In India's dynamic tax environment, tax professionals are paramount in guiding clients through goods and services tax (GST) compliance.

Effective support mechanisms have become essential with evolving GST processes and increasing complexities.

The GST Complaint Portal and the GST Helpdesk are indispensable tools for resolving issues and providing assistance.

This blog aims to clarify these platforms' differences, enabling tax professionals to optimize their use for client benefit and ensure smooth GST operations.

TL;DR

- Key differences between the GST Complaint Portal and GST Helpdesk.

- Learn which platform to use for formal grievances versus routine GST queries.

- Practical advice for Tax professionals on guiding clients appropriately.

- Current challenges faced in GST compliance management.

- Actionable insights to improve client support and compliance outcomes.

Understanding GST Support Channels

GST Complaint Portal

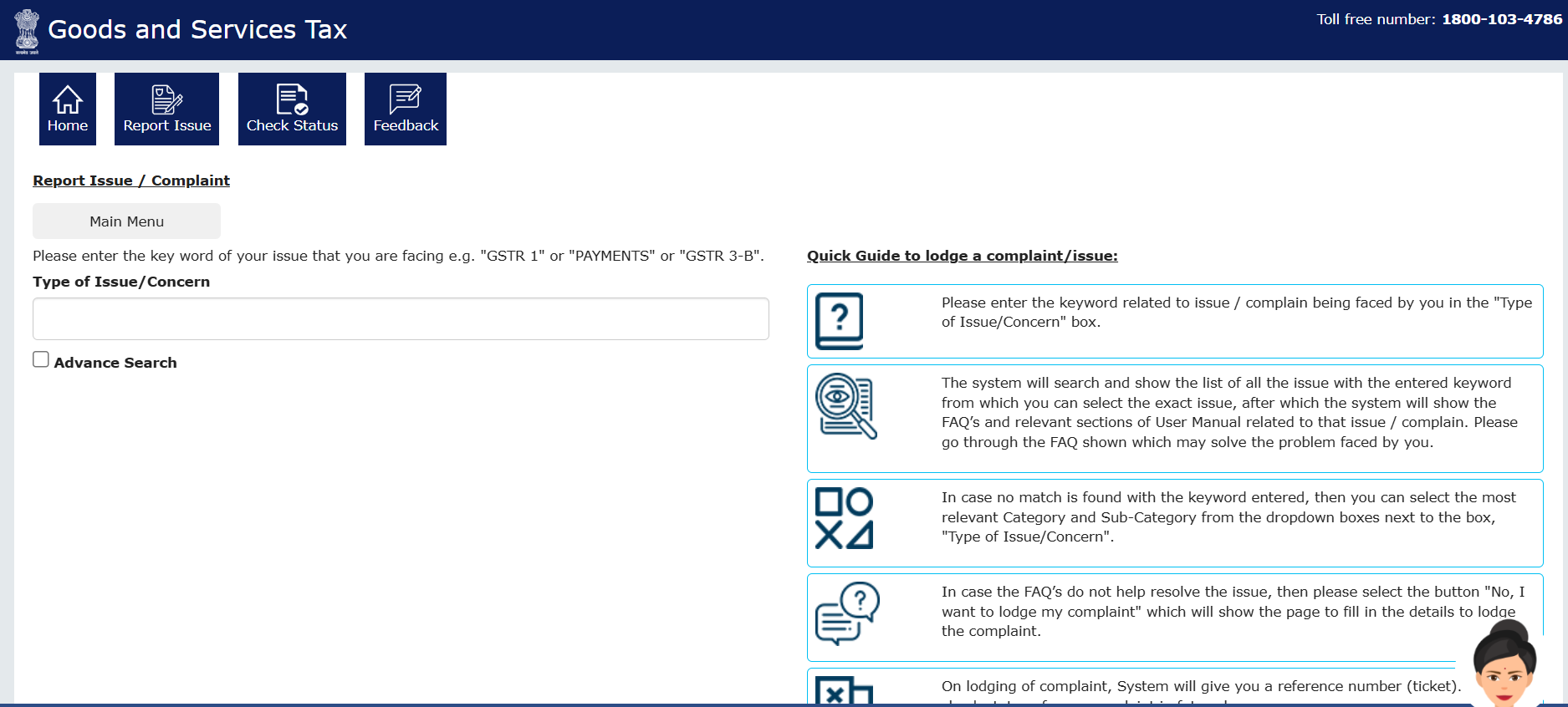

The GST Complaint Portal is designed for users to file formal grievances related to GST processes. It deals primarily with registration delays, refund processing problems, and technical system glitches that users encounter during compliance.

Through a structured complaint submission process, users can seek resolution and track the status of their grievances.

- Types of complaints handled: Registration problems, refund delays, payment mismatches, system errors

- GST complaint filing process: Online submission with details of the issue and user information

- Response timeline: Typically within a few working days, subject to escalation

- Escalation: Available if initial responses are unsatisfactory, ensuring accountability

GST Helpdesk

The GST Helpdesk is an immediate support system assisting primarily through queries and procedural guidance. It is the first point of contact for taxpayers and professionals requiring clarifications on GST filings, return submission processes, or technical support for the GST portal.

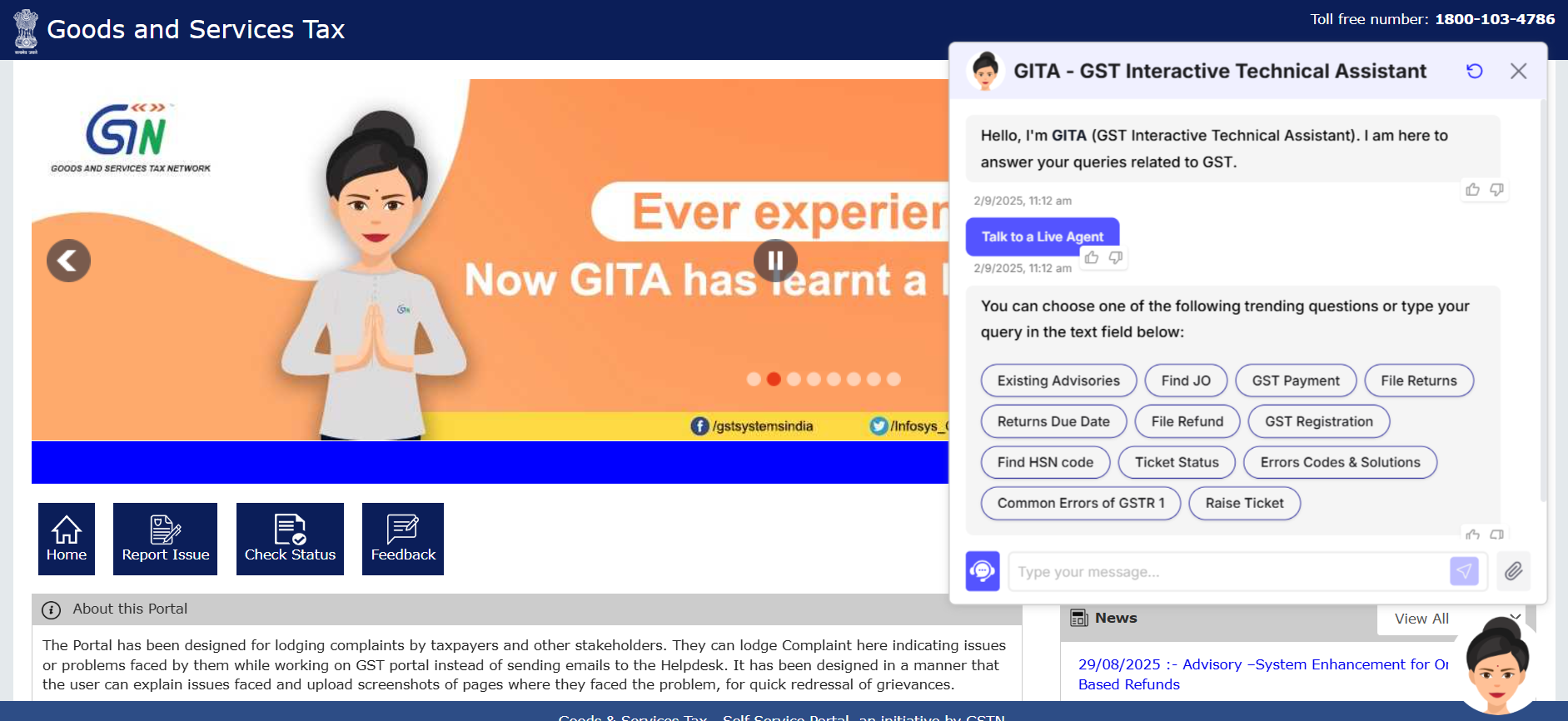

GITA, the GST Interactive Technical Assistant, is an AI-driven virtual assistant that provides users with real-time support for their GST-related questions, delivering fast and precise answers and guidance on compliance and filing procedures.

- Scope: Responds to routine queries and procedural clarifications

- Contact modes: Phone helpline, email support, and online chat options

- Availability: Operational 24/7 with a quick response intent

- Resolution workflow: Assists in troubleshooting errors and guiding correct compliance steps

Key Differences Between GST Complaint Portal and GST Helpdesk

| Aspect | GST Complaint Portal | GST Helpdesk |

|---|---|---|

| Nature of Support | Formal complaint redressal | Query resolution and procedural guidance |

| User Engagement | Detailed complaint submissions with tracking | Immediate, interactive assistance |

| Response Time | Longer, based on issue complexity | Quicker, focused on clarifications |

| Documentation | Formal complaint record | Informal query support |

| Escalation Process | Yes, with higher authority intervention | Limited primarily to initial assistance |

This distinction helps tax professionals advise clients to use the most appropriate channel, saving time and enhancing efficiency.

Practical Guidance for Taxpayers & Tax Professionals

When to Use the GST Complaint Portal

- For unresolved grievances relating to GST registration, refunds, and payments

- When clients face persistent technical issues on the GST portal

- To formally document and track problem resolution status

When to Approach the GST Helpdesk

- For clarifications on GST return filing procedures and deadlines

- When clients encounter common GST portal login errors and need quick resolution

- To obtain guidance on GST compliance requirements and legal provisions

Understanding when and how to engage these platforms can significantly improve client satisfaction and compliance adherence.

Addressing Current Industry Challenges with These Tools

The Indian GST ecosystem continually evolves, posing several challenges to taxpayers and professionals. Efficient use of the GST Complaint Portal and GST Helpdesk can address these challenges by:

- Streamlining client support and reducing resolution times

- Ensuring compliance deadlines are met with clear guidance

- Leveraging digital tools to manage the increasing volume of client queries

- Preventing penalties by swiftly rectifying issues through formal channels

Tax professionals must stay conversant with these channels to deliver proactive, value-added services to their clients.

Distinguishing GST Support Channels for Better Compliance

While the GST Complaint Portal and GST Helpdesk support users, their functions are distinct and complementary.

Tax professionals should educate clients about the differences to optimize issue resolution and compliance efficiency. By guiding clients to the appropriate platform, tax professionals reinforce their vital role in the GST framework and enhance overall professional service quality.

FAQs

Q1: What is the primary purpose of the GST Complaint Portal?

A1: The GST Complaint Portal is designed to register formal complaints related to GST issues such as registration delays, refund problems, and technical glitches, ensuring users have a platform to seek resolution and track grievance status.

Q2: How does the GST Helpdesk differ from the Complaint Portal?

A2: The GST Helpdesk provides immediate assistance for routine queries and procedural clarifications, while the Complaint Portal handles formal grievance redressal with documented follow-up and escalation options.

Q3: When should a tax professional advise clients to use the GST Helpdesk?

A3: Clients should be guided to use the GST Helpdesk for quick clarifications on filing returns, understanding compliance procedures, and resolving common portal errors promptly.

Q4:Can complaints filed on the GST Complaint Portal be escalated?

A4: If the initial response to a complaint is unsatisfactory, users can escalate the issue for higher-level intervention to ensure resolution.

Q5: How can using these GST support channels improve compliance management?

A5: Using the GST Complaint Portal and Helpdesk helps tax professionals resolve client issues efficiently, meet compliance deadlines, avoid penalties, and provide better advisory services.