Bookkeeping is all about maintaining track of transactions and organizing them. Every business, regardless of its size or industry, needs bookkeeping for better financial management. By keeping up-to-date records, bookkeeping helps you understand your performance, make smarter company decisions, keep track of cash flow, be ready to handle tax obligations and meet government regulations.

In this blog, we'll dive into the basics of bookkeeping and highlight its importance for businesses of all sizes and scales. We'll also talk about the latest developments in bookkeeping and accounting including cloud-based accounting automation software, mobile accounting apps and automated bookkeeping services.

What is Bookkeeping?

The process of bookkeeping involves recording all the financial transactions of the company and organizing them. It is a systematic method of keeping a track record of all incomes and expenses, including assets and liabilities of your business. You can do bookkeeping either manually or by using software.

Here are some examples of bookkeeping activities:

- Recording sales and invoices

- Recording payments to suppliers and employees

- Recording bank deposits and withdrawals

- Recording depreciation of assets

- Preparing financial statements such as the balance sheet, income statement, and cash flow statement

Also Read: Flip the Script on Recording: Dive into the World of Automated Bookkeeping

What are the objectives of bookkeeping?

1. Record all financial transactions accurately and completely.

This includes keeping a record of all income and expenses, along with the assets and liabilities.

- Record all income: This includes income from sales, investments, and other sources.

- Record all expenses: This includes expenses such as rent, salaries, and utilities.

- Record all assets: This involves assets such as cash, inventory, and equipment.

- Record all liabilities: This includes liabilities such as accounts payable and loans.

2. Produce financial statements that show the financial position and performance of the business.

Financial statements consist of the balance sheet, income statement, and cash flow statement.

- Balance sheet: The balance sheet shows the financial position of your business at a specific point in time. It shows the assets, liabilities, and equity of the business.

- Income statement: The income statement shows the financial performance of your business over a period of time. It shows the income and expenses of the business.

- Cash flow statement: The cash flow statement shows the inflows and outflows of cash for your business over a period of time. It shows you how your business is generating and using cash.

3. Comply with all applicable tax laws and regulations.

This includes keeping records of certain types of transactions for a specified period of time and filing tax returns accurately and on time.

- Keep records of certain types of transactions: You are required to keep records of certain types of transactions for a specified period of time. This includes records of sales, expenses, and assets.

- File tax returns accurately and on time: You are required to file tax returns accurately and on time. Bookkeeping helps you ensure that you have the information you need to file your taxes correctly.

Also Read: Bookkeeping vs. Accounting: What's The Difference?

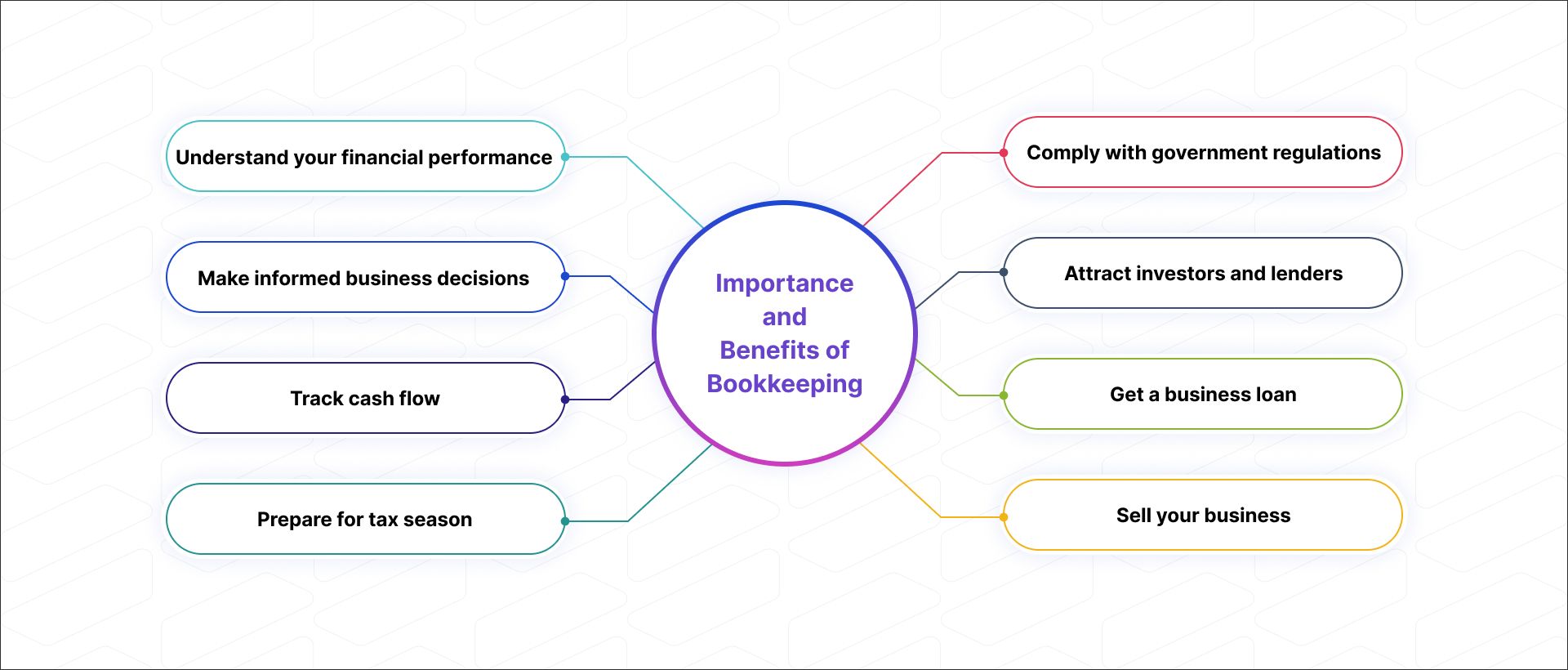

Importance and Benefits of Bookkeeping

1. Understand your financial performance:

Keeping track of your income and expenses through bookkeeping allows you to monitor the performance of your business over time. This valuable information enables you to identify trends and patterns assisting you in making business decisions.

For instance, if you notice that your sales are, on the rise but your profits aren't reflecting that it would be wise to investigate the underlying reasons for this discrepancy. Bookkeeping also enables you to compare your performance against your budget and industry standards providing insights, into how you're doing.

2. Make informed business decisions:

Bookkeeping data can be used to make informed business decisions about things like pricing, inventory levels, and marketing campaigns. For example, if you see that your sales of a particular product are low, you may need to reduce the price or increase marketing for that product. Bookkeeping data can also be used to evaluate the performance of new business initiatives.

3. Track cash flow:

Bookkeeping helps you to track your cash flow, so you can see when you have money coming in and going out. This information can be used to ensure that you have enough cash to cover your expenses and to make plans for future investments. For example, if you know that you have a large bill coming due in a few weeks, you can start to save up for it in advance.

4. Prepare for tax season:

Bookkeeping makes it easier to prepare taxes at the end of the year. By keeping accurate records of income and expenses, businesses can avoid costly mistakes and ensure that they pay the correct amount of tax. Bookkeeping can also help businesses to identify tax deductions and credits that they may be eligible for.

5. Comply with government regulations:

Many businesses are required to comply with government regulations related to bookkeeping and accounting. For example, businesses may need to keep records of certain types of transactions for a specified period of time. Bookkeeping can help businesses to ensure that they are complying with all applicable regulations.

6. Attract investors and lenders:

If a business is seeking investment or a loan, investors and lenders will want to see that the business has accurate and up-to-date financial records. Bookkeeping can help businesses to demonstrate that they are financially sound and a good investment.

7. Get a business loan:

If a business is applying for a business loan, lenders will want to see that the business has a good track record of managing its finances. Bookkeeping can help businesses to show lenders that they are responsible borrowers and that they are likely to repay the loan.

8. Sell your business:

If a business is considering selling, potential buyers will want to see that the business has accurate and up-to-date financial records. Bookkeeping can help businesses to prepare their business for sale and to maximize its value.

In addition to these specific benefits, bookkeeping can also help businesses to:

- Improve their overall financial management: Bookkeeping provides businesses with a clear and concise overview of their financial situation. This information can be used to make better decisions about how to allocate resources and how to grow the business.

- Identify potential problems early: Bookkeeping can help businesses to identify potential problems early on, so that they can be addressed before they cause major damage. For example, if a business sees that its expenses are increasing faster than its income, it can take steps to reduce costs or increase sales.

- Make better business plans: Bookkeeping data can be used to make more informed business plans. For example, a business can use its bookkeeping data to project future sales and expenses. This information can be used to set realistic goals and to develop strategies for achieving those goals.

Recommended Read: Bookkeeping vs. Accounting: What's The Difference?

Modern Bookkeeping and Accounting

Modern bookkeeping and accounting is all about using technology to automate and streamline financial processes. This can lead to increased efficiency, reduced costs, improved accuracy, and real-time insights.

Cloud-based accounting software is one of the most popular modern bookkeeping and accounting solutions. Cloud-based accounting software is hosted online, so businesses can access their financial data from anywhere with an internet connection. Cloud-based accounting software also offers a number of features that make it easier to automate bookkeeping tasks, such as bank reconciliation and invoice processing.

Mobile accounting apps are another popular modern bookkeeping and accounting solution. Mobile accounting apps allow businesses to record and track financial transactions on the go. Mobile accounting apps can also be used to generate reports and to make payments to suppliers and employees.

Automated bookkeeping services use artificial intelligence (AI) and machine learning to automate a wide range of bookkeeping tasks. This can free up business owners and accountants to focus on more strategic tasks.

Here are some specific examples of how modern bookkeeping and accounting solutions can be used to benefit businesses:

- A small business owner can use cloud-based accounting software to track their sales and expenses, generate invoices, and pay bills. This can save them hours of time each month.

- A medium-sized business can use mobile accounting apps to allow their sales team to enter sales data on the go. This can help the business to track its sales performance more closely and to identify sales opportunities more quickly.

- A large corporation can use automated bookkeeping services to automate tasks such as bank reconciliation and payroll processing. This can free up the corporation's accounting team to focus on more strategic tasks, such as financial planning and analysis.

Accounting Automation

Accounting automation is the use of software and technology to automate tasks and processes in the accounting function. This can help businesses of all sizes to improve their efficiency, accuracy, and productivity.

Benefits of accounting automation

- Increased efficiency: Accounting automation can help businesses automate and streamline their accounting processes, which can lead to increased efficiency. For example, accounting automation software can automate tasks such as bank reconciliation, invoice processing, and payroll processing. This can free up accounting staff to focus on more strategic tasks.

- Reduced costs: Accounting automation can help businesses to reduce the costs associated with accounting. For example, accounting automation software can help businesses reduce the amount of time spent on manual tasks, such as data entry. This can lead to reduced labour costs.

- Improved accuracy: Accounting automation can help businesses to improve the accuracy of their financial records. For example, accounting automation software can help to reduce the number of human errors that can occur in manual accounting processes.

- Real-time insights: Accounting automation can provide businesses with real-time insights into their financial performance. This information can be used to make better business decisions. For example, accounting automation software can provide businesses with reports on their sales, expenses, and cash flow.

How to choose an accounting automation solution

When choosing an accounting automation solution, it is important to consider the following factors:

- The size and needs of your business: Choose a solution that is appropriate for the size and needs of your business. For example, a small business may have different needs than a large corporation.

- The features you need: Make a list of the accounting features that are important to you, such as bank reconciliation, invoice processing, and payroll processing.

- The cost of the solution: Compare the costs of different solutions before making a decision.

- The ease of use: Choose a solution that is easy to use for both you and your accounting staff.

- The security of the solution: Choose a solution that offers adequate security features.

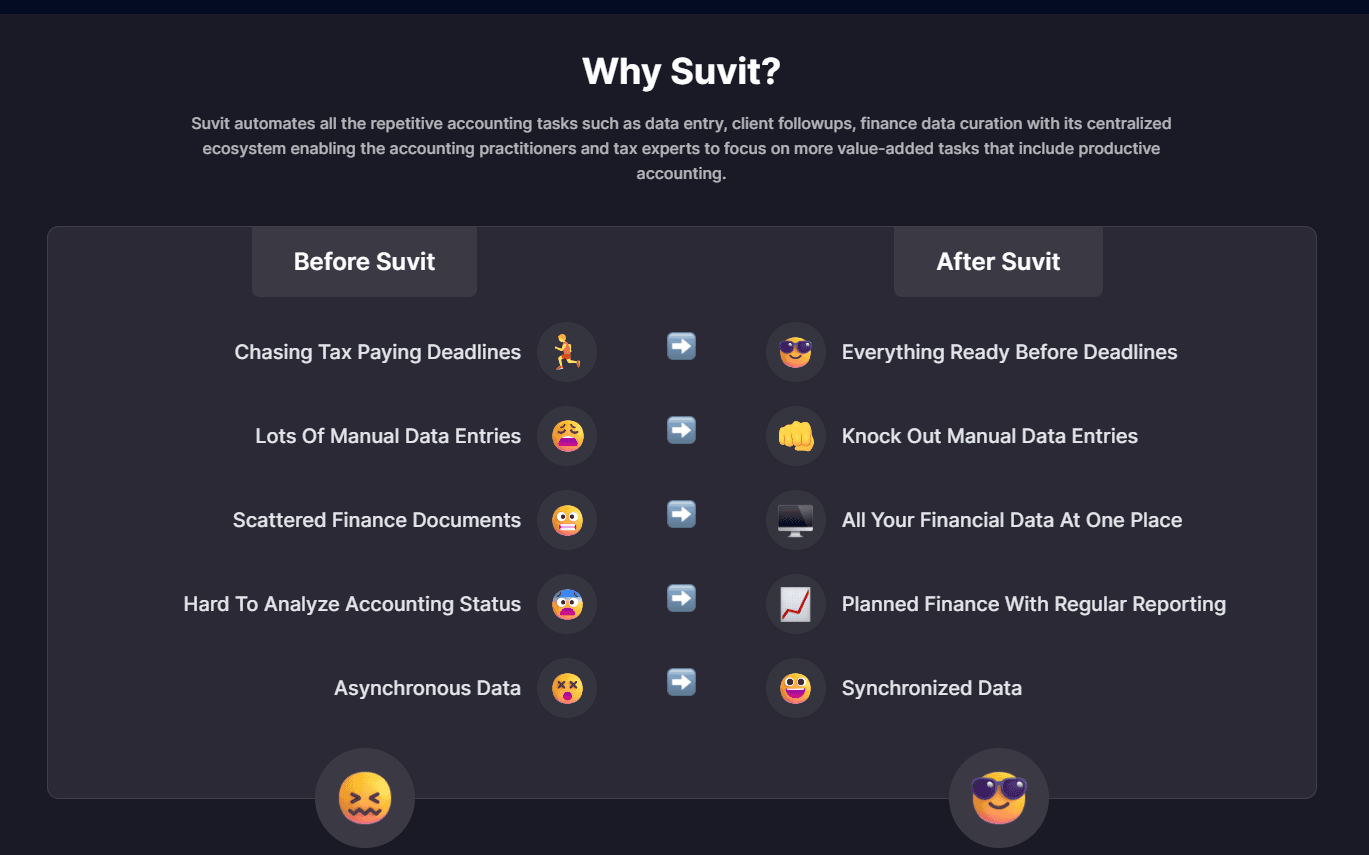

Introducing Vyapar TaxOne - The Perfect Automation Tool for Accountants

If you are looking for a way to automate your accounting tasks and save time and money, then taxone.vyapar.com is the perfect solution to begin with. Here are some specific features of taxone.vyapar.com that make it a great tool for accounting automation:

- Document processing: Vyapar TaxOne can automatically process documents such as invoices, receipts, and bank statements. This saves you time and effort, and it also helps to ensure that your data is accurate.

- Bank reconciliation: It can automatically reconcile your bank statements. This ensures that your records are up-to-date and that your bank balance is accurate.

- Financial reporting: Vyapar TaxOne can generate financial reports such as balance sheets, income statements, and cash flow statements. This can help you to track your financial performance and make better business decisions.

- Client management: Vyapar TaxOne can help you to manage your clients' data. This includes storing their contact information, invoices, and payments.

- Collaboration: It allows you to collaborate with your team members on accounting tasks. This can help to improve efficiency and accuracy.

Next Steps

Bookkeeping is an essential part of any business, regardless of size or industry. Accurate and up-to-date bookkeeping records can help you to understand your financial performance, make informed business decisions, track cash flow, prepare for tax season, and comply with government regulations.

Modern bookkeeping and accounting solutions can help businesses automate and streamline their financial processes, which can lead to increased efficiency, reduced costs, improved accuracy, and real-time insights.

If you are looking for ways to improve your bookkeeping and accounting processes, consider using one of the many modern bookkeeping and accounting solutions available.

Want to try out accounting automation and take the first step towards better accounting management? Try out Vyapar TaxOne for free today.