Are you on the lookout for a secure and smart way to save while also saving on taxes? If so, the National Savings Certificate (NSC) could be just what you need.

Backed by the Government of India, NSC is an excellent choice for those who want a safe, tax-efficient savings option. This scheme allows you to earn fixed interest while also providing you with the benefit of tax deductions under Section 80C of the Income Tax Act, 1961.

Whether you're a small investor or someone aiming for long-term financial goals, NSC provides the perfect balance of safety and growth.

In this post, we'll walk you through everything you need to know about NSC: its eligibility, interest rates, tax-saving benefits, and how you can invest in this government-backed scheme.

What is NSC?

NSC stands for National Savings Certificate, a popular fixed-income investment scheme launched by the Government of India in 1950. The primary goal of the scheme is to encourage savings among Indian citizens, while also offering guaranteed returns.

The best part? NSC is issued by post offices, making it easily accessible to everyone. It is available to Indian residents and is especially attractive for those looking for a low-risk, long-term investment option.

Key Features of NSC

-

Fixed Interest Rate: The government revises the interest rate on NSC every quarter. For Q1 FY 2023-24, the interest rate stands at 7.7% per annum, which is a competitive rate compared to other fixed-income products.

-

Maturity Period: The maturity period of NSC is 5 years.

-

Tax Benefits: You can claim a deduction of up to Rs. 1.5 lakh under Section 80C for the amount invested in NSC. This helps reduce your taxable income, providing a double benefit—interest earnings and tax savings.

-

Interest on NSC: While the interest earned on NSC is taxable, it is eligible for deduction under Section 80C. However, the interest earned during the final year is subject to tax as “income from other sources.

What are the benefits of NSC?

NSC offers several advantages, making it an attractive option for small to medium investors:

-

Guaranteed Safety: Since NSC is backed by the Government of India, it offers capital protection, ensuring that your investment is safe from market volatility or default.

-

Competitive Interest Rates: With a current interest rate of 7.7%, NSC offers a higher return than many other fixed-income options like bank FDs or PPFs.

-

Tax Savings: As mentioned earlier, NSC allows tax deductions under Section 80C, helping you reduce your tax liability. The interest earned is also tax-free in the first four years.

-

Liquidity: NSC can be encashed before maturity in case of emergencies, though premature withdrawal is subject to penalties. You can also use it as collateral for loans.

-

Flexibility in Investment: You can invest in NSC in multiples of Rs. 100, with a minimum of Rs. 1,000, and there is no upper limit on the amount. This flexibility makes NSC suitable for people with varying investment amounts.

How to invest in NSC?

Investing in NSC is very easy and convenient. You just need to follow these simple steps:

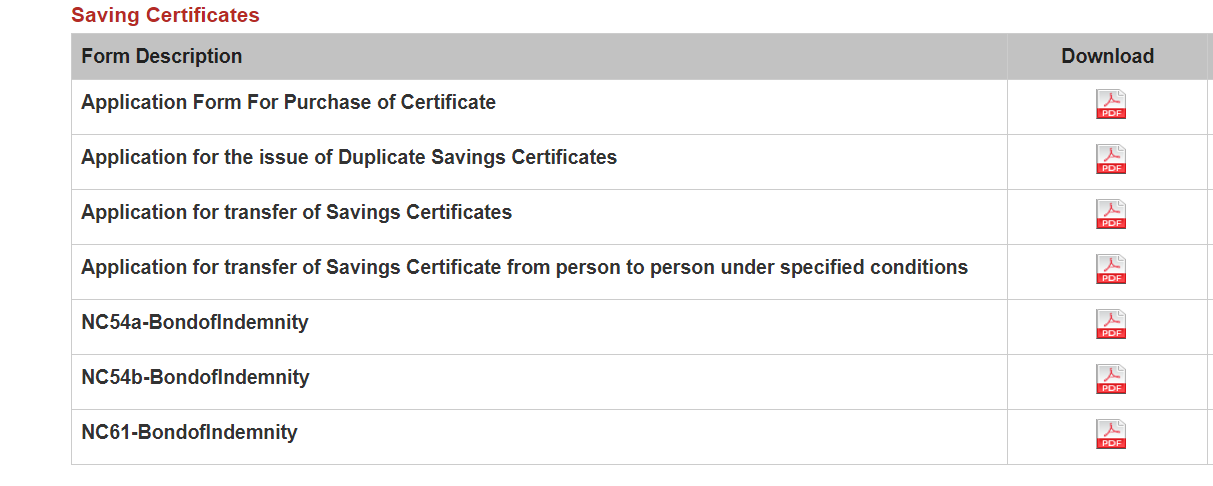

Step 1: Visit a Post Office: Head to your nearest post office and fill out the NSC application form. You can also download the form online from the India Post website.

Step 2: Submit Documents: Provide documents such as identity proof, address proof, and PAN card to complete your application.

Step 3: Make Payment: You can pay your investment amount via cash, cheque, or demand draft. Online payments are also accepted through the India Post website.

Step 4: Collect Your Certificate: After the payment is made, you will receive an NSC certificate (or a passbook or e-certificate if you prefer digital). Keep it safe until maturity.

Step 5: Nominate a Beneficiary: You can nominate someone to receive the maturity amount in case of your unfortunate demise.

How to calculate your returns and tax savings from NSC?

Want to know how much you’ll earn and save? You can easily calculate your NSC returns and tax benefits using an online NSC calculator.

Here’s what you’ll need to input:

- Investment amount

- Interest rate

- Investment tenure

- Your tax slab

Once you enter these details, the calculator will give you a breakdown of:

- Interest earned each year

- Total maturity amount

- Tax savings under Section 80C

This tool helps you compare different NSC schemes and select the one that best suits your needs.

FAQS

What is the minimum and maximum amount I can invest in NSC?

The minimum investment is Rs. 1,000, and the amount can be increased in multiples of Rs. 100. There is no maximum limit for investment, but the tax deduction is capped at Rs. 1.5 lakh per year under Section 80C.

How can I buy and redeem NSC?

You can buy NSC at any post office, filling out an application form and submitting required documents. Redemption can be done at the post office at maturity by presenting your NSC certificate. In case of emergencies, NSC can be redeemed before maturity, subject to penalties.

What are the advantages of NSC over other savings schemes?

Here are some advantages of NSC over other schemes like PPF or bank FDs:

- Higher interest rates than PPF and many FDs.

- Shorter 5-year maturity compared to PPF's 15 years.

- No maximum investment limit (unlike PPF).

- Can be used as collateral for loans.

- Easily transferable from one post office to another.