In accounting and taxation in India, Chartered Accountants are navigating increasing complexity in compliance, fast turnaround demands, and rising client expectations.

Traditional accounting tools like Tally ERP have long been trusted, but their desktop-centric nature limits flexibility, automation capabilities, and collaborative workflows critical for modern firms.

Suvit, powered by cloud technology and AI automation, brings a revolutionary solution, Tally on Cloud, integrated with powerful automation tailored specifically for CAs.

This blog explores how Suvit transforms accounting practices, enabling efficiency, accuracy, scalability, and secure compliance.

The Growing Need for Cloud Accounting Among CAs

Shifting Work Paradigms and Remote Access

The adoption of cloud computing in professional services is no longer optional but essential for flexible work arrangements.

Remote and hybrid models demand 24/7 access to critical financial data from any device or location. Cloud-hosted Tally through Suvit removes traditional access bottlenecks, facilitating virtual teamwork and client collaboration seamlessly.

Addressing Traditional Pain Points in Accounting Firms

Accounting firms often struggle with inefficient manual workflows, including chasing clients for documents, entering repetitive data, and correcting errors late in the filing cycle.

These inefficiencies lead to long turnaround times, risk of penalty, and client dissatisfaction.

Why Cloud Accounting is a Smart Business Decision

- Supports easy scalability to onboard more clients without proportional cost addition

- Offers stronger data security through encrypted cloud storage and automatic backups

- Enables real-time visibility into firm-wide accounting operations through centralized dashboards

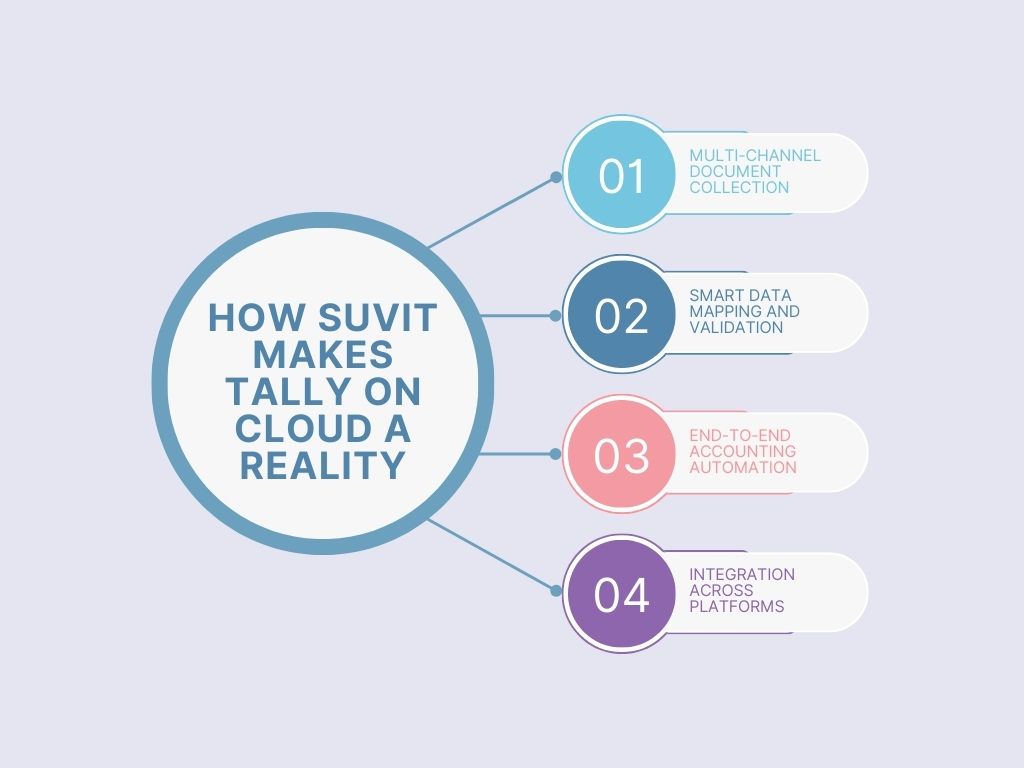

How Suvit Makes Tally on Cloud a Reality

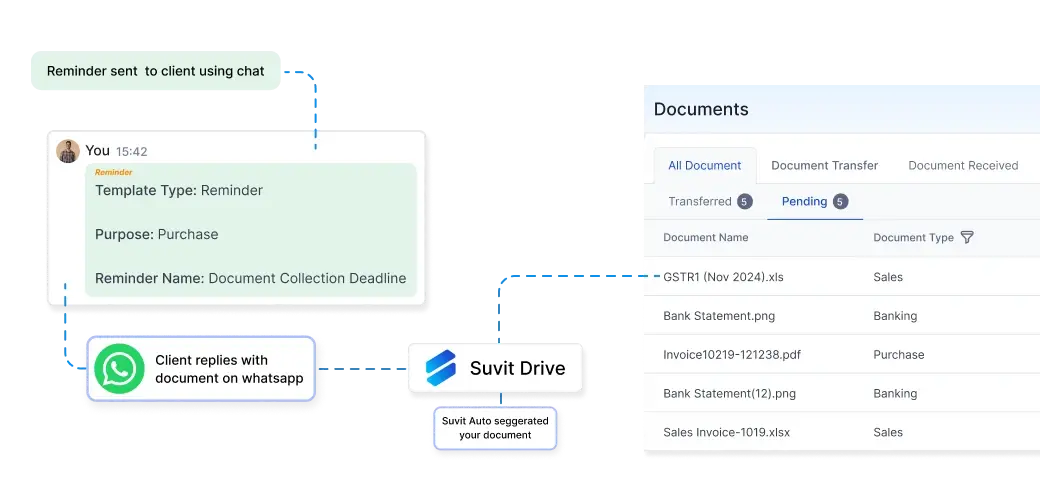

Automated, Multi-Channel Document Collection

Suvit simplifies one of the most time-consuming tasks, document collection, by integrating WhatsApp-based client reminders along with Vyapar Accounting software connectivity.

This multi-pronged approach ensures invoices, bank statements, and ledgers are received promptly without manual chasing, improving workflow predictability.

Smart Data Mapping and Validation with AI

Once documents are collected, Suvit employs AI to smartly tag and map transactions into the correct ledger accounts in Tally.

This automatic classification reduces human errors during data entry and ledger maintenance. Additionally, the platform runs validation checks on data completeness and accuracy, identifying duplicates or missing information proactively.

End-to-End Accounting Automation on Cloud

Suvit provides an AI-driven single ecosystem that covers the entire bookkeeping process: from document gathering, transaction conciliation, and ledger preparation to final GST filing submission.

This drastically reduces manual overhead, accelerates compliance, and boosts accuracy.

Integration Across Platforms for Unified Experience

Combining data from Vyapar, Tally (ERP or Prime), and Suvit’s own chat-based capture, the platform creates a unified workspace.

CAs can cross-check and verify ledger entries with a simple click, unifying their workflow in one cloud environment accessible anywhere.

Detailed Automation Features That Redefine CA Workflow

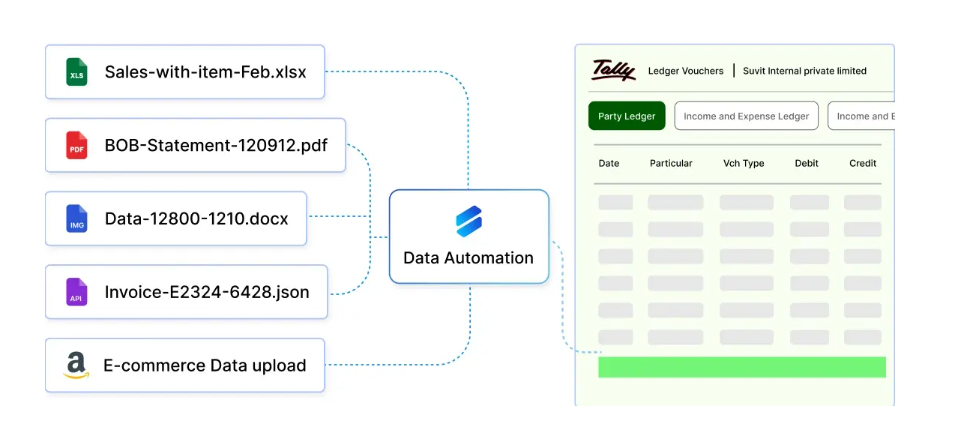

Data Entry and Voucher Automation

- Intelligent extraction of transaction data from invoices, PDFs, images, and Excel

- Bulk upload of vouchers into Tally with AI-powered ledger suggestions to minimize errors

- Auto-reconciliation of bank statements, highlighting exceptions requiring manual review

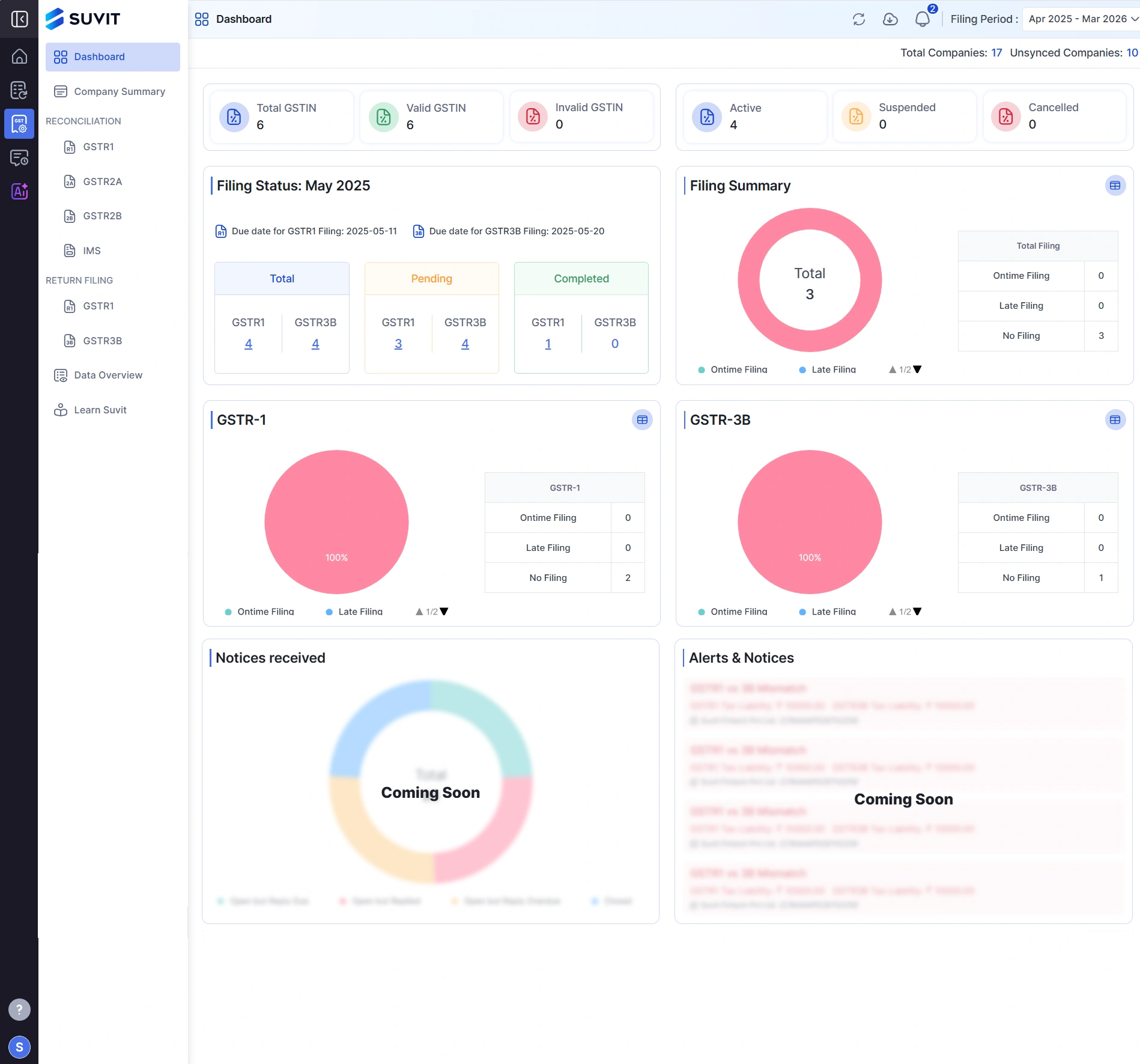

Compliance-Centric Automation

- Auto-calculations of eligible ITC with built-in error detection and validation rules

- Quick GST health report

- Direct integration with the government GST portal reduces reconciliation errors and saves time

Real-Time Task and Workflow Management

- Automated scheduling of tasks with configurable reminders for due dates

- Interactive dashboards providing real-time updates on client document status and processing stages

- Digital audit trails and organized document repositories for quick access during audits

Security and Compliance Benefits: Empowering CAs

Enterprise-Grade Data Protection

- Encrypted database storage with multi-layer security protocols protecting sensitive accounting data

- Cloud infrastructure offering 24/7 monitoring and disaster recovery setups

- Role-based access permissions limit data exposure to authorized personnel only

Compliance Accuracy and Risk Reduction

- Pre-filing automated validations prevent costly GST submission errors and penalties

- Transparent, audit-ready ledgers with detailed change history streamline audit processes

- Timely reminders and tracking ensure no statutory deadlines are missed

Practical Steps for Indian CA Firms to Adopt Suvit’s Cloud Solution

Assess, Migrate, Train, and Scale

- Conduct client segment analysis for proper Suvit adoption

- Comprehensive staff training on Suvit’s AI workflows and cloud-based Tally operations for seamless adaptation

- Monitor operational metrics post-adoption to optimize automated processes and improve client experience

Return on Investment (ROI) and Business Impact

- Reduction in manual data entry and document follow-ups by an estimated 80%

- Increased client onboarding capacity without expanding workforce or physical office space

- Lower compliance risk due to enhanced data accuracy and pre-submission validation

- Improved client satisfaction through faster turnaround and transparent collaboration

Real-World Use Cases

Accelerated GST Compliance Indian CA firms using Suvit benefit from automation that expedites GST reconciliation, reducing turnaround from days to hours without errors.

Enabling Remote and Hybrid Working Models CAs and their clients can collaborate remotely on a shared cloud platform, accessing real-time data, resolving queries faster, and ensuring uninterrupted service delivery despite geographical distances.

Handling High Client Volumes Efficiently Suvit supports batch processing, multi-user workflows, and centralized management, allowing firms to handle multiple client accounts simultaneously without operational bottlenecks.

Suvit Automates Tally for Smarter CA

Suvit’s cloud-enabled, AI-powered Tally automation platform is a game-changer for CAs in India, aiming to modernize operations, improve accuracy, and scale clients efficiently.

By automating document handling, data entry, reconciliation, and GST compliance, all secured on the cloud, Suvit empowers CAs to unlock more time for strategic advisory and growth.

FAQs

1. What is Suvit’s Tally on Cloud solution?

A cloud platform that integrates Tally with AI automation to streamline accounting workflows for CAs, enabling remote access and faster GST compliance.

2. How does Suvit automate bookkeeping?

It automates document collection, data entry, reconciliation, and GST reconciliation and filing, with AI-powered validations and WhatsApp integration.

3. Is my financial data secure with Suvit?

Yes, Suvit stores data on encrypted, cloud servers with role-based access and regular backups.

4. Can my CA firm easily switch from desktop Tally to Tally on Cloud using Suvit?

Yes, Suvit offers smooth support and training to help firms transition to cloud-based automated accounting.