Accounting is an essential part of any business, but it can also be tedious, time-consuming, and prone to errors. That’s why we, Vyapar TaxOne, an AI-powered accounting automation tool, are here to help you streamline your accounting workflow and boost your productivity.

Vyapar TaxOne is designed for accountants, tax professionals, CA, and CS who want to reduce their clerical work, improve their data accuracy, and provide better service to their clients. Vyapar TaxOne has various features that can help you achieve these goals. Let's understand them in detail:

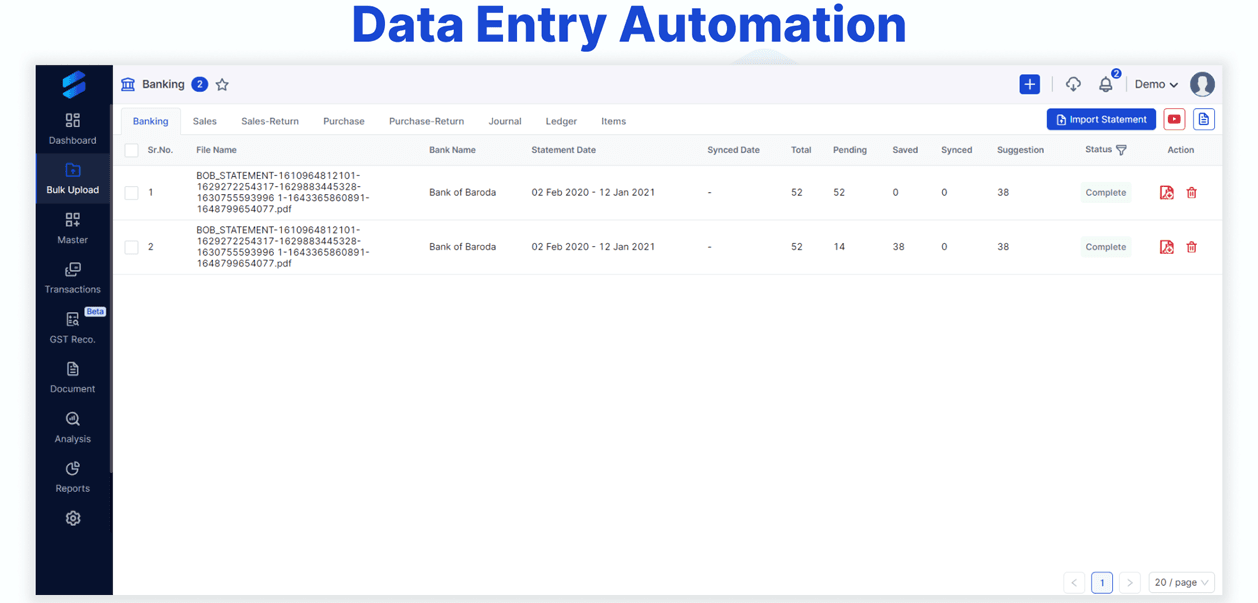

Data Entry Automation

Vyapar TaxOne can automatically extract data from invoices, bills, receipts, bank statements, and other documents, and enter them into your accounting software. You can also upload your documents in bulk and let Vyapar TaxOne do the rest. This way, you can save time, avoid manual errors, and ensure compliance with GST and other regulations.

Vyapar TaxOne supports various types of data entry, such as:

-

Banking Statements: Vyapar TaxOne can process your banking statements in payment, receipt, and contra vouchers. It can also suggest ledger names based on your previous transactions. You can also create rules for auto-filters in ledgers to make mapping easier.

-

Sales/Purchase Transactions: Vyapar TaxOne can process your sales and purchase transactions in Excel, image, and invoice formats. It can also handle sales and purchase returns, and invoices.

-

Journal Entries: Vyapar TaxOne can process your journal entries and create vouchers for payment, receipt, and contra transactions manually. It can also suggest ledger names and voucher types based on your data.

-

Stock Items and Ledgers: Vyapar TaxOne can create stock items and ledgers in bulk within minutes. It can also suggest item names and ledger names based on your records.

Vyapar TaxOne’s data entry automation feature can help you redefine your data entries for errorless accounting

Read More: Accounting Automation Tool: A Boon & Growth Engine for Practicing CAs

Document Management

Vyapar TaxOne can help you organize and manage your documents in a secure cloud storage. You can easily store and access your documents anytime. You can also share your documents with your clients or team.

Vyapar TaxOne’s document management feature offers various benefits, such as:

-

Client-centric Uploads: You can upload client-specific documents with ease, and make different folders, such as banking, sales, purchase, journal, or others. You can also upload documents in various formats, such as Excel, pdf, image or invoice.

-

Organized Folder Structure: You can access and manage all client folders, ensuring a systematic organization of documents in one central location. You can also create subfolders and rename them according to your preferences.

-

Secure Storage: You can safely store documents within designated folders, ensuring secure and organized storage. You don't have to worry about loss or corruption as your data is stored in the cloud.

Vyapar TaxOne’s document management feature can help you access and process documents anytime, anywhere.

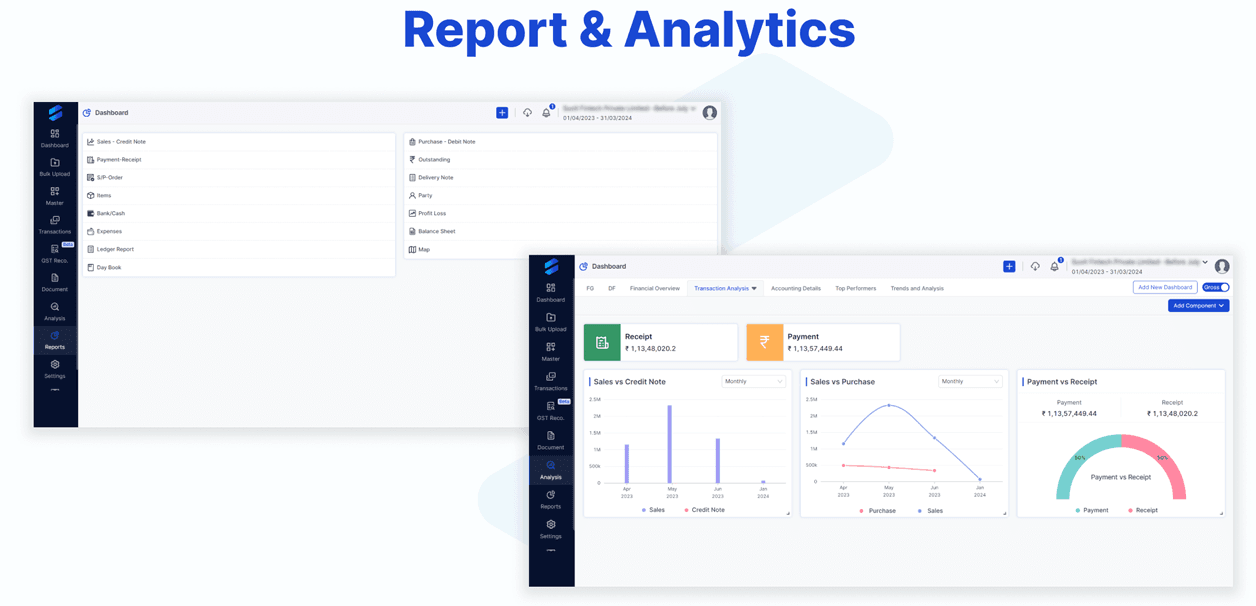

Report and Analytics

Vyapar TaxOne can help you generate and analyze various reports, such as profit and loss, balance sheet, cash flow, GST returns, and more. You can also customize your reports according to your needs. You can also use the filters and options to modify your report as per your requirements.

Vyapar TaxOne’s report and analytics feature can help you:

-

Monitor your Business Performance: You can access insightful dashboards for owners, CFOs, sales, accounts, and expenses to track your business’s daily performance regularly. You can also view key metrics, such as revenue, expenses, profit, cash flow, and GST liability, and compare them with previous periods or budgets. You can also drill down into the details of each metric, such as the top customers, products, or regions, and identify the areas of improvement or growth.

-

Make Informed Decisions: You can leverage Vyapar TaxOne’s AI-powered data analysis to gain insights and run your business smartly. You can also get alerts and notifications for cash flow, inventory, payment dues, and key KPIs.

-

Simplify your Reporting: You can easily generate various reports, such as profit and loss, balance sheet, cash flow, GST returns, and more. You can also customize your reports according to your needs, such as changing the layout or applying filters. You can also share your reports with your clients or stakeholders, and get feedback or approval.

Vyapar TaxOne’s report and analytics feature can help you access and understand your business data anytime, anywhere.

Read More: Vyapar TaxOne: Cloud Accounting Advancing Accountants Anytime, Anywhere!

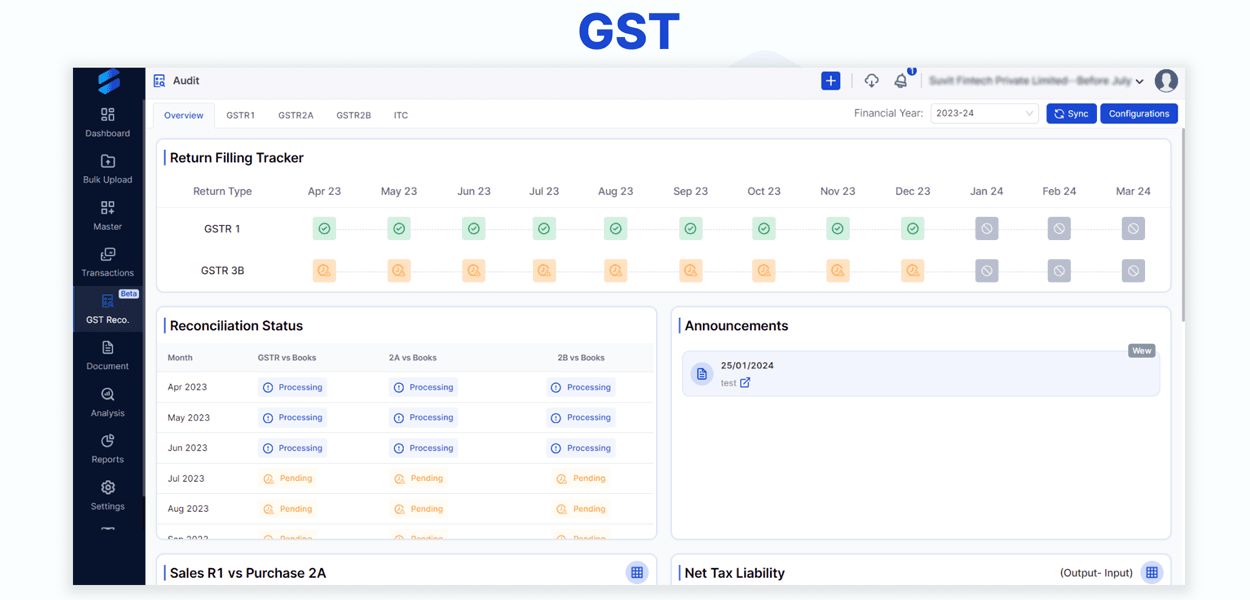

GST

Vyapar TaxOne can help you reconcile your GST data with the government portal, and identify any mismatches or discrepancies. You can also view the summary and details of your GST data. And you can track the status of GST return filing and reconciliation.

Vyapar TaxOne’s GST reconciliation feature can help you with various tasks, such as:

-

GSTR-1 Reconciliation: You can reconcile your GSTR-1 data, which contains the details of your outward supplies, with the GSTR-2A data of your recipients, which contains the details of their inward supplies. You can also compare your GSTR-1 data with your sales register, and identify any missing or incorrect entries.

-

GSTR-2A Reconciliation: You can reconcile your GSTR-2A data, which is an auto-generated return based on your suppliers’ GSTR-1 data, with your purchase register, and identify any missing or mismatched invoices. You can also download your GSTR-2A data in JSON or Excel format, and import it into your accounting software.

-

GSTR-2B Reconciliation: You can reconcile your GSTR-2B data, which is a static statement that contains the details of your ITC eligibility, with your purchase register, and identify any ineligible or blocked ITC. You can also verify your GSTR-2B data with your suppliers’ GSTR-1 data, and resolve any discrepancies. You can also download your GSTR-2B data in JSON or Excel format, and import it into your accounting software.

-

Eligible ITC Report: You can determine your eligible ITC by comparing your invoices and managing your vendors. You can also get your calculated ITC and generate a report for streamlined tracking and claims, providing a clear overview of your tax-related information.

-

GST Health Report: You can get a month-wise status for your pending and reconciled data. You can also examine your IGST, CGST, SGST, and CESS balances and transaction reports, covering tax, interest, penalties, fees, and other relevant details.

Vyapar TaxOne’s GST reconciliation feature can help you simplify and automate your GST compliance process.

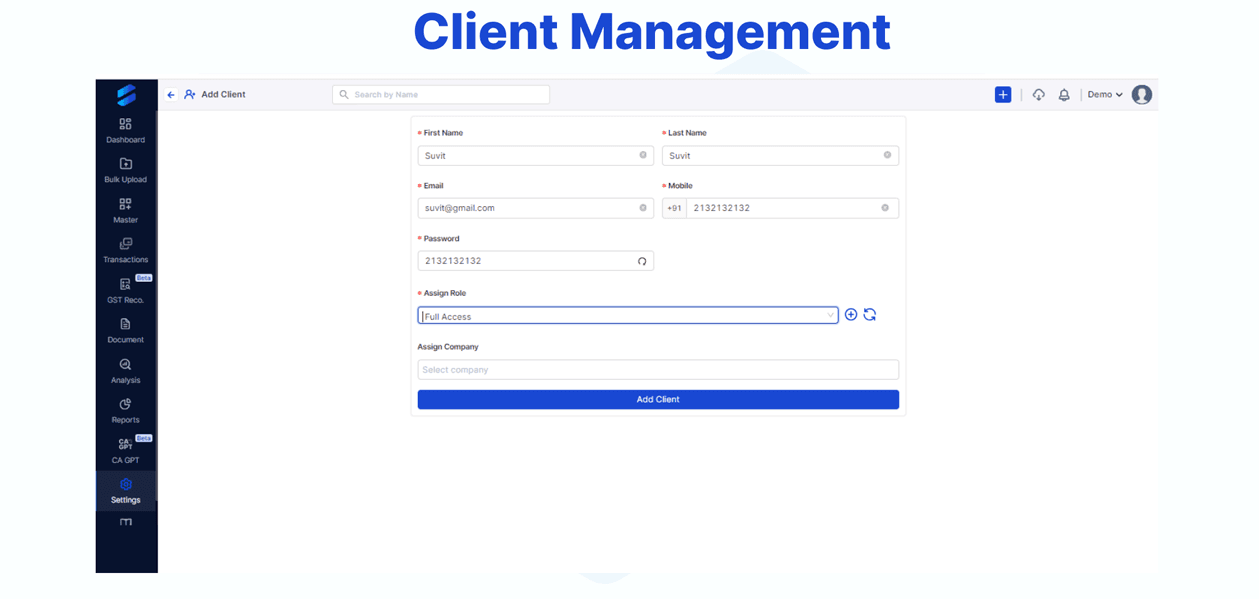

Client and User Management

Vyapar TaxOne can help you manage your clients and their accounting data in a single dashboard. You can also communicate with your clients through email, or phone, and send them reminders, invoices, or payment links.

Vyapar TaxOne also allows you to create and assign tasks to your team members, and monitor their progress and performance.

Vyapar TaxOne’s client management feature can help you with various aspects, such as:

-

Client Onboarding: You can easily onboard your clients by adding them to Vyapar TaxOne. You can also import your clients’ data from Tally or Excel, and sync it with Vyapar TaxOne. You can also customize your client profile by adding their name, GSTIN, and other details.

-

Client Communication: You can communicate with your clients through email, or phone, and share documents, reports, or invoices with them. You can also send them reminders, and payment links, and track their responses.

-

Client Collaboration: You can collaborate with your clients by creating and assigning tasks to them, such as uploading documents, or verifying data. You can also monitor their progress and performance, and provide feedback or guidance.

Vyapar TaxOne’s client management feature can help you build and maintain a strong relationship with your clients.

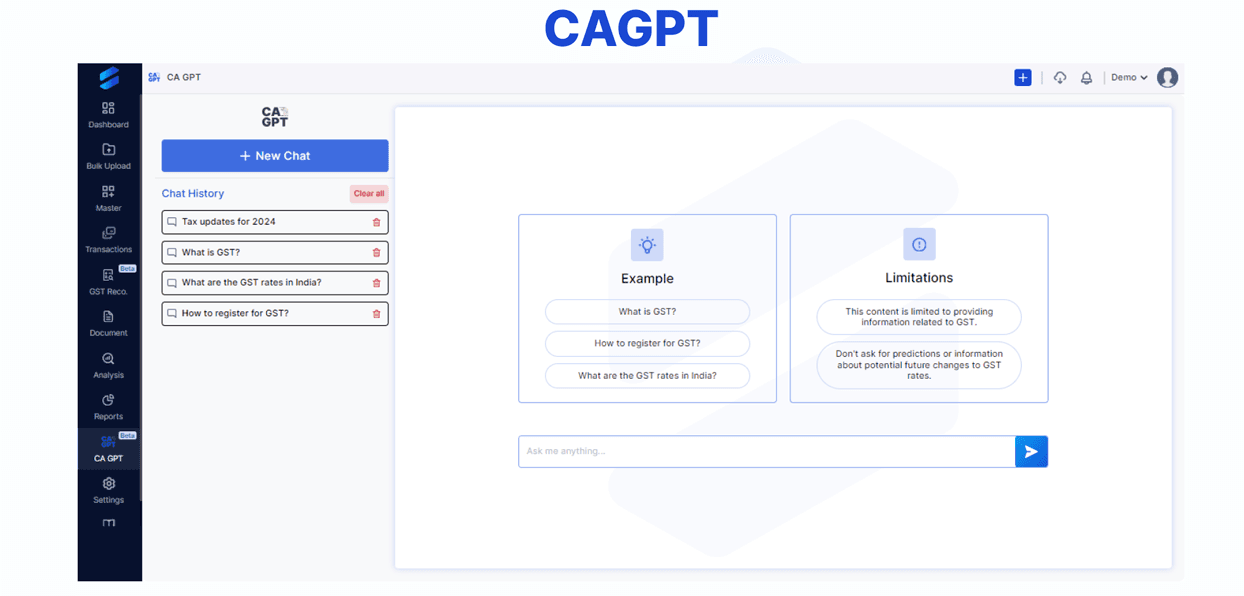

CAGPT

Vyapar TaxOne’s CAGPT is a chatbot that can answer your queries related to the accounting industry. You can receive support in comprehending and deciphering Indian tax regulations, along with advice on tax strategizing. CAGPT provides direction on audit protocols, formulating financial strategies, and managing budgets.

Vyapar TaxOne’s VAGPT feature can help you with various aspects, such as:

-

Taxation Queries: Whether you are a business owner, a taxpayer, or a professional, you can use CAGPT to get assistance in understanding and interpreting Indian tax laws, and advice on tax planning. CAGPT will respond with the best possible answer, along with relevant sources and links.

-

Finance Queries: It provides expert assistance in audit procedures, financial plan creation, and budgeting strategies. Enhance your financial management with its comprehensive guidance.

Vyapar TaxOne’s CAGPT feature can help you solve your GST queries simply and conveniently.

If you are interested in trying out Vyapar TaxOne, you can sign up for a free trial of seven days or request a demo on the website.

Vyapar TaxOne is the ultimate solution for your accounting needs. With Vyapar TaxOne, you can focus on your core business and leave the rest to Automation!