Chartered Accountants in India face growing demands for accuracy and efficiency. To help meet these challenges, the Institute of Chartered Accountants of India (ICAI) has introduced AI-driven tools like CA-GPT. AI tools are automating tasks such as data entry, GST filing, and client communication, allowing CAs to focus on more strategic work.

This blog explores five AI tools that help accountants save time and improve productivity.

TL;DR

- Overview of 5 Tally AI tools for accountants.

- Time-saving benefits for CAs.

- Impact of AI on productivity and accuracy.

- Practical insights for implementing these tools.

- How AI helps with client communication automation.

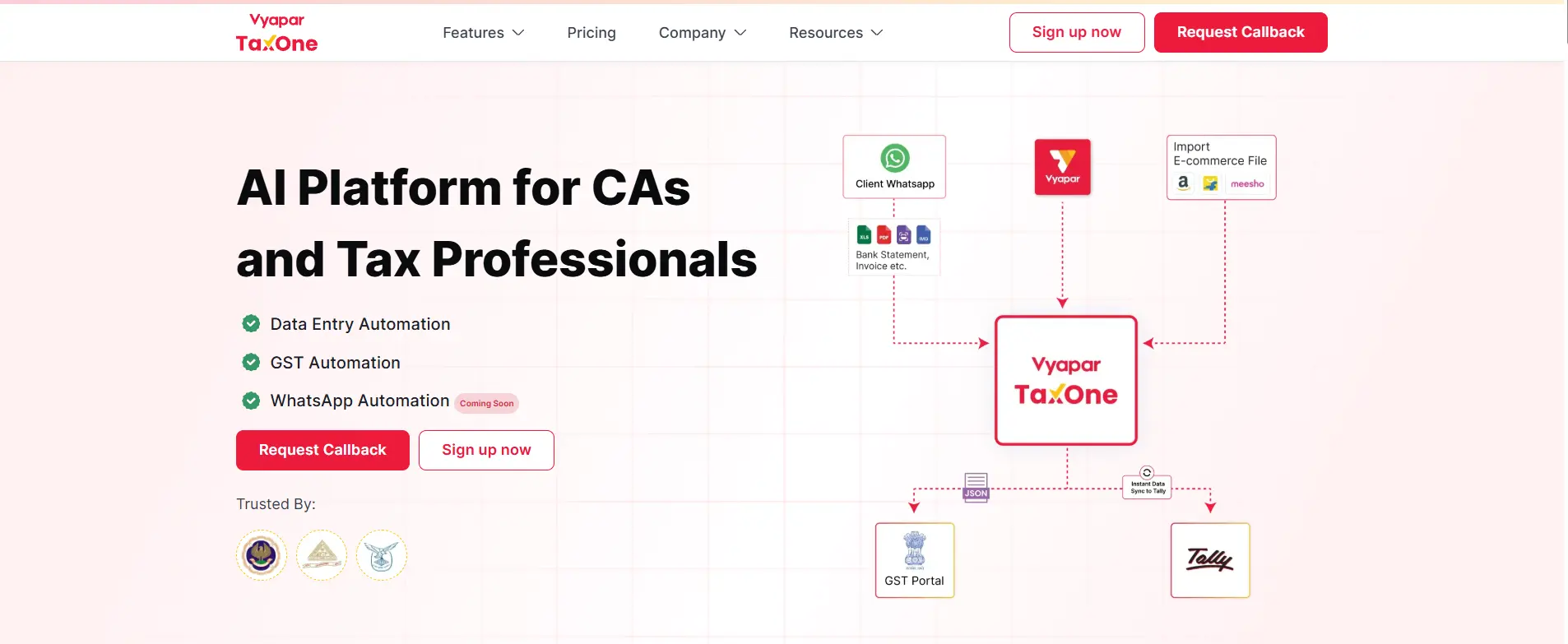

1. Vyapar TaxOne – India’s All-in-One AI Automation Platform

Overview:

Vyapar TaxOne is an AI-driven practice management tool designed specifically for Indian CAs. Integrated with Tally, Vyapar, Excel, and WhatsApp, it automates essential tasks such as data entry, GST filings, and reconciliation.

Key Features:

- Automated Data Entry:

Vyapar TaxOne reduces manual data entry by extracting data from invoices, bank statements, and vouchers. This automation accelerates the workflow and enhances precision.

- GST Automation:

It ensures accurate GST filing and reconciliation, minimizing the chances of human error and ensuring compliance with India’s tax regulations.

- Client Communication Automation:

Vyapar TaxOne automates client reminders and notifications via WhatsApp, saving time spent on client follow-ups.

Impact:

By automating repetitive tasks, Vyapar TaxOne allows CAs to focus on strategic services like tax planning and business advisory, maximizing productivity and client engagement.

2. TallyZen – AI-Powered Assistant for Tally

Overview:

TallyZen integrates directly with Tally, providing a suite of AI-powered tools to automate accounting tasks such as reconciliations, GST filing, and report generation.

Key Features:

- Automated Reconciliation:

TallyZen automates the process of reconciling transactions with bank statements, reducing time spent on manual matching.

- GST Compliance:

It generates and files GST returns automatically, ensuring compliance with India’s tax regulations.

- MIS Reporting:

The platform provides Management Information System (MIS) reports, accessible via WhatsApp for quick insights.

Impact:

TallyZen’s automation reduces the manual work involved in reconciliations and reporting, freeing up CAs to focus on high-value services like financial analysis and client advisory.

3. AI Accountant – Smart Automation for Tally & Zoho Books

Overview:

AI Accountant connects with both Tally and Zoho Books to automate critical accounting functions like data entry, invoice matching, and bank reconciliations.

Key Features:

- Invoice Matching:

AI Accountant matches invoices with transactions, reducing the time spent on manual matching and eliminating errors.

- Data Synchronization:

It ensures seamless synchronization of data across platforms, including Tally and Zoho Books, streamlining the accounting process.

- Error Reduction:

The tool minimizes errors caused by manual entry, ensuring that financial data is accurate and reliable.

Impact:

With AI Accountant, CAs can automate time-consuming data entry and invoice matching, resulting in fewer errors and more time for client-focused activities.

4. Entera – AI-Based Data Entry for Accounting Software

Overview:

Entera is an AI tool that automates data entry for accounting software like Tally, Zoho Books, and QuickBooks, handling documents in various formats.

Key Features:

- Multi-Format Data Processing:

Entera processes data from invoices, receipts, and bank statements, converting them into structured formats for easy input into accounting systems.

- Auto-Mapping:

It automatically categorizes and maps data to the correct ledgers, eliminating the need for manual data classification.

- Integration:

Entera integrates with Tally and other accounting software, ensuring smooth and accurate data transfer.

Impact:

Entera significantly reduces manual data entry time, allowing accountants to focus on tasks that add greater value, such as financial analysis and reporting.

5. Tally Prime 6.0 – AI-Enhanced Accounting Software

Overview:

Tally Prime 6.0 incorporates AI-powered tools to enhance accounting workflows, including automation of approval processes, tax calculations, and reporting.

Key Features:

- Smart Extensions:

Tally Prime 6.0 includes extensions for automating approval workflows and customized tax calculations, simplifying routine administrative tasks.

- Real-Time Data Visualization:

It provides real-time data insights, helping accountants analyze financial performance and make informed decisions.

- Multi-Entity Management:

The software allows accountants to manage multiple clients or entities, streamlining accounting for firms with diverse portfolios.

Impact:

With advanced automation and real-time reporting, Tally Prime 6.0 enhances decision-making capabilities, saves time, and improves the accuracy of financial data.

Practical Insights for Implementation

To optimize the benefits of these AI tools, Chartered Accountants should consider the following approaches:

Start Small:

Begin by automating one task, such as GST filing or data entry, to measure time savings and assess the impact.

Training and Onboarding:

Ensure your team is adequately trained to use AI tools. Familiarity with the tools will improve their effectiveness and enhance overall productivity.

Monitor Impact:

Continuously track the time saved and adjust workflows as needed to optimize your practice further.

Embracing AI for a Smarter Accounting Future

AI tools like Vyapar TaxOne, TallyZen, and others are transforming the accounting profession. By automating repetitive tasks, these tools help Chartered Accountants save valuable time, enhance accuracy, and stay compliant with evolving tax regulations.

Embracing AI not only boosts productivity but also allows CAs to focus on more strategic, high-value services for their clients.

Also Read: How to Integrate AI with Tally for Faster Data Entry

FAQs

1. How do Tally AI tools help automate accounting tasks?

Tally AI tools automate routine accounting functions like data entry, invoice matching, bank reconciliation, and GST filing. By reducing manual effort, these tools enhance efficiency and accuracy, freeing up time for Chartered Accountants to focus on higher-value tasks.

2. Which Tally AI tool is best for automating data entry?

Vyapar TaxOne is a top AI tool for automating data entry in Tally. It extracts and structures data from invoices, bank statements, and other documents, reducing manual input and improving workflow efficiency.

3. How does Tally automation simplify GST compliance?

Tally AI tools like Vyapar TaxOne, TallyZen, and Tally Prime 6.0 automate GST return generation and filing, ensuring timely compliance with Indian tax laws. These tools also reduce errors in tax calculations, minimizing the risk of penalties.

4. Can Tally AI tools automate bank reconciliations?

Yes, Tally Zen automates the reconciliation of bank statements with accounting records in Tally, saving time and improving accuracy by eliminating manual matching.