Input Tax Credit plays a vital role in the Goods and Services Tax (GST) system by allowing businesses to offset their tax liabilities. For Chartered Accountants in India, managing ITC accurately is essential to safeguard compliance and optimize financial operations.

However, ITC mismanagement remains a significant challenge due to complex GST rules, voluminous transactions, and reliance on manual processes. Improper management of ITC can lead to penalties, refund delays, and damage to a business’s reputation.

This blog explores the common causes of ITC mismanagement and provides actionable solutions, empowering accounting professionals with best practices and modern automation approaches.

TL;DR

- ITC mismanagement leads to compliance risks, penalties, and financial loss.

- Common causes: incorrect invoice data, supplier mismatches, ineligible credits, late filings, and manual errors.

- Solutions: automate data capture, perform regular reconciliations, train personnel, and ensure timely filings.

- Dispelling myths helps avoid avoidable mistakes.

- Chartered Accountants are essential to guiding, monitoring, and automating ITC compliance.

Common Causes of Input Tax Credit Mismanagement

1. Incomplete or Incorrect Invoice Data

One of the most frequent causes of ITC errors arises from incomplete or inaccurate invoice details. Missing or mismatched GSTINs, invoice numbers, or dates can invalidate ITC claims.

Additionally, tax rate or amount miscalculations on purchase invoices contribute to discrepancies when filing GST returns, leading to claim rejections.

2. Non-Matching with Supplier’s GSTR-1

GST compliance requires that buyers’ ITC claims reconcile with suppliers' outward supply reports (GSTR-1). Mismatches or omissions in supplier filings create conflicts wherein the GST portal automatically denies ITC claims. This reconciliation failure is a leading cause of ITC disputes.

3. Ineligible or Blocked Credits

ITC is denied on specific categories such as exempt supplies, goods for personal use, or blocked inputs under the GST law. Many businesses mistakenly claim credits on ineligible items, resulting in penalties and demand notices. Clarity on these restrictions is essential for error-free ITC management.

4. Late or Delayed Filing of Returns

GST mandates the timely filing of periodic returns such as GSTR-3B and auto-generated GSTR-2B. Delayed filings often lead to non-acceptance of ITC claims for the relevant periods, causing cash flow bottlenecks and increased tax liabilities.

5. Manual Data Entry and Reconciliation Errors

Manual data entry and reconciliation increase the risk of human errors like duplicates, missed transactions, and misclassifications. These errors cause inaccuracies in ITC claims and complicate audits.

Effective Solutions to Prevent Input Tax Credit Mismanagement

1. Automate Invoice Data Capture and Validation

Integrating GST-enabled ERP or accounting software automates the capture and validation of purchase invoices. Automation ensures that invoice details like GSTIN, invoice numbers, and tax calculations are accurate and conform to supplier data, minimizing errors and reconciliation issues.

2. Regular Reconciliation with GSTR-2B and GSTR-3B

Periodic automatic reconciliation between GSTR-2B (auto-drafted ITC statement) and GSTR-3B returns helps identify mismatches early. Proactive reconciliation allows businesses to address supplier discrepancies promptly, ensuring ITC claims are correct and timely.

3. Train Teams on GST Compliance and ITC Rules

Continuous training ensures that accounting teams understand the nuances of ITC eligibility, blocked credits, and amendment procedures. Well-informed personnel significantly reduce errors and improve compliance adherence.

4. Implement Timely Return Filing Processes

Establishing automated reminders and workflow schedules for return filing guarantees adherence to submission deadlines. Consistent compliance prevents denial of ITC due to late filings.

5. Leverage Technology for Error Reduction

Adopting AI-driven GST automation tools minimizes manual intervention, reducing data entry errors and speeding up reconciliation processes. These tools enhance accuracy and provide audit-ready reports, simplifying statutory compliance.

Common Myths and Misconceptions about Input Tax Credit

ITC management is often clouded by misunderstandings that lead to costly errors. Addressing these myths clarifies proper practices:

- Myth 1: ITC can be claimed on all purchase invoices regardless of supplier compliance.

Fact: ITC claims must align with the supplier’s accurate GSTR-1 submissions. Unmatched claims are rejected.

- Myth 2: ITC on personal or exempt supplies is allowable.

Fact: ITC is blocked on exempt goods/services and personal expenses per the GST law.

- Myth 3: Late ITC claims can be regularized without penalty at any time.

Fact: There are strict time limits and conditions under which late ITC can be claimed. Penalties may apply for non-compliance.

- Myth 4: Manual entry ensures better control over ITC claims than automated systems.

Fact: Manual processes increase error risk; automation enhances accuracy and compliance readiness.

Role of Chartered Accountants in ITC Compliance

Chartered Accountants are key to effective ITC management and maintaining GST compliance:

- Advisory Role: Guide clients on proper procurement documentation, invoice verification, and record-keeping essentials aligned with GST standards.

- Monitoring Eligibility: Review purchases continuously to ensure ITC is claimed only on eligible items, avoiding blocked credits.

- Reconciliation Assistance: Facilitate regular reconciliation between inward supplies, supplier filings, and GST returns to prevent mismatches.

- Technology Enablement: Recommend and deploy AI-based GST automation software to clients for seamless ITC management and error reduction.

- Compliance Oversight: Ensure timely filing of GST returns, manage amendments, and assist in audit defense relating to ITC claims.

GST Automation by Suvit for CAs

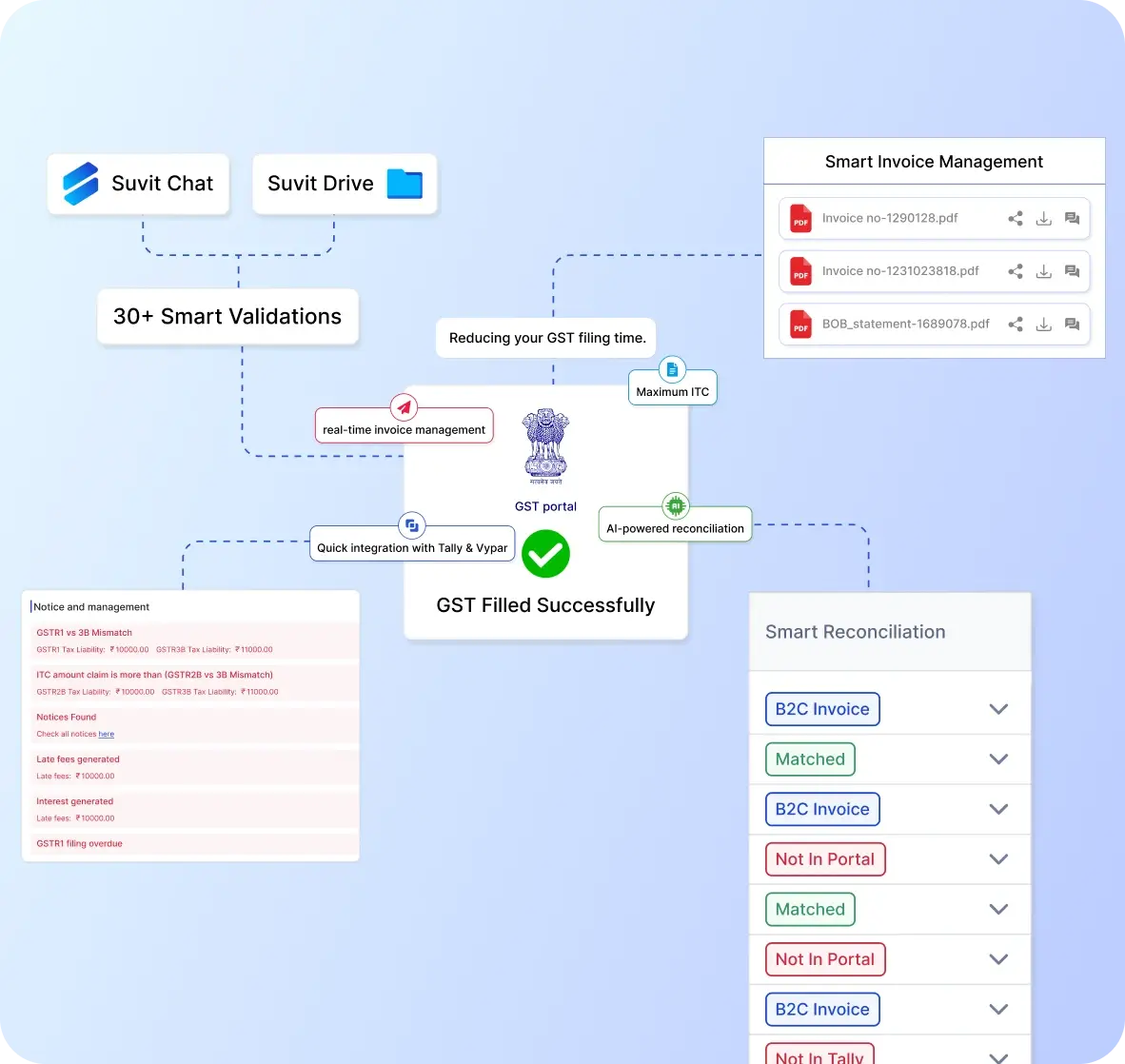

Suvit offers an AI-powered GST automation platform explicitly designed for Chartered Accountants in India. Suvit automates ITC reconciliation by extracting and matching invoice data efficiently, minimizing manual errors. Its easy integration supports timely GST return filing and real-time compliance monitoring.

By adopting Suvit, CAs and firms gain enhanced accuracy, faster processing times, and improved regulatory adherence, making ITC management seamless and audit-ready.

By embracing technology and following best practices, Chartered Accountants can reduce ITC mismanagement risks, optimize tax credit utilization, and add significant value to their clients’ financial operations in today’s dynamic GST landscape.

FAQs

1. What are the common causes of Input Tax Credit mismanagement?

Common causes include invoice errors, mismatches with supplier returns, claiming ineligible credits, delays in filing, and manual reconciliation mistakes.

2. How does automation help in preventing ITC mismanagement?

Automation ensures accurate data capture, real-time reconciliation, and on-time return filings, reducing errors and compliance risk effectively.

3. What items are blocked under GST for claiming ITC?

Credits on exempt supplies, personal consumption goods, and specific blocked categories like motor vehicles are not eligible for ITC under GST.

4. What is the role of Chartered Accountants in ITC management?

CAs advise clients on eligibility, assist in reconciliations, train accounting teams, recommend technology tools, and ensure compliance with GST filings and audits.