Efficiently importing PDF bank statements into TallyPrime is an essential practice for Chartered Accountants in India.

Manual data entry is time-consuming, prone to errors, and can hamper regulatory compliance. Leveraging automation tools like Suvit streamlines this task, improving accuracy, speed, and alignment with evolving financial norms.

This guide provides a step-by-step approach, practical insights, the latest regulatory considerations, and expert tips for seamlessly converting PDF bank statements to TallyPrime, thereby optimizing workflows for 2025 and beyond.

Why Automate PDF Bank Statement Import to TallyPrime?

Automating bank statement imports saves a considerable amount of time by eliminating repetitive manual entry tasks. It significantly reduces errors, ensuring high data accuracy, which is vital for financial audits and filings.

Automation also enhances compliance by maintaining robust audit trails and simplifying timely reconciliation and reporting, thereby helping CAs deliver faster and more reliable services.

Current Regulatory Context in India

India's financial compliance environment, shaped by directives from the Reserve Bank of India (RBI) and the Income Tax Department, mandates transparent and accurate record-keeping.

Automation tools integrated with TallyPrime empower CAs to meet these requirements effortlessly, reducing human error and ensuring reliable documentation for audits and tax filings.

Let’s see a step-by-step process on how to transfer PDF bank statement data to Tally using Suvit.

Step 1: Preparing Your PDF Bank Statement

Supported Formats: Upload only bank statements in the PDF format, directly downloaded from the official bank website, to ensure clarity and compatibility.

Unsupported Documents: Avoid passbooks, loan or share market statements, password-protected PDFs, RTP/TXT files, and PDFs with dot matrix fonts, as these are incompatible and may cause processing failures.

Quality Assurance: Confirm the statement covers the complete transaction period relevant to your accounting cycle. Partial statements or missing pages can lead to discrepancies during import and reconciliation.

Step 2: Uploading the Bank Statement in Suvit

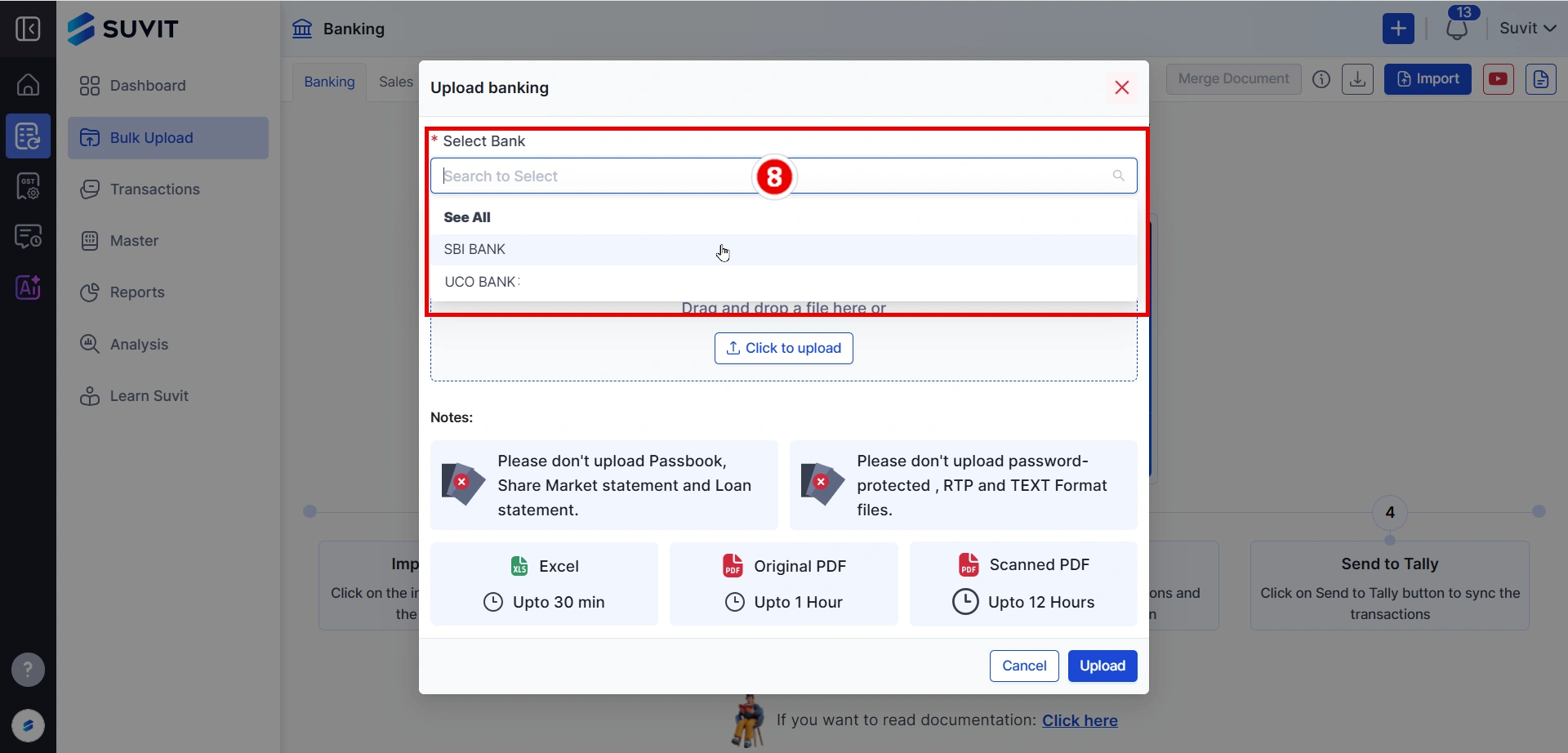

Simple Upload Process:

- Access the Suvit dashboard and navigate to the ‘Banking’ section.

- Select ‘Import Bank Statement’ and upload the PDF via drag-and-drop or file selection.

- Choose the correct bank associated with your statement before clicking ‘Upload’.

Handling Upload Issues:

- Duplicate file warnings require renaming the file before re-upload to maintain data integrity.

- If processing lags, refresh the page (Ctrl+Shift+R) to resolve any temporary delays.

Monitoring upload progress and promptly resolving system alerts is critical for a seamless workflow.

Step 3: Understanding Processing Status

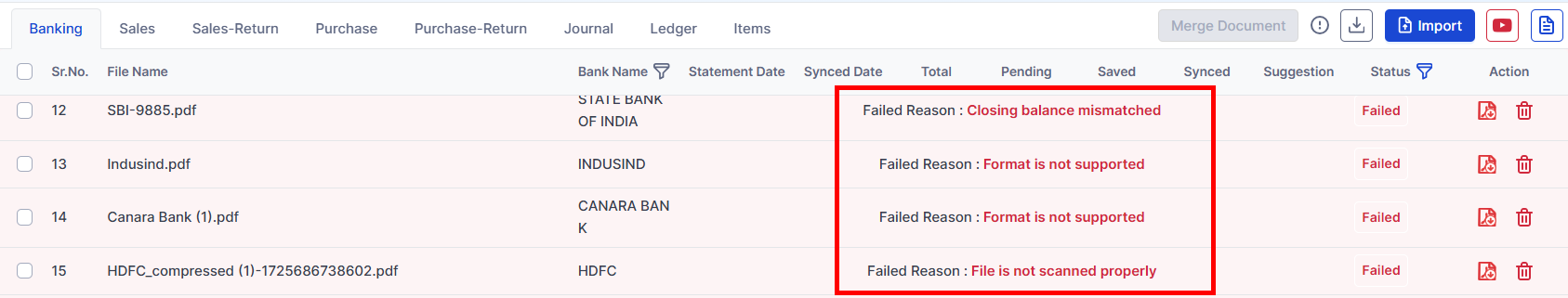

Post-upload, Suvit assigns processing statuses:

-

Completed: File processed successfully and ready for ledger assignment.

-

Failed: Usually due to unsupported or corrupted files; demands re-upload after correction.

-

Duplicate: Identifies repeat uploads; avoid accounting confusion.

-

Partial: Indicates incomplete processing; review and re-upload missing data if possible.

Timely intervention on ‘Failed’ or ‘Partial’ uploads ensures continuous accuracy and prevents backlog.

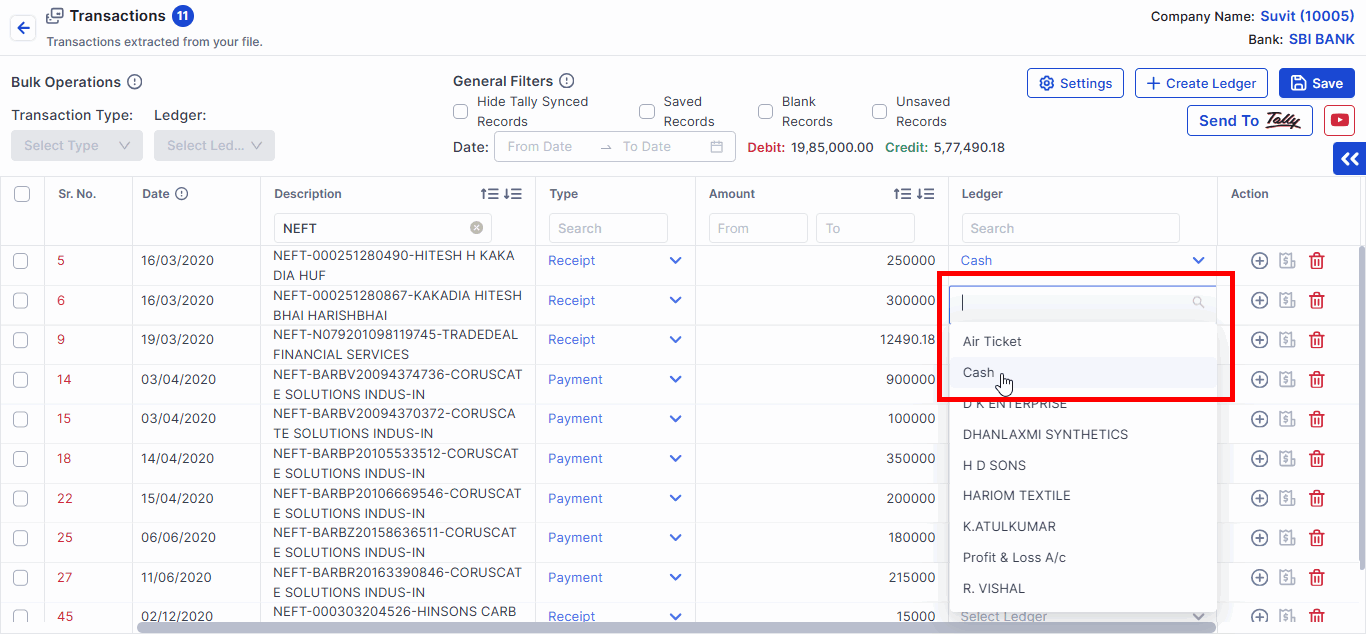

Step 4: Ledger Selection and Mapping in TallyPrime

Ledger mapping is crucial for faithful financial reporting. Proper alignment of transactions with the correct ledgers guarantees precise accounting and simplifies reconciliation.

Using Suvit’s interface, review extracted transactions and assign them systematically to appropriate ledgers. Consistent ledger naming conventions across clients improve efficiency and reduce errors.

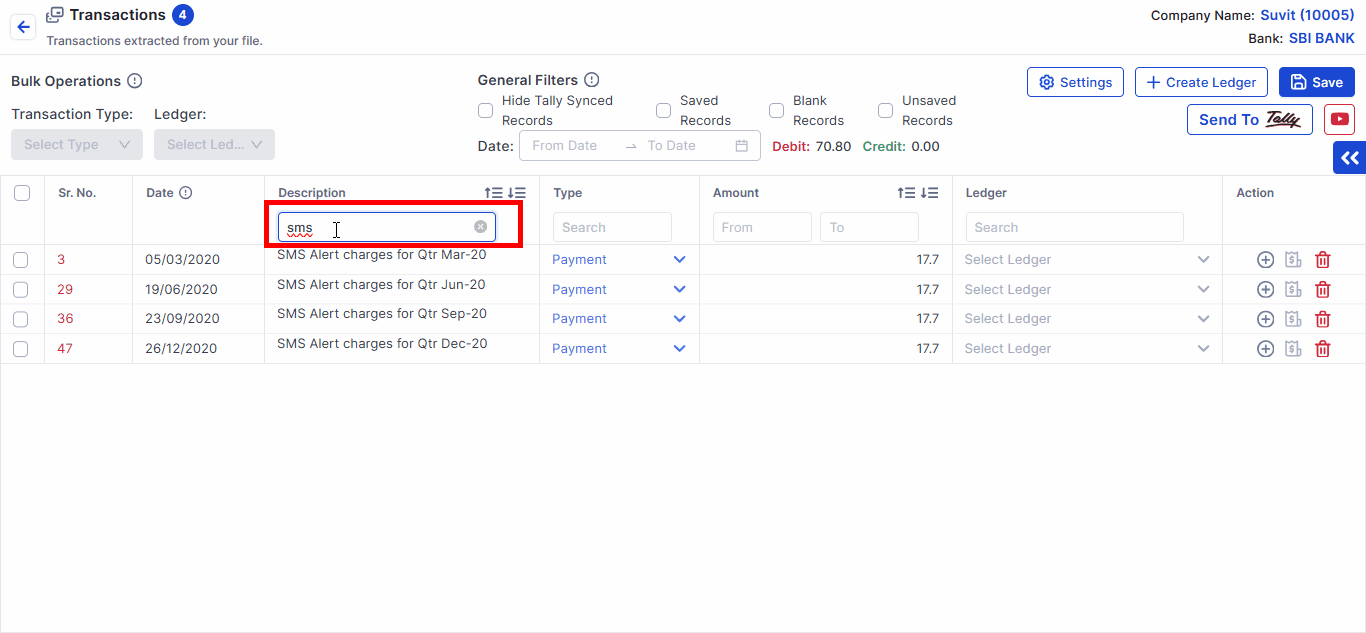

Step 5: Utilizing General Filters for Efficient Data Management

Filters enable quick sorting by transaction date, amount, or type, enhancing data review accuracy and speed before final import.

This facilitates verification, makes monthly and quarterly reporting more manageable, and supports audit readiness by highlighting discrepancies early.

Step 6: Resolving Failed or Partial Imports

Common failure causes include unsupported formats, password protection, or corrupted files.

Solutions involve:

- Redownloading statements directly from the bank website in PDF format.

- Ensuring PDFs are not password-secured and free from scanning errors. (Read here how to remove password protection from your files)

- Contact Suvit support when issues persist despite corrective actions.

Proactive issue resolution safeguards data integrity and workflow continuity.

Practical Tips for CAs

- Confirm bank and statement details before uploading to prevent mismatches.

- Monitor the processing status frequently and respond promptly to any failures.

- Maintain standardized ledger structures across clients for consistency.

- Use filters routinely to expedite reconciliation and reporting.

- Stay informed about updates in TallyPrime and Suvit for leveraging new efficiencies.

Embracing AI-powered Enhancements for Future-readiness

Emerging AI technologies are complementing TallyPrime and Suvit, introducing advanced features like predictive analytics, automated anomaly detection, and intelligent data validation.

CAs should consider integrating these AI tools to reduce their manual workload further and enhance service precision.

Effortlessly Import Bank Statements to Tally

By automating PDF bank statement imports to TallyPrime using Suvit, Chartered Accountants in India can significantly improve accuracy, speed, and compliance in financial workflows.

Adhering to the detailed processes, understanding processing statuses, mastering ledger mapping, and embracing AI advancements will empower CAs to deliver greater client value and stay competitive in a dynamic regulatory environment.

Adopt these best practices to transform your accounting operations confidently in 2025 and beyond.

FAQs

1. What types of PDF bank statements can be imported into TallyPrime using Suvit?

Only standard bank statements in PDF format downloaded directly from the bank’s online portal are supported. Password-protected PDFs, RTP/TXT files, and dot matrix font PDFs are not supported for import due to format incompatibilities.

2. How do I handle errors or failures during the import process of bank statements?

If an import fails or shows a partial status, first ensure that the PDF is clear, correctly formatted, and not password-protected. Re-upload it after verifying these points. Persistent issues should be escalated to Suvit support for assistance with troubleshooting.

3. What is ledger mapping, and why is it essential when importing bank statements into TallyPrime?

Ledger mapping assigns each imported transaction to a specific ledger account in TallyPrime, ensuring accurate categorization and reconciliation. Proper mapping prevents accounting errors and streamlines monthly and annual financial reporting.

4. Can multiple bank statements be imported and processed in bulk using Suvit?

Yes, Suvit’s bulk upload functionality enables CAs to upload and process numerous bank statements simultaneously, leveraging AI to automatically map data to TallyPrime, thereby saving significant manual effort across multiple client accounts.

5. How do I check the status of a bank statement import, and what do the different statuses mean?

After uploading, the statement is assigned a status, such as Completed (successfully imported), Failed (issues with the file or format), Duplicate (the file already exists), or Partial (only some transactions were processed). Monitoring these statuses helps in timely action to resolve issues or confirm successful imports.