Tally has long been the backbone of accounting for Chartered Accountants and small businesses in India.

While its reliability and accuracy are unparalleled, the process of managing manual data entry in Tally often becomes time-consuming and prone to human error. With increasing transaction volumes and heightened expectations from clients, CAs need more innovative, faster, and error-free methods of managing Tally workflows.

This is where Artificial Intelligence (AI) integration with Tally proves transformative. AI tools greatly improve productivity and accuracy by streamlining routine tasks like data entry, reconciliation, and compliance reporting.

Among leading intelligent automation platforms, Suvit has emerged as a highly practical solution for CAs and accounting professionals in India. Let's see why and how?

TL;DR

- AI automates repetitive and time-consuming Tally data entry.

- Custom workflows manage recurring entries efficiently.

- Automation improves scalability without increasing the accounting staff.

- Secure platforms protect sensitive financial and client data.

Why AI-Tally Integration Matters for Chartered Accountants

The accounting ecosystem in India is evolving rapidly. Chartered Accountants today deal with multiple regulatory shifts, diverse client needs, and rising transaction complexity. AI-powered automation plays a critical role in addressing these challenges.

- Efficiency Gains: AI eliminates repetitive typing in Tally, enabling firms to process high transaction volumes at reduced cost and time.

- Error Reduction: Automated data entry minimizes posting mistakes and avoids mismatched ledgers.

- Compliance Readiness: With frequent GST amendments, MCA notifications, and e-invoicing requirements, automation ensures data is structured correctly and ready for filings.

- Scalability: Firms can manage more clients without proportionate increases in workforce or time investment.

By integrating AI with Tally, CAs can shift their focus from bookkeeping operations to higher-value advisory roles.

Practical Ways to Integrate AI with Tally

1. Automating Data Entry

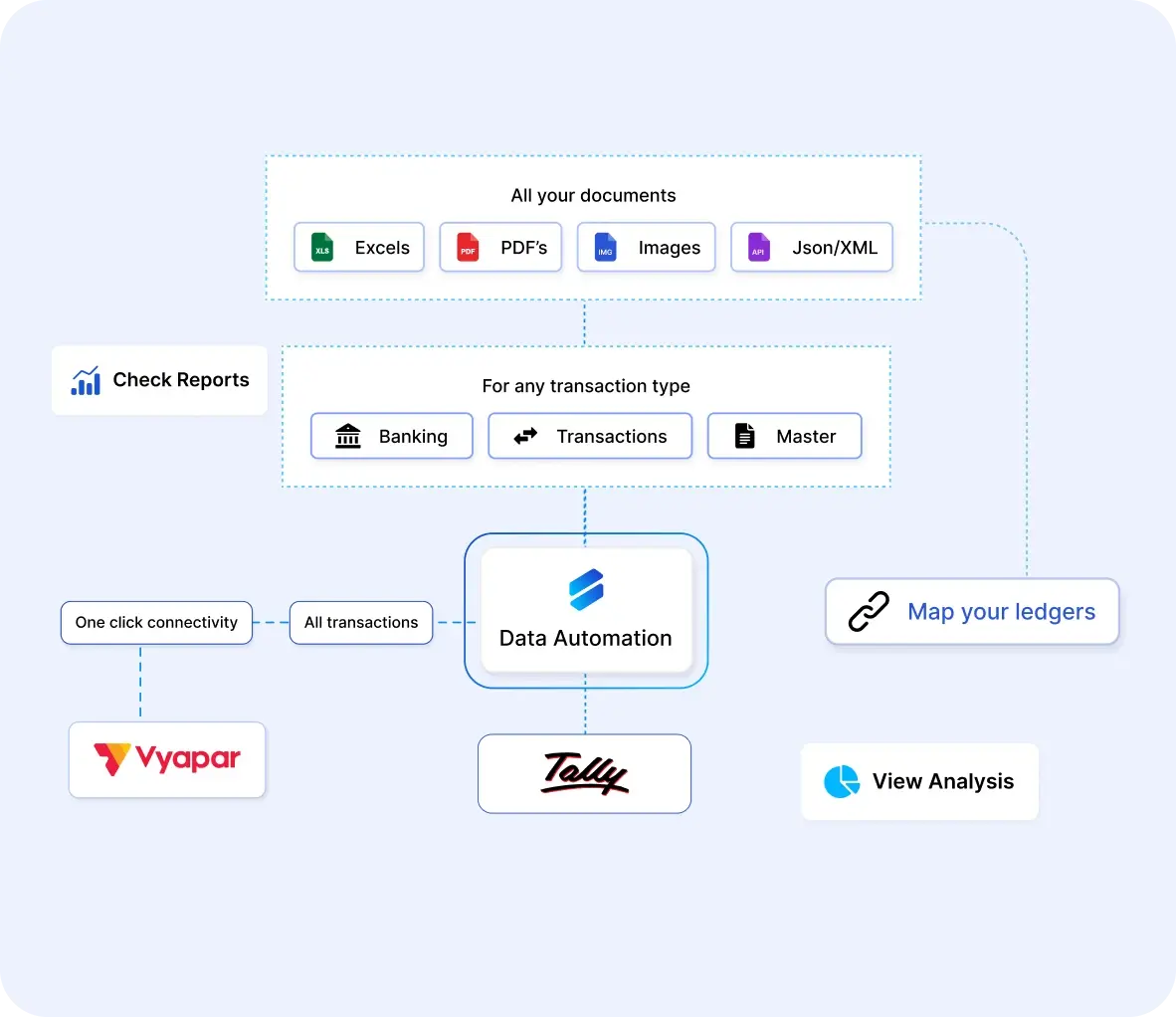

Manual entry of invoices, purchase registers, and expense statements consumes countless hours for accountants. AI automation tools like Suvit allow users to upload Excel or PDF files and instantly send them into Tally-compatible entries after mapping fields. This not only accelerates bookkeeping but also reduces dependency on manual labor.

2. Smart Document Recognition

One of the most challenging aspects of accounting is handling unstructured data such as PDF invoices, scanned bills, and GST challans. AI-based document recognition extracts critical details like GSTINs, invoice numbers, and amounts, automatically mapping them into appropriate Tally ledgers.

3. Simplified Reconciliation

Bank and vendor reconciliations are traditionally error-prone and time-intensive. AI integration enables real-time comparison of bank statements with books of accounts in Tally, quickly flagging mismatches. CAs can then focus only on exceptions, saving hours of manual comparisons.

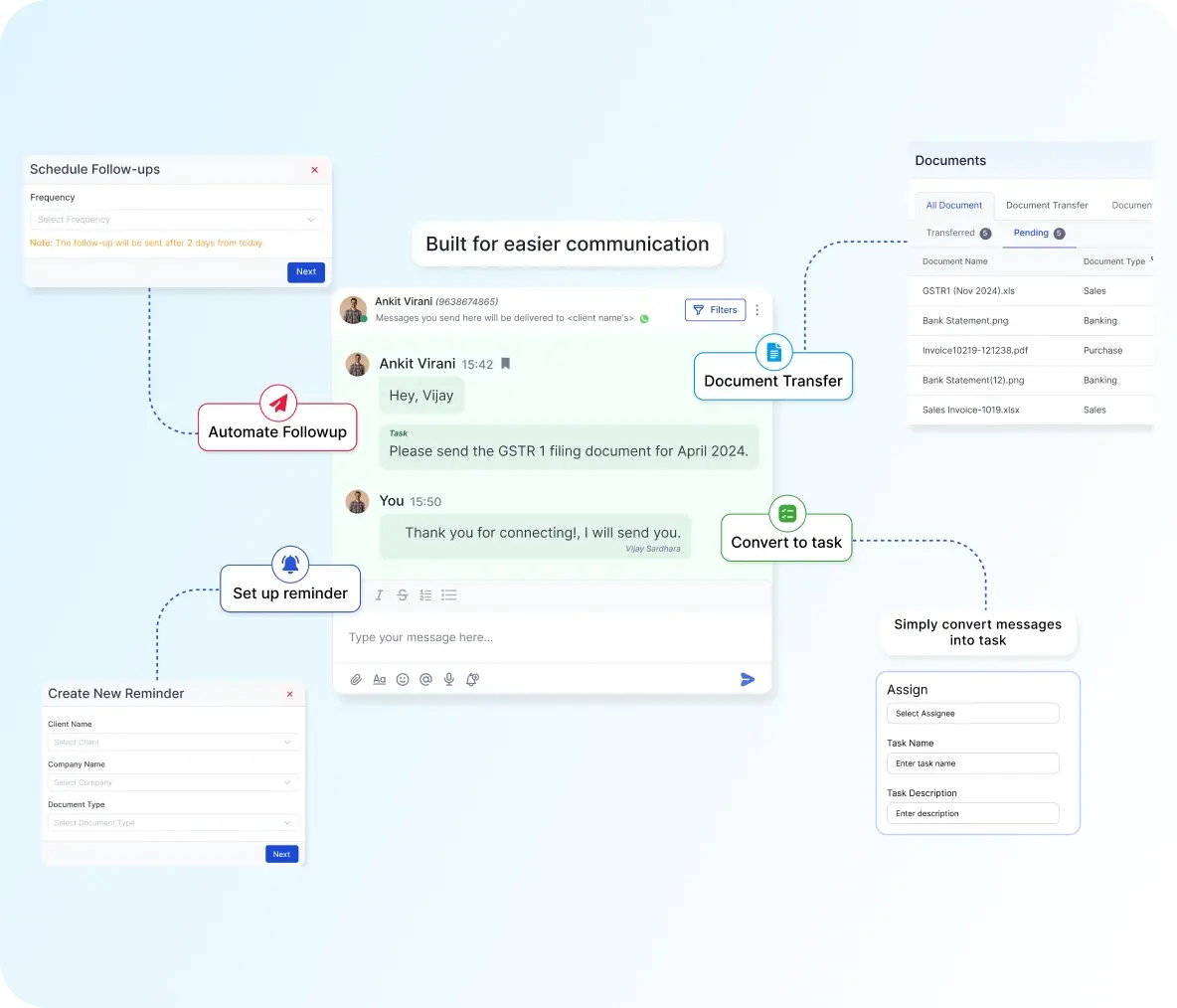

4. Workflow Customization

CAs often manage recurring journal entries for salaries, vendor dues, or monthly provisions. By integrating rule-based AI workflows with Tally, these repetitive tasks can be automated. Further, AI solutions can set compliance reminders for GST filing due dates, payment timelines, or ROC submissions, ensuring no deadlines are missed.

Case Example: Suvit’s Role in AI-Tally Integration

Suvit empowers Chartered Accountants and accounting firms across India to integrate AI seamlessly into their existing Tally environments.

- For Individual CAs:

-

Automates manual bookkeeping tasks such as data migration from Excel to Tally.

-

Provides faster turnaround for clients by minimizing paperwork.

-

Reduces fatigue and rework caused by manual punching errors.

-

For Accounting Firms:

- Streamlines multi-client operations within a centralized dashboard.

- Handles high transaction volumes, especially in industries like retail, manufacturing, and services.

- Improves profitability by reducing the need for repetitive, time-consuming staff interventions.

By leveraging Suvit, accounting professionals can set up AI-powered workflows that directly feed Tally, thereby enhancing operational excellence.

Best Practices for a Smooth AI-Tally Integration

- Start Small with Structured Data: Begin with Excel or PDF uploads for initial automation, then gradually expand to unstructured document recognition.

- Validate Initial Outputs: Supervise AI-generated entries during the early adoption phase to ensure accuracy and accounting standard compliance.

- Regularly Update Tools: Keep AI automation software updated in line with regulatory changes, such as GST amendments or MCA notifications.

- Customize Workflows: Configure rules and tagging specific to client sectors to maximize efficiency.

- Focus on Security: Ensure data privacy and compliance by using trusted platforms like Suvit with secure cloud-based infrastructure.

The Future of Accounting with AI and Tally

Integrating AI with Tally is no longer a convenience; it’s a necessity for Chartered Accountants. By automating data entry, reconciliations, and compliance tasks, firms save time, cut errors, and stay audit-ready.

This shift allows accountants to focus on strategic advisory rather than repetitive work. Embracing AI-driven Tally automation today ensures efficiency, compliance, and scalability for tomorrow’s accounting challenges.

FAQs

1. How can I integrate AI with Tally for accounting tasks?

You can integrate AI with Tally using automation platforms like Suvit, which allow uploading Excel, PDF, or scanned PDF files and automatically send them to Tally. AI-powered tools also automate reconciliation and compliance workflows.

2. What are the benefits of using AI in Tally for Chartered Accountants?

The key benefits include faster data entry, reduced human error, simplified GST compliance, real-time reconciliation, and the ability to handle larger transaction volumes without increasing staff requirements.

3. Is AI integration with Tally compliant with Indian accounting standards and GST laws?

Yes, AI integration is fully compliant. In fact, it improves compliance by ensuring accurate ledger postings, automated GST categorization, audit-ready records, and seamless e-invoicing as per the latest GSTN mandates.

4. Can AI tools like Suvit handle unstructured data such as scanned invoices or PDFs?

Yes. AI-powered document recognition in tools like Suvit extracts invoice numbers, GSTINs, dates, and amounts from unstructured documents and maps them to the correct Tally ledgers automatically.

5. Do small accounting firms also benefit from AI-Tally integration, or is it only for large firms?

Both small and large firms benefit. Solo CAs save time on manual punching, while larger firms use AI to handle bulk client data, improving profitability and scalability without expanding teams.