The days of flipping through complex paperwork and endless follow-ups for your Employee Provident Fund (EPF) are over. Enter the Universal Account Number (UAN), your digital key to managing your EPF effortlessly! With the user-friendly EPFO portal, UAN unlocks a world of online services, empowering you to take control of your financial future. Whether you need to check your balance, withdraw funds, or even apply for a PF loan – it's all just a click away. This comprehensive guide delves into every aspect of your UAN, equipping you with the knowledge and confidence to navigate the online EPF ecosystem with ease.

What is UAN and Why Does it Matter?

Imagine a magic key that unlocks a treasure trove of your entire EPF history, regardless of how many jobs you've changed. That's UAN in a nutshell – a 12-digit alphanumeric code assigned by the Employees' Provident Fund Organisation (EPFO) that acts as your unique identifier in the EPF universe. It stays with you through job shifts and promotions, ensuring your EPF contributions remain a unified and portable entity throughout your career.

In short:

- UAN is a 12-digit alphanumeric code assigned by the EPFO, acting as your unique EPF identifier, regardless of job changes.

- It simplifies PF management, linking all your accounts under one umbrella for seamless access and control.

How to Find Your UAN?

Through your employer: Normally, employers assign a Universal Account Number according to the EPFO guidelines. In certain cases, the UAN may also be included in salary slips by some employers. Through the UAN portal: If you can't get your Universal Account Number from your employer, you can easily obtain it from the UAN portal by following these steps:

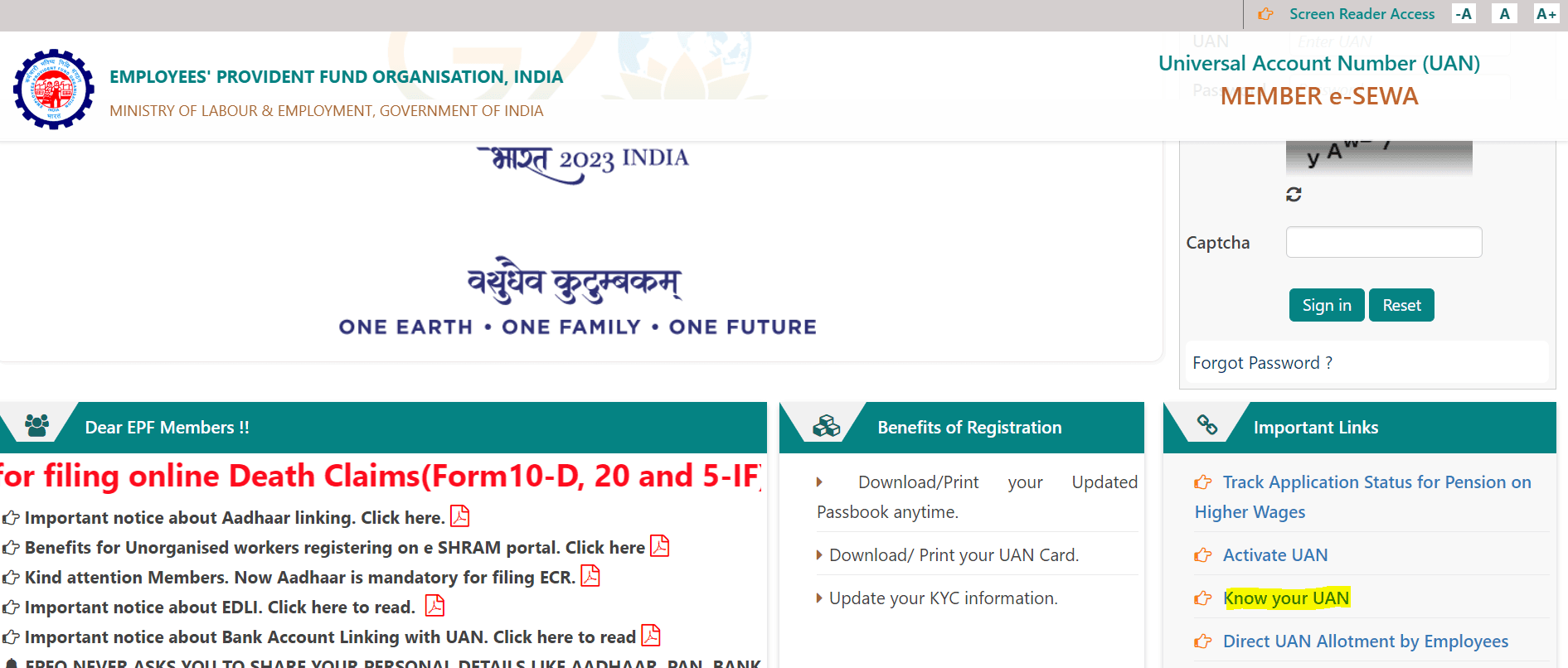

Step-1: Head to https://unifiedportal-mem.epfindia.gov.in/ website.

Step-2: Now, click on "Know your UAN”.

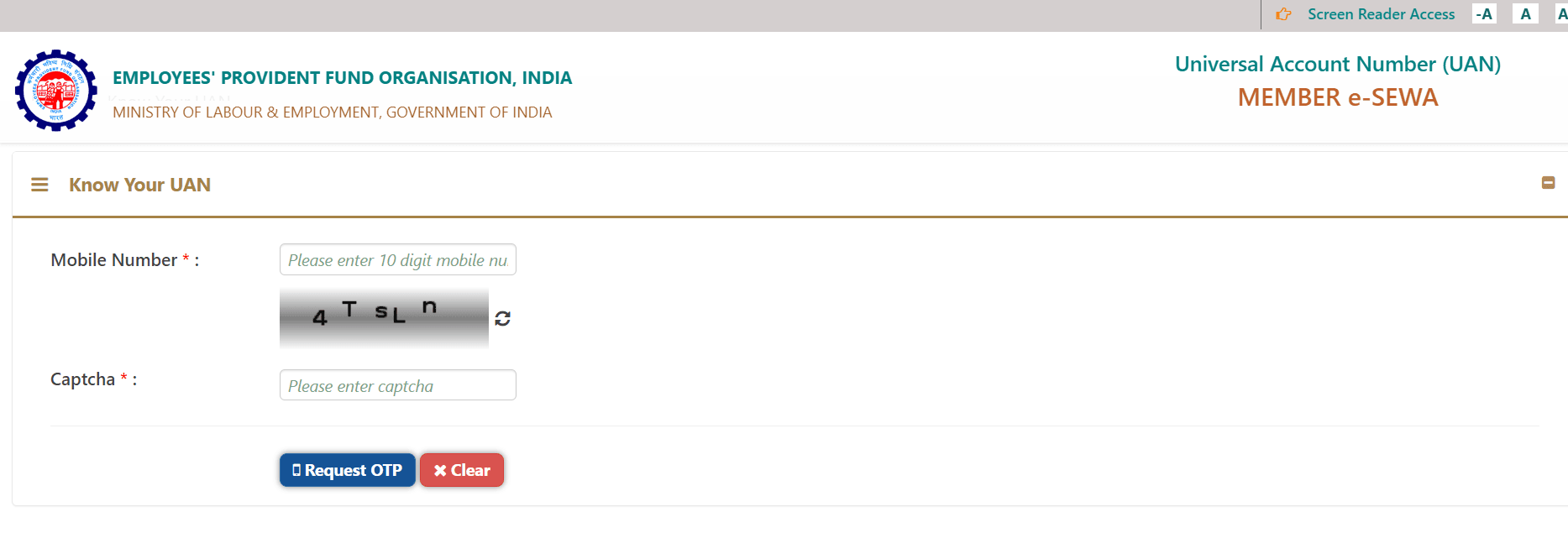

Step-3: Now enter Mobile number and captcha code.

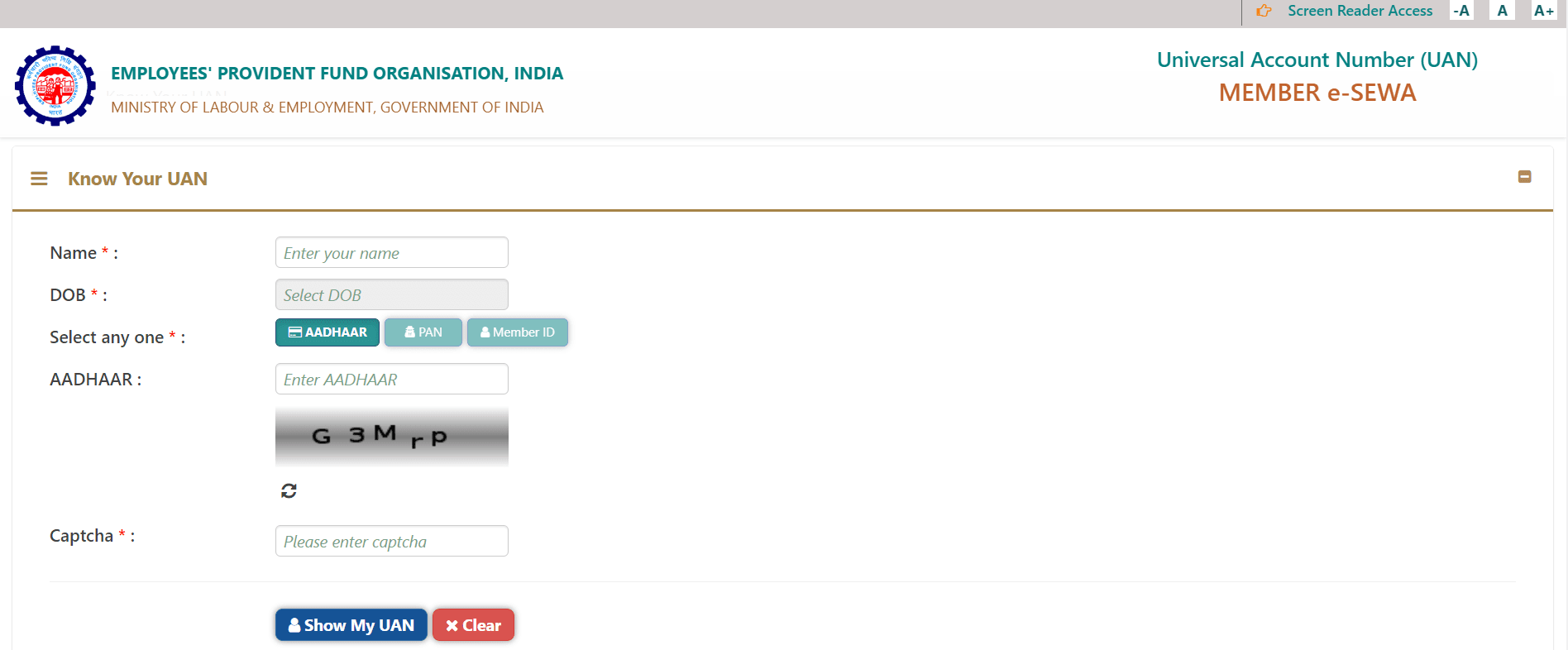

Step-4: After requesting OTP, you’ve to validate it. After validating OTP, you have to enter further information like Name, DOB, AADHAR/PAN/Member ID.

Step-5: Once you've provided all the details, select the 'Show my UAN' button. And your ‘UAN’ Number will appear on the screen.

Activating And Logging Into The Epfo Member Portal Using UAN - UAN Login Process Now with your UAN in hand, let's activate your portal access.

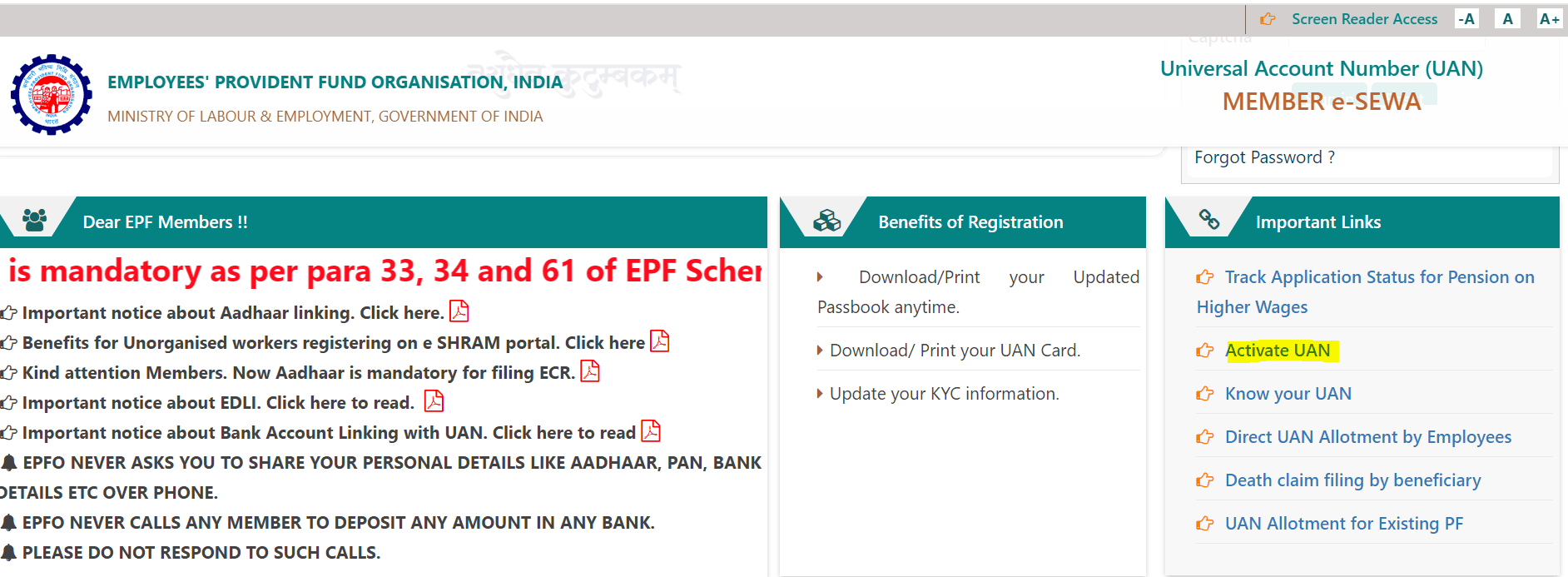

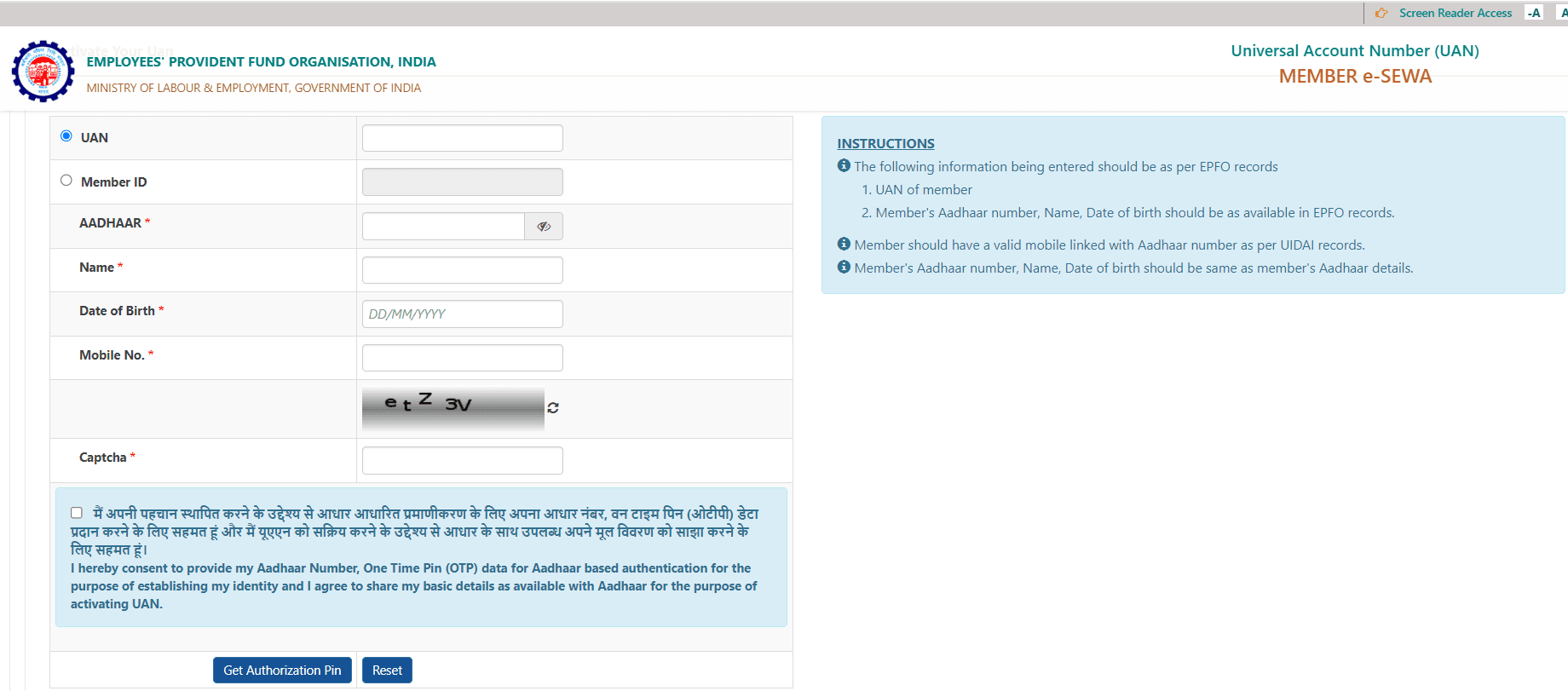

Step-1: On the UAN portal, click on "Activate UAN".

Step-2: Now enter your UAN, Aadhaar number, and other information.

Step-3: Once you validate your details, an OTP will appear on your registered mobile number. Use it to set your password

Step-4: Upon successful OTP verification, the UAN will be activated.

Opening Your UAN: Required Documents

If you've recently started working at your first registered company, you'll require the following documents to obtain your Universal Account Number.

Bank Account Details: Keep your finances easily accessible by providing your bank account number, IFSC code, and branch name. Remember, this account will receive your EPF contributions.

Photo ID: Prove who you are with any government-issued photo ID like your driving license, passport, voter ID, or Aadhaar card. Even your SSLC Book can work!

Proof of Residence: You can submit a recent utility bill in your name, a rental/lease agreement, or even your ration card – as long as it reflects your current address.

PAN Card: Link your UAN to your PAN for smooth financial transactions.

Aadhaar Card: This handy card plays a dual role, verifying your bank account and mobile number, both important for UAN activation.

Once you have these documents in hand, you can either approach your employer for UAN generation or navigate the process yourself through the online EPFO portal. Remember, a valid Aadhaar card is mandatory for online activation.

How to Download Your UAN Card Online?

Your UAN card serves as a portable gateway to your EPF information. Here's how you can download it and keep it handy: Conditions: Active UAN and Password: Ensure your UAN is activated and you have a valid password to access the EPFO portal.

Steps to Download:

- Visit the UAN Portal: Head to the official EPFO portal (link to UAN portal: https://unifiedportal-mem.epfindia.gov.in/).

- Log In: Enter your UAN, password, and the displayed Captcha code, then click "Sign In."

- Access the Card: Under the "View" tab, select "UAN Card."

- Download and Save: Click the "Download UAN Card" button on the top right corner. Choose to save a soft copy for digital access or print a hard copy for physical reference.

Linking Your Aadhaar: A Step-by-Step Guide:

- Head to the EPFO Portal: Access UAN portal: https://unifiedportal-mem.epfindia.gov.in/ and select 'UAN Member e-Sewa’ under ‘For Employees’

- Login with UAN and Password: Make sure you have your UAN and password handy for smooth entry.

- Navigate to the "Manage" Section: On the top panel, locate the "Manage" tab and click on "KYC" within it.

- Select Aadhaar and Enter Details: Tick the checkbox for Aadhaar, then accurately enter your 12-digit Aadhaar number and name.

- Save and Track: Review your information and click "Save." Your details will appear under "Pending KYC," awaiting your employer's approval.

Once approved by your employer (usually within 15 days), your Aadhaar will be visible under "Approved KYC."

Remember: Your employer plays an important role in approving KYC details. Don't hesitate to follow up with them if the process takes longer than expected.

The Benefits of UAN

With UAN, managing your EPF becomes a breeze. Here's a glimpse of the magic it holds: Centralized Data: No more juggling multiple PF accounts from different employers. UAN links all your accounts under one umbrella, simplifying access and management. Online Nirvana: Gone are the days of physical forms and endless queues. With UAN, you can withdraw your PF (partially or fully), transfer funds between accounts, and even check your balance – all from the comfort of your screen. Transparency: View your PF statement, download your UAN card, and even update your KYC details – the portal keeps you informed and empowered. Security Ensured: UAN acts as a secure gateway, preventing unauthorized access to your EPF funds and providing you peace of mind.

UAN Portal Features

Now that you've unlocked the portal, let's delve into its functionalities:

View Service: Get detailed information about your EPF account, including contributions, interest earned, and current balance.

Profile: Update your personal details like name, date of birth, and contact information.

Service History: See a comprehensive timeline of your PF accounts under different employers, linked seamlessly through your UAN.

UAN Card: Download a soft copy of your UAN card for easy access and reference.

EPF Passbook: Track your EPF contributions and interest accrual in detail.

Manage Service: Update your basic details, contact information, and KYC documents to keep your data accurate and secure.

E-Nomination: Designate your beneficiaries online, ensuring your loved ones receive your EPF funds in case of unfortunate circumstances.

Account: Change your password to maintain optimal security.

Online Services: Taking Control of Your EPF

UAN empowers you to manage your EPF actively through the "Online Services" section:

Claim (Form 31, 19 & 10C/10D): Apply for partial or full withdrawal of your PF funds easily.

One Member One EPF Account (Transfer request): Consolidate your PF accounts from different employers under one roof.

Track EPF Claim Status: Follow the progress of your PF withdrawal claims in real-time.

Download Annexure K: Download the form required for transferring your PF from an exempted to an unexempted establishment.