In India, Goods and Services Tax has become a vital part of every business's tax framework. However, for businesses with multiple branches or distinct GST Identification Numbers (GSTINs) across various states, GST compliance becomes increasingly complex.

Managing accurate returns, tracking input tax credits, and complying with diverse tax rates across multiple regions can be overwhelming.

For businesses facing these challenges, leveraging automation tools has emerged as the most effective solution.

This blog explores how automation simplifies multi-entity GST compliance, consolidates data across various entities, and ensures timely and accurate filings, helping businesses stay compliant and avoid penalties.

Challenges of Multi-Entity GST Compliance

1. Complexity of Managing Multiple GSTINs

Managing GST compliance across various regions requires businesses to have multiple GSTINs, one for each state. This creates several challenges:

- Different filing deadlines for each GSTIN.

- Varying tax rates in different regions.

- Multiple sets of returns and reporting requirements.

2. Issues with Data Consolidation

Handling data from multiple branches or entities can become an administrative nightmare.

- Discrepancies: Data is often stored in different formats across various systems.

- Manual Entry: Consolidating this data manually increases the likelihood of human errors.

3. Compliance Risks and Penalties

Non-compliance due to missing deadlines, errors in filing, or inaccurate returns leads to:

- Penalties and fines.

- Audit risks from incorrect or inconsistent filings.

How Automation Simplifies Multi-Entity GST Compliance

Automation tools provide several solutions to help businesses tackle the complexities of multi-entity GST compliance.

Here's how:

1. Streamlined Data Aggregation and Filing

- Automated Data Integration: Automation consolidates data from various GSTINs in real-time.

- Accurate Reporting: Automatically generates GST reports and ensures correct tax calculations across branches.

- Real-Time Data Updates: Ensures all data is current, reducing discrepancies.

2. Simplified GST Returns and Reconciliation

- Automated Tax Calculation: GST liabilities and input tax credits (ITC) are calculated automatically for each entity.

- Efficient Reconciliation: Reconciliation of inter-branch transactions happens in real-time, ensuring consistency.

3. Real-Time Updates and Alerts

- Compliance Deadlines: Automated systems send alerts for important deadlines.

- Regulatory Updates: Businesses receive notifications on changes to tax rates or compliance requirements.

4. Reduced Risk of Human Error

- Minimal Manual Intervention: Automation minimizes the risk of GST errors during data entry, tax calculation, and report generation.

- Consistency: Standardized processes across all entities ensure uniformity.

Benefits of GST Automation for Businesses with Multiple Entities

1. Efficiency and Time Savings

Automation reduces time spent on manual consolidation, reporting, and filing. With automation, businesses can:

- Manage all GST returns from one platform.

- Redirect time saved towards core business activities.

2. Cost Reduction

By automating the GST process, businesses can:

- Eliminate manual errors, reducing the cost of corrections.

- Avoid penalties due to late or incorrect filings.

3. Enhanced Compliance and Audit Readiness

- Timely Filings: With automation, businesses are always prepared for audits with accurate, timely reports.

- Transparency: All records are digitized, ensuring transparency in filings.

4. Scalability for Growing Businesses

As businesses expand, automation tools like Suvit scale effortlessly. This means businesses can:

- Add new branches or GSTINs without worrying about manual compliance tasks.

- Ensure consistent compliance across growing operations.

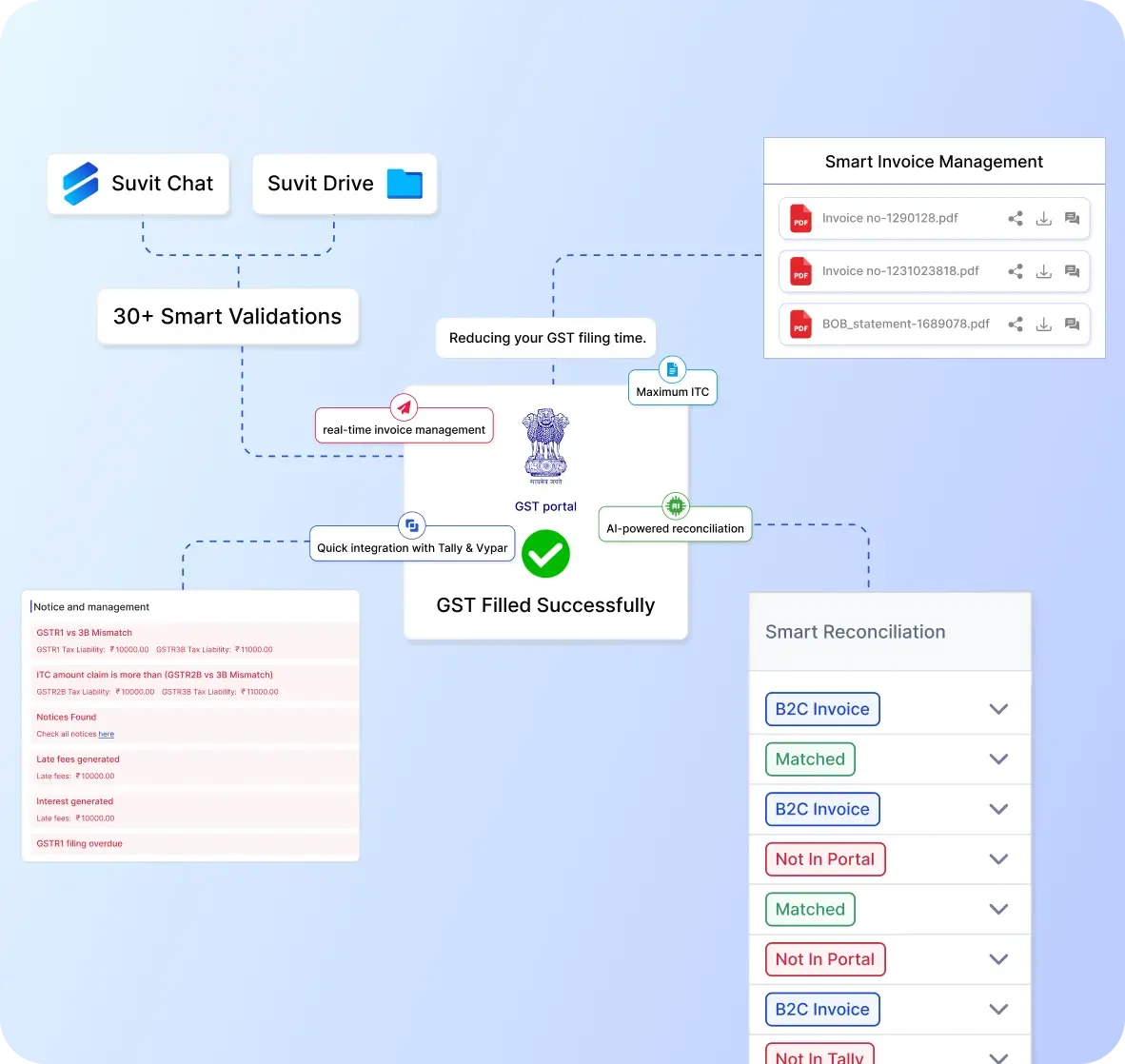

Suvit’s GST Automation Feature: A Comprehensive Solution

Suvit’s GST automation tool addresses the unique challenges of businesses with multiple entities. Below are the key features that make Suvit a powerful solution for multi-entity GST compliance:

1. Multi-Entity Integration

- Centralized System: Suvit integrates multiple GSTINs seamlessly, allowing businesses to manage all GST activities from one dashboard.

2. Centralized Dashboard

- All-in-One Access: A user-friendly dashboard provides an overview of the GST compliance status of all entities in one place.

- Real-Time Updates: Receive instant alerts on the status of returns and discrepancies.

3. Automated Reconciliation

- Cross-Entity Reconciliation: Suvit’s system automatically reconciles transactions between inter-branch operations, ensuring consistent records across all entities.

4. Real-Time Alerts and Notifications

- Stay Informed: Receive notifications on compliance deadlines, discrepancies, or changes in tax regulations to ensure your business is always ahead of the curve.

5. Tax Calculation and Filing

- Accurate Filing: Suvit’s automation tool calculates GST liabilities and ITC for each entity, then automatically generates and files GST returns on your behalf.

Why Choose Suvit for GST Automation?

Suvit’s GST automation tool is designed to streamline and simplify the GST filing process for businesses managing multiple entities. Here’s why businesses trust Suvit:

- Comprehensive Coverage: Suvit manages multiple GSTINs across diverse jurisdictions, making it ideal for multi-entity businesses.

- User-Friendly Interface: The intuitive dashboard allows easy management and monitoring of all compliance activities.

- Scalable Solution: As your business grows, Suvit’s automation scales seamlessly to accommodate additional GSTINs and entities.

Suvit’s GST Automation vs Manual Compliance

| Feature | Manual Compliance | Suvit’s GST Automation |

|---|---|---|

| Data Consolidation | Time-consuming, error-prone | Automated, real-time aggregation of data |

| Tax Calculation | Requires manual effort, prone to errors | Automated calculation of GST liabilities |

| Reconciliation | Complex, prone to discrepancies | Real-time reconciliation between entities |

| Filing Compliance | Risk of missed deadlines and penalties | Timely, accurate, and automatic filings |

| Audit Readiness | Requires manual preparation and checks | Always audit-ready with organized, digital records |

Simplifying Multi-Entity GST Compliance Through Automation

Managing GST compliance across multiple entities or GSTINs is challenging. However, with the advent of automation, businesses can streamline this process, reduce errors, and enhance compliance.

Automation tools, such as Suvit’s GST automation tool, offer significant benefits: saving time, reducing costs, and ensuring timely filings. These tools are scalable, allowing businesses to grow without the burden of manual GST compliance.

By adopting Suvit’s GST automation, businesses can consolidate their GST data efficiently, stay compliant, and mitigate the risks associated with manual errors or late filings.

If you’re looking to simplify your multi-entity GST compliance, explore Suvit’s GST automation tool today. Improve your compliance process, save time, and ensure accurate returns with Suvit.

Try Suvit for free for a week!

FAQs

1. What is multi-entity GST compliance?

Multi-entity GST compliance refers to managing GST filings and returns for businesses that have multiple GSTINs across various states or regions. It involves consolidating data from different branches and ensuring accurate and timely compliance with GST laws.

2. How does GST automation help businesses with multiple GSTINs?

GST automation simplifies the process by consolidating data from various GSTINs, automating tax calculations, reconciling transactions, and ensuring timely filings, reducing manual errors and compliance risks.

3. What are the key benefits of automating GST compliance?

Automation saves time, reduces manual errors, ensures accurate filings, improves compliance, and provides real-time alerts on deadlines, tax rates, and discrepancies, making the entire GST management process more efficient.

4. Can Suvit’s GST automation tool handle multiple GSTINs?

Yes, Suvit’s GST automation tool integrates multiple GSTINs into a centralized system, streamlining data consolidation, tax calculations, and filings across various entities, making compliance management easier for businesses with multiple branches.

5. How does Suvit ensure GST compliance across growing businesses?

Suvit’s GST automation tool is scalable, allowing businesses to easily add new GSTINs as they expand, while ensuring consistent compliance and reducing administrative overhead for both small and large enterprises.