As a technology enthusiast and keen observer of India's digital evolution, we are fascinated by the PAN 2.0 Project.

It's not just another government initiative – it's how technology can revise mundane administrative processes into seamless, user-friendly experiences (just like Suvit, yes😉!).

The Cabinet Committee on Economic Affairs (CCEA) has greenlit the Income Tax Department’s ambitious PAN 2.0 Project.

A ₹1,435 crore initiative aimed at transforming the processes surrounding Permanent Account Numbers (PAN) and Tax Deduction and Collection Account Numbers (TAN).

This project focuses on integrating services, improving taxpayer experience, and aligning with India's Digital India vision.

Why PAN 2.0?

With 78 crore PANs and 73.28 lakh TANs issued, managing taxpayer data efficiently is critical.

Currently, PAN-related services are scattered across three platforms—the Income Tax Department’s e-Filing portal, UTIITSL Portal, and Protean e-Gov Portal—leading to fragmented user experiences and delays.

PAN 2.0 seeks to address these challenges by creating a unified portal for all PAN and TAN services.

The project also positions PAN as a common business identifier, fulfilling the Union Budget 2023 announcement.

It aims to modernize processes, ensure eco-friendly operations, and enhance security measures.

Key Features of PAN 2.0

1. Unified Portal for PAN and TAN Services

- All PAN/TAN-related services will now be consolidated on a single portal. This includes PAN/TAN applications, updates, Aadhaar-PAN linking, re-issuance, corrections, and online PAN validation.

- Users will benefit from a streamlined interface, reducing delays and simplifying grievance redressal.

2. Digital and Paperless Processes

- PAN 2.0 prioritizes an eco-friendly, completely paperless approach. From PAN issuance to updates, all processes can be completed online.

- Electronic PAN (e-PAN) will be issued instantly, free of cost, and delivered to the applicant’s registered email address.

3. QR Code Features

- New PAN cards will include dynamic QR codes containing up-to-date taxpayer details.

- QR codes ensure quick and reliable PAN verification, supporting secure transactions.

4. PAN as a Unified Identifier

- PAN will act as a common identifier for digital systems across government agencies, streamlining compliance processes for businesses.

5. Security Upgrades

- A PAN Data Vault will safeguard taxpayer data, providing better privacy and fraud prevention.

- The improved system will detect and prevent duplicate PANs more effectively.

6. Dedicated Call Center and Helpdesk

- To enhance user support, a dedicated helpline will address taxpayer queries, ensuring smoother issue resolution.

Benefits for Taxpayers

1. Free and Faster Services

PAN applications, updates, and corrections will now be free of cost.

Physical PAN cards can still be issued for a nominal fee (₹50 domestically and ₹15 plus delivery charges internationally).

2. Simpler Compliance

With PAN as a unified identifier, businesses can fulfill multiple compliance requirements without needing separate IDs.

3. Improved User Experience

The unified portal reduces the need to navigate between multiple platforms, saving time and effort.

4. Grievance Redressal

The re-engineered system will enable faster resolution of taxpayer grievances and processing delays.

5. Stronger Fraud Prevention

Dynamic QR codes and a centralized data vault improve the security of taxpayer information and transactions.

PAN 2.0 and Digital India

The project reflects the government’s commitment to Digital India, focusing on transparency, efficiency, and eco-friendly practices.

By integrating systems and transitioning to a paperless ecosystem, PAN 2.0 not only simplifies processes but also contributes to sustainable governance.

PAN 2.0 and Business Compliance

In the Union Budget 2023, it was announced that PAN would serve as the common business identifier for digital systems of specified government agencies.

This means businesses will no longer need to maintain separate identifiers for different compliance requirements, reducing administrative overhead.

Addressing Common Concerns

Do older PAN cards without QR codes need to be replaced?

No. Older PAN cards remain valid. However, taxpayers have the option to request new QR-coded PAN cards if desired.

What happens if a taxpayer has multiple PANs?

The Income Tax Department mandates that individuals hold only one PAN. PAN 2.0’s improved system will identify and deactivate duplicate PANs more efficiently.

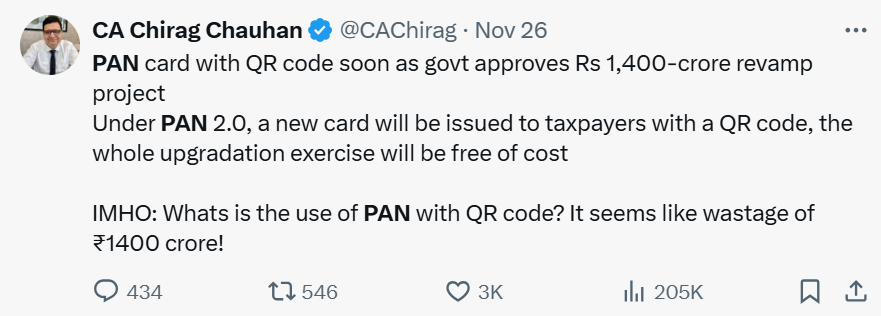

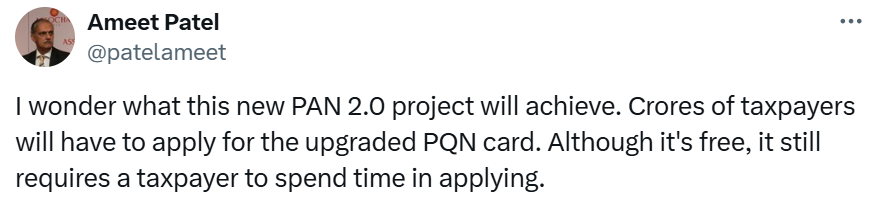

Though some CAs have given their opinions on X(Twitter) which you should not miss! Checkout the highly engaged tweets:

Looking Towards the Future

PAN 2.0 is more than a technological upgrade – it's a bold statement about India's commitment to digital innovation, user-centric governance, and efficient public services.

By simplifying complex processes, enhancing security, and creating a more accessible tax identification system, the project sets a new benchmark for digital governance.

As we move forward, PAN 2.0 will continue to evolve, promising an increasingly streamlined, secure, and user-friendly experience for millions of Indian taxpayers and businesses.

The future of tax identification is here, and it's smarter, faster, and more transparent than ever before.

Frequently Asked Questions

1. Do existing PAN holders need to apply for new PANs under PAN 2.0?

No. Current PANs remain valid, and holders do not need to apply for a new PAN unless updates or corrections are required.

2. What does the new QR code offer?

The QR code will display real-time taxpayer details, ensuring secure and quick verification.

3. Can existing PAN holders update their details for free?

Yes. Updates such as name, address, email, and mobile number can be made free of charge after PAN 2.0's launch.

4. Will physical PAN cards still be issued?

Yes. While e-PANs are free, physical PAN cards can be requested for a nominal fee.

5. How does PAN 2.0 handle duplicate PANs?

The upgraded system uses advanced technology to detect and eliminate duplicate PANs more effectively.

6. How does the unified portal improve service delivery?

By centralizing all PAN and TAN services, the portal ensures faster application processing, easier updates, and quicker grievance redressal.