If you are an employee of an organization that is covered under the Employees’ Provident Fund (EPF) scheme, you must contribute a part of your salary every month to your EPF account. Your employer also contributes an equal amount to your EPF account.

The EPF is a long-term savings and retirement fund that earns interest and grows over time. You can withdraw the money from your EPF account when you retire or under certain conditions before retirement. In this blog post, we will explain how to withdraw PF amounts online and what are the rules and tax implications of PF withdrawal.

When Can You Withdraw EPF?

You can withdraw your EPF balance either fully or partially, depending on your situation. Here are the scenarios when you can withdraw EPF:

-

Full Withdrawal: You can withdraw your entire EPF balance only in two cases:

-

When you retire from service after attaining the age of 58 years.

-

When you remain unemployed for more than two months after leaving your job. In this case, you can withdraw 75% of your EPF balance after one month of unemployment and the remaining 25% after two months of unemployment.

-

-

Partial Withdrawal: You can withdraw a part of your EPF balance before retirement for specific purposes, such as medical emergencies, marriage, education, purchase or construction of a house, repayment of a home loan, etc. The amount and the eligibility criteria for partial withdrawal vary depending on the purpose.

You can refer to the table below for more details.

| List of reasons for withdrawal | Limit for withdrawal | No. of years of service required | Other conditions |

|---|---|---|---|

| Medical purposes | Lower of below: - Six times the monthly basic salary, or - The total employee’s share plus interest | No criteria | Medical treatment of self, spouse, children, or parents |

| Marriage | Up to 50% of employee’s share of contribution to EPF | 7 years | For the marriage of self, son/daughter, and brother/sister |

| Education | Up to 50% of employee’s share of contribution to EPF | 7 years | Either for account holder’s education or child’s education (post matriculation) |

| Purchase of land or purchase/construction of a house | For land – Up to 24 times of monthly basic salary plus dearness allowance. For house – Up to 36 times of monthly basic salary plus dearness allowance, The above limits are restricted to the total cost. | 5 years | The asset, i.e. land or the house, should be in the employee’s name or jointly with the spouse. It can be withdrawn just once for this purpose during the entire service. |

| Specially-abled individuals | Specially-abled account holders can withdraw 6 months of basic wage along with a dearness allowance or employee share with interest (whichever is less) to pay for the equipment cost. | No criteria | This facility has been introduced to ease the financial burden of purchasing expensive equipment. |

| Existing debts | Individuals can withdraw 36 months of basic wage + dearness allowance or the total of employee and employer pay along with interest to pay their home loan EMIs. | 10 years | This facility is available only after a minimum of 10 years of contribution towards the EPF account. |

How To Withdraw PF Amount Online?

The easiest and fastest way to withdraw your PF amount is to apply online through the EPFO portal. You need to have an active Universal Account Number (UAN) and a registered mobile number to access the portal. You also need to link your Aadhaar, PAN, and bank account details with your UAN. Here are the steps to withdraw the PF amount online:

Step 1: Visit the UAN website and log in with your UAN and password.

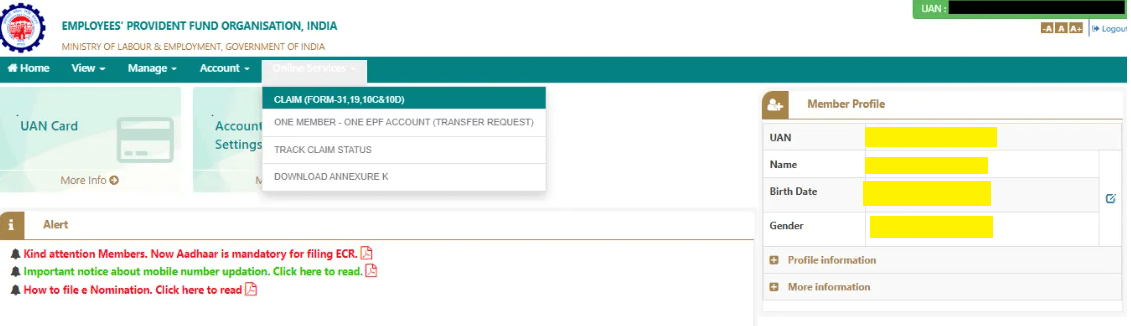

Step 2: Click on the ‘Online Services’ tab and select the ‘Claim’ option from the drop-down menu.

Step 3: Verify your bank account number and click on ‘Proceed for Online Claim’.

Step 4: Choose the type of claim you want to make, such as full EPF settlement, EPF part withdrawal, or pension withdrawal, from the ‘I Want To Apply For’ tab. The type of claim will depend on your eligibility and the purpose of withdrawal.

Step 5: Fill out the online claim form with the required details, such as the purpose of withdrawal, the amount of withdrawal, and your address.

Step 6: Tick the declaration box and submit the claim form.

Step 7: You may have to upload some supporting documents, such as identity proof, address proof, canceled cheque, etc., depending on the purpose of withdrawal.

Step 8: Your employer will have to approve your claim request online, after which the EPFO will process your claim and transfer the amount to your bank account within a few days.

EPF Withdrawal Taxability

The tax treatment of EPF withdrawal depends on the duration of your service and the amount of withdrawal. Here are the tax rules for EPF withdrawal:

-

If you withdraw your EPF balance after completing five years of continuous service, then the withdrawal is tax-free. The continuous service of five years includes the period of previous employment as well as if you have transferred your EPF balance from the previous employer to the current employer.

-

If you withdraw your EPF balance before completing five years of continuous service, then the withdrawal is taxable in your hands in the year of withdrawal. The taxable amount will include your own contribution plus interest and the employer’s contribution plus interest. You will have to pay tax on this amount as per your income tax slab rate. You will also have to pay tax on the interest earned on your contribution, which is exempt under section 80C of the Income Tax Act, 1961.

-

If you withdraw your EPF balance before completing five years of continuous service and the amount is less than Rs. 50,000, then the withdrawal is tax-free. You don’t have to pay any tax on the withdrawal amount.

-

If you withdraw your EPF balance before completing five years of continuous service and the amount is more than Rs. 50,000, then the EPFO will deduct tax at source (TDS) at the rate of 10%, if you have provided your PAN, or at the rate of 34.608%, if you have not provided your PAN. However, you can avoid TDS by submitting Form 15G/15H, if you meet the conditions for filing these forms.

-

If you withdraw your EPF balance before completing five years of continuous service, but your service is terminated due to ill health, closure of business, or any other reason beyond your control, then the withdrawal is tax-free. You don’t have to pay any tax on the withdrawal amount.

-

If you withdraw your EPF balance before completing five years of continuous service, but you transfer the amount to a new EPF account with a new employer, then the withdrawal is tax-free. You don’t have to pay any tax on the transfer amount.

How to Withdraw Your EPF without UAN?

UAN or Universal Account Number is a unique 12-digit number assigned to every EPF member by the EPFO. It helps in linking multiple EPF accounts of the same employee under different employers. It also enables the employee to access and manage his/her EPF account online. However, if you don’t have a UAN, you can still withdraw your EPF balance by following these steps:

-

Download the offline claim forms from the EPFO website or collect them from the regional EPFO office. You will need Form 19 (for PF final settlement), Form 10C (for pension withdrawal benefit and scheme certificate), and Form 31 (for PF partial withdrawal).

-

Fill the forms with the necessary details, such as your PF account number, name, date of birth, bank account number, IFSC code, address, etc.

-

Get the forms attested by your employer or any authorized official, such as a bank manager, gazetted officer, magistrate, etc.

-

Submit the forms along with the relevant documents, such as identity proof, address proof, canceled cheque, etc., to the regional EPFO office, either by post or in person.

-

The EPFO will verify the forms and the documents and process your claim request. The PF amount will be credited to your bank account within a few weeks.

Conclusion

EPF is a beneficial scheme for employees, as it provides them with a secure and tax-efficient savings and retirement fund. You can withdraw your EPF balance either fully or partially, depending on your situation and need. You can withdraw your PF amount online or offline, depending on your convenience and preference. You should also be aware of the tax implications of EPF withdrawal and plan your withdrawal accordingly.