In 2025, GST reconciliation has become an integral part of compliant and efficient financial management for Chartered Accountants.

With the continuous evolution of the Indian GST system, Chartered Accountants face mounting challenges such as handling large data volumes, reconciling mismatches, and ensuring accurate Input Tax Credit (ITC) claims. Relying on manual reconciliation processes is not only time-consuming but also prone to costly errors.

Thankfully, modern GST reconciliation software is transforming how professionals manage compliance. Tools specifically designed for CAs provide automation, error detection, and client management features that save hours of labor.

This guide explores the leading reconciliation solutions in 2025 and offers practical tips for CAs to stay ahead.

Why GST Reconciliation Matters in 2025

GST reconciliation remains at the heart of compliance because mismatches in filing can lead to penalties, legal notices, and revenue loss. For Chartered Accountants, regular reconciliation ensures:

- Accurate matching of sales and purchase invoices with GST portal records

- Correct and optimize the Input Tax Credit claims

- Error-free filing of GSTR-1, GSTR-3B, and annual returns

- Improved efficiency while managing multiple clients and bulk invoices

- Greater trust and transparency in client reporting

With government scrutiny on GST filings increasing year by year, reconciliation has shifted from a periodic task to a continuous compliance process.

Key Features to Look for in GST Reconciliation Software

The best GST reconciliation software for CAs in 2025 provides advanced automation and user-friendly features. Leading solutions include:

- Auto-matching invoices with GSTR-2A and GSTR-2B data

- Real-time reconciliation and automatic error detection

- Bulk invoice upload and processing within minutes

- Multi-client management dashboards tailored for tax professionals

- Seamless integration with popular accounting software (Tally Prime, Zoho Books, Busy Accounting, etc.)

- Cloud-based security with updated compliance features after each government notification

Top GST Reconciliation Software for Chartered Accountants in 2025

Suvit

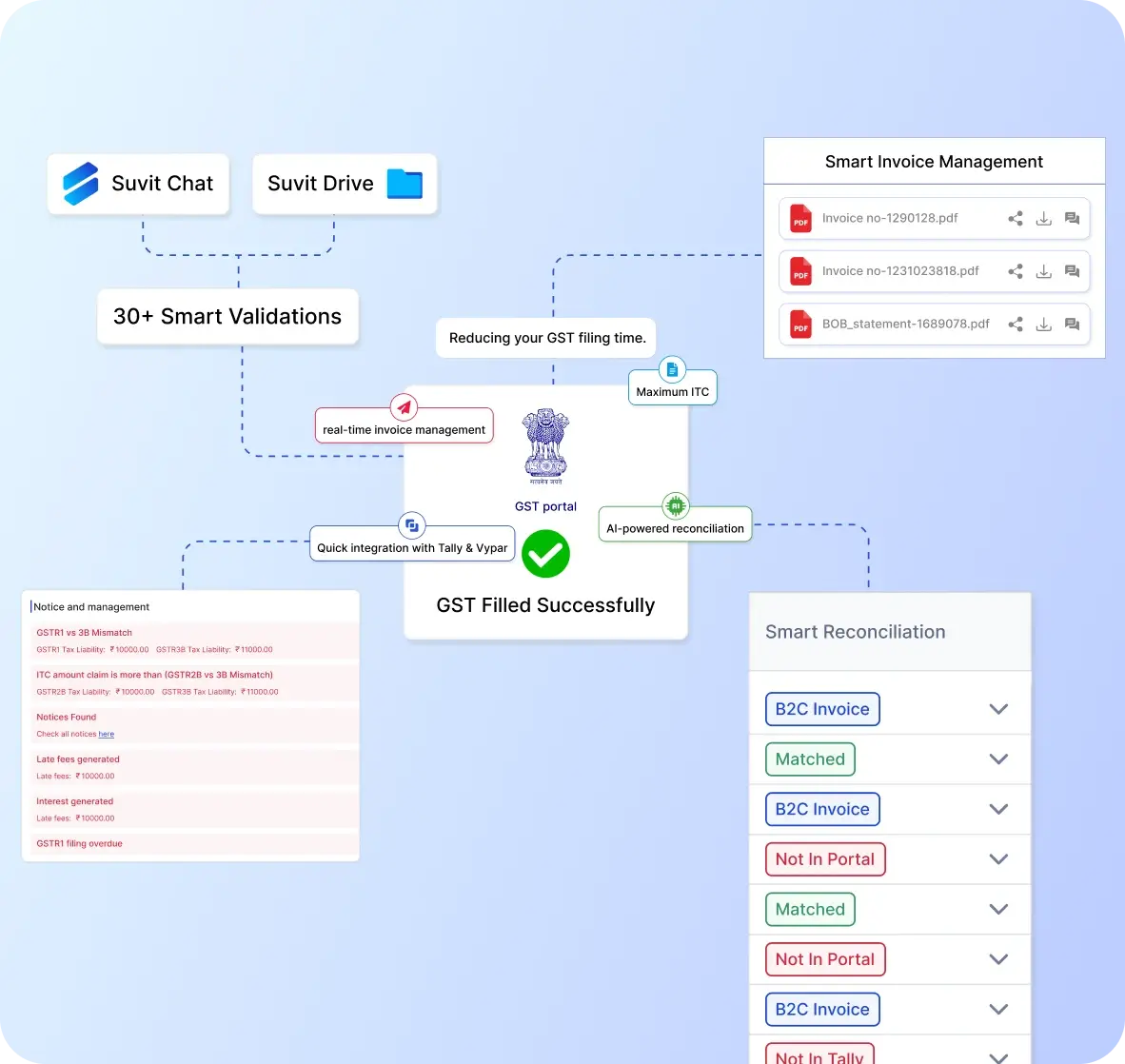

As one of the fastest-growing automation platforms for CAs, Suvit leads the way in 2025 by offering:

- AI-driven GST reconciliation with unmatched accuracy

- Bulk invoice upload and auto-matching with GSTN data

- Multi-client management tailored for Chartered Accountants

- Compatible with major accounting platforms like TallyPrime

- Compliance-focused dashboards and detailed analytics reports

CAs using Suvit GST reconciliation software report saving up to 80% of their time on compliance tasks, while ensuring error-free returns and client satisfaction.

ClearTax GST

- Advanced GST filing and reconciliation platform

- AI-based mismatch identification and ITC tracking

- Designed for ease of collaboration across CA teams

- Popular for annual return filings like GSTR-9 and audit reconciliation

TallyPrime with GST Module

- Trusted accounting software with GST compliance features

- Easy invoice reconciliation and ledger management

- Mixes offline and online tools to suit SME clients

- Preferred for comprehensive accounting operations beyond GST

Zoho Books with GST Integration

- Cloud-first solution for tax-compliant accounting

- Automated generation of GST returns, including GSTR-1 and GSTR-3B

- Fast reconciliation with the GST portal

- Suitable for e-commerce and startups requiring flexible reporting

Genie GST

- Purpose-built GST tool for bulk reconciliation

- Real-time mismatch alerts and ITC computations

- Supports multi-client scalability for CA firms

- Focused on usability and automation

Benefits of Using GST Reconciliation Software for CAs

For Chartered Accountants, GST reconciliation tools offer far more than just compliance; they provide efficiency, competitiveness, and client confidence.

Key benefits include:

- Saving 70–80% of the manual time typically spent on reconciliation

- Enhancing accuracy and reducing the likelihood of compliance risks

- Providing professional, client-ready reports with transparency

- Enabling CA firms to scale by efficiently handling large client pools

- Staying up-to-date with the latest GST compliance requirements

How to Choose the Right Software in 2025

When selecting the most suitable GST reconciliation tool, Chartered Accountants should consider:

- Client volume and data complexity

- Compatibility with existing accounting systems like Tally or Zoho Books

- Accuracy in GST mismatch detection and ITC claim calculation

- Vendor’s support, update frequency, and data security policies

- Pricing plans that align with a firm’s scalability needs

Practical Tips for Chartered Accountants

To maximize the value of GST reconciliation software in 2025, Chartered Accountants should follow these practices:

- Set monthly or quarterly reconciliation cycles to avoid year-end pressure

- Train staff to use AI-powered features for faster adaptation

- Monitor GST Council notifications and ensure timely software updates

- Leverage analytics tools to offer advisory beyond compliance

- Secure client data by regularly backing up reconciled records

Take Control of Your GST Compliance Today

In 2025, GST reconciliation software is a critical tool for efficiency, compliance, and scalability. Platforms like Suvit empower professionals to move beyond manual tasks, reduce compliance risks, and deliver more value to their clients.

By adopting innovative technology, Chartered Accountants can stay ahead in the evolving GST era, ensuring their firms remain agile, trusted, and future-ready.

FAQs

1. What is GST reconciliation software?

It is an automated tool that helps Chartered Accountants compare purchase and sales data from their books with GST portal data, ensuring accurate Input Tax Credit claims and compliance.

2. Why is GST reconciliation meaningful for Chartered Accountants?

It prevents errors and mismatches in GST returns, which can lead to penalties, ITC denial, and audits. It also saves time by automating manual reconciliation processes.

3. Can GST reconciliation software handle multiple clients?

Yes, top software like Suvit offers multi-client management features explicitly tailored for CA firms to manage GST compliance for many clients efficiently.

4. Is manual Excel reconciliation still effective in 2025?

For small-scale operations, it might work, but for larger firms and complex data, automated software is far more accurate, scalable, and aligned with current GST regulations.

5. What key features should I look for in GST reconciliation software?

Look for error detection, bulk invoice upload, GSTR-2A/2B auto-matching, integration with accounting tools like Tally or Zoho Books, multi-client dashboard, and compliance updates.