Hey there, fellow business owners and taxpayers!

Keeping up with GST transactions can feel like a juggling act sometimes. But guess what?

The Goods and Services Tax Network (GSTN) has rolled out a handy tool to make our lives easier – the GSTN e-Services mobile app.

This app is a game-changer, letting you track all your GST activities right from your smartphone.

Pretty cool, right? Let's explore how this app can simplify your GST journey!

What is the GSTN e-Services Mobile App?

The GSTN e-Services app is a free mobile application available on both the Google Play Store for Android users and the App Store for iOS users.

It's designed to provide easy access to your GST transaction history and other important information.

Think of it as your personal GST assistant, always ready to help!

Why Should I Use the GSTN e-Services App?

This app is all about convenience and transparency. Here are a few reasons why you should definitely give it a try:

- Track Your Transactions Anytime, Anywhere:

The app lets you monitor your entire GST transaction history linked to your GSTIN (Goods and Services Tax Identification Number). Whether you're at your desk or on the go, you can stay updated on your GST activities.

- Stay Compliant with Ease:

The app provides real-time notifications and helps you monitor your GST return filings. This makes it super easy to stay on top of your tax liabilities and avoid any penalties.

- Verify e-Invoices Effortlessly:

The app makes it easy to scan and verify e-invoice QR codes. This ensures the authenticity of your transactions and helps you avoid any fraudulent activities.

Key Features of the GSTN e-Services App

This app is packed with features designed to simplify your GST experience.

Let's take a closer look:

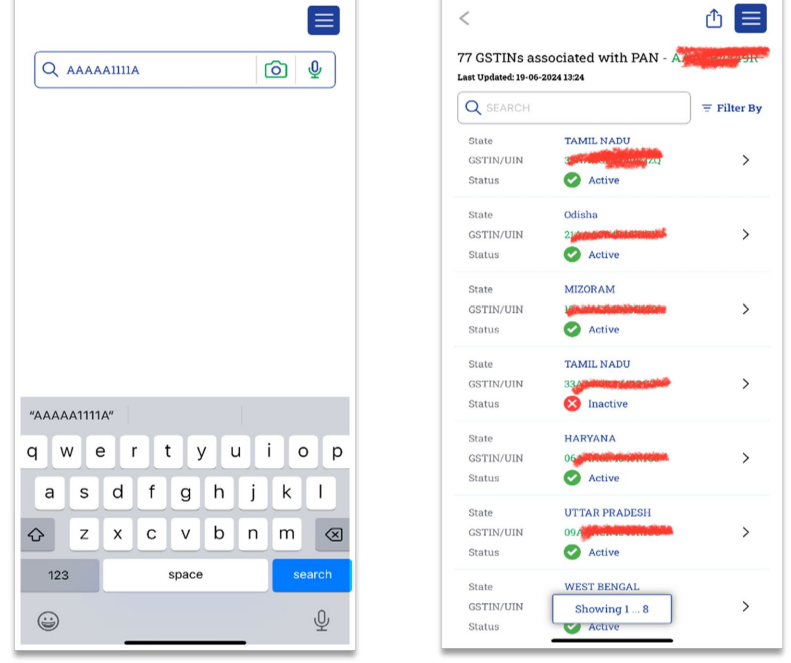

Taxpayer Authentication

You can easily search for any registered business using their GSTIN or PAN. This feature comes in handy when you need to verify the details of your business partners or suppliers.

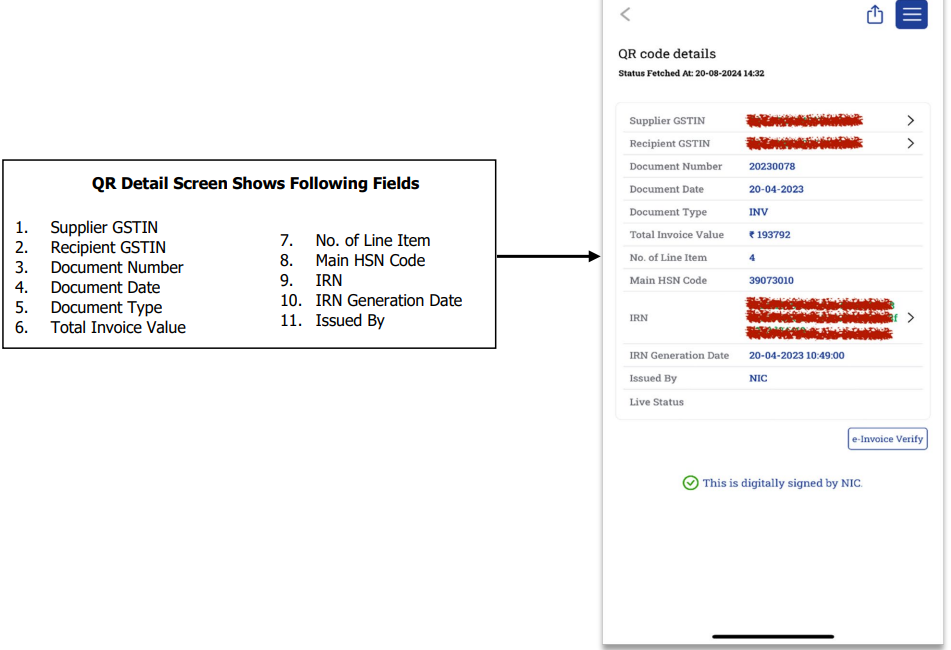

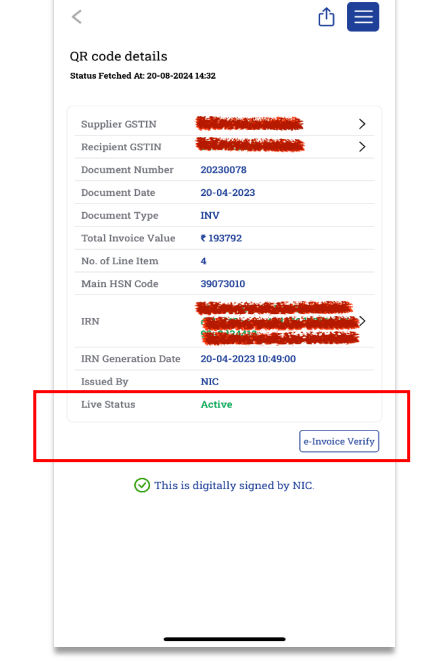

QR Code Authentication

Scan QR codes on e-invoices to instantly verify their authenticity. This helps ensure the legitimacy of your transactions and protect you from potential fraud.

IRN (Invoice Reference Number) Verification

Check the status of Invoice Reference Numbers (IRNs) to verify the validity of issued e-invoices. This ensures that all your invoices are properly registered and accounted for.

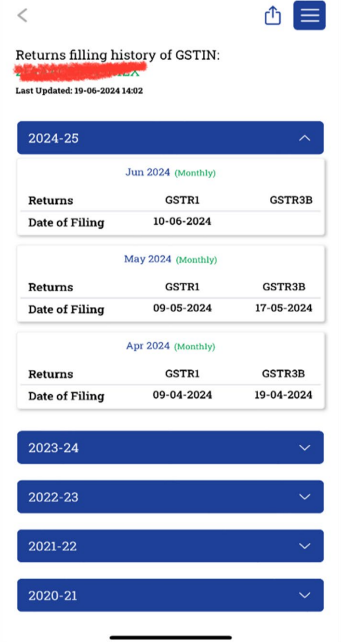

History of Return Filings

View and examine any GSTIN's return filing history. This allows you to monitor your own compliance and that of your business partners.

Benefits of Using the GSTN e-Services App

Let's talk about how the app can be a real lifesaver in managing your GST and other tax obligations:

- Save Time and Money: The app automates many GST compliance tasks, freeing up your time and resources for other important business aspects.

- Reduce Errors and Penalties: The app provides real-time information and notifications to help you avoid common errors in GST filings, reducing the risk of penalties and fines.

- Improve Transparency and Accountability: The app makes it easier to track your GST transactions and ensure that all your invoices are properly registered, promoting transparency and accountability in your business operations.

- Make Informed Business Decisions: The app provides easy access to your GST transaction history and return filing status, enabling you to make more informed business decisions.

How to Use the GSTN e-Services App

Using the app is super easy and clear:

- Download and Install: Head over to the Google Play Store or the App Store and download the GSTN e-Services app.

- No Login Required! That's right, you don't need any login credentials or authentication to use the app. Open the app, then begin exploring.

- Search and Explore: Use the search bar to enter a GSTIN or PAN and access various details, including transaction history and return filing status. You can even use voice input or scan text for easier input.

- Scan and Verify: Use the app to scan e-invoice QR codes for quick and easy verification.

Stay Ahead of the Curve

The GSTN e-Services mobile app is a testament to the increasing digitalization of tax processes in India.

It empowers businesses of all sizes to manage their GST compliance more efficiently and with greater transparency.

Never Miss a Tax Deadline!

In addition to managing your GST, the GSTN e-Services website offers a wealth of information for Indian taxpayers, including:

-

Latest Tax Updates: Stay informed about the latest changes and updates in tax laws and regulations, including GST, Income Tax, TDS, and Company Law. This ensures you are always up-to-date and compliant.

-

GST Updates by CBIC: Get the most recent circulars, orders, and notifications pertaining to GST from the Central Board of Indirect Taxes and Customs (CBIC). This helps you understand the latest interpretations and clarifications on GST provisions.

-

Income Tax + TDS Updates: Stay informed about any changes to income tax rates, deductions, exemptions, and TDS provisions.

-

Company Law Updates: Keep track of changes in company law, including incorporation, compliance requirements, and reporting deadlines.

-

Important Due Dates: Never miss a tax deadline! The website provides a comprehensive list of important tax due dates, including:

- GST Payment Due Dates

- Income Tax Return Filing Due Dates

- TDS/TCS Return Due Dates

- Due Dates of Filing ROC Return (Registrar of Companies)

- XBRL Filing Due Dates with MCA (Ministry of Corporate Affairs)

By utilizing these resources, you can streamline your tax compliance processes, stay informed about the latest developments, and avoid any potential penalties or compliance issues.

So why wait? Download the GSTN e-services app today and take control of your GST journey!

Need Help with Your Accounting and GST?

Managing your finances and GST compliance can be time-consuming. If you're looking for a way to streamline your accounting processes and automate your GST tasks, check out Vyapar TaxOne. It's an AI accounting tool that can:

- Automate your manual accounting tasks

- Simplify GST reconciliation

- Generate accurate financial reports

You can cut down on mistakes, save time, and concentrate on expanding your business with Vyapar TaxOne!

Try Vyapar TaxOne for free for a week!