Paying your income tax online in India has never been more accessible or secure.

With the government’s continuous push towards digitalisation, the e-Pay Tax system provides taxpayers with a seamless, efficient, and safe way to fulfil their tax obligations.

Whether you are a salaried individual, a self-employed professional, or a business owner, understanding the latest procedures, deadlines, and benefits of online tax payment is crucial for staying compliant and avoiding penalties.

Latest Updates for FY 2025-26

Record Early Filing & Extended Deadlines

As of June 2, 2025, more than 54,000 Income Tax Returns (ITRs) have already been filed for Assessment Year 2025-26, reflecting a significant increase in digital compliance and awareness among taxpayers.

Recognising the need for adequate preparation time, the government has extended the ITR filing deadline for non-audit cases to September 15, 2025. This extension is beneficial due to delays in the notification of forms and the release of updated utility tools.

No Major Changes in Tax Regimes

The Income-tax Bill 2025, introduced in Parliament, maintains the prevailing tax rates and regimes. This means that both individuals and corporations can continue to follow the same tax structures as in the previous year, bringing much-needed stability and predictability to financial planning.

Why Should You Pay Income Tax Online?

With the evolution of digital services, paying your income tax online offers several compelling advantages:

- Convenience: No need to visit banks or tax offices. Payments can be made 24/7 from anywhere.

- Security: The e-Pay Tax portal utilises encrypted payment gateways, ensuring that your financial information remains secure.

- Instant Confirmation: Receive immediate confirmation via email and SMS, along with a digital challan receipt.

- Accurate Record-Keeping: Digital receipts reduce the risk of lost or misplaced challans and make it easy to track your payment history.

- Multiple Payment Options: Choose from net banking, debit/credit cards, UPI, RTGS/NEFT, or even over-the-counter payments at authorised banks.

- Automatic Updates: Your tax records are updated in real-time with the Income Tax Department, reducing manual errors and paperwork.

Who Must Pay Income Taxes Online?

Online tax payment is mandatory for:

- All corporate taxpayers.

- All non-corporate taxpayers, subject to tax audit under Section 44AB of the Income Tax Act, 1961.

Other taxpayers, including individuals and small businesses, are encouraged to use the e-pay Tax system voluntarily for greater convenience and transparency.

Step-by-Step Guide: How to Pay Income Tax Online (FY 2025-26)

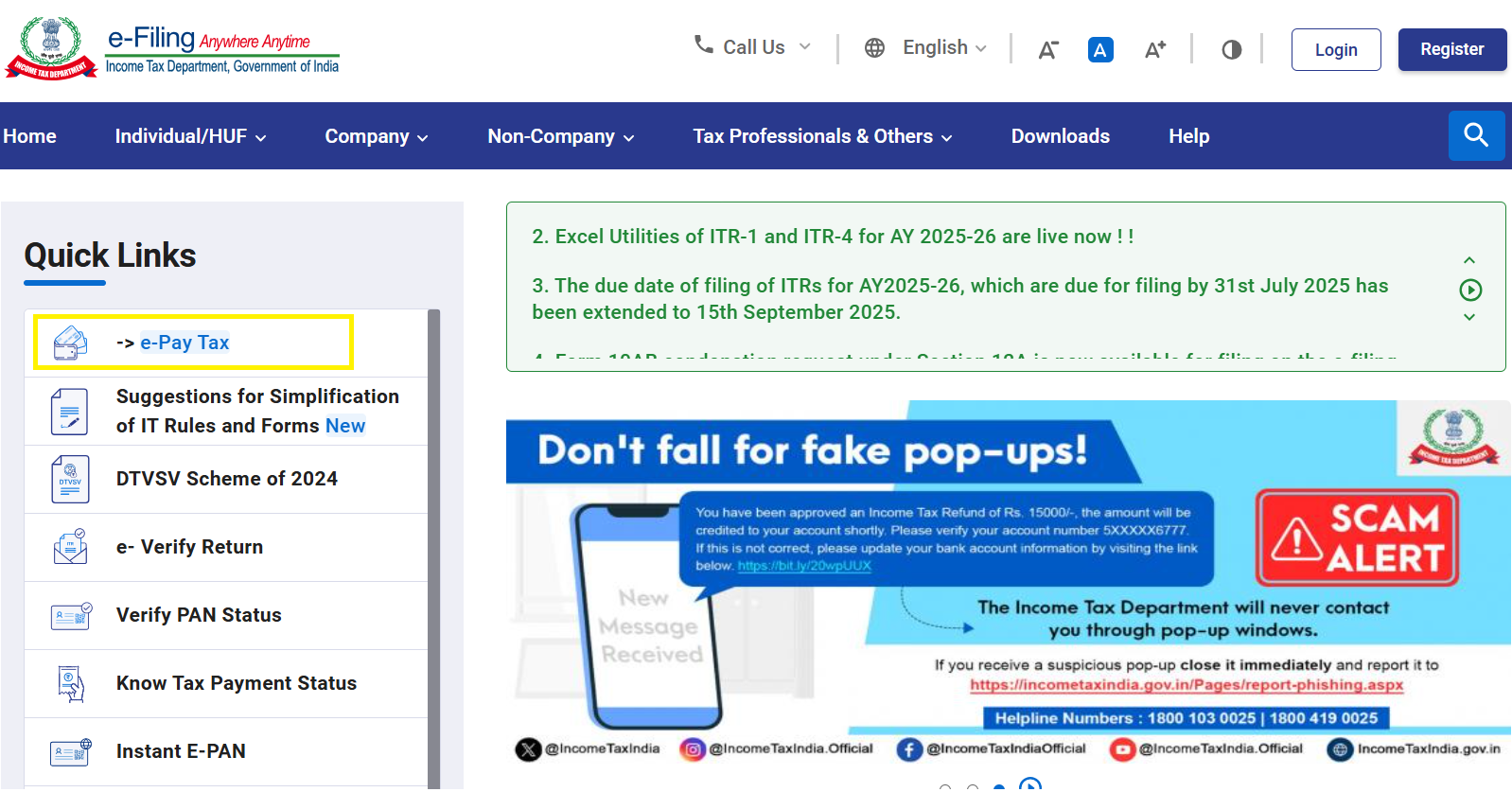

Step 1: Access the e-Pay Tax Portal

- Visit the official website of the Income Tax Department.

- Locate the “e-Pay Tax” option under Quick Links or use the search bar.

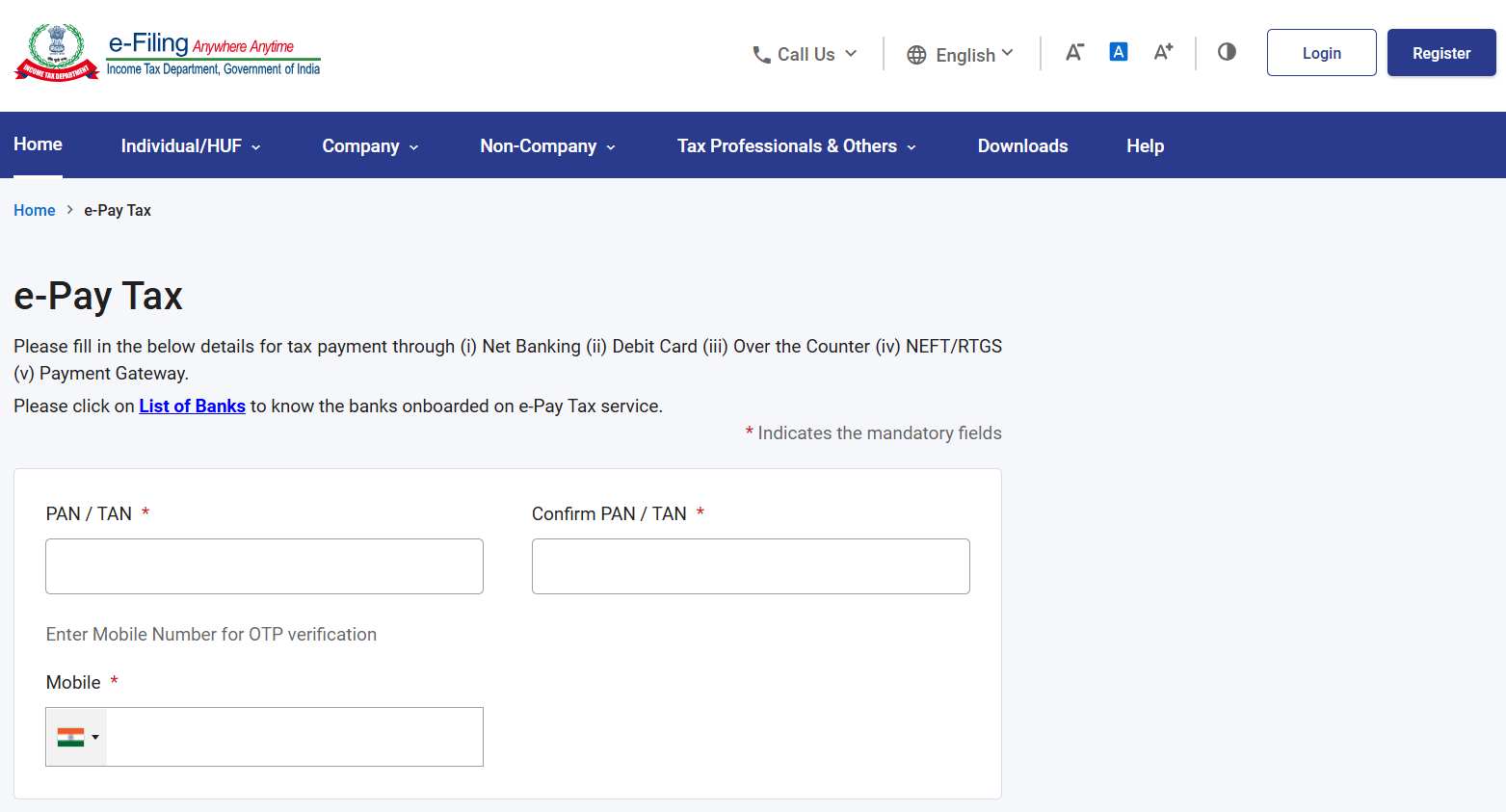

Step 2: Verify Your Identity

- Enter your Permanent Account Number (PAN), mobile number, and the OTP you receive.

- Alternatively, log in to the e-Filing portal using your credentials and select “e-Pay Tax” from the e-File menu.

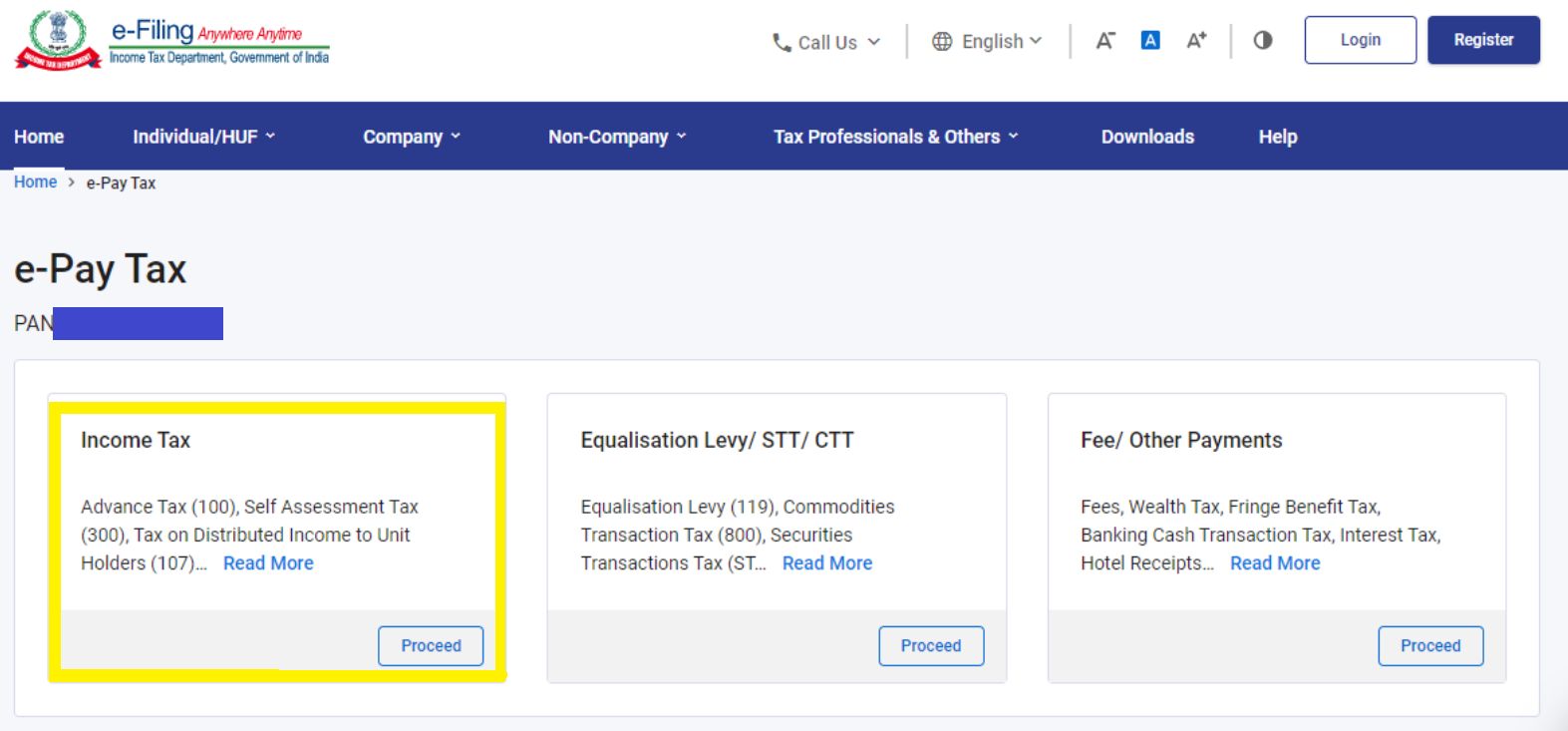

Step 3: Select the Type of Payment

- Choose the relevant payment type (Income Tax, TDS, STT, etc.).

- For most individuals, select “Income Tax” and the correct Assessment Year (AY 2026-27 for FY 2025-26).

- Under “Type of Payment,” select “Self-Assessment Tax (300)” or the applicable option.

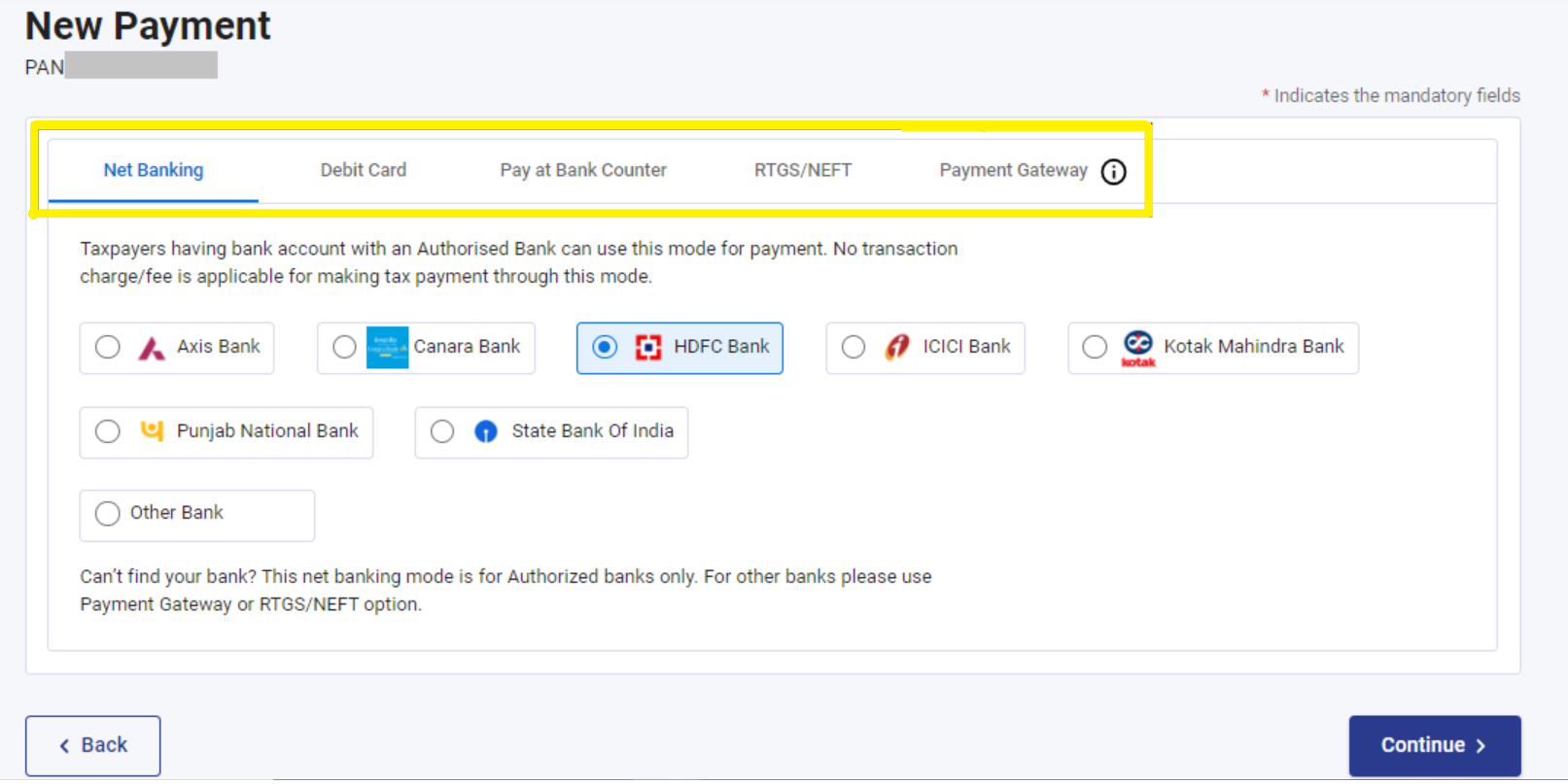

Step 4: Choose Your Payment Method

- Select from net banking, debit card, credit card, UPI, RTGS/NEFT, or pay at the bank counter.

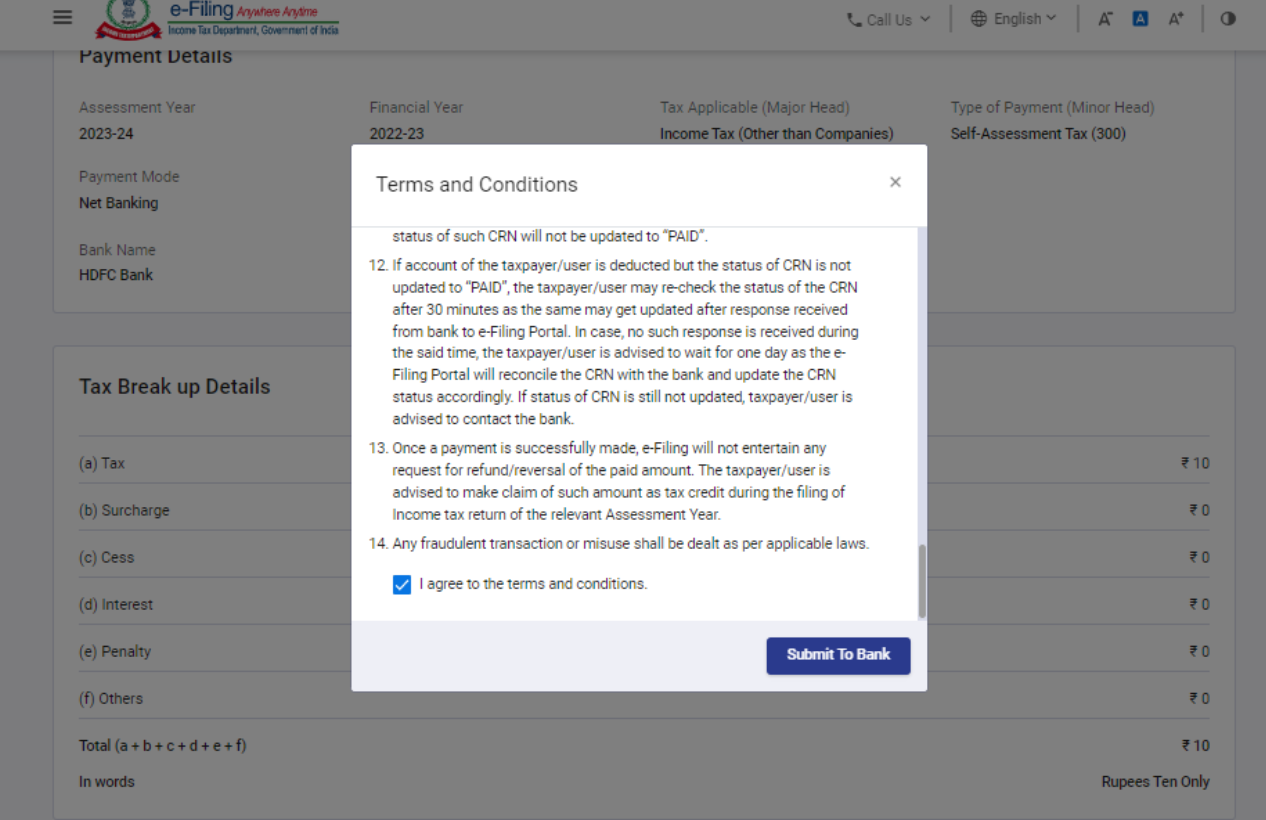

Step 5: Review and Confirm

- Double-check all payment details and the tax breakup.

- Accept the terms and conditions, then click “Submit to Bank.”

Step 6: Complete the Payment

- You will be redirected to your bank’s secure portal to complete the transaction.

- After successful payment, you’ll receive instant confirmation via email and SMS.

Step 7: Download Your Challan Receipt

- Download and save the digital challan receipt, which includes the Challan Identification Number (CIN), for your records.

- You can also check your payment status anytime under the “Payment History” tab on the e-Pay Tax page.

Advance Tax: What You Need to Know for FY 2025-26

Advance tax is the “pay-as-you-earn” system, requiring taxpayers to pay tax in installments as income is earned rather than as a lump sum at the end of the year. This system applies to all taxpayers: salaried, self-employed, and businesses; if their total tax liability exceeds ₹10,000 in a financial year. Senior citizens (aged 60 or above) without business income are exempt.

Advance Tax Due Dates for FY 2025-26

| Due Date | Minimum Advance Tax Payable |

|---|---|

| On or before 15th June | 15% of total advance tax |

| On or before 15th Sept | 45% (cumulative) |

| On or before 15th Dec | 75% (cumulative) |

| On or before 15th March | 100% (cumulative) |

Presumptive Taxation:

Taxpayers under Section 44AD or 44ADA must pay the entire advance tax by March 15 (or, at the latest, by March 31).

How to Calculate Advance Tax

-

Estimate your total income for the financial year, including salary, business income, capital gains, and other sources.

-

Calculate your total tax liability based on the current tax slabs.

-

Deduct TDS/TCS already deducted or to be deducted.

-

Pay the balance as advance tax in the prescribed installments.

Common Mistakes to Avoid While Paying Income Tax Online

- Missing Deadlines: Late payment attracts interest under Sections 234B and 234C.

- Incorrect Assessment Year: Always select the correct assessment year (AY 2026-27 for FY 2025-26).

- Incorrect Payment Type: Ensure you choose the correct payment type (e.g., Self-Assessment, Advance Tax).

- Not Saving the Challan: Always download and securely store your challan receipt.

Practical Tips for Hassle-Free Online Tax Payment

- Keep your PAN, Aadhaar, and bank details readily available before initiating the payment process.

- Double-check all entries before submitting your payment.

- Use a secure internet connection to avoid any security risks.

- Set calendar reminders for advance tax due dates and the ITR filing deadline.

- Consult a tax professional if you have complex income sources or are unsure about calculations.

Feeling Ready, Already?

Paying your income tax online for the financial year 2025-26 is fast, secure, and convenient. With the government’s continued focus on digital transformation, the e-Pay Tax facility empowers you to manage your tax obligations efficiently and stay compliant with the latest rules and deadlines.

Take advantage of the extended ITR deadline, keep track of your advance tax instalments, and always save your digital receipts for future reference.

By staying informed and proactive, you can avoid penalties, ensure peace of mind, and contribute to a transparent tax ecosystem in India.

FAQs

Q: What if my bank isn’t authorised for e-tax?

A: You can use an account from any authorised bank, even if it belongs to a family member or associate.

Q: How do I retrieve a lost challan counterfoil?

A: Most banks allow you to regenerate the challan online through their portal.

Q: What if my account is debited twice?

A: Claim a refund for the excess tax paid when filing your Income Tax Return.

Q: What if I select the wrong assessment year?

A:

- Mention the payment details when filing your return.

- Contact your Assessing Officer or bank within 7 days for correction.

- File a Section 154 rectification request if needed.

Q: How do I know if my payment was successful?

A: You will receive an instant confirmation via email and SMS, and you can check the payment status in the “Payment History” section of the e-Pay Tax portal.

Q: What if I miss the advance tax deadline?

A: You may have to pay interest on the delayed amount. It’s best to pay as soon as possible to minimise penalties.