Financial compliance is critical for chartered accountants who manage multiple companies, subsidiaries, or banks. Each entity may have unique yet overlapping regulatory requirements, increasing the complexity of maintaining consistent compliance.

Rule cloning, an effective technology-driven strategy, enables CAs to efficiently replicate compliance rules across entities, reducing manual effort, ensuring consistency, and minimizing errors.

This blog dives deep into how rule cloning, primarily through innovative tools like Suvit, transforms multi-entity compliance management in India for 2025 and beyond.

Understanding Rule Cloning in Financial Compliance

Rule cloning refers to duplicating compliance rules configured for a specific entity (such as a company or bank) and consistently applying those rules to other related entities. Instead of recreating rules from scratch for each entity, CAs can leverage cloning to centralize compliance frameworks while allowing flexibility for entity-specific variations.

Why Rule Cloning Matters:

- Scalability: As businesses grow and add new entities, compliance frameworks must scale without proportional increases in manual work.

- Uniformity: Cloning guarantees that regulatory policies and controls are identical (or appropriately customized) across entities, reducing risk.

- Efficiency: Minimizes redundant rule creation, saves time, and lowers operational costs.

Through automation, rule cloning aligns with internal policies and external regulatory requirements, such as GST, AML/KYC guidelines, RBI directives, and other sector-specific mandates, enabling comprehensive financial governance.

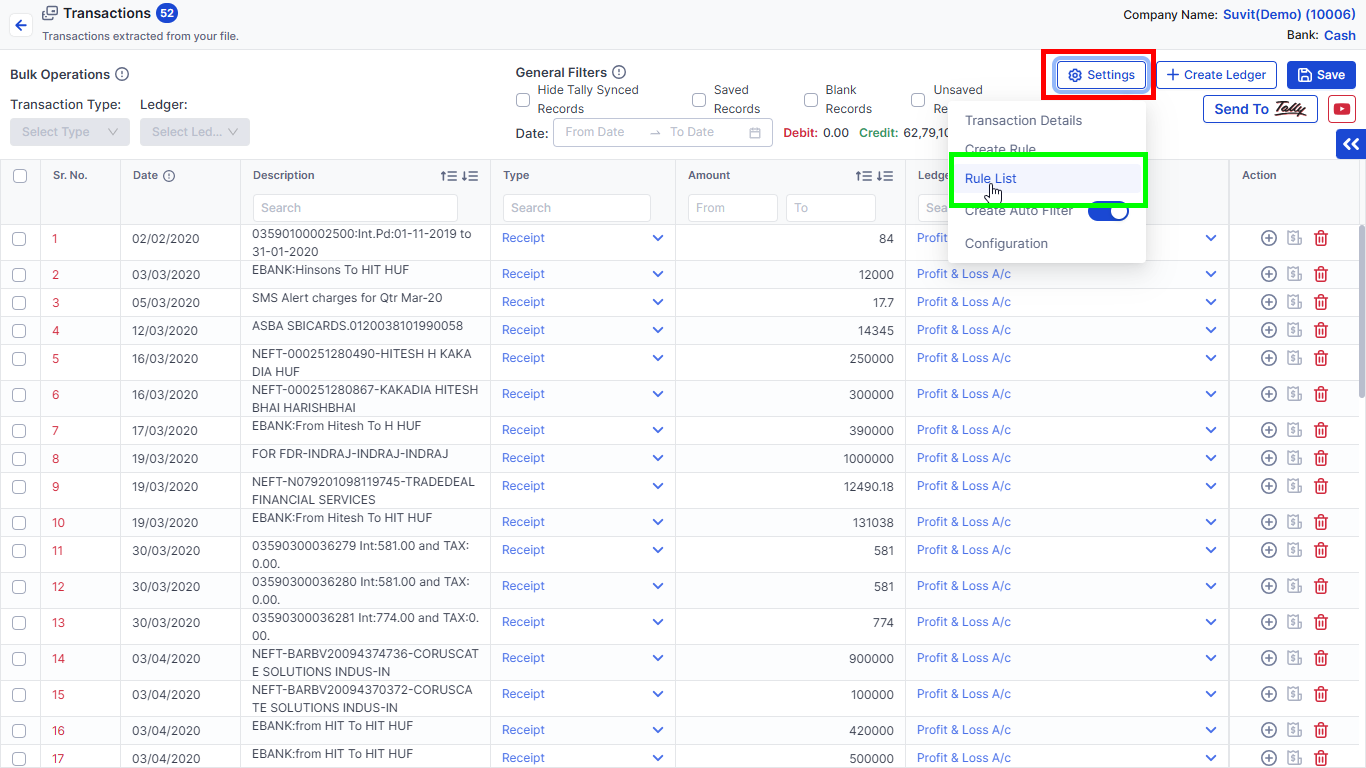

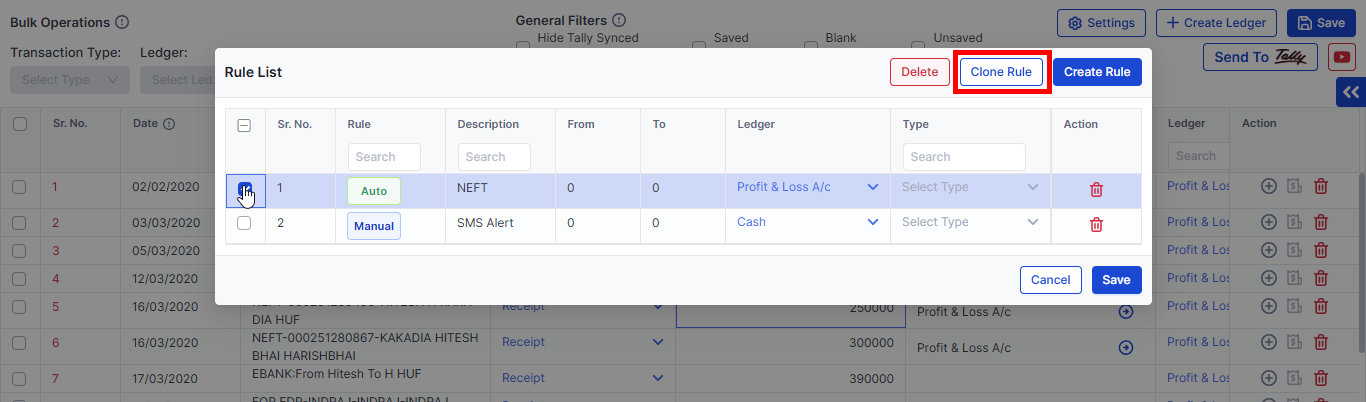

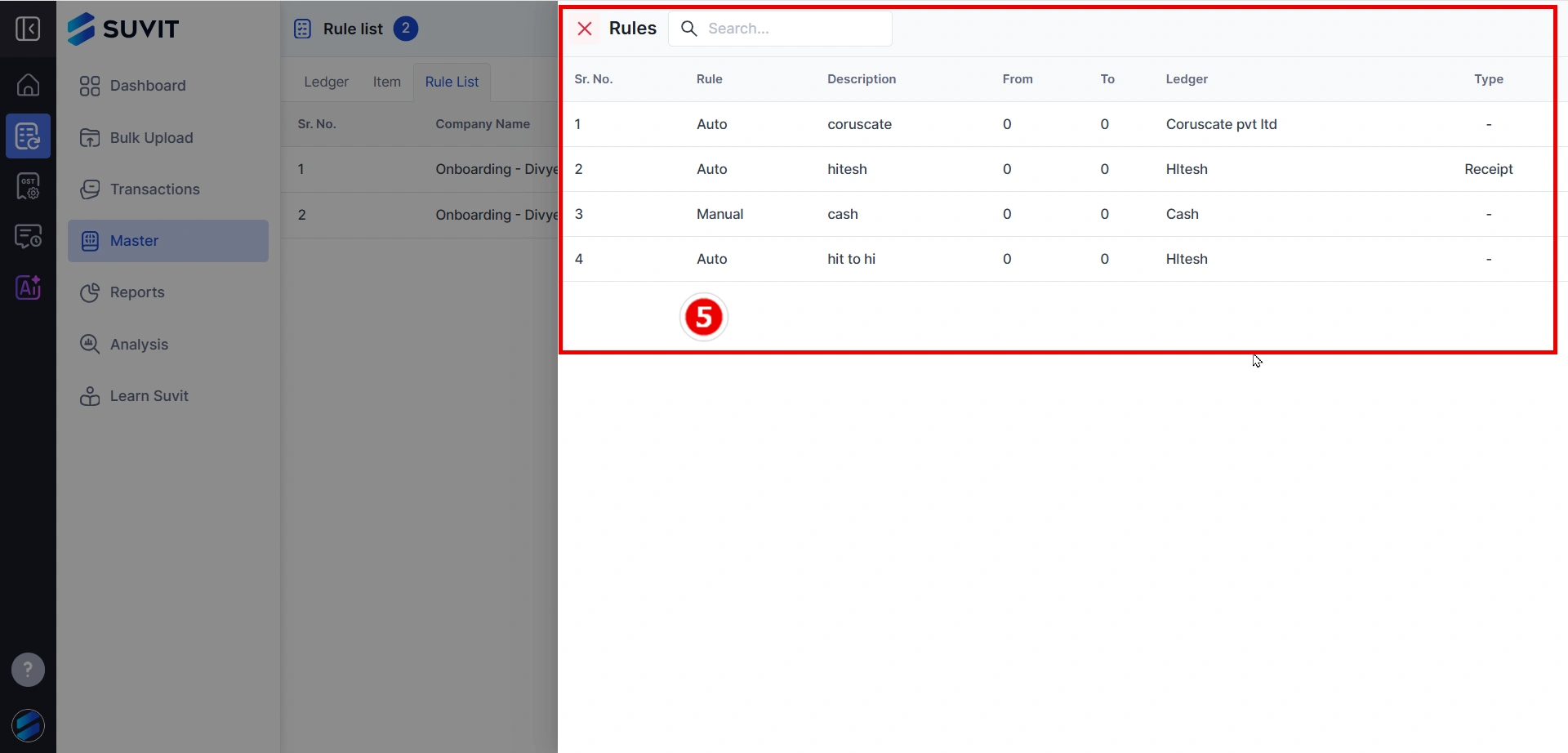

Practical Insights into Suvit’s Rule Cloning Feature

Suvit offers one of the most sophisticated rule cloning solutions tailored for chartered accountants handling complex multi-entity compliance demands.

The platform enables seamless replication and management of compliance rules through an intuitive dashboard that serves as a control tower for all entities and banks under management.

Core Features Include:

- Centralized Rule Management:

View and control total compliance rules associated with each company and banking entity from a unified interface.

- One-Click Cloning:

Efficiently duplicate compliance rules from one entity to others, eliminating manual rule creation and configuration errors.

- Real-Time Monitoring:

Track the status, application, and exceptions of cloned rules with detailed reporting, helping identify compliance gaps swiftly.

-

Flexible Customization: While promoting consistency, allow fine-tuning cloned rules to meet specific entity regulatory needs or operational scenarios.

-

Integration Support: Synchronize cloned rules with accounting packages, ERP systems, and modules to maintain end-to-end compliance automation.

This powerful blend of automation and flexibility empowers CAs to maintain uniform standards without sacrificing responsiveness.

Use Cases & Real-World Applications

Multi-Entity GST Compliance

Consider a CA firm managing multiple subsidiaries of a large corporate group. Each subsidiary files GST returns and claims Input Tax Credit (ITC). Using Suvit’s rule cloning:

- GST reconciliation and filing rules created for one company can be cloned and applied seamlessly to others.

- Consistent ITC tracking and mismatch reporting ensure that all subsidiaries comply with GST regulations uniformly, avoiding penalties.

Banking Compliance Across Multiple Institutions

A financial services organization overseeing several banks benefits from the consistent application of RBI’s compliance mandates, such as KYC, AML, and transaction monitoring:

- Rule cloning allows the replication of checklists, validation processes, and alerts across banks.

- Reduces manual oversight, ensuring every bank adheres to the highest standards without duplicated efforts.

ERP-Driven Compliance Management

Large corporations with diverse business units often use multiple ERP systems with different compliance settings:

- By integrating Suvit’s rule cloning capabilities, CAs can replicate financial reporting and audit rules across systems.

- This centralized approach ensures compliance rules remain standardized despite software heterogeneity.

Best Practices for Implementing Rule Cloning

To harness the full potential of rule cloning, CAs should observe specific operational guidelines:

- Design Modular Rules: Construct compliance rules in modular, reusable units to facilitate easy cloning and adjustments.

- Regular Rule Reviews: Schedule periodic audits of cloned rules to align with ongoing regulatory updates.

- Define Access Controls: Ensure only authorized personnel can clone or modify compliance rules to maintain governance.

- Train Teams Effectively: Empower CA teams with seamless training on new rule cloning software functionalities to maximize adoption and accuracy.

Risks and Mitigation Strategies

While rule cloning optimizes compliance management, certain risks must be managed:

- Risk of Blind Replication: Cloning without review can propagate outdated or irrelevant rules, causing non-compliance.

- Loss of Entity Specificity: Over-standardizing rules may ignore particular entity needs, ensuring cloning includes room for custom exceptions.

- System Errors: Automated cloning may introduce configuration errors if validation checks are not rigorous.

Mitigation includes implementing approval workflows for cloning actions, rigorous validation protocols, and logging all changes for accountability.

Future-Proofing Compliance with Rule Cloning

In 2025 and beyond, financial compliance will demand agility, accuracy, and automation. As exemplified by Suvit’s advanced platform, rule cloning converts the traditionally tedious multi-entity compliance task into an agile, scalable solution.

For Indian Chartered Accountants, adopting such technology isn’t merely beneficial; it’s imperative to stay ahead of regulatory complexities while improving operational efficiency and client service.

By future-proofing compliance with rule cloning:

- Firms can reduce human error and manual workload.

- Ensure real-time regulatory alignment across diverse entities.

- Foster trust with clients through transparent and reliable compliance management.

This comprehensive approach to leveraging rule cloning reflects the evolving landscape where technology and expert knowledge empower Chartered Accountants to deliver unmatched compliance excellence.

FAQs

1. What is rule cloning in financial compliance?

Rule cloning is replicating compliance rules from one entity to multiple other entities, ensuring consistent application and easier management of financial regulations across companies or banks.

2. How does rule cloning benefit Chartered Accountants managing multiple entities?

It reduces manual workload, minimizes errors, streamlines audit readiness, and ensures uniform compliance with regulatory requirements across different companies or subsidiaries.

3. Can rule cloning allow customization for entity-specific compliance needs?

While rule cloning establishes consistency, it also permits tailored modifications to accommodate individual entities' unique regulatory or operational requirements.

4. What are common risks involved in rule cloning, and how can they be mitigated?

Risks include incorrect rule propagation or outdated rules. Mitigation involves rigorous validation, approval workflows, and regular audits to ensure accuracy and relevance.