In 2025, the GST ecosystem is smarter and more stringent than ever, with advanced real-time analytics and AI-driven systems automatically flagging even minor mismatches.

Yet, over 1.6 lakh GST returns are currently under scrutiny due to discrepancies, resulting in businesses losing lakhs in Input Tax Credit, incurring delays, and facing increased compliance risks.

GST was designed to simplify taxation for businesses, but for many companies and CA firms, reconciliation has become a complex and daunting task.

Common GST pain points include:

- Tedious and error-prone manual matching

- Handling multiple data formats like Excel, JSON, and PDFs

- Frequent mismatches between GSTR-1, 2A, 2B, and 3B returns

- Delays in claiming Input Tax Credit due to reconciliation gaps

With CBIC's automated cross-verification technologies, even minor errors, such as invoice mismatches or delayed supplier filings, result in system-generated notices and penalties, rendering manual reconciliation outdated in a data-driven tax environment, akin to using a computer calculator.

That's why leveraging the best GST reconciliation software is no longer optional; it's essential for safeguarding ITC, avoiding audits, and ensuring timely compliance.

What Is GST Reconciliation Software, Really?

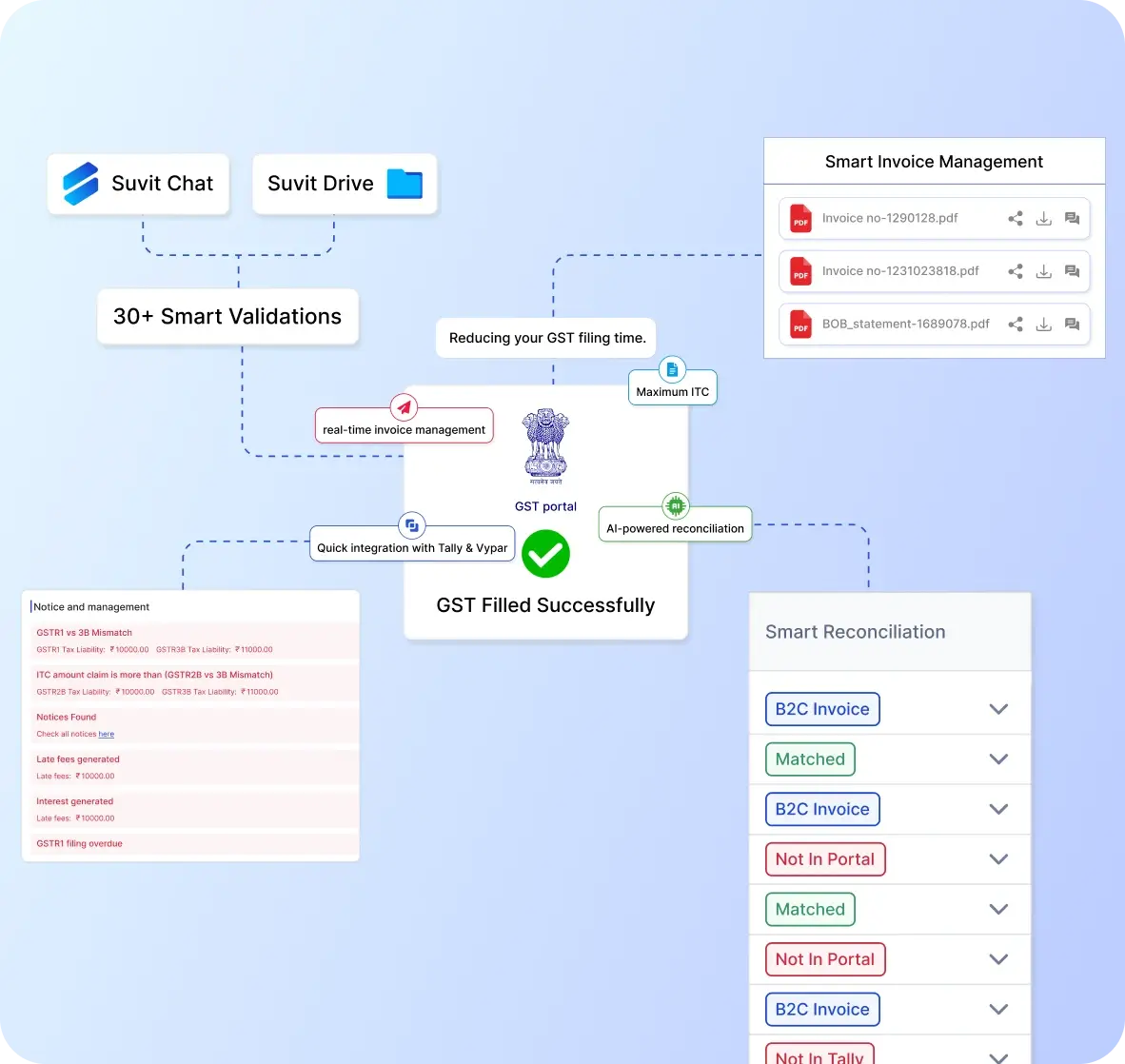

Let’s cut through the buzzwords and technical fog. At its core, GST Reconciliation Software is your firm’s silent watchdog. It's a digital solution that automates the comparison of purchase data (from your books) with the data auto-populated in the GST portal (GSTR-2A and GSTR-2B).

The goal? Spot mismatches, flag issues, and ensure your Input Tax Credit claims are squeaky clean and compliant.

But this isn’t just about matching invoices. It’s about eliminating manual drudgery, reducing human error, and giving Chartered Accountants and tax pros their time back—so they can focus on high-value advisory work instead of spreadsheet wrangling.

Here’s what a robust GST reconciliation tool typically does under the hood:

| Feature | What It Does | Why It Matters |

|---|---|---|

| Invoice Matching | Compares purchase invoices in your system with supplier-filed data in GSTR-2A/2B | Ensures eligible ITC is not missed or wrongly claimed |

| Mismatch Detection | Identifies discrepancies in invoice amounts, GSTINs, dates, or tax values | Reduces the risk of notices, penalties, or audits |

| Auto Reconciliation | Automatically syncs and reconciles matched entries with minimal input | Saves hours of manual work every month |

| Vendor-Wise Reports | Tracks vendor compliance and consistency in filing returns | Helps in vendor management and better procurement decisions |

| Audit Trail | Maintains logs of changes, reconciliations, and adjustments | Supports transparency and audit readiness |

Think of it this way: GST reconciliation software is like a radar system for your compliance—scanning, identifying, and alerting you about risks before they turn into problems.

The best solutions don’t just flag errors—they empower firms with real-time dashboards, visual reports, and bulk-processing features that bring scale and speed to GST compliance workflows.

And in today’s landscape of ever-tightening regulations and frequent GST updates, having a smart reconciliation tool is not just helpful—it's mission-critical.

Who Actually Needs It?

Not just enterprise giants. The best GST reconciliation software is now built for:

- CA Firms managing multiple client accounts and deadlines

- Mid-sized businesses with frequent vendor transactions

- Ecommerce sellers dealing with high invoice volumes

- Exporters and service-based businesses who must track ITC across multiple branches and locations

Basically, if you file GSTRs, you need it.

Checklist: Must-Have Features in a GST Reconciliation Tool

Here’s what separates smart software from glorified spreadsheets:

| Feature | Why It Matters |

|---|---|

| API integration with GST portal | No more manual JSON downloads/uploads |

| Auto-matching GSTR-1, 2A, 2B | Saves hours, reduces human errors |

| Flag mismatches with clarity | Understand why something doesn’t match |

| Bulk data upload (Excel, PDF, scanned PDFs) | Flexibility for real-world documents |

| ITC categorization (eligible/ineligible) | Accurate ITC claims |

| Vendor-wise reconciliation | Spot recurring issues by vendor |

| Audit trail & logs | Essential for internal control & audits |

| Tally & Zoho integration | Work where your books live |

| Multi-client dashboard | For CAs juggling 50+ clients |

Red Flags to Avoid

Sometimes, what a tool doesn’t offer is more telling:

- No real-time API sync = outdated data

- Limited to only JSON uploads = more manual work

- Doesn’t support scanned or PDF invoices = half your docs ignored

- No audit trail or version history = zero visibility

- Dated user interface = low adoption, higher frustration

If it takes more than 2 hours to train your staff or clients, it’s probably not worth it.

Beyond Compliance: Why a Great Tool Saves Time, Money, and Your Reputation

- Time saved = focus on higher-value work (e.g., strategic tax planning)

- Lower mismatch rates = less back-and-forth with vendors

- Reduced penalties = no more late filings or incorrect ITC claims

- Scalable = handle more clients or branches with the same team

A great GST reconciliation solution doesn’t just tick compliance boxes. It gives you a competitive edge.

Top GST Reconciliation Tools in India (2025 Edition)

Here’s a quick comparison of some of the best GST reconciliation software available:

| Tool | Best For | Key Features | Limitations |

|---|---|---|---|

| Vyapar TaxOne | CAs, Tax Pros | Accepts Excel, PDFs, scanned PDFs, auto-matching, real-time ITC insights, multi-client support | Only for Vyapar TaxOne users, separately module is not available |

| ClearTax GST | Enterprises, CAs | Bulk filing, analytics, cloud, support | Premium pricing, limited PDF |

| TallyPrime | Accountants, SMEs | Deep accounting, e-waybill, offline | UI less friendly for new users |

| Zoho Books | Startups, MSMEs | Zoho ecosystem, automated | Zoho users only |

| Vyapar GST | Small, Budget Firms | Mobile, GST, offline | Basic features vs. others |

| AI Accountant | Tally integrations, SMBs | AI mapping, error detection, OCR | New in the market |

Vyapar TaxOne stands out as a top-tier choice for CA firms and GST practitioners who deal with diverse document types and need real-time intelligence.

How to Actually Pick One (Without Regret)

Ask yourself:

- Are we reconciling for one business or many clients?

- Do we work with Excel, PDFs, or scanned bills?

- Do we need integration with Tally, Zoho, or ERP?

- How much automation vs. control do we need?

- Will the team actually use it, or curse it daily?

Start with a free trial. Upload real data. See how the system handles it.

If support feels like ghosting and the dashboard looks like Windows 98—run.

( On a side note, you can try Vyapar TaxOne for free for a week! )

Future-Proofing: What to Look for in 2025 and Beyond

The best GST reconciliation software isn’t static. It evolves. Watch for:

- AI-powered anomaly detection (find what you didn’t know was wrong)

- Predictive ITC forecasting

- Collaborative workflows with vendors

- Auto-reminders for reconciliation cycles

- Automated GST return filing

Invest in tools that aren’t just solving 2023’s problems—they’re anticipating 2026’s.

Final Word: It’s Not Just About Features, It’s About Fit

You don’t need the fanciest tool.

You need the best GST reconciliation software that fits your team, your workflows, your client expectations, and your pace of growth.

Look for:

- Flexibility

- Accuracy

- Support

- Scalability

Because at the end of the day, compliance isn’t optional—but stress is.

TL;DR

GST reconciliation is no longer a manual Excel task. It's a high-stakes compliance process that can make or break your ITC claims and tax standing. The right GST reconciliation software will do more than auto-match invoices—it will save you hours, reduce mismatches, simplify audit trails, and keep clients (and regulators) happy. This blog dives deep into what to look for, red flags to avoid, and how to make the smartest choice for your CA firm or business.

FAQs

What is GST reconciliation?

GST reconciliation is the process of matching purchase data from your books with data auto-populated from the GST portal (GSTR-2A/2B). It's done to ensure accurate ITC claims and stay compliant with GST regulations.

What is the difference between GSTR-2A and GSTR-2B?

- GSTR-2A is a dynamic form that updates in real-time.

- While GSTR-2B is a static statement and generated on the 14th of every month. It is used for ITC claim filing.

What if I miss a month’s GST filing?

In 2025, even a single missed filing is instantly flagged via automation, so your software must track every deadline.

Do the authorities trust AI-based GST reconciliation?

Yes, CBIC encourages automated reconciliation to reduce disputes and prevent fraud, with AI now powering real-time scrutiny at the backend.

Can I reconcile multiple clients with one software?

Yes, especially if you're using tools like Vyapar TaxOne or ClearGST that are designed for CA firms with multi-client dashboards.

Is Excel-based reconciliation still effective?

For small businesses, yes. But as data complexity grows, Excel becomes risky. Automation is more accurate and scalable.