Running an ecommerce business is exciting, but let’s accept the fact: GST compliance can feel daunting.

With multiple GST registrations, tax filings, and reconciling sales data across platforms like Amazon, Flipkart, or Shopify, the process can quickly become overwhelming.

Happens to you?

If you’ve been searching for an easier way to handle everything here’s the good news: GST software for ecommerce sellers can be a saviour.

In this guide, we’ll break down everything you need to know about GST software, why it’s essential for your ecommerce business, and how it can simplify compliance while giving you back precious time to focus on growing your online store.

Why Ecommerce Sellers Need GST Software

Ecommerce businesses operate in a rush and dynamic environment. Between managing inventory, marketing, and customer service, keeping up with GST regulations might feel like one more mountain to climb.

Here are some reasons why GST software is necessary for ecommerce sellers:

- Multiple GST Registrations: If your business operates in various states, you’re required to register for GST in each one. Managing these registrations manually can be cumbersome.

- Diverse Transaction Types: Ecommerce sellers handle B2B, B2C, and even export transactions—each with unique GST implications.

- Strict Deadlines: Missing a filing deadline could result in hefty penalties. GST software ensures you never miss an important date.

- Platform Integration Needs: Your sales data from platforms like Amazon and Flipkart must align with your GST returns, making accurate reconciliation necessary.

In short, GST software takes the complexity out of compliance and allows you to focus on scaling your ecommerce business.

Key Features to Look for in GST Software for Ecommerce Sellers

Choosing the right GST software can save you time, money, and headaches. Here are the must-have features:

1. Automated GST Return Filing

Say goodbye to manually entering data into GST returns. The right software can automatically generate and file GSTR-1, GSTR-3B, and other returns, ensuring accuracy and timeliness.

2. E-Way Bill Generation

If your ecommerce business involves shipping goods across state borders, you’ll need e-way bills. GST software simplifies this process by generating bills directly from your sales data.

3. GST Reconciliation

Ensure your sales data matches the GST portal’s records to avoid mismatches and penalties.

4. Multi-Platform Integration

Look for software that integrates seamlessly with ecommerce platforms like Amazon, Flipkart, Shopify, or WooCommerce, as well as accounting tools like Tally or Zoho Books.

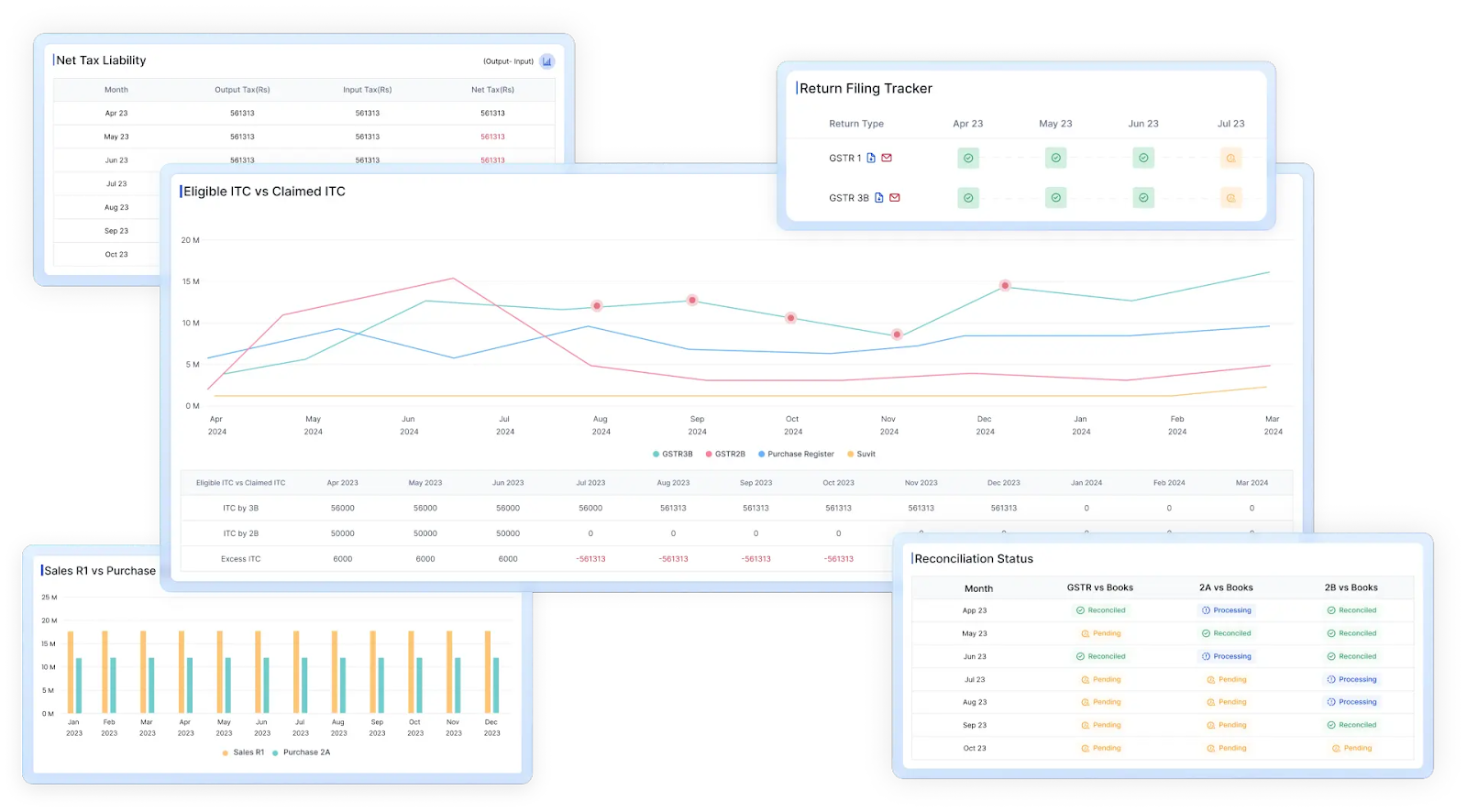

5. Real-Time Reporting and Analytics

Stay on top of your GST liabilities, ITC claims, and filing status with easy-to-understand dashboards and reports.

6. User-Friendly Interface

You don’t need to be a tech expert to use GST software. Opt for solutions with intuitive dashboards and guided workflows.

Top GST Software for Ecommerce Sellers in India

Here are some of the best GST software options designed to simplify compliance for ecommerce businesses:

1. Suvit

Suvit’s cloud-based GST software is tailored for ecommerce sellers, offering automated data entry, GST reconciliation, and platform integrations. Its intuitive design makes it easy to use even for small businesses.

2. Vyapar

Perfect for small ecommerce sellers, Vyapar offers GST invoicing, return filing, and inventory tracking at an affordable price point.

3. ClearGST

Popular among businesses, ClearGST offers features like e-way bill generation, multi-platform integrations, and accurate reconciliation tools.

4. Zoho Books

Zoho Books combines accounting and GST compliance in one platform. It’s a good choice for ecommerce sellers who want a comprehensive solution.

5. TallyPrime

TallyPrime’s GST module simplifies return filing and reconciliation, making it a trusted choice for Indian businesses

How GST Software Streamlines Ecommerce Compliance

Using GST software can change your compliance process.

Here’s how:

- Automation: Automate repetitive tasks like return filing and e-way bill generation, saving hours of manual work.

- Error Reduction: Minimize human errors in invoicing, tax calculations, and reconciliations.

- State-Wise Compliance: Easily manage GST registrations and filings across multiple states.

- Input Tax Credit Tracking: Maximize your ITC claims with accurate tracking and reconciliation.

Helpful Tips for Choosing the Best GST Software

Here’s how to pick the right GST software for your ecommerce business:

- Scalability: Make sure the software you choose can handle increased sales volume as your business grows.

- Cloud-Based: Look for cloud solutions to access your data anytime, anywhere.

- Support & Training: Opt for software with robust customer support and tutorials.

- Regular Updates: GST regulations develop, so choose software that keeps up with the latest changes.

Success Story: Ecommerce Sellers Using GST Software

Take the example of Priya, an ecommerce seller running a successful home decor store on Amazon.

Before using GST software, Priya struggled to reconcile her monthly sales data and often missed filing deadlines.

After adopting Suvit, she tracked her GST returns, automated GST reconciliations, and saved hours of calculating ITC every month—freeing up time to focus on growing her product line.

Make a Smart Move by Choosing the Right GST Software

GST compliance doesn’t have to be a headache. With the right GST software, ecommerce sellers can streamline their processes, stay compliant, and focus on what matters most—growing their business.

Whether you’re managing multiple platforms or scaling to new markets, GST software ensures you’re always a step ahead.

Ready to simplify your GST compliance? Explore Suvit’s GST Module today and experience the difference!

FAQs

1. Can GST software integrate with my ecommerce platform?

Yes, most GST software solutions offer seamless integration with platforms like Amazon, Flipkart, and Shopify.

2. How does GST software help with input tax credit claims?

By automating reconciliation and tracking eligible credits, GST software ensures you don’t miss out on any ITC claims.

3. Is GST software affordable for small ecommerce sellers?

Yes, there are budget-friendly options like Vyapar designed specifically for small businesses.