want to edit the data manually.

Vyapar TaxOne will fetch up the data from your invoice. But, still you get an option if you want to edit the data manually.

Also Read: Learn the Difference Between Invoicing and Accounting Software

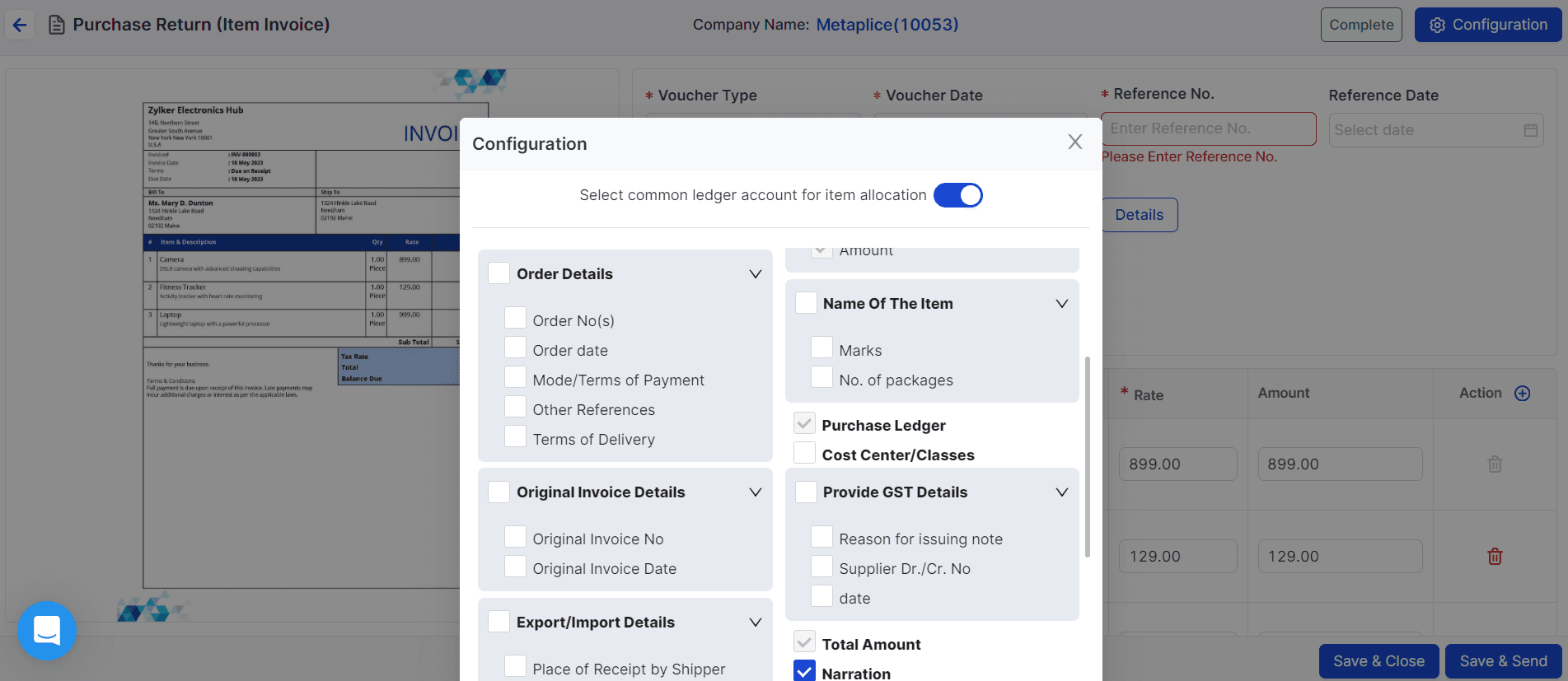

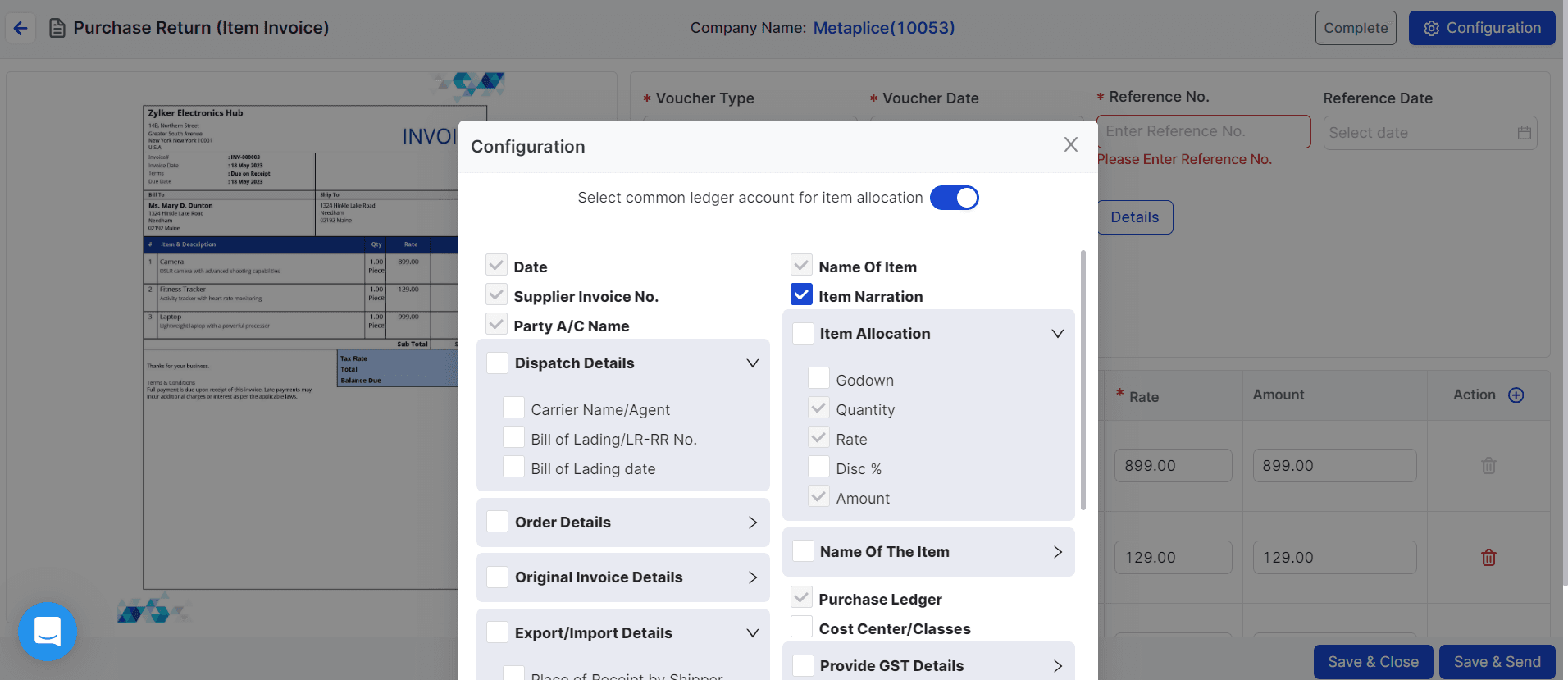

Step 4: Configuration

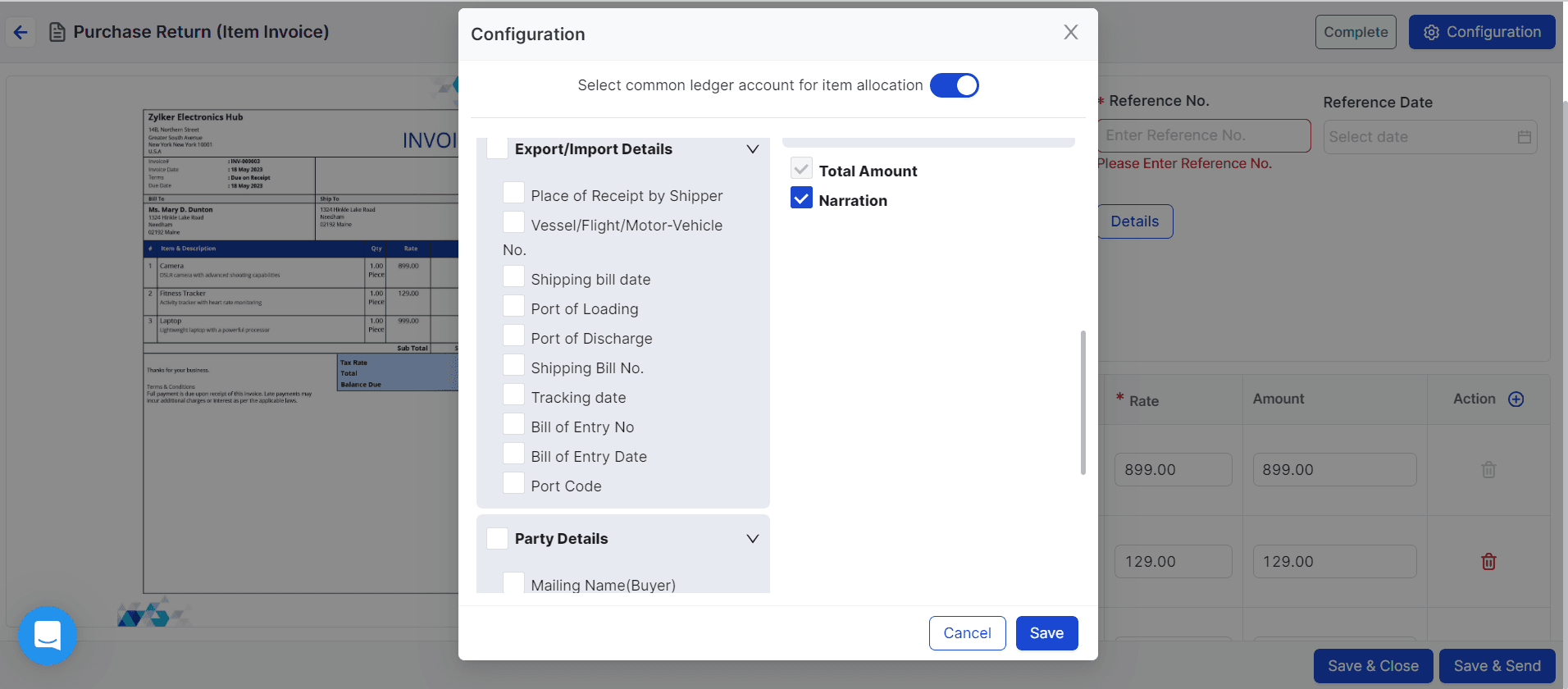

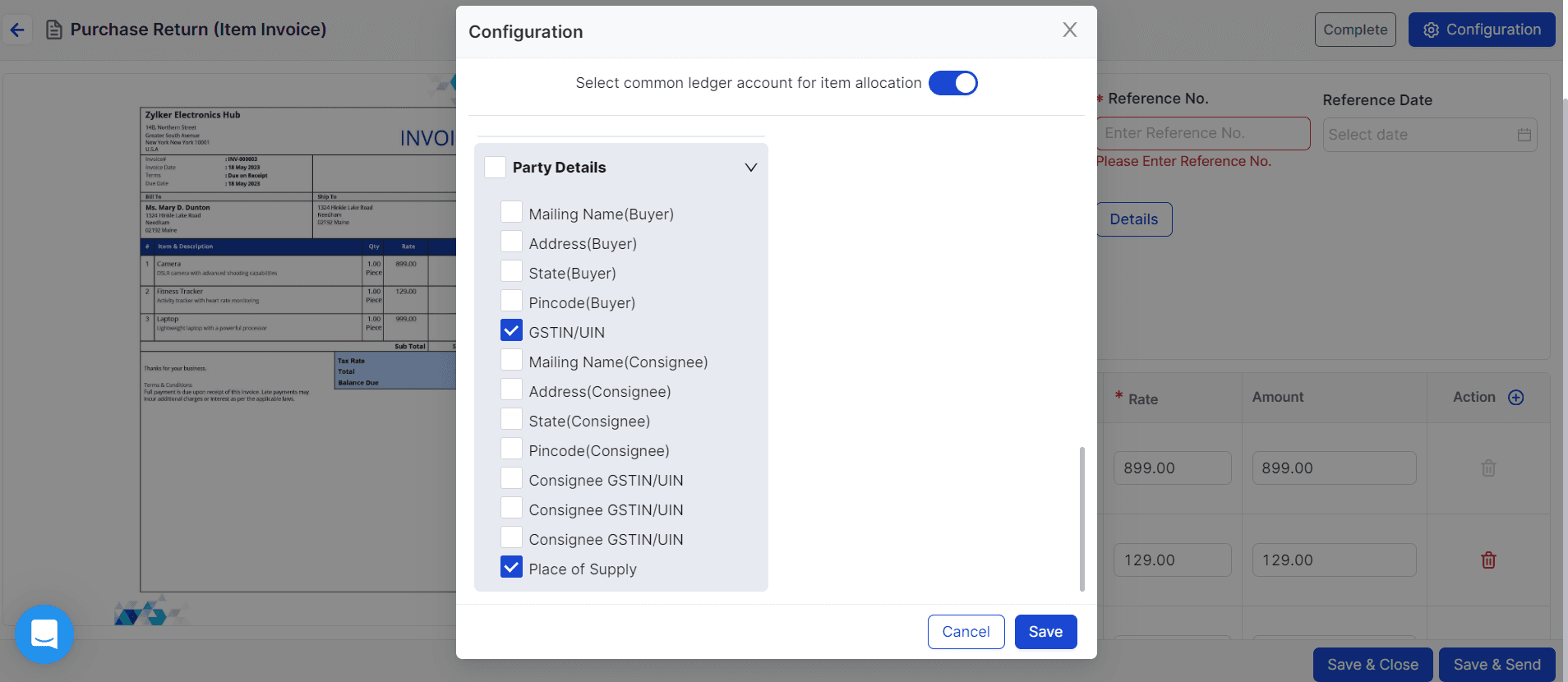

You can configure parameters as per your choice. Click on the Configuration button, in the top right corner. You’ll get the ledger options as shown below:

Upon finishing with the details, click on the save button from the configuration pop-up.

Now, you will see a Save & Send option in the bottom right corner. Click on it to send the data to Tally.

And now you know how much easier it is to extract data from invoices using Vyapar TaxOne!

Upon finishing with the details, click on the save button from the configuration pop-up.

Now, you will see a Save & Send option in the bottom right corner. Click on it to send the data to Tally.

And now you know how much easier it is to extract data from invoices using Vyapar TaxOne!

Benefits for Tax Professionals

Using invoice extraction software can result in more accuracy and efficiency for tax professionals. But using Vyapar TaxOne, accountants and Certified Public Accountants (CAs) can shift their attention to more strategic areas of financial management by processing and sending a considerable number of invoices to Tally in a fraction of the time it would take to process them manually.

Furthermore, there is a much lower chance of human error, guaranteeing that the data used for financial reports and tax computations is accurate and trustworthy. This fosters client trust while also enhancing the credibility of financial professionals.

The Human Touch - Customization and Validation

Tax professionals can continue to use their expertise by tailoring Vyapar TaxOne to meet specific requirements, even though automation handles the heavy lifting. Vyapar TaxOne as an invoice extraction tool enables the validation of data that has been extracted, allowing for the smooth fusion of human judgment with the effectiveness of automation. So what are you waiting for, take a seven day free trial to experience a simple way to do invoice extraction!

Also Read: E-Invoicing In India: Everything You Need to Know

Apart from that, Vyapar TaxOne do:

Processing of documents: Vyapar TaxOne can automatically process bank statements, invoices, and receipts. In addition to saving you time and effort, this also helps to guarantee the accuracy of your data.

Bank Reconciliation: Your bank statements can be automatically reconciled by it. This guarantees that your bank balance is accurate and that your records are current.

Financial reporting: Cash flow, income, and balance sheets are just a few of the financial reports that Vyapar TaxOne can produce. Making better business decisions and monitoring your financial performance can be aided by this.

Client Management: Vyapar TaxOne can assist you in managing the data of your clients. This entails keeping track of their payments, invoices, and contact details.

Collaboration: It enables you to work together on accounting assignments with your team members. This could lead to increased productivity.