Transferring data from Excel to Tally - this is a very common problem that arises for accountants. For easy data import, it is essential to clean and format the data the right way.

As Tally remains the backbone of accounting for countless Indian enterprises, we at Vyapar TaxOne understand that the smooth transition of data is important.

Thus, this blog will break down the steps to clean and format your data like a pro, using simple language and relatable examples.

Let’s get started.

Section 1: Understanding Data Import to Tally

Tally isn't just software; it's the heartbeat of Indian accounting and business management. It takes care of various aspects of financial operations, offering insights, organising records, and guiding decisions.

Significance of Tally

- Tally is the go-to tool for Indian businesses, from small shops to large enterprises.

- It streamlines tax compliance, statutory reporting, and day-to-day financial management.

- In a country with complex taxation systems, Tally eases the burden of staying compliant.

Data Accuracy Matters

- Accurate data is the fuel Tally needs to run effectively. There are a lot of challenges in Excel to Tally data migration that you can face and data formatting can be the reason for one.

- Think of Tally as a conductor – it can create the right financial entries only with accurate inputs.

- Errors in data transfer can lead to financial mistakes, affecting decision-making.

Key Data Fields for Seamless Import

1. Ledger Accounts

- Ledger accounts are the narrative of your financial journey.

- They categorize income, expenses, assets, and liabilities.

- Accurate ledger data ensures a solid foundation for your financial records.

2. Stock Items

- Stock items encompass the products you buy, sell, or manufacture.

- Accurate stock data enables efficient inventory management and cost calculations.

- Mistakes in stock data can lead to wrong profit assessments.

3. Transactions

- Transactions are the heartbeat of your financial activities.

- They record inflows, outflows, purchases, sales, and more.

- Correct transaction details ensure your financial story is coherent and reliable.

As we embark on the journey of understanding data import to Tally, remember that Tally isn't just a tool; it's your financial friend, helping you navigate the intricate waters of Indian business. Next, we'll move to the nitty-gritty of preparing your Excel data for this enriching journey.

Section 2: Preparing Your Excel Data

Structured data is essential for a successful Excel-to-Tally journey. Think of it as organizing your spices before cooking a delicious meal – each ingredient in its place ensures a delightful outcome.

Step-by-Step Data Cleaning and Organization

Create Headings:

- Assign clear and concise headings to each column.

- Headings should reflect the data they hold, like "Date," "Item Name," "Quantity," "Amount," etc.

Column Clarity:

- Each column should hold a specific type of data.

- For example, one column for dates, another for numerical values, and one for text descriptions.

No Blank Spaces:

- Eliminate empty cells or rows to avoid confusion during import.

- This ensures a smooth flow of data into Tally without unexpected gaps.

Consistent Formats:

- Maintain uniform formatting across similar data.

- Dates, for instance, should follow a single format (e.g., DD/MM/YYYY) to prevent errors.

Check for Duplicates:

- Remove duplicate entries to prevent data redundancy.

- Duplicate entries can lead to incorrect financial calculations.

Exploring Common Data Types and Examples

Sales Data:

- Columns for "Date," "Customer Name," "Product Sold," "Quantity," "Total Amount," etc.

- A structured sales data sheet ensures accurate profit calculations and customer insights.

Purchase Data:

- Columns for "Date," "Supplier Name," "Item Purchased," "Quantity," "Total Cost," etc.

- Well-organized purchase data aids in tracking expenses and optimising procurement.

Expense Data:

- Columns for "Date," "Expense Category," "Description," "Amount," etc.

- Organised expense data facilitates budgeting and expense analysis.

Section 3: Data Cleaning Techniques

Data cleaning is like tidying up your workspace before starting a project – it sets the stage for seamless data transfer and speeds up data entry in Tally. Cluttered or inconsistent data can lead to misinterpretations and errors, much like a recipe gone awry.

Common Data Cleaning Tasks and Tips

Banishing Duplicates:

- Identify and remove duplicate entries to avoid skewed calculations.

- Tally thrives on accuracy; duplicates can be like adding extra spices to a dish – it might taste off.

Blank Cell Woes:

- Address empty cells by filling them appropriately or removing them.

- Just as a missing ingredient can impact a recipe's flavour, empty cells can affect Tally's understanding of your data.

Formatting Finesse:

- Standardize data formats like dates, currency, and units.

- Inconsistent formats are like using different measuring cups for a single recipe – Tally needs uniformity.

Dealing with Inconsistent Dates:

- Convert varied date formats into a consistent one, e.g., DD/MM/YYYY.

- Imagine using both Celsius and Fahrenheit in a recipe; Tally needs the same temperature scale.

Tackling Amount Errors:

- Rectify improperly entered amounts, ensuring they are accurate and in the correct currency.

- Similar to getting the right proportions in a recipe, precise amounts matter to Tally.

Real-Life Scenarios

Scenario 1 - Date:

Handling dates like "07/15/2023," "15-July-2023," and "2023/07/15" by converting them to a uniform format.

Scenario 2 - Currency:

Converting amounts with different currency symbols or comma/period usage to a consistent numerical format.

Scenario 3 - Text-to-Number Transition:

Transforming text-formatted numbers like "1,000" to numerical values, which Tally can interpret accurately.

Section 4: Formatting for Tally Compatibility

Just as wearing the right outfit to a specific event is important, formatting your Excel data appropriately is essential for a successful Tally import. Tally has its requirements, and aligning your data accordingly guarantees a smooth flow of information.

Guidelines for Tally-Aligned Data

Text Formatting:

- Ensure text fields, like names and descriptions, are not too lengthy.

- Tally appreciates concise yet informative inputs.

Numerical Precision:

- Round off numerical values to the appropriate decimal places.

- For example, monetary values could be rounded to two decimal places for consistency.

Date Formatting:

- Keep dates uniform, using a consistent format like DD/MM/YYYY.

- Tally needs clarity; varying date formats could lead to confusion.

Special Characters:

- Limit the use of special characters or symbols, especially in text fields.

- Tally prefers simplicity for smooth interpretation.

Practical Examples

Example 1 - Text Fields:

- Before: "Super Deluxe Premium Bed – King Size"

- After: "King Size Bed"

Example 2 - Numerical Precision:

- Before: 58.7531

- After: 58.75

Example 3 - Date Formatting:

- Before: 15/07/2023

- After: 15/07/2023

Example 4 - Special Characters:

- Before: "Fantastic! Chair - Black"

- After: "Black Chair"

By adhering to these formatting guidelines, you're ensuring that your Excel data speaks Tally's language.

Section 5: Handling Special Cases

The Goods and Services Tax (GST) adds a unique flavour to Indian business transactions. Tally understands this complexity, but you need to prepare your data properly to ensure the GST story is told accurately.

Correctly Formatting GST-Related Data

Tax Codes and Rates:

- Assign the correct GST tax codes to each transaction.

- Ensure the corresponding tax rates are accurate, as they impact financial calculations.

Inclusive vs. Exclusive Tax:

- Clearly indicate whether the tax amount is included in the transaction value (inclusive) or added additionally (exclusive).

- Proper indication avoids discrepancies in Tally's calculations.

HSN and SAC Codes:

- Use accurate Harmonized System of Nomenclature (HSN) codes for goods and Services Accounting Codes (SAC) codes for services.

- Tally relies on these codes for correct categorization.

Real-Life Examples: Intra-State and Inter-State Transactions

Intra-State Transactions:

- Selling within the same state requires a state GST (SGST) and central GST (CGST).

- Set the tax codes accordingly: SGST, CGST.

Inter-State Transactions:

- Selling across state borders involves integrated GST (IGST).

- Set the tax code as IGST for seamless cross-border transactions.

Handling GST on Services:

- Services follow similar principles with SGST, CGST, and IGST, based on whether it's intra-state or inter-state.

Section 6: Using Data Import Tools

Just as a chef relies on quality knives, your data journey can be eased with the right tools. Whether within Excel or with third-party software, these tools can be your allies in achieving a seamless data transition to Tally.

Exploring Data Cleaning and Formatting Tools

Excel Functions:

- Utilize functions like CONCATENATE to merge data, TRIM to remove extra spaces, and TEXT to ensure consistent formatting.

- Excel's built-in functions are like secret ingredients to refine your data.

Third-Party Software:

- Explore tools like OpenRefine or Power Query for advanced data cleaning.

- These tools can handle large datasets and complex tasks efficiently.

Using Data Formatting Functions

CONCATENATE Function:

- Combine data from different columns into a single cell.

- Example: Merging first and last names into a full name column.

TRIM Function:

- Remove extra spaces from cells, especially in text fields.

- Example: Eliminating accidental spaces in product names.

TEXT Function:

- Ensure consistent formatting, like dates in DD/MM/YYYY format.

- Example: Formatting various date styles into a unified form.

Section 7: Trial Error Checking

Think of it as a dress rehearsal – spotting errors and making adjustments without impacting your actual financial records.

Verifying Accuracy in Tally

Step 1: Review Ledgers and Transactions:

- Check if ledger names match your expectations.

- Verify transaction entries against your original data.

Step 2: Check Totals and Balances:

- Ensure that your final totals align with what you anticipated.

- Cross-check balances for accuracy.

Step 3: Taxation Tally:

- Confirm that tax calculations, like GST, align with your Excel data.

- Double-check tax codes and rates.

Troubleshooting Common Errors

Mismatched Ledger Names:

- If ledger names differ in Tally, they won't reconcile with your data.

- Review and adjust ledger names before the final import.

Incorrect Transaction Entries:

- Wrong figures can lead to skewed financial insights.

- Verify each transaction's values and details for precision.

Misaligned Dates:

- If dates don't sync, it affects chronological accuracy.

- Rectify any inconsistencies in date formatting.

Taxing Tax Issues:

- Incorrect tax codes or rates can cause discrepancies.

- Ensure GST and other tax-related data match.

Ready With Your Formatted Excel File? Import it in seconds to Tally Using Vyapar TaxOne!

After doing a lot of work on formatting and cleaning your data, you don’t have to spend more hours transferring it to Tally. Using an accounting automation software, you can transfer your Excel data to Tally in just a few short steps.

Using Vyapar TaxOne, you don’t have to do manual data entry and shifting anymore. It helps in making error-free entries, boosting your productivity to whole new levels.

Below’s how you can use the tool to make the Excel to Tally import.

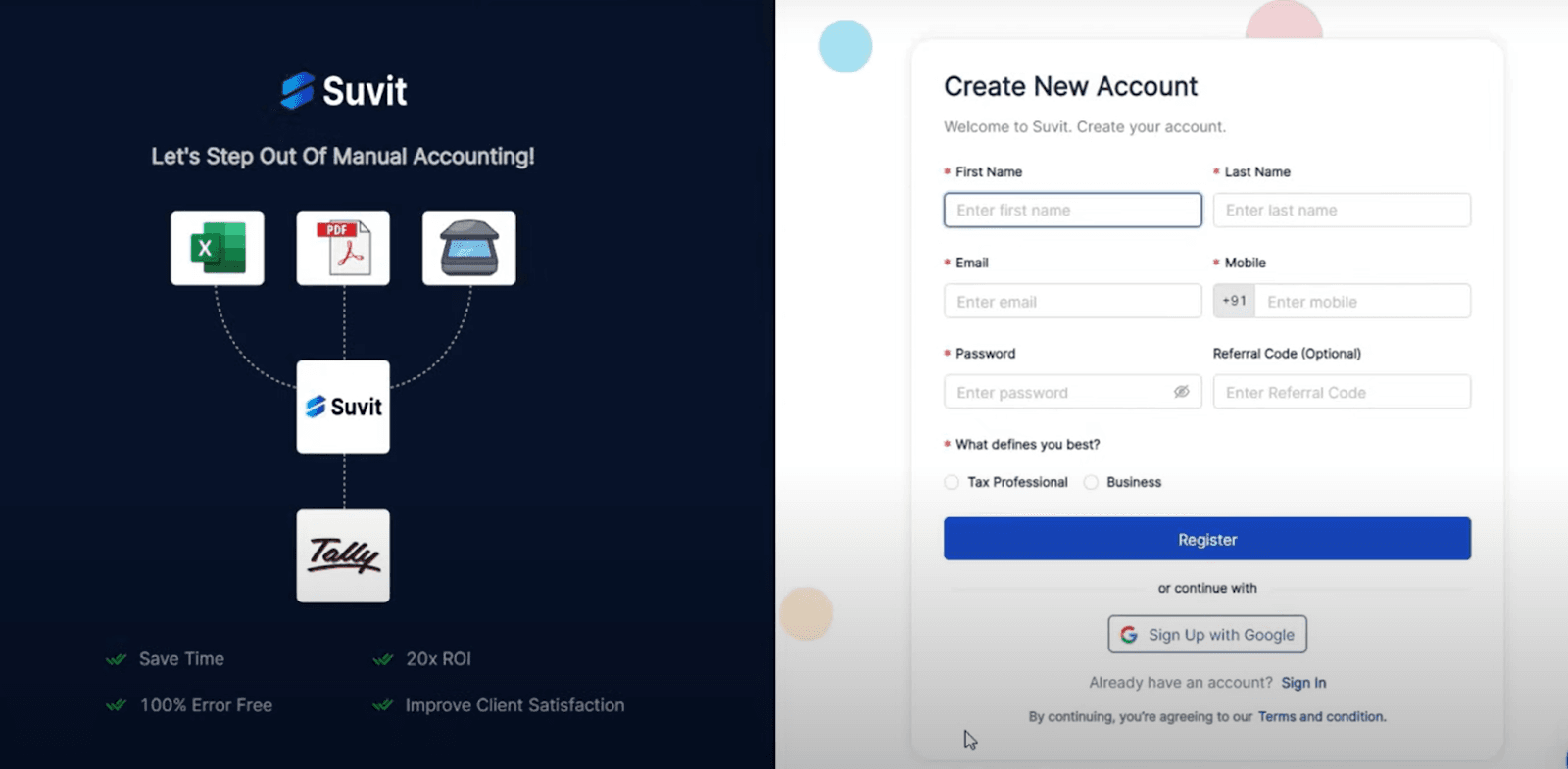

1. Sign up for your Vyapar TaxOne account

Visit the official Vyapar TaxOne website to sign up for your account. You can start with a 7-day free trial to get a taste of what it can do before purchasing a plan.

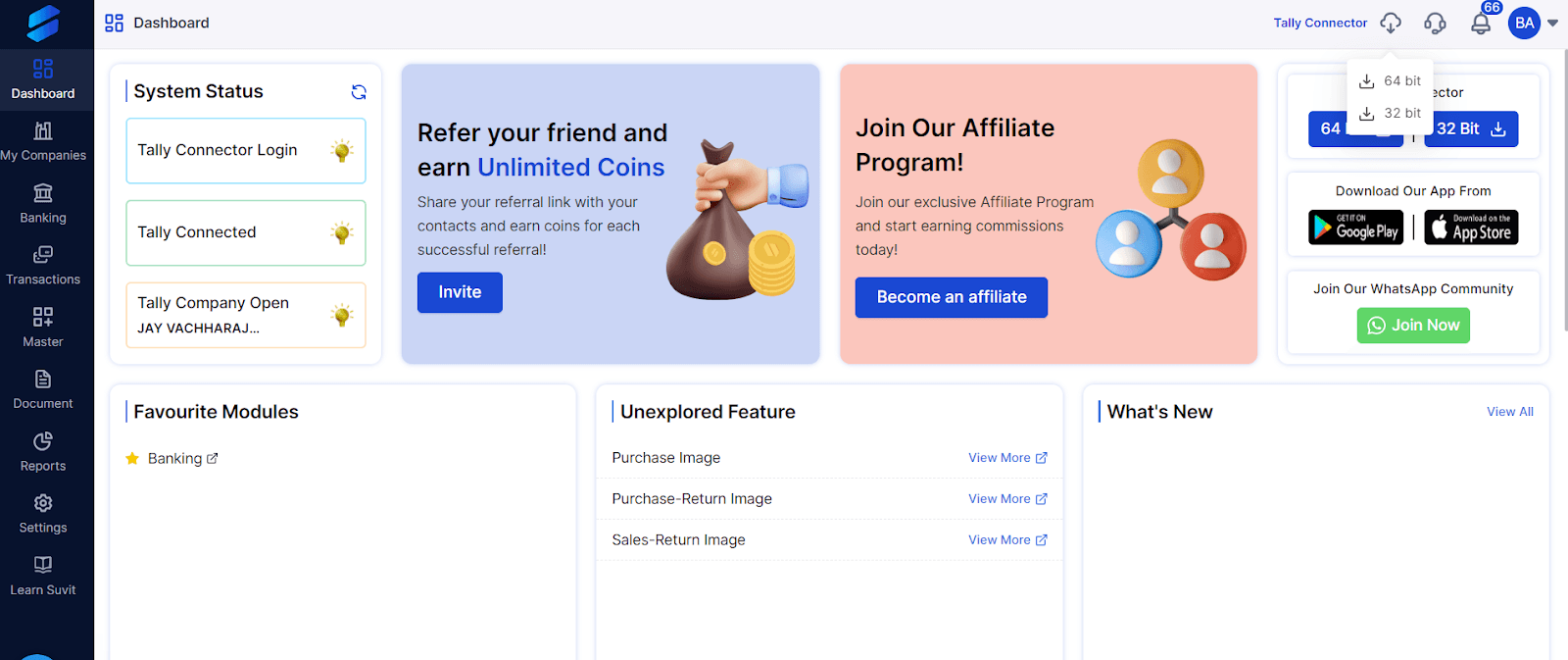

2. Connect with Tally

The next step is to establish a connection between Vyapar TaxOne and your Tally software. Vyapar TaxOne ensures a secure link to Tally, making data transfer hassle-free.

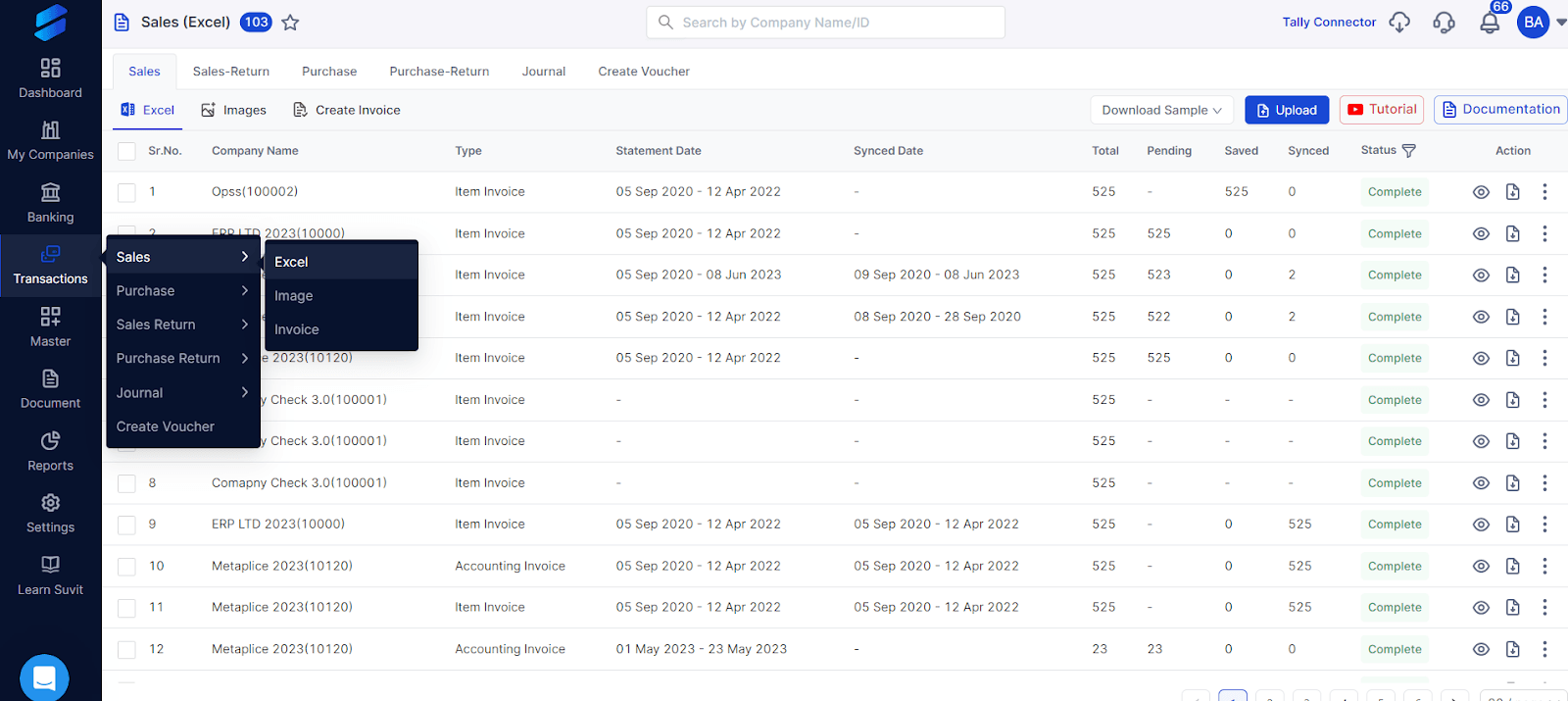

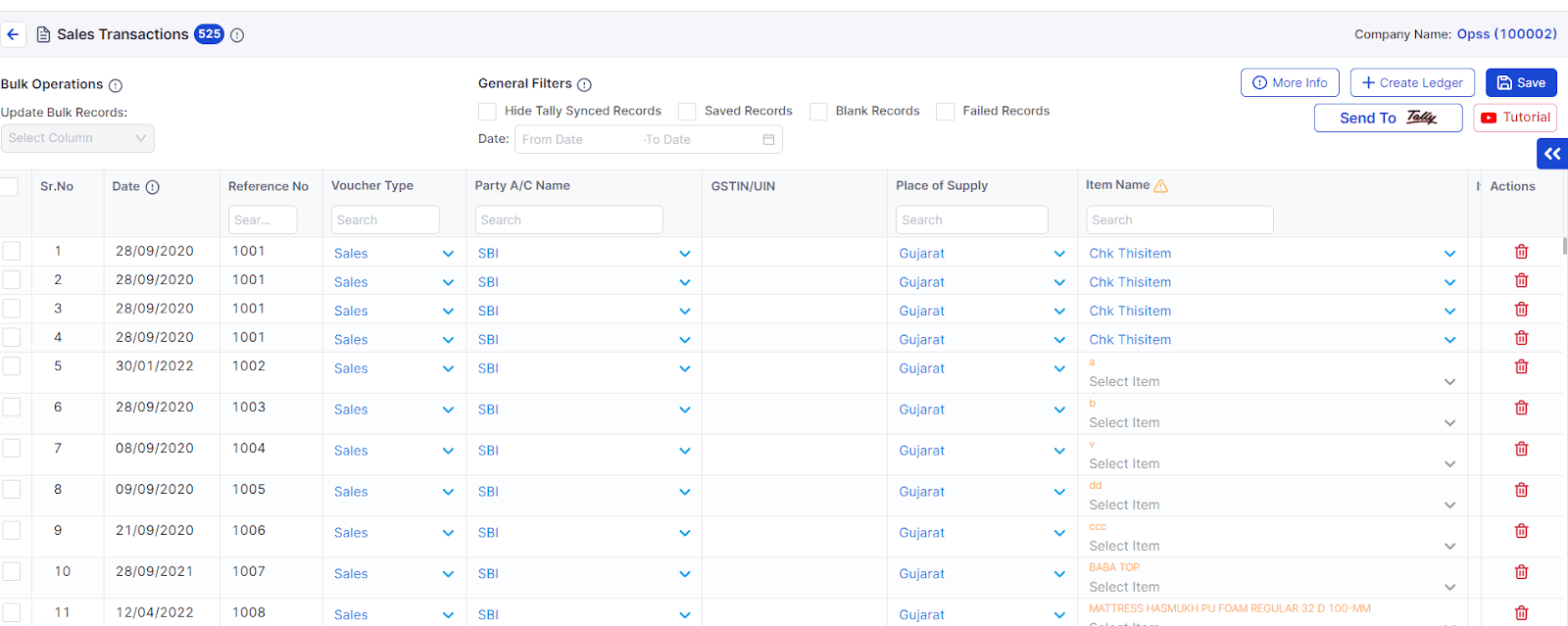

3. Select the right module and upload your Excel file

Vyapar TaxOne simplifies things further by offering different modules for various types of data – be it Banking, Sales, or Purchase. Depending on what kind of data you're migrating, select the relevant module in Vyapar TaxOne.

Next, Go to the ‘Transactions’ tab from the left-hand side menu and select the category where you want to upload your Excel file.

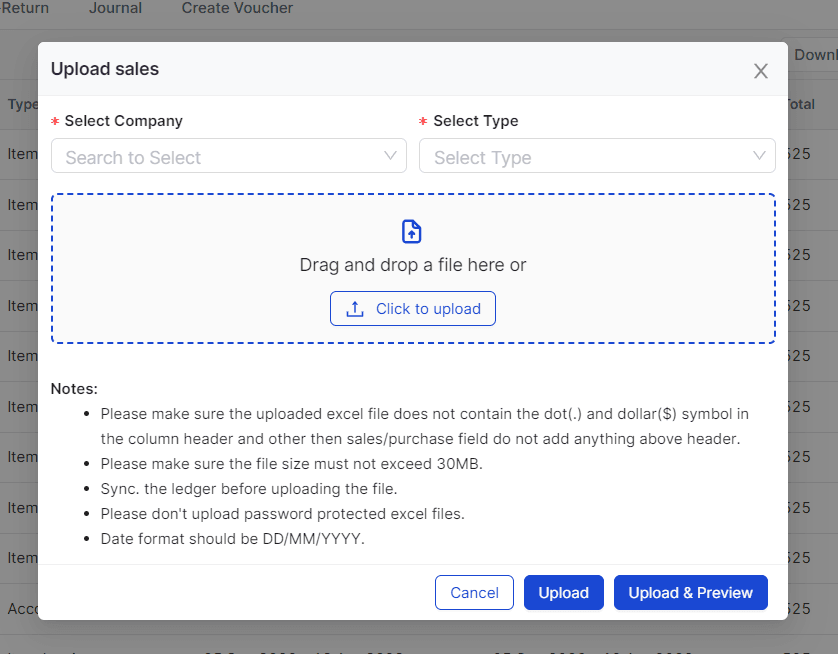

Click on the ‘Upload’ button on the top right and then upload your Excel file.

Step 8: Send Transactions to Tally

Ready to transfer? Once you've ensured the accuracy of your data within Vyapar TaxOne, hit the "Send Transactions to Tally" button on the top-right corner of the page. Like magic, Vyapar TaxOne takes over, automating the data entry process. Your data flows into Tally with 100% accuracy and reliability.

And There You Have It!

With our guide, you've uncovered the art of seamless data transfer – from structuring your Excel data to formatting, cleaning, and utilizing specialized tools. You've delved into GST considerations, understood the importance of trial imports, and even witnessed the magic of Vyapar TaxOne automation.

Remember, every keystroke and every formatted cell contribute to accurate financial insights in Tally. As you embark on your data migration expedition, armed with knowledge and newfound tools, may your Excel-to-Tally journey be as smooth as silk and as enriching as your business itself. 📈

Also, don’t forget to try Vyapar TaxOne now and experience the future of data migration – accurate, efficient, and hassle-free. Sign up for the 7-day free trial today!