In the world of accounting in India, Chartered Accountants and tax professionals are increasingly adopting Practice Management Software (PMS) to boost efficiency, streamline operations, and ensure compliance with the latest regulations.

The right PMS can significantly enhance productivity, minimize manual errors, and provide a centralized system for managing client data, billing, and task workflows.

This blog explores the key features of PMS solutions and highlights the best options available for accountants in India.

Key Features to Look for in Practice Management Software for Accountants

1. Compliance and Regulatory Adherence

As India’s tax laws and financial regulations continuously evolve, having a PMS that ensures compliance is important for accounting firms. Features to look for include:

- Automated Updates for Regulations: PMS solutions should automatically update with changes in GST, TDS, Income Tax, and MCA filings.

- Real-time Alerts: Timely reminders for upcoming deadlines and filing dates help ensure compliance.

- Integration with Government Portals: Direct integration with government portals for seamless submission of returns, e-filings, and payments.

2. Workflow and Task Automation

Managing multiple clients and complex tasks can become overwhelming without an efficient workflow. A PMS that automates repetitive tasks and allows for customizable workflows is invaluable:

- Customizable Task Workflows: Create tailored workflows for various services, whether it’s tax filing, audits, or financial planning.

- Automated Reminders: Automation of recurring tasks like document collection, filing, and client follow-ups ensures that no deadlines are missed.

- Centralized Dashboard: A clear dashboard that consolidates tasks, deadlines, and client information in one place ensures that accountants stay on top of their workload.

3. Client and Document Management

Managing client information securely and efficiently is crucial in today’s digital age. Look for PMS with these features:

- Secure Client Portals: Provide clients with easy access to their financial documents through secure portals.

- Centralized Document Storage: Store client records, financial statements, and communications in one location for easy access.

- Role-based Access Control: Ensure that only authorized individuals can access sensitive client data, enhancing security.

4. Billing and Invoicing

Efficient billing systems are essential for maintaining a healthy cash flow and transparent client relationships. Key billing features include:

- Automated Billing: PMS should enable automatic invoicing based on time-tracking or fixed fees, reducing manual efforts.

- Integrated Payment Gateways: Make it easier for clients to pay through integrated payment systems.

- Financial Reporting: Generate detailed financial reports, track outstanding payments, and forecast cash flow.

5. Integration Capabilities

For accountants to work efficiently, the PMS should be compatible with other software tools and services. Features to consider:

- Accounting Software Integration: Ensure the PMS integrates seamlessly with your existing accounting tools.

- API Support: Look for software that supports APIs for integration with third-party applications like CRM systems or cloud storage services.

- Cloud-based Access: Cloud solutions offer flexibility by allowing access from anywhere, supporting remote work and collaboration.

Recommended PMS Solutions for Indian Accountants

1. Vyapar TaxOne

Overview: Vyapar TaxOne is an AI-powered practice management software tailored for Indian Chartered Accountants and tax professionals. It leverages automation and artificial intelligence to streamline accounting workflows.

Key Features:

- Data Entry Automation: Vyapar TaxOne uses Optical Character Recognition to automate data entry, saving time and reducing errors.

- GST Automation: The platform automatically reconciles and files GST data, reducing the manual effort involved in filing.

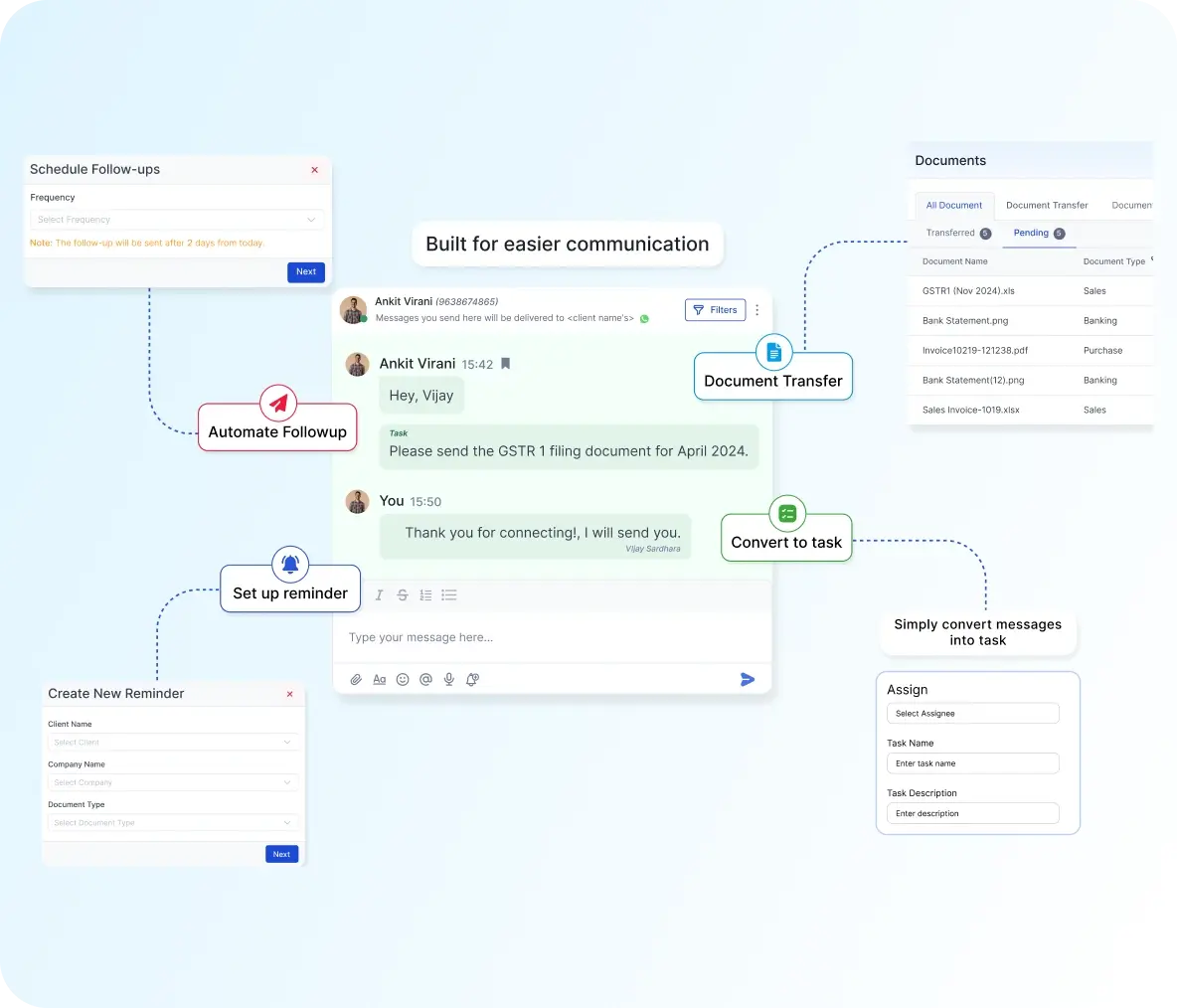

- Client Management: Secure client portals and document storage, along with integrated chat features for seamless communication.

- Task Automation: Vyapar TaxOne automates many routine accounting tasks, allowing accountants to focus on more strategic activities.

Benefits: Vyapar TaxOne’s intelligent automation, compliance management, and efficient communication tools make it an ideal choice for accounting firms in India. 50% off if you are a member of ICAI!

2. Turia

Overview: Developed by IIM Lucknow, Turia is a PMS designed specifically for CA and CS professionals in India.

Key Features:

- Compliance Tracking: Turia helps professionals stay up-to-date with MCA, GST, TDS, and Income Tax regulations.

- Task and Billing Management: Track tasks, manage workflows, and automate billing processes to save time.

- Credential Management: Securely store DSC and password details.

Benefits: A comprehensive toolset for Indian accounting professionals looking to streamline their practice management.

3. Zoho Books

Overview: Zoho Books is a cloud-based accounting software widely used by small and medium-sized businesses in India.

Key Features:

- Invoicing and Expense Tracking: Simplify billing, track expenses, and reconcile accounts. VAT Support: Helps businesses manage VAT filings and compliance.

- Integration with Zoho Apps: Seamlessly integrates with other Zoho applications like Zoho CRM, Zoho Inventory, and Zoho Projects.

Benefits: A scalable and cost-effective solution for businesses of all sizes. Zoho Books also integrates well with third-party applications.

4. Karbon

Overview: Karbon is an online practice management software that automates routine tasks and enhances team collaboration.

Key Features:

- Client Management: Karbon centralizes client data and communications in one place.

- Task Automation: Automates repetitive tasks like data entry, invoicing, and follow-ups.

- Team Collaboration: Facilitates easy collaboration and coordination between team members.

Benefits: Perfect for accounting firms that want to improve collaboration and task management.

5. Jetpack Workflow

Overview: Jetpack Workflow is designed to help accounting professionals automate their workflow and manage recurring tasks more effectively.

Key Features:

- Recurring Task Automation: Automates the scheduling and tracking of recurring tasks like tax filing and client meetings.

- Time Tracking and Invoicing: Simplifies time tracking and invoicing, allowing for accurate billing.

- Client Management: Organizes client data and communication, making it easier to provide timely service.

Benefits: Jetpack Workflow increases productivity and reduces administrative overhead by automating key tasks.

Optimizing Accounting Practices with the Right PMS Solution

The right Practice Management Software (PMS) can transform the way accounting firms in India operate, helping them become more efficient, compliant, and client-centric.

Solutions like Vyapar TaxOne offer cutting-edge automation and AI-powered tools tailored to the unique needs of Indian accountants, while other options like Zoho Books, Karbon, and Jetpack Workflow also provide valuable features for improving workflow and task management.

By adopting the right PMS, accounting professionals can enhance productivity, reduce administrative overhead, and focus on providing strategic advisory services that drive growth for their clients.

Choosing the right PMS is no longer just a matter of convenience; it’s a necessity for firms aiming to stay competitive in today’s fast-paced, tech-driven world.

FAQs

1. What is Practice Management Software (PMS) for accountants?

Practice Management Software (PMS) helps accounting professionals manage their daily operations by automating tasks, tracking deadlines, ensuring compliance, managing client communications, and organizing financial data. It streamlines workflows and enhances productivity.

2. What features should accountants look for in a PMS?

Key features include compliance and regulatory tracking, workflow automation, client and document management, billing and invoicing, and integration with accounting software. A good PMS should also offer cloud-based access and security features.

3. Why is Vyapar TaxOne a good choice for accountants in India?

Vyapar TaxOne is an AI-powered PMS designed specifically for Indian accounting professionals. It offers automated data entry, GST reconciliation, client management, and task automation, all tailored to Indian tax and regulatory frameworks.

4. Can PMS help accountants reduce manual errors?

Yes, PMS solutions like Vyapar TaxOne and others automate routine tasks, such as data entry and tax filings, reducing the risk of human error and ensuring greater accuracy in financial reporting.

5. How can PMS improve client interactions?

Many PMS platforms, including Vyapar TaxOne, offer integrated client portals and communication tools, allowing for secure document sharing and real-time messaging, thereby improving client service and communication.