The Goods and Services Tax (GST) framework requires every registered taxpayer to file periodic returns, including the GSTR-1 return, which summarizes all outward supplies (sales).

For businesses filing quarterly under the QRMP scheme, understanding the exact filing timelines and compliance rules for the August 2025 quarter is essential to avoid penalties and secure smooth operations.

This blog details the official due dates, filing requirements, recent amendments, and actionable advice to ensure timely and accurate GSTR-1 submissions.

Understanding Quarterly GSTR-1 Filing

What is GSTR-1?

GSTR-1 is a statutory GST return that captures outward supply invoices, enabling the government and buyers to reconcile input tax credit claims. Filing this return correctly reflects the supply transactions and ensures proper GST credit flow.

Taxpayers can file GSTR-1 monthly or quarterly, with quarterly filing available under the QRMP scheme for businesses with turnover up to ₹5 crore in the previous financial year.

Who Should File Quarterly GSTR-1?

Businesses with an aggregate turnover of up to ₹5 crore who opt for the Quarterly Return Monthly Payment (QRMP) scheme must file GSTR-1 quarterly.

This scheme aims to reduce the compliance burden on small and medium enterprises while maintaining regulatory transparency. Taxpayers must stay vigilant about quarterly deadlines, including the August 2025 quarter.

Key Details About the August 2025 Due Date

Official Due Date for August 2025 Quarter

For July–September 2025, including August, the quarterly GSTR-1 is due on 13th October 2025. This due date allows taxpayers sufficient time to consolidate all sales invoices for three months and submit them accurately. Missing this deadline attracts late fees and can delay input tax credit claims by buyers.

Late Fees and Filing Restrictions

- Late fees amount to ₹50 per day (₹25 CGST + ₹25 SGST) for every day of delay, with a capped maximum fee depending on turnover. The highest late fee for turnover up to ₹5 crore is ₹5,000.

- Filers with nil GSTR-1 returns incur a lower late fee of ₹20 per day, capped at ₹500.

- Significantly, the GSTN portal restricts filing GSTR-1 beyond three years from the due date, emphasizing prompt compliance.

Recent Compliance Notifications

- Taxpayers must report valid HSN codes in Table 12 with bifurcation into B2B and B2C tabs, an update to improve accuracy.

- For B2C supplies where no B2B supply exists, an entry in Table 12A (B2B summary) with dummy HSN and zero values is required to proceed with filing.

- Amendments to filed GSTR-1 are only possible via subsequent returns within the filing period and cannot be revised after submission.

Practical Insights for Smooth Compliance

Preparing Accurate Quarterly GSTR-1

- Consistently upload all sales invoices using the Invoice Furnishing Facility (IFF) for the first two months and consolidate the third month for quarterly filing.

- Verify all GSTINs, invoice values, and tax rates before final submission to avoid validation errors on the GST portal.

- Use the drop-down menu provided by GSTN for HSN codes rather than manual entry to reduce mistakes.

Common Filing Issues and Resolutions

- Leaving Table 12A blank when no B2B supplies exist can block filing. Enter a dummy HSN code with zero values to resolve.

- Late filing leads to penalties and potential disruption in input tax credit flow for buyers.

- Do not submit GSTR-1 after three years, as the portal won’t accept it.

Leveraging Technology for Compliance

- Utilize GST software solutions that support QRMP scheme filings, invoice management, and real-time validation to streamline compliance.

- Periodic audit of sales data ensures there are no invoice mismatches or omissions. This proactive approach reduces filing errors.

How Suvit’s GST Automation Ensures Timely Filing and Reconciliation

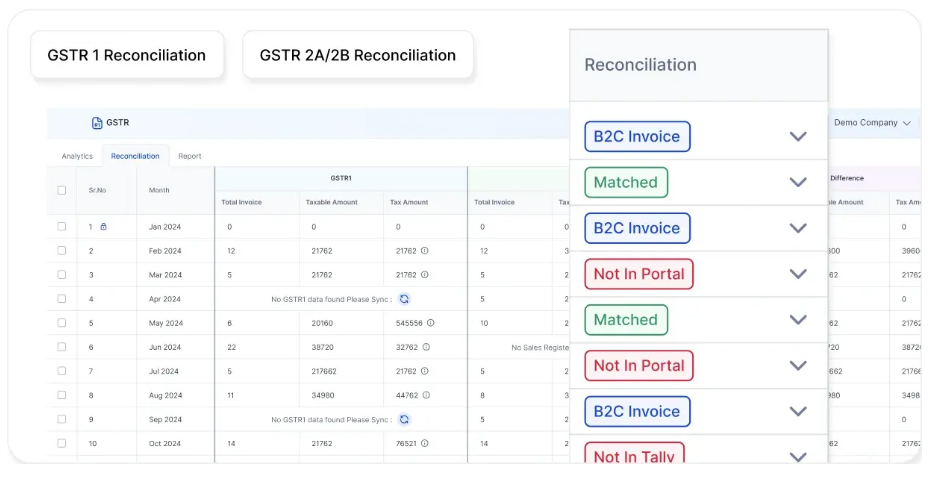

Suvit’s advanced GST automation platform streamlines the entire GSTR-1 filing process, especially for quarterly filers under the QRMP scheme. Its integrated reconciliation engine automatically matches sales invoices with purchase data, flagging discrepancies instantly to avoid last-minute surprises.

The platform offers real-time alerts and reminders for upcoming GSTR-1 due dates, helping businesses stay proactive and compliant.

Key benefits of Suvit’s GST automation include:

- Automated Invoice Uploads: Seamlessly import sales data from multiple systems, reducing manual entry errors.

- Intelligent Reconciliation: Auto-compare outward supplies with suppliers’ data, ensuring accuracy before filing.

- Compliance Validation: Built-in GSTN rule checks, including HSN code validations and table-wise data accuracy.

- Deadline Notifications: Timely alerts and filing reminders prevent missed deadlines and associated penalties.

- Amendment Support: Facilitate easy corrections and amendments within the allowed filing period.

By leveraging Suvit, businesses can confidently manage quarterly GSTR-1 submissions, improve data accuracy, optimize cash flow through timely claim of input tax credits, and mitigate risks of late fees, ensuring full GST compliance with minimal effort.

Actionable Compliance Tips

- Upload invoices regularly via IFF for early months; finalize and review before the due date.

- Always enter valid HSN codes using the GST portal drop-down lists.

- Make dummy entries in Table 12A when no B2B supplies exist but B2C supplies are reported.

- Monitor notifications and adapt to any GSTN portal changes promptly.

- Use expert GST software with validation tools to minimize errors.

Stay Ahead in GST Compliance: Ensure Timely Quarterly GSTR-1 Filing

The quarterly GSTR-1 for August 2025 (part of the July–September 2025 quarter) is due by 13th October 2025 for QRMP taxpayers, with strict penalties for late filing.

Staying aware of updated filing rules, making timely entries, and leveraging technology are vital to ensuring smooth GST compliance.

By preparing proactively and following verified guidelines, businesses can avoid costly delays and maintain seamless input tax credit flows with suppliers and customers.

FAQs

Q1. Who is eligible to file Quarterly GSTR-1 under the QRMP scheme?

Taxpayers with an aggregate turnover of up to ₹5 crore in the previous financial year can file GSTR-1 quarterly under the QRMP scheme.

Q2. What is the due date for Quarterly GSTR-1 filing for the August 2025 quarter?

The due date for filing GSTR-1 for the July-September 2025 quarter (including August) is 13th October 2025.

Q3. Can I file a nil GSTR-1 if there are no outward supplies?

Yes, even if no sales are made during the period, filing a nil GSTR-1 is mandatory to remain compliant.

Q4. Is it possible to amend a GSTR-1 return after submission?

No, once submitted, GSTR-1 cannot be revised. However, corrections can be made in the next period’s return using amendment tables.