The financial world is constantly evolving, and as a result, we can see the growing skills gap among the accounting staff.

This can create a number of challenges for businesses like decreased efficiency, increased errors, and difficulty meeting compliance requirements.

In the current business environment, identifying and closing skills gaps among your accounting team is important for being competitive and ensuring financial accuracy.

So is there any effective approach?

In this blog, we'll learn how you can pinpoint those gaps and, most importantly, how you effectively solve them by taking appropriate steps.

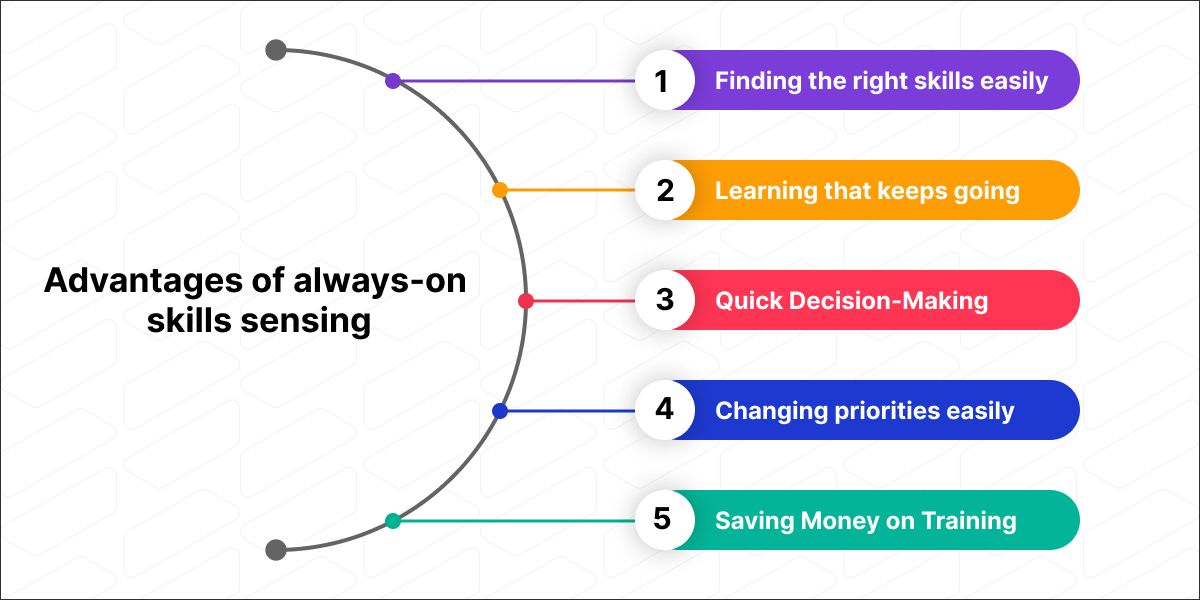

Advantages of Always-on Skills Sensing

Change is the only constant, and having awareness of your skills is a game-changer.

Think about always understanding which skills are needed and how you can use your expertise. It's not just about staying ahead; it's about smartly shaping your career or business.

Being aware of your skills all the time brings many benefits, from boosting your career to staying ahead in your field.

Using an always-on skills-sensing strategy for your accounting team has some great advantages. Let's take a closer look at these benefits:

1. Finding the Right Skills Easily

- Effortless Skill Discovery: It's like having a map that shows you the best route without getting lost. The always-on method acts like a map for skills, helping you quickly find the most important ones.

- Skills That Stay Fresh: When you keep practising something regularly, you get better and don't forget how to do it. The always-on approach keeps your team's skills fresh and ready to use.

2. Learning That Keeps Going

- Never-Ending Learning: Instead of learning something once and then stopping, the always-on method makes learning a constant journey. Your team stays engaged and keeps getting better at what they do.

- Remembering What You Learn: Just like you remember how to ride a bike because you do it often, your team remembers their skills better when they use them regularly. Practice makes a man perfect, remember?

3. Quick Decision-Making

- Fast Decision-Making: Traditional methods of learning can be slow, with lots of talking and waiting. But the always-on approach helps you make decisions fast. Your team sees progress quickly, and they feel important and excited about their training.

4. Changing Priorities Easily

- Being Flexible with Priorities: The always-on approach lets you change your plans quickly when things in the world change. If a new skill becomes really important, you can focus on it right away.

5. Saving Money on Training

- Using Money Wisely: By choosing to learn skills that are needed now, you can spend your training money wisely. You make sure your team learns things that help them with their current work, so you don't waste money on things you don't need.

Navigating Skills Gaps: Uncovering Key Considerations with the Always-On Approach

Going one step forward in this fast-paced job market is essential and could be a major step.

The digital landscape is constantly changing, and it is becoming a real challenge for financers to have the skills they'll require in the future.

To solve this uncertainty, financial leaders have adopted a game-changing strategy – the "stay ready" approach. This ensures they're always prepared to face whatever changes come their way.

This means they're quick to act when they realize they need new skills. Instead of trying to guess what they might need in the future, they focus on being flexible and reacting fast to what's happening right now.

Why Accurate Data Is Important

Having accurate data is important when you want to figure out which skills are missing. It makes sure that when you decide to learn something new, you're making a smart choice based on real facts. Plus, it helps you use your resources wisely and stay on the right path.

Focus on Skills That Matter Most

When accountants realize they need to learn something new, they should think about how much it will help them at work. Will it make their job quicker or more accurate? Could it lead to better tasks or even better jobs in the future?

By answering these questions, accountants can figure out which skills are most worth learning. This way, they stay interested in their job and make sure they're improving the skills they really need for accounting.

Keep Checking Which Skills Are Important

It's essential to keep an eye on which skills matter the most. Sometimes, learning new skills is a must to do better at work. And it's also important to see how good you are at those new skills to stay updated with technology trends like accounting automation. By watching what accountants do and giving them the tools they need, companies can grab new opportunities and stay competitive in the digital age.

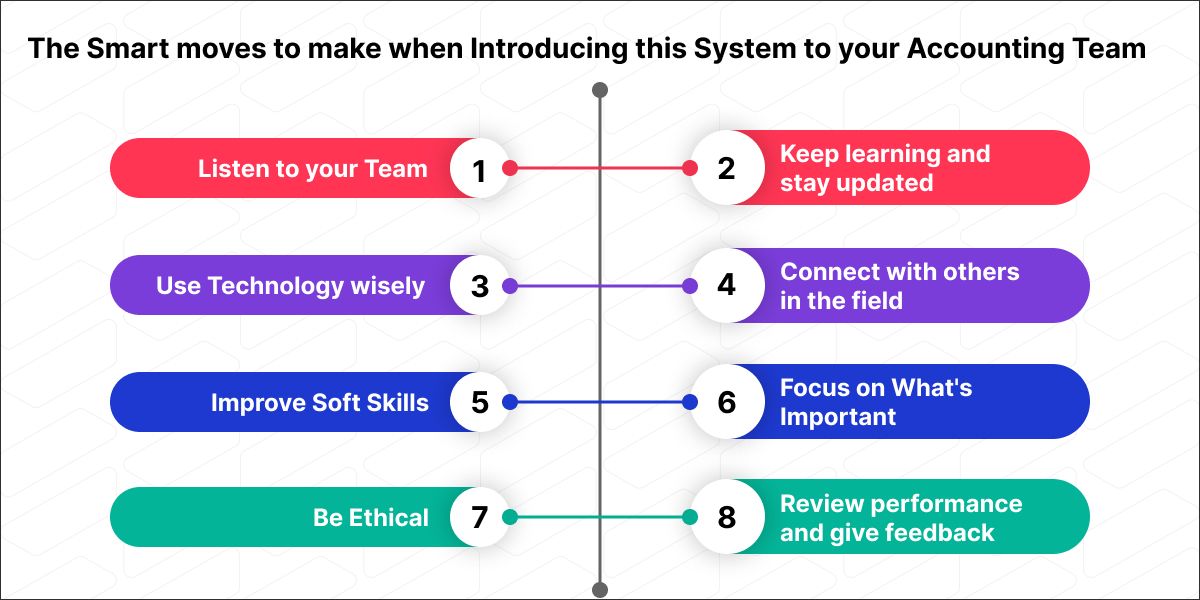

The Smart Moves To Make When Introducing This System To Your Accounting Team

You need to understand that keeping up with changing skill requirements doesn't need to be difficult for experienced leaders.

By using the right software and plan, they can effortlessly stay up-to-date with skill trends and make them a top priority without much effort.

1. Focus on What's Important Right Now

- Stay Flexible: Don't worry too much about far-off goals. Instead, focus on the skills you need right now. For example, if there are new tax rules, make sure your team knows how to handle them.

- Solve Daily Problems: Learn skills that help with everyday challenges at work. These skills make a real difference in your team's daily tasks.

2. Listen to Your Team

- Ask Your Team: Your team members know their jobs well. Ask them what skills they need. It's like getting treasure maps from them – they know the way.

- Use Their Knowledge: Your team together has a lot of knowledge and experience. Use their wisdom to find out which skills are most important and need training.

3. Keep Learning and Stay Updated

- Never Stop Learning: The financial world changes fast. Invest in training and learning for your team. This way, they can keep up with new trends and rules.

- Think About Tomorrow: Encourage your team to think about the skills they might need in the future. Being ready for what's coming is a smart move.

4. Use Technology Wisely

- Use Accounting Software: Make the most of accounting software and tools. They can help your team work faster and better. Teach them how to use the latest software.

- Learn About Automation: Automation is becoming important in accounting. Show your team how to use automated tools to do tasks faster and with fewer mistakes.

5. Connect with Others in the Field

- Go to Meetings and Events: Send your team to meetings and events in the financial industry. They can learn from experts and make new connections.

- Join Professional Groups: Encourage your team to join groups for accountants. These groups offer resources, chances to meet people, and updates about the industry.

6. Improve Soft Skills

- Talk Clearly: Good communication is key in accounting. Train your team to speak and write clearly with clients and colleagues.

- Solve Problems: Teach your team how to solve tough financial problems. It helps them make smart decisions.

7. Be Ethical

- Learn About Ethics: Make sure your team knows the rules for being fair and honest in their work. It's important for trust.

- Talk About Tough Choices: Have conversations about tricky situations at work. This helps your team make ethical decisions.

8. Review Performance and Give Feedback

- Check Progress: Regularly see how well your team is doing. Give them feedback on what they're doing well and where they can improve.

- Reward Good Work: When your team does a great job or learns new skills, make sure to recognize and reward them. It keeps them motivated to get even better.

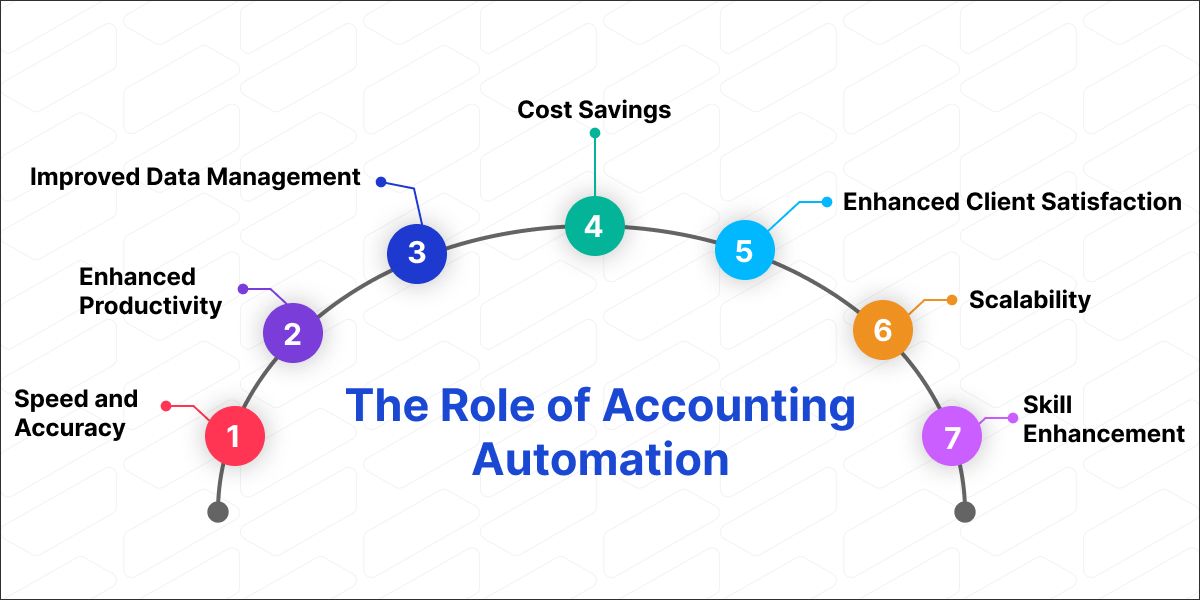

The Role of Accounting Automation

Mastering accounting automation is a game-changer for your accounting team in today’s world. Here's why:

1. Speed and Accuracy

- Faster Tasks: Automation tools like Vyapar TaxOne can swiftly handle repetitive tasks like data entry, reducing the time spent on manual work.

- Fewer Errors: Automation reduces the risk of human error, ensuring that your financial records are accurate and reliable.

2. Enhanced Productivity

- Focus on Value-Added Tasks: By automating routine processes, your team can shift their focus to more value-added activities such as financial analysis, strategy development, and client interactions.

- Time Savings: Automation frees up valuable time, allowing your accountants to tackle complex challenges and provide higher-quality services to clients.

3. Improved Data Management

- Data Security: Automation tools like Vyapar TaxOne often come with robust data security measures, ensuring that sensitive financial information is well-protected.

- Efficient Data Retrieval: Easily access and retrieve financial data when needed, streamlining audits and reporting.

4. Cost Savings

- Reduced Labor Costs: With automation handling routine tasks, you can optimize your workforce, potentially reducing labour expenses.

- Lower Error-Related Costs: Fewer errors mean less time and resources spent on error correction.

5. Scalability

- Easy Scaling: As your business grows, automation can adapt to increased workloads without the need for significant manual hiring.

6. Enhanced Client Satisfaction

- Quick Responses: Automation allows your team to respond faster to client queries and provide more comprehensive support.

- Accurate Data: Clients value accuracy in financial reporting, and automation helps maintain precision.

7. Skill Enhancement

- Valuable Skill: Learning to operate automation tools is a valuable skill in the accounting field. It enhances your team's marketability and career prospects.

- Future-Proofing: As automation becomes more prevalent, accountants with automation skills are better prepared for the job market of the future.

To wrap it up,

Using the always-on approach and following these helpful tips can make your accounting team in India successful in the fast-changing financial world. By focusing on what's important now, listening to your team, learning continuously, using technology wisely, connecting with others, improving communication, and doing the right thing, your team can become better and handle any challenges that come their way.

Ready to make your employees smarter and processes more efficient? Begin with automating basic tasks such as data entry and Tally transfer using Vyapar TaxOne. Learn more about it here!