Managing eCommerce accounting across multiple platforms has become increasingly complex, but Suvit simplifies the process by automating the mapping and import of sales Excel sheets directly into Tally ERP.

This solution helps online sellers and accountants maintain accurate, up-to-date financial records without manual data entry or error-prone reconciliations.

India's eCommerce market is booming, expected to reach ₹29.89 lakh crore by 2030 (Source). Key trends shaping the eCommerce landscape include mobile-first shopping, with over 70% of traffic coming from mobile devices, and a surge in digital payments, with UPI transactions surpassing 10 billion per month.

Additionally, quick commerce now accounts for 20% of the market, growing at a robust annual rate of 50% (Source), and festive D2C sales saw a 25% increase during Navratri (Source).

With these trends in mind, Suvit’s automation addresses the growing need for streamlined accounting, simplifying financial management across multiple platforms. Suvit’s cloud-based infrastructure further empowers online sellers and accountants, offering remote accessibility, scalability, and enhanced security.

The New Challenge in Multi-Marketplace Accounting

Manual Data Entry and Platform Fragmentation

Sellers downloading sales and financial reports from Amazon, Flipkart, Meesho, and Ajio must standardize columns and header formats for every platform.

Manual consolidation and data input into Tally are time-intensive and susceptible to mistakes. This not only delays financial reporting but also increases compliance risks in GST and TDS documentation.

Impact on Seller Operations

Errors in manual accounting can result in missed entries, tax calculation mistakes, and lost time for core business activities. There is a clear need for reliable automation to strengthen data accuracy and free up resources.

Suvit: Excel Sheet Upload, Mapping, and Tally Integration

Direct Sales Sheet Uploads

Suvit’s platform allows users to:

- Easily upload official sales Excel sheets from Amazon, Flipkart, Meesho, Ajio, and other marketplaces.

- Preview and validate the data for completeness and format consistency before processing.

- Identify discrepancies in headers, date formats, or missing entries through automated checks.

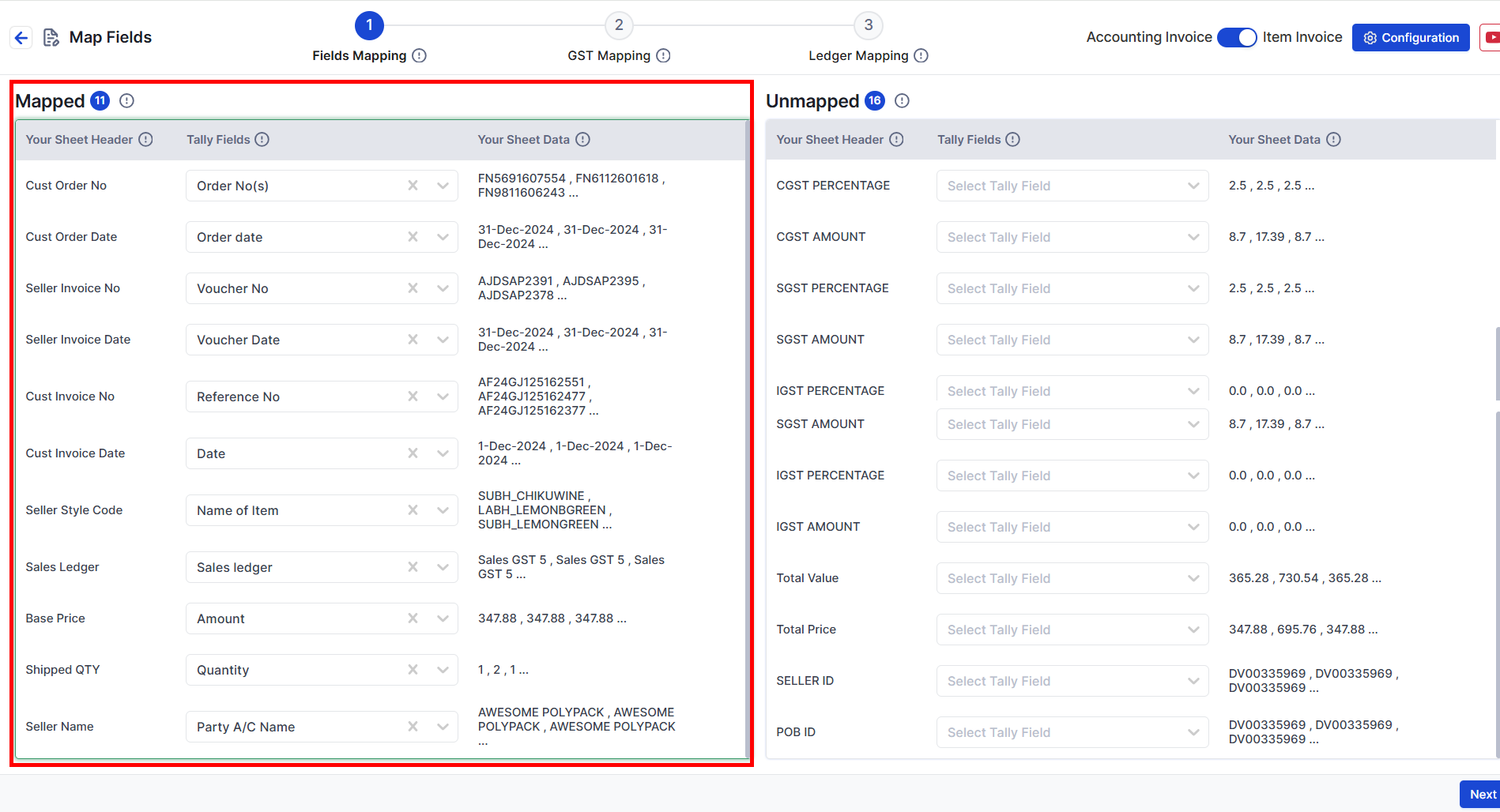

Intelligent Column-to-Ledger Mapping

One of Suvit’s core strengths is its customizable mapping feature:

- Users map each column from their sales sheets to corresponding fields in Tally (e.g., voucher date, item codes, GST components, order numbers).

- Suvit memorizes mapping templates for future uploads, speeding up subsequent data imports.

- Manual adjustments are allowed for any unmapped or custom columns, minimizing downtime from header mismatches.

Automated Data Validation and Bulk Import to Tally

After mapping:

- Suvit runs validation checks for missing or incorrect data.

- When data is verified, users can push sales transactions directly to Tally ERP or TallyPrime with a single click, eliminating manual entry and ensuring consistent ledgers.

- Automated GST ledger mapping helps maintain up-to-date compliance.

Key Benefits for eCommerce Sellers and Accountants

| Benefit | Description |

|---|---|

| Zero Manual Entry | Eliminate repetitive manual data entry; upload and push bulk sales data from Excel to Tally with ease. |

| Error Reduction | AI-driven validation detects issues in sales sheets and reduces human error in accounting processes. |

| Audit-Ready Compliance | Automated GST/TDS mapping and record keeping enable smooth and timely audits without missing documentation. |

| Faster Reconciliation | Automated bank matching and error detection speed up the reconciliation of marketplace payouts versus sales records. |

| Scalability | Easily handle growing transaction volumes, more marketplaces, and new reporting demands as the business expands. |

| Time Savings | Accountants and sellers free up hours each week thanks to rapid mapping and bulk transactions processing. |

| Better Financial Insights | Consolidated dashboards and reports improve visibility and enable sharper business decisions. |

| Cost Efficiency | Automation minimizes resource requirements as business scales, reducing operational costs over time. |

| Improved Productivity | Teams can focus on higher-level work such as analysis and advisory, rather than repetitive bookkeeping tasks. |

| Secure Data Management | Suvit employs cloud-based, encrypted document collection and access controls for safer, centralized storage. |

Explanations of Each Key Benefit

Zero Manual Entry:

With Suvit, sellers and accountants avoid typing or copying data line-by-line by uploading their Excel sales sheets and pushing transactions directly to Tally, which significantly cuts down on effort and errors.

Error Reduction:

Suvit's AI checks for inconsistencies or missing fields, flags potential mismatches, and ensures that accounting records closely reflect sales reality, reducing the risk of costly mistakes or omissions.

Audit-Ready Compliance:

Automated GST, TDS, and statutory mapping means records are consistently formatted and stored, making audits, tax filings, and compliance documentation faster and far less stressful.

Faster Reconciliation:

Suvit automates the matching of bank deposits and sales payouts with accounting records, quickly identifying unresolved entries and reducing the need for tedious manual review.

Scalability:

As transaction volumes and marketplace operations increase, Suvit adapts easily with bulk uploading and easy mapping templates, allowing sellers to grow without adding manual overhead.

Time Savings:

Routine accounting and reconciliation get done in a fraction of the usual time so that professionals can focus on analysis, tax planning, and customer service.

Better Financial Insights:

Unified dashboards present real-time business metrics, sales trends, and profitability reports, helping sellers make faster, evidence-driven strategic decisions.

Cost Efficiency:

Automation enables sellers and accounting teams to manage more work with fewer resources, minimizing unnecessary labor costs and overhead.

Improved Productivity:

Freed from routine tasks, teams can quickly process more accounts and even serve more clients, focusing on what drives greater business value.

Secure Data Management:

Cloud-based uploads, encrypted storage, and role-based access controls mean all sensitive sales and financial data remain protected from loss or unauthorized access.

Get Started: Actionable Steps for Fast Automation

Step 1: Prepare Official Sales Sheets

- Download official Excel sales sheets from each eCommerce platform (Amazon, Flipkart, Meesho, Ajio).

- Ensure clean data, correct column headers, and completeness.

Step 2: Upload and Preview in Suvit

- Log in to Suvit, select the upload function, and preview the sheet data for issues.

- Validate dates, transaction periods, and matching column headers.

Step 3: Map Columns for Tally Integration

- Use Suvit’s mapping tool to connect sheet columns with Tally’s accounting fields.

- Save mapping templates for quick reuse.

- Adjust manually for any unmatched columns; accuracy here ensures seamless automation.

Step 4: Validate and Push Data to Tally

- Review flagged errors and discrepancies, correcting where needed.

- Send all validated sales transactions to Tally in bulk, with GST ledger mapping enabled.

Best Practices for Maximizing Suvit’s Accounting Automation

- Always use unaltered, official sales sheets from each marketplace.

- Standardize data columns and headers for consistent mapping.

- Regularly review mapping templates and update them for new sales sheet formats.

- Confirm GST and TDS settings within Suvit to reflect the latest compliance rules.

Streamline Multi-Marketplace Accounting Now

Suvit offers a practical, intelligent solution for automating eCommerce accounting by facilitating the upload, mapping, and integration of sales Excel sheets from Amazon, Flipkart, Meesho, and Ajio into Tally ERP.

Sellers and accountants can eliminate manual entry, reduce errors, maintain compliance, and spend more time on strategic business operations.

Apply this approach for efficient multi-marketplace accounting and operational excellence.

FAQs

Q1: How does Suvit help automate eCommerce accounting?

Suvit allows users to upload sales Excel sheets from platforms like Amazon, Flipkart, Meesho, and Ajio, then maps these sheets to Tally for automatic ledger creation and reconciliation, eliminating manual data entry.

Q2: Can Suvit handle GST compliance automatically?

Yes, Suvit automatically maps GST components from sales sheets, performs validations, and ensures GST filings are accurate and error-free, simplifying compliance for Indian eCommerce sellers.

Q3: Which eCommerce platforms does Suvit support for sales data uploads?

Suvit supports major platforms such as Amazon, Flipkart, Meesho, AJIO, and others, enabling multi-platform sales data integration through simple sheet uploads.

Q4: Is Suvit suitable for accounting professionals and CAs?

Suvit is designed to assist Chartered Accountants and tax professionals in automating eCommerce bookkeeping, GST reconciliation, and data management, enhancing their practice efficiency.

Q5: How can I get started with Suvit for my eCommerce business?

Begin by downloading sales sheets from your platforms, ensuring data accuracy, uploading these sheets to Suvit, mapping columns with your Tally, and then exporting verified data into Tally for seamless accounting.