At Suvit, while we excel in automating tally processes, we noticed a common challenge that goes beyond our core offerings: the complexities surrounding PAN Card updates. Many individuals and businesses struggle with navigating these updates, often feeling overwhelmed by the detailed procedures and lack of clear information.

This initiative, though outside our usual scope, is driven by our commitment to making financial tasks accessible and manageable for everyone.

By sharing our insights and providing a clear, step-by-step guide, we aim to empower you with the knowledge to confidently manage your PAN Card details.

Maintaining up-to-date information on your PAN Card is crucial for smooth financial operations and adhering to tax laws.

Correcting a typo in your name, updating an old address, fixing an incorrect date of birth, or updating your mobile number, has been made straightforward with the availability of online services.

In this complete guide, we'll navigate through the steps and intricacies of correcting or updating your PAN Card details online, making the process hassle-free and efficient.

What are the Steps to Modify the Details on Your PAN Card?

Sometimes, mistakes happen during the issuance of your PAN Card, such as typos in your name, your parent's name, or your birthdate.

Your name and address might change once your PAN card is issued. In these situations, your PAN card needs to be updated with the new name, birthdate, address, and parents' names. It is possible to change the PAN card details offline or online.

How to Update Your PAN Card Offline?

Use this step-by-step instruction to file for PAN card modification offline:

Step 1: Get the online PAN card correction form.

Step 2: Complete the form completely and submit it at any nearby PAN center along with all the required documentation.

Step 3: You will receive a confirmation slip at the center upon submission and payment.

Step 4: This slip must be sent within 15 days to the Income Tax PAN Service Unit of the NSDL.

How to Update Your PAN Card Online?

Via the NSDL e-Gov or UTIITSL websites, you can update your PAN card information online.

How to update a PAN card on the NSDL e-Gov portal?

Here's how to correct your PAN card online, step-by-step:

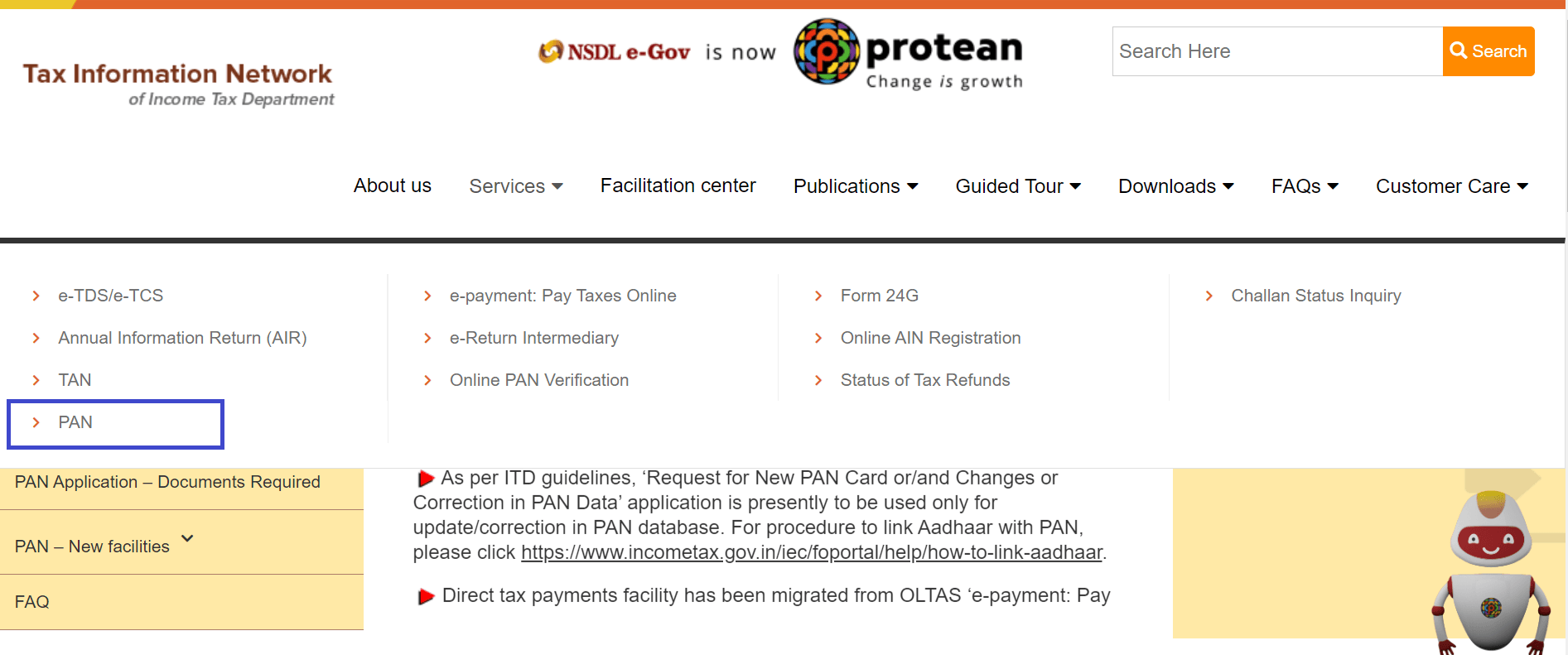

Step 1: Go to the e-Gov portal for NSDL.

Step 2: Choose "PAN" from the drop-down menu by clicking on the "Services" tab.

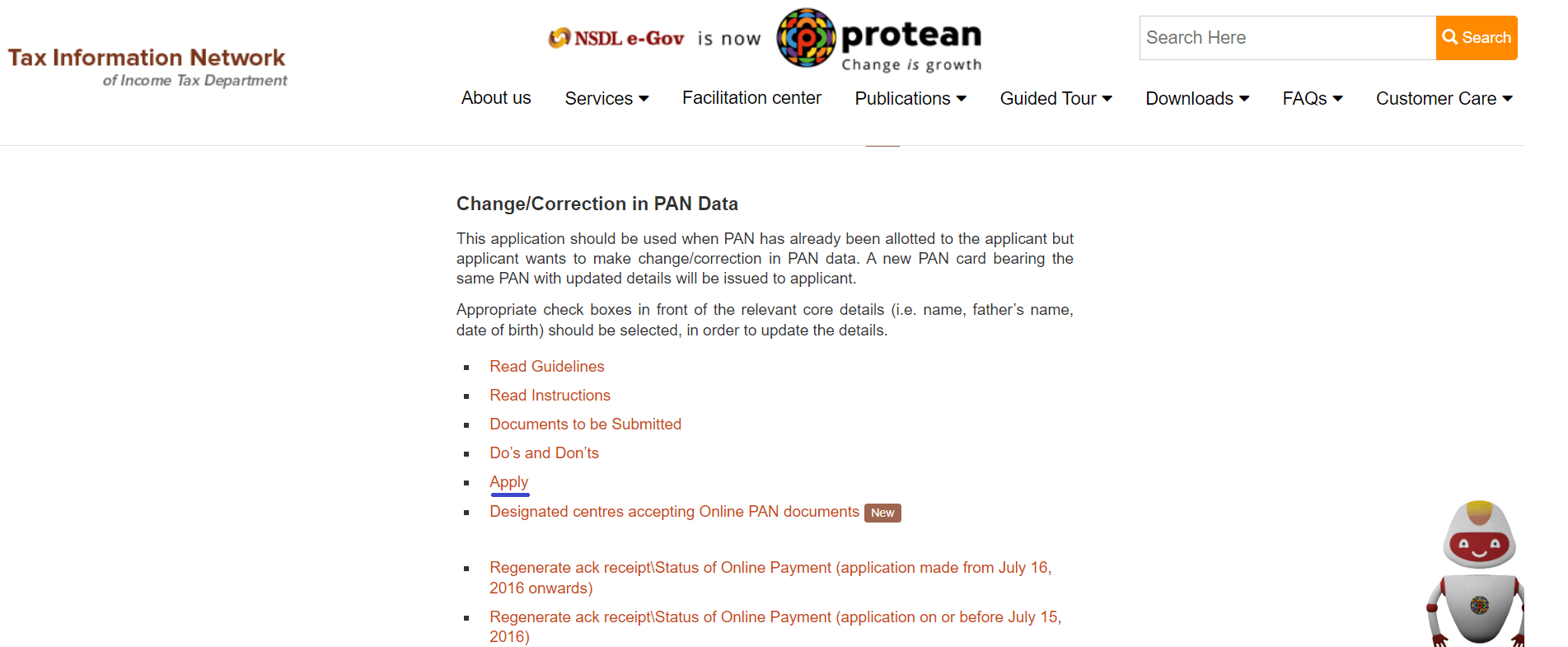

Step 3: Scroll down to find the "Change/Correction in PAN Data" heading. From the available options, select "Apply."

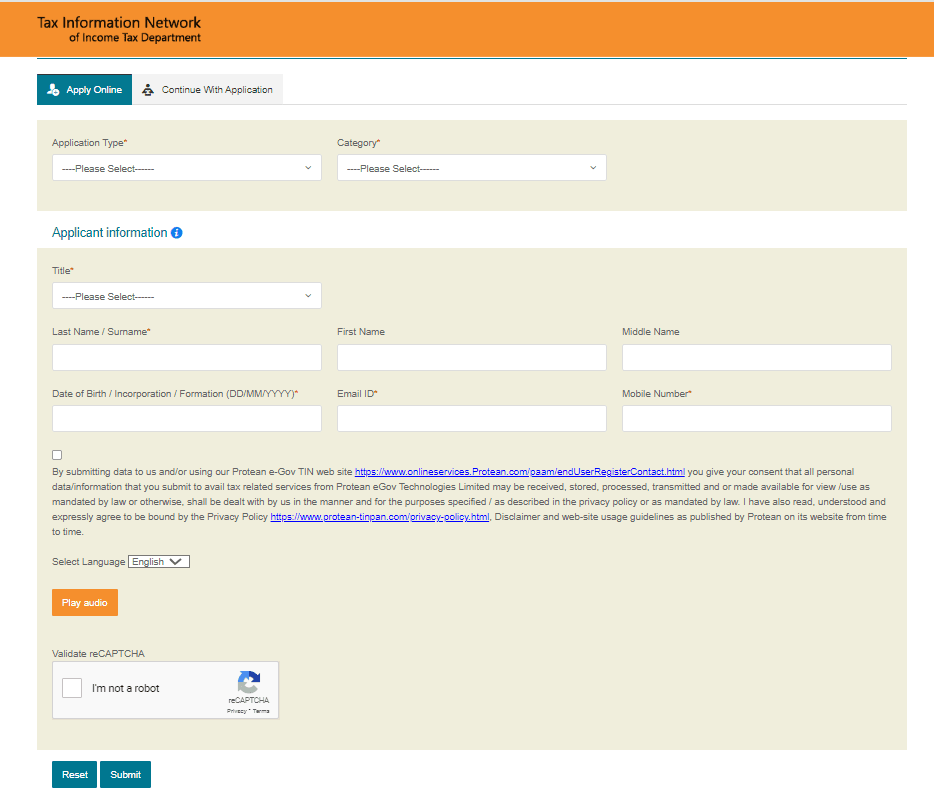

Step 4: At this point, you must complete the online PAN application. Let's check how to fill in every detail.

- Application type: Reprinting a PAN card or making changes to the current PAN data

- Category: From the drop-down menu, choose the appropriate category.

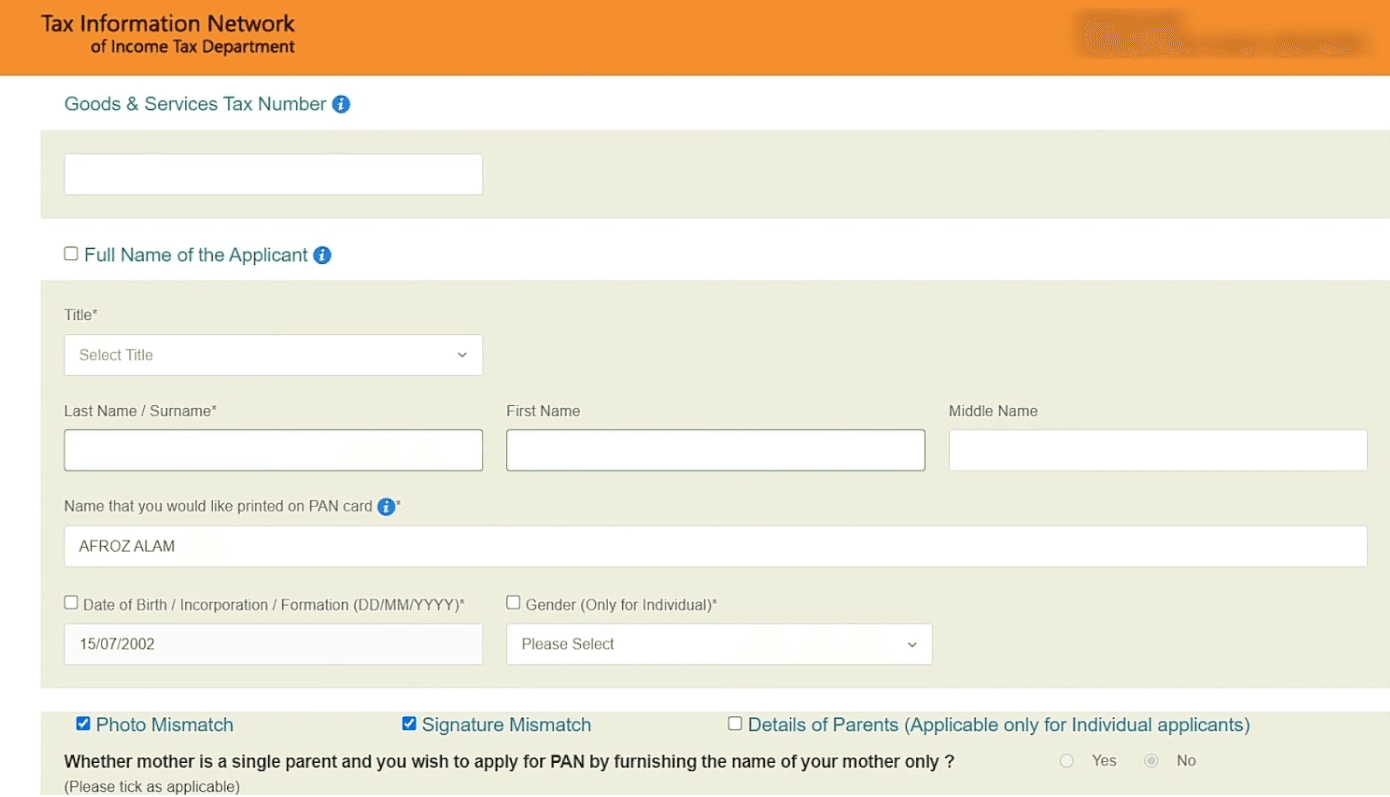

- Additional information: Add more personal information here, such as:

- First Name

- Middle Name

- Last Name / Surname

- Date of Birth / Incorporation / Formation

- Email Address

- Phone number

- Indian or non-Indian citizenship

- PAN number

- After entering the "Captcha Code," press "Submit."

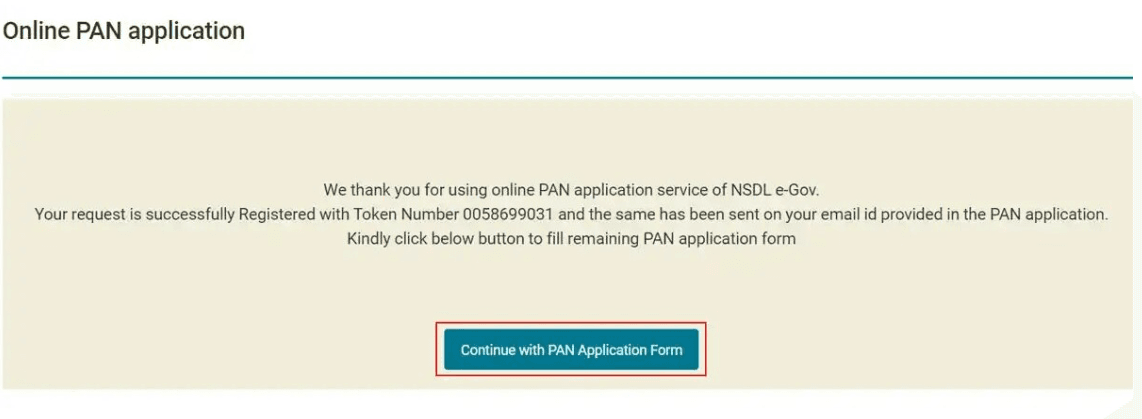

Step 5: A Token Number will be sent to the email address you entered here as soon as the request is registered.

In the event of a session timeout, this token number can be utilized to get to the draft version of the form.

Click "Continue with PAN Application Form".

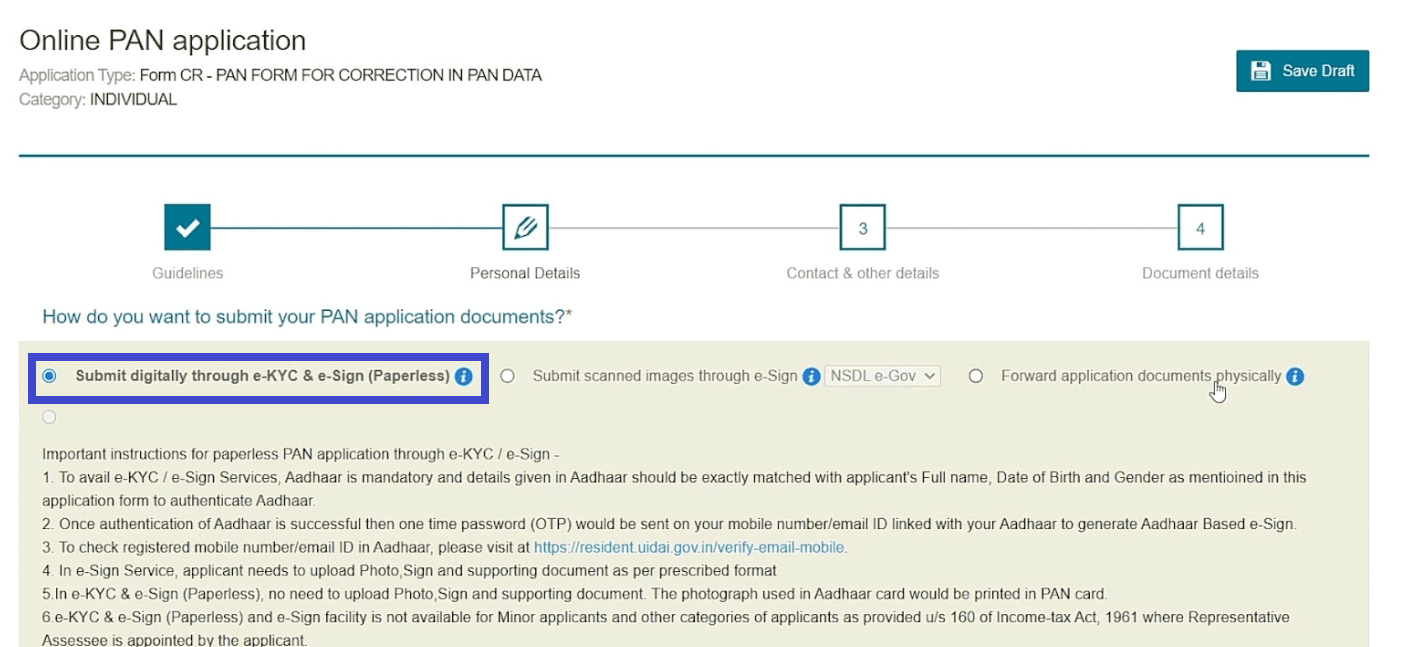

Step 6: Three options will appear on your screen.

- Submit digitally through e-KYC & e-Sign (Paperless)

- Submit scanned images through e-Sign

- Forward application documents physically

Click "Continue with PAN Application Form".

For updating your PAN, choose the first option, "Submit digitally through e-KYC & e-Sign (Paperless)," to finish the process online using Aadhaar OTP.

Step 7: Choose "yes" if you require a new hard copy of the amended PAN card. You will be charged nominal fees.

Step 8: Enter your Aadhaar number's last four digits by scrolling down.

Step 9: Update the necessary information by scrolling down. Don't forget to check the appropriate box indicating which needs an update or correction. Once completed, click "Next" to go to the "Contact and other details" page.

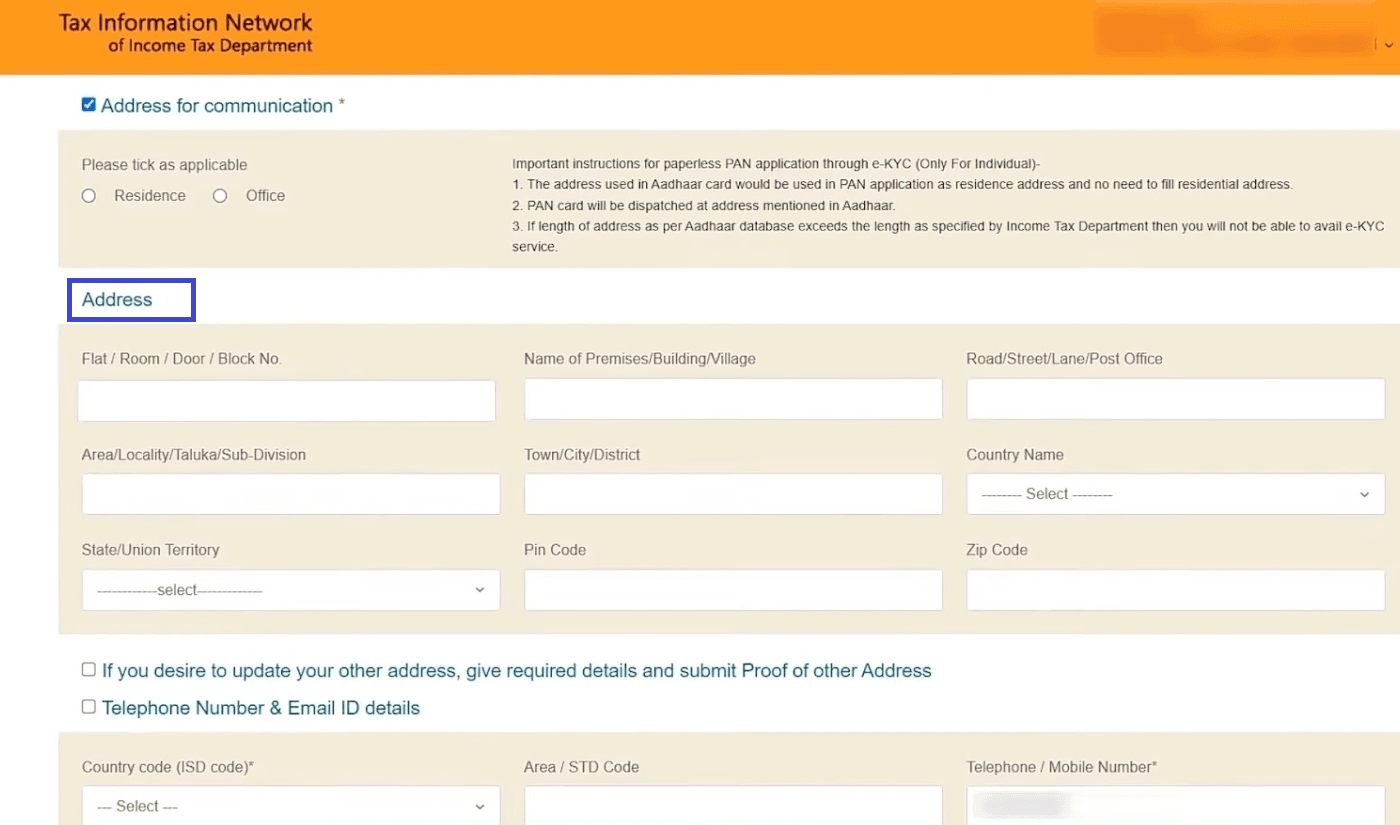

Step 10: Enter the updated new address and turn on the page.

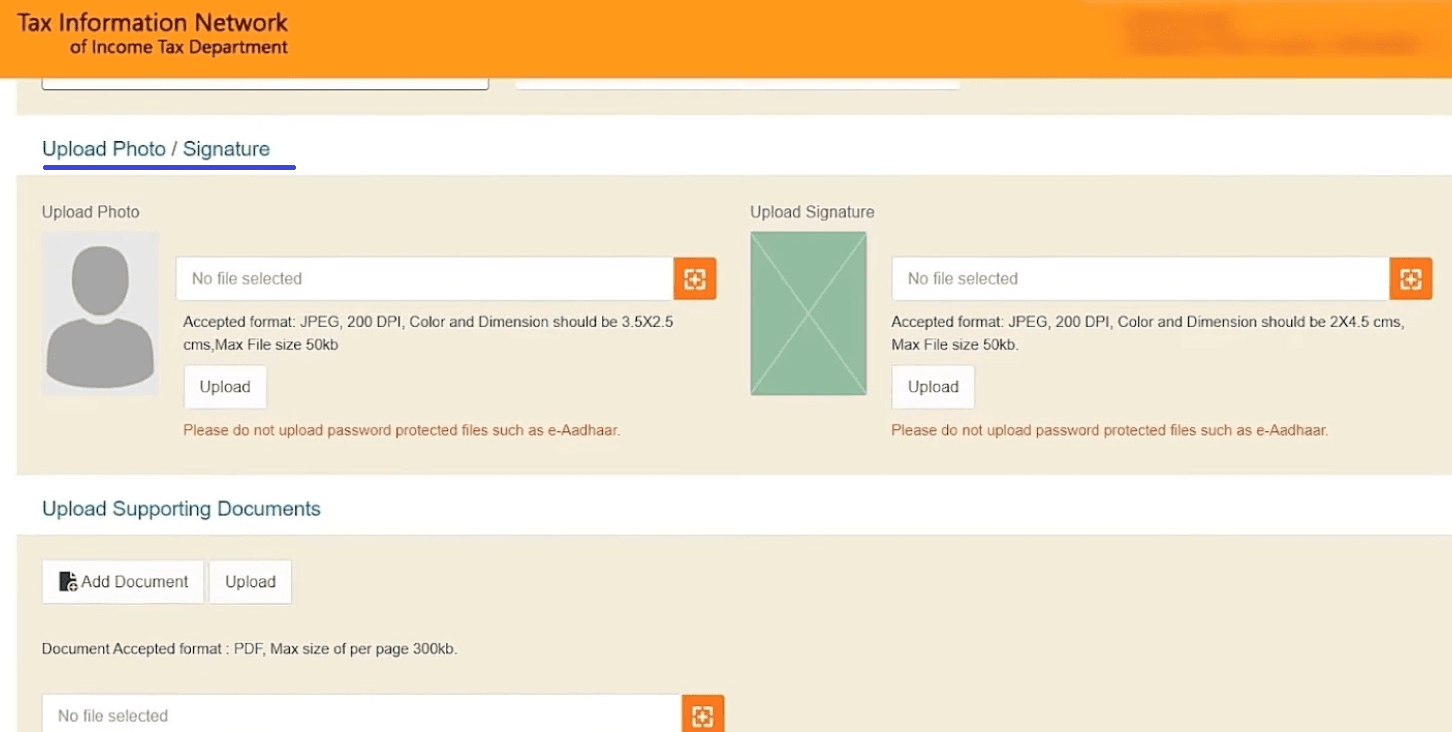

Step 11: Attach the proof document and a copy of the PAN based on the updated particular.

Also Read: How To Download E-Pan Card

Step 12: Under the section on declarations,

- Write your name,

- Indicate that you are filling out the form on your own behalf by choosing "Himself/herself."

- Enter your residential address.

Step 13: Go down and provide a copy of your "signature" and "photograph."

Make sure the files meet the stated requirements and dimensions.

Once finished, select "Submit."

Step 14: A preview of the form is now visible to you.

Enter your Aadhaar number's first eight digits, and make sure the other information you provided is accurate.

Step 15: The payment page will show up following the submission of the PAN card correction form.

Several payment gateways are available for making payments.

A payment receipt will be sent to you following a successful payment.

Step 16: Click "continue" to finish updating or correcting your PAN card. It is now necessary for you to finish the KYC procedure. Click "Authenticate" after checking the box indicating your acceptance of the terms and conditions.

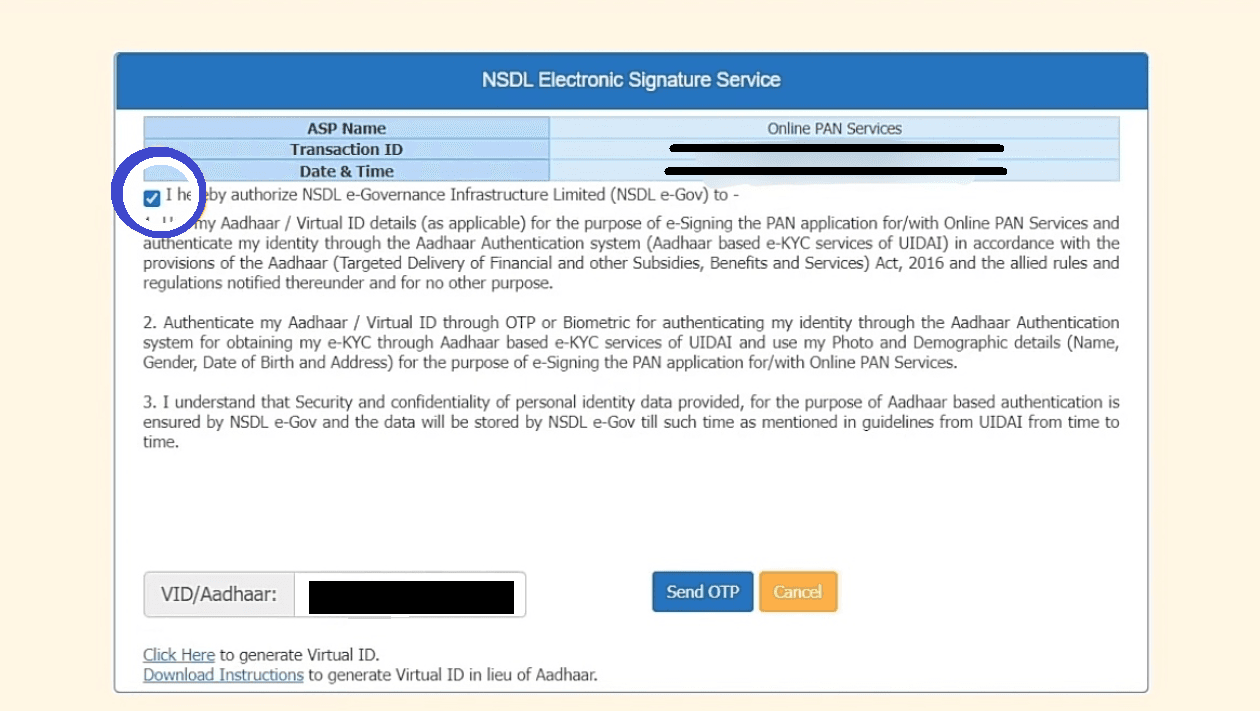

Step 17: Your Aadhaar registered mobile number will receive an OTP. After completing the online PAN application form, enter the OTP.

Step 18: Select "continue" with eSign from the screen that appears next.

Step 19: Check the box to indicate your acceptance of the terms and conditions. After entering your Aadhaar number, select "Send OTP."

Step 20: Verify by entering the OTP that was sent to the mobile number you registered with Aadhaar. The acknowledgement form has become available for download. To access this file, enter your birthdate in the DD/MM/YYYY format as the password.

How to update a PAN card on the UTIITSL portal?

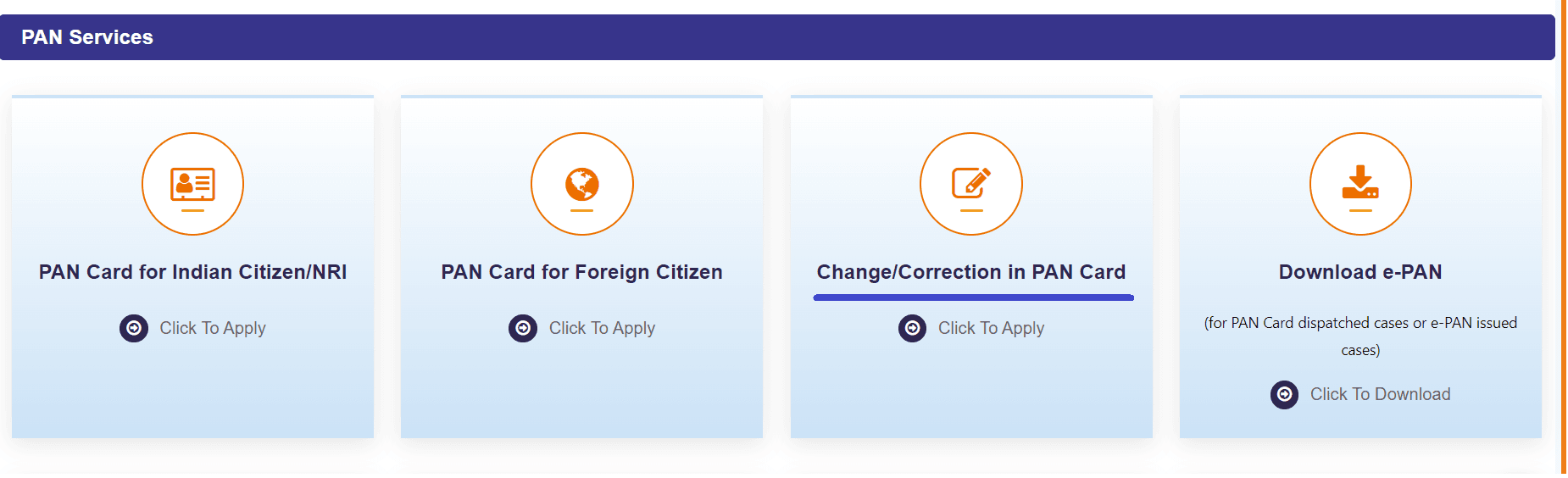

Step 1: Go to the website of UTIITSL.

Step 2: Under the "Change/Correction in PAN Card" tab, select "Click to Apply."

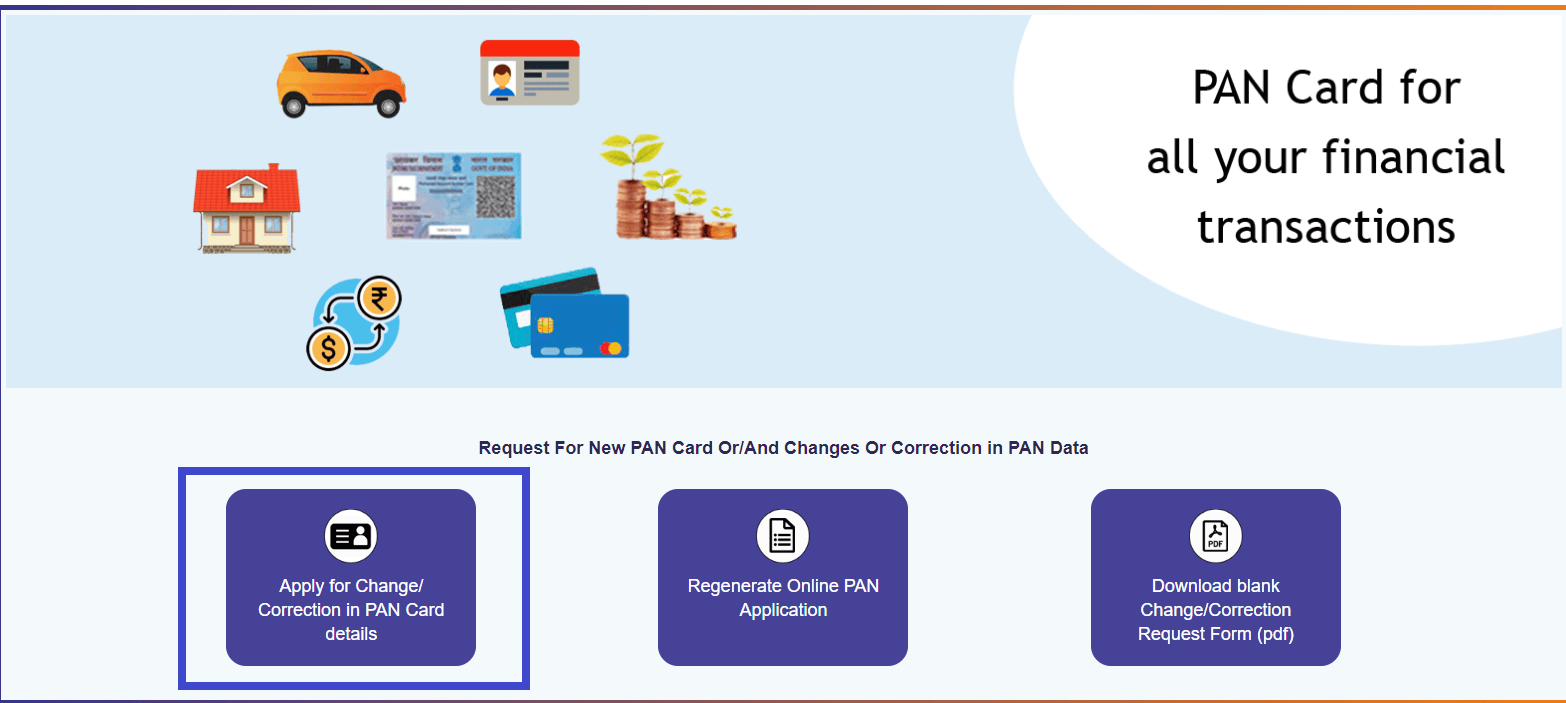

Step 3: Select the tab marked as "Apply for Change/Correction in PAN card details."

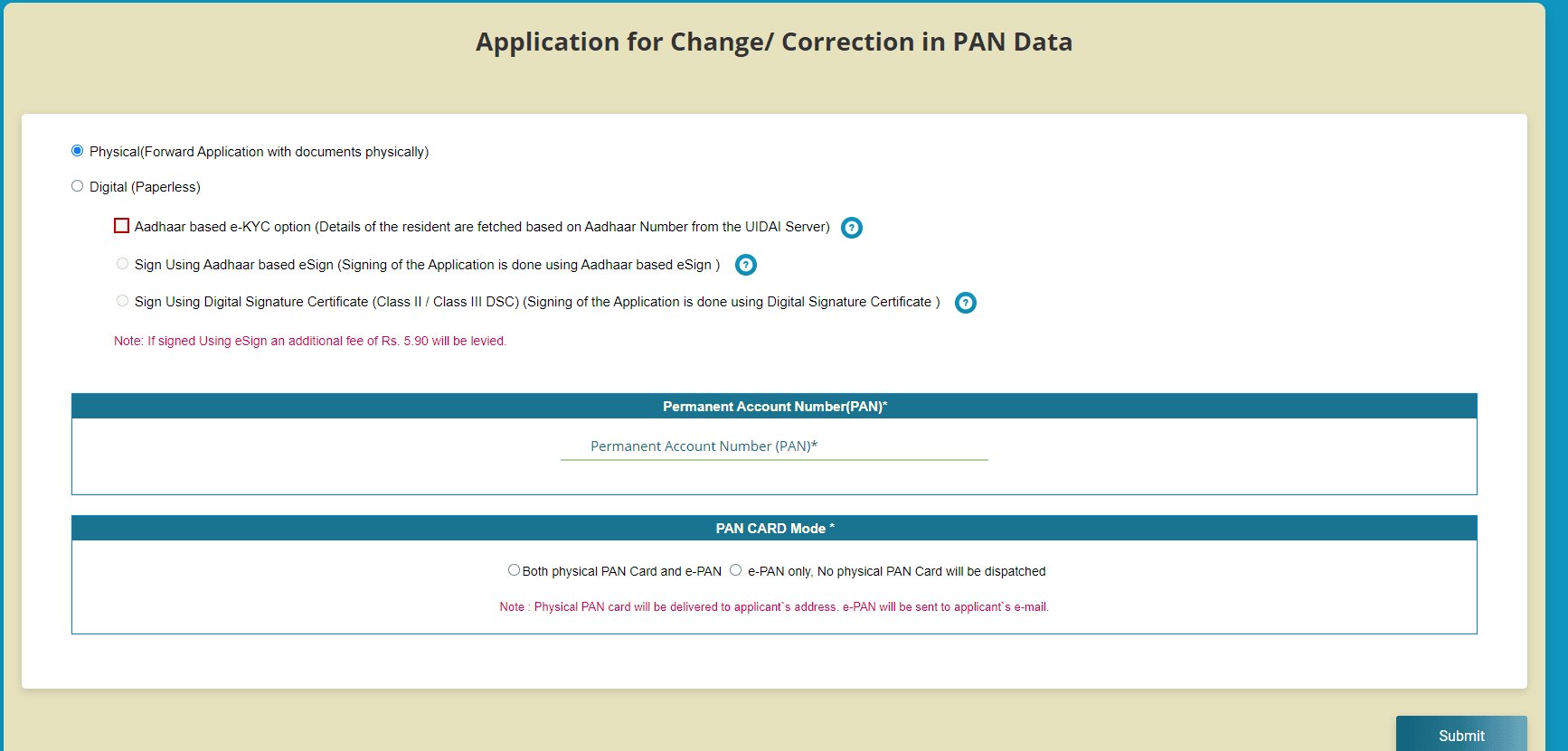

Step 4: Choose the document submission method, type in your PAN, choose the PAN card mode, and press the "Submit" button.

Step 5: You will be given a reference number as soon as the request is registered. Press the "OK" button.

Also Read: Search PAN Card Details - Using Name

Step 6: Click "Next Step" after entering the name and address.

Step 7: Click "Next Step" after entering the PAN number and verification.

Step 8: Click "Submit" after uploading the documents.

PAN correction usually takes 15 days. When your PAN card is shipped by mail, you will receive a text message on the phone number you registered.

We at Suvit hope this guide helps you easily update your PAN Card. Our main job is to make tally work automated with our software, but we also want to help you with other important things like this.

Remember, keeping your details right and up-to-date is very important.