The exponential growth of e-commerce in India has transformed the retail landscape, creating vast sales data that Chartered Accountants must efficiently manage for accurate bookkeeping and GST compliance.

Reconciling sales sheets from multiple platforms such as Amazon, Flipkart, AJIO, Meesho, and others with Tally ERP software can be complex and time-consuming. This challenge calls for a reliable, automated solution to streamline the process.

Vyapar TaxOne is an advanced automation tool designed to bridge the gap between diverse e-commerce sales data and Tally accounting software. It can process sales sheets from any e-commerce platform, making it an indispensable asset for CAs handling multi-channel e-commerce clients.

This guide helps Indian CAs seamlessly integrate e-commerce sales data into Tally using Vyapar TaxOne, improving accuracy, saving time, and ensuring compliance.

TL;DR

- Vyapar TaxOne automates e-commerce to Tally integration.

- Maps sales sheet columns to Tally fields.

- Ensures GST ledger mapping for compliance.

- Validates data before export to Tally.

- Ideal for Indian CAs managing e-commerce.

1. Preparing Your Tally Environment for Vyapar TaxOne Integration

Before importing e-commerce data with Vyapar TaxOne, it's essential to configure your Tally environment for optimal data processing:

- Enable Accounting with Inventory: This setting allows Tally to track both financial transactions and inventory movements, essential for e-commerce businesses dealing with stock and sales.

- Activate Default Accounting Allocation: Ensuring voucher types have a default ledger allocation streamlines data import by automatically assigning relevant accounts.

- Use Inventory Allocation of Ledgers: This enables precise linkage between inventory items and financial ledgers, facilitating accurate stock valuations and GST treatment.

Proper Tally setup ensures that imported data aligns with transactional and taxation requirements, minimizing manual intervention.

2. Downloading and Preparing E-commerce Sales Sheets

E-commerce platforms like Amazon, Flipkart, AJIO, Meesho, and more provide downloadable sales sheets, but each platform has unique formats and data structures. Chartered Accountants must:

- Download sales data regularly to maintain timely books.

- Use unaltered, official platform formats to prevent discrepancies.

- Standardize data columns to match bookkeeping needs (e.g., order number, invoice date, SKU, quantity, price, GST details).

- Ensure data cleanliness by checking for missing or duplicate entries.

Accurate preparation of sales sheets sets the foundation for seamless data automation.

3. Uploading Sales Data to Vyapar TaxOne

Vyapar TaxOne’s user-friendly interface allows for quick uploading of sales sheets from any e-commerce platform.

Key steps include:

- Log in to Vyapar TaxOne and navigate to the sales data upload section.

- Uploading the raw sales sheets and previewing the data.

- Identifying and correcting errors such as mismatched headers, invalid dates, or missing entries before processing.

- Using Vyapar TaxOne’s validation tools to flag and resolve inconsistencies.

This careful cross-check reduces errors entering Tally and saves significant reconciliation time.

4. Mapping E-commerce Columns to Tally Fields via Vyapar TaxOne

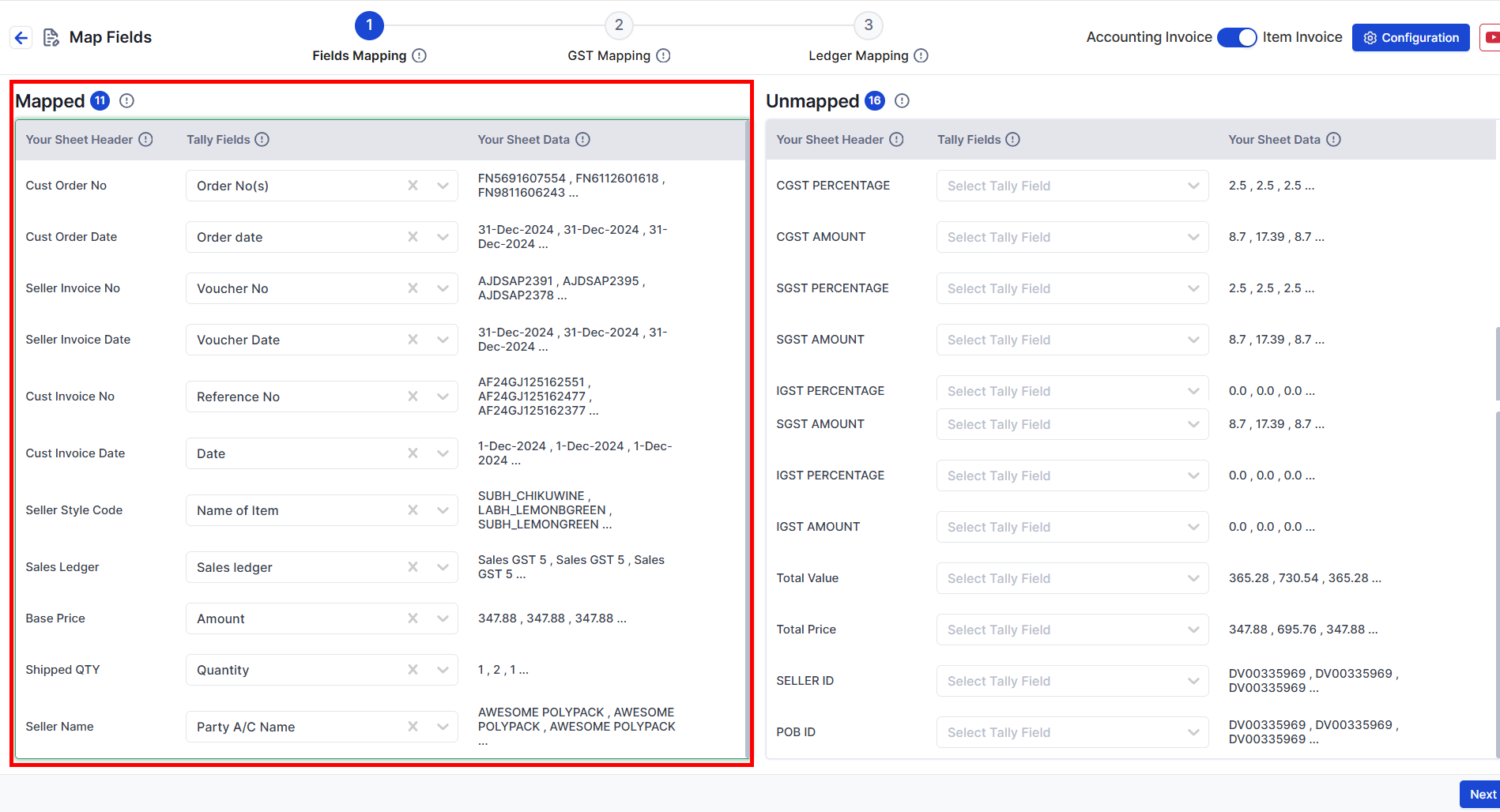

One of Vyapar TaxOne’s strongest features is its flexible mapping system, which connects e-commerce sales sheet columns to corresponding Tally accounting fields:

- Essential mappings include Order Number, Voucher Date, Ledger Names, Item Codes, Quantity, Price, and GST components.

- Mapping tables vary depending on the e-commerce platform; Vyapar TaxOne supports all major platforms by allowing customizable maps.

- For example, for AJIO, map "Cust Order No" to "Order No(s)" in Vyapar TaxOne, while for Amazon or Flipkart, similar fields can be mapped accordingly.

- It is vital to ensure exact matching of column headers; even slight spelling differences cause mapping failure.

- Vyapar TaxOne allows for manual adjustments and the saving of mapping templates, making it easy to reuse them with future uploads.

Efficient column-to-ledger mapping with Vyapar TaxOne automates voucher creation inside Tally and reduces manual errors.

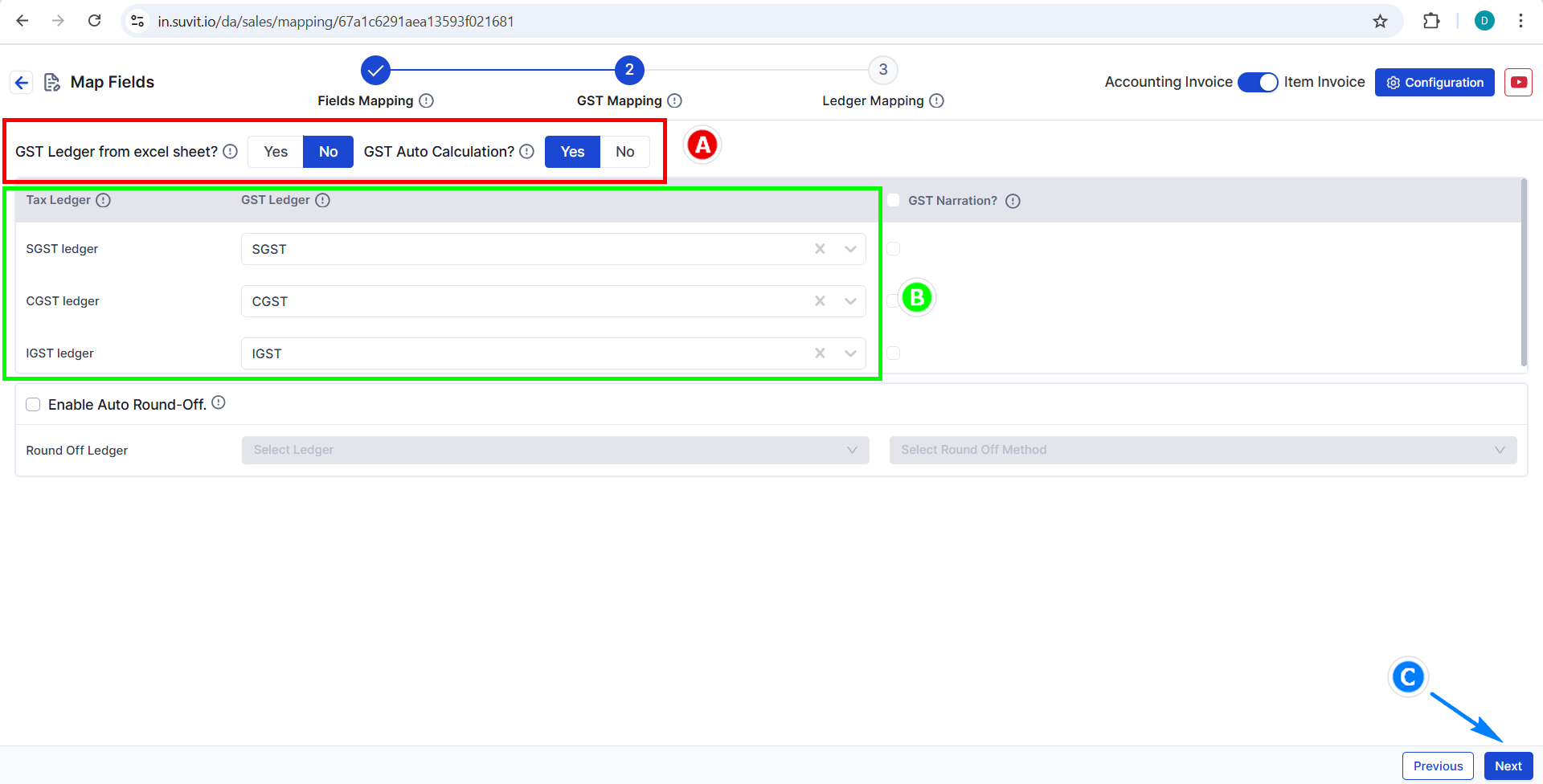

5. Configuring GST and Ledger Mapping for Compliance

GST compliance is paramount for Indian Chartered Accountants managing e-commerce transactions. Vyapar TaxOne facilitates:

- Mapping of GST ledgers, SGST, CGST, IGST, and TCS directly from the sales data, ensuring tax calculations are accurate.

- Assigning ledgers for components such as discounts, shipping charges, and round-offs to maintain detailed financial records.

- Leveraging Tally’s GST features in conjunction with Vyapar TaxOne’s mapping for automated tax filing readiness.

- Saving GST mapping templates enhances efficiency in recurring monthly reconciliations.

This comprehensive GST ledger mapping with Vyapar TaxOne ensures accounting accuracy for audits and returns filing.

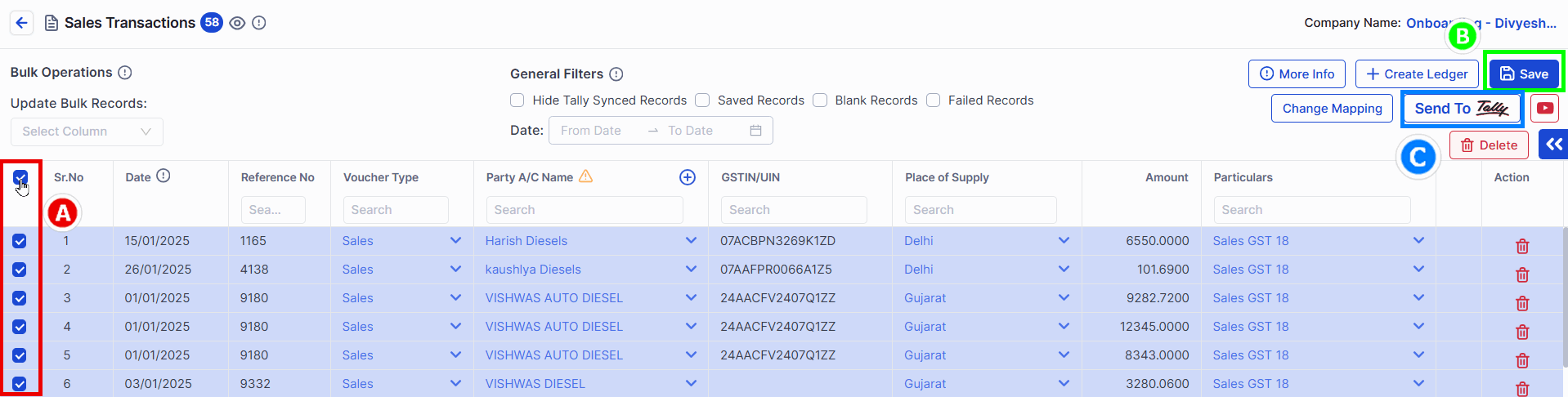

6. Auditing and Verifying Sales Data Before Export

Before exporting processed data into Tally, CAs should perform a rigorous check:

- Validate key data points like invoice dates, customer accounts, amounts, and GST values against original platform reports.

- Address any flagged discrepancies in mapping or data quality.

- Sample check transactions periodically to maintain continuous compliance.

Pre-export validation minimizes costly errors and audit red flags.

7. Exporting to Tally from Vyapar TaxOne - Finalizing the Process

Once mapping and validation are complete:

- Use Vyapar TaxOne’s export function to push sales vouchers into Tally ERP or TallyPrime automatically.

- The Tally Connector facilitates smooth voucher creation, including inventory and GST records.

- This automation accelerates bookkeeping cycles, reduces manual data entry, and produces error-free accounts ready for GST filing.

Seamless export from Vyapar TaxOne to Tally is the culmination of optimized e-commerce accounting workflows.

8. Troubleshooting and Pro Tips for Chartered Accountants

To maximize Vyapar TaxOne’s benefits, keep in mind:

- Constantly update both Vyapar TaxOne and Tally for compatibility with the latest platform changes.

- Maintain clear and consistent mapping templates to speed up monthly uploads.

- Resolve header mismatches by regularly checking for e-commerce platform data format changes.

- Train accounting teams on the Vyapar TaxOne-Tally workflow to reduce operational bottlenecks.

- Keep a detailed log of imported sales data and export batches for audit purposes.

These best practices empower Chartered Accountants to harness Vyapar TaxOne’s full potential for e-commerce clients.

Embracing Automation in E-commerce Accounting

Integrating e-commerce sales data from multiple platforms, such as Amazon, Flipkart, AJIO, Meesho into Tally is no longer a difficult task for Chartered Accountants, thanks to Vyapar TaxOne.

By automating the entire process, from uploading sales sheets, mapping fields meticulously, ensuring GST compliance, to exporting error-free records into Tally, CAs can save significant time, reduce manual errors, and uphold the highest accounting standards.

Embrace this state-of-the-art technology to future-proof your accounting practice in the evolving digital commerce landscape.

Also Read: Key Features to Look in eCommerce to Tally Data Import Tools

FAQs

How does Vyapar TaxOne connect e-commerce to Tally?

Vyapar TaxOne uploads e-commerce sales sheets, maps columns to Tally ledgers, validates data, and exports vouchers automatically, creating accurate records in Tally ERP.

Which e-commerce platforms does Vyapar TaxOne support?

Vyapar TaxOne supports all major platforms, including Amazon, Flipkart, AJIO, Meesho, and many more, allowing multi-platform sales data integration.

Can Vyapar TaxOne handle GST ledger mapping automatically?

Yes, Vyapar TaxOne allows precise GST ledger mapping (SGST, CGST, IGST, TCS) from sales sheets to ensure GST compliance within Tally.

How do I prepare sales sheets for Vyapar TaxOne?

Download official sales sheets from e-commerce portals, maintain exact column headers, check for data completeness, and upload clean, standardized sheets to Vyapar TaxOne for processing.