Chartered Accountants (CAs) in India face increasing pressure to manage GST compliance with greater speed and accuracy in a regulatory environment.

With frequent government notifications, complex reconciliations, and mounting workloads, the traditional manual approach to GST filing is proving inadequate. This is where Artificial Intelligence (AI) is becoming a true game-changer.

AI-driven GST automation tools are enabling accountants to file GST returns five times faster while reducing compliance risks.

TL;DR

- File GST returns five times faster with AI

- Automate reconciliations and eliminate manual errors

- Ensure accuracy, compliance, and avoid penalties

- Scale client handling without adding extra staff

- Free up time for advisory and strategy

- AI in GST filing is the future

The Growing Complexity of GST Compliance in India

Since its introduction in 2017, the Goods and Services Tax (GST) system has seen constant changes, turning compliance into an ongoing and challenging process.

Some key challenges CAs face include:

- Multiple return filings: GSTR-1, GSTR-3B, GSTR-9, and GSTR-9C each require accurate reporting and reconciliation.

- Invoice-level scrutiny: Mismatches between GSTR-2B and purchase data can lead to blocked ITC (Input Tax Credit).

- Evolving regulations: With e-invoicing now mandatory for businesses above ₹5 crore turnover, more small businesses are integrated into the compliance net.

- Penalty risks: Even minor delays or errors can attract fines, interest, or notices from tax authorities.

For an expanding client base, time-consuming manual work often reduces the CA’s ability to focus on value-added advisory services.

How AI is Transforming GST Filing

AI-powered accounting software and GST automation solutions are revolutionizing how CAs handle compliance. Here’s how:

1. Automated Data Capture

- Automatically pulls invoice data from PDFs, Excel sheets, and ERP systems.

- AI-based OCR (Optical Character Recognition) can even scan clear handwritten invoices, reducing the burden of manual entry.

2. Error Detection & Validation

- Intelligent algorithms quickly flag mismatches between purchase records and GSTR-2B.

- Duplicate invoices, incorrect GSTINs, and missing data are highlighted instantly, reducing last-minute rushes.

3. Intelligent Reconciliation

- AI tools can reconcile thousands of line items in minutes.

- Automated GST reconciliation between GSTR-1, 3B, and the books of accounts ensures accuracy before filing.

4. Predictive Assistance

AI models forecast tax liabilities, enabling CAs to advise clients on cash flow planning. Suggests optimal strategies to maximize ITC claims without raising compliance risks.

5. Natural Language Queries

Accountants can use plain English to search data within GST software: e.g., “Show pending ITC for August” or “List invoices not reported in GSTR-1.”

Benefits for Chartered Accountants

The application of AI in GST filing delivers tangible outcomes for CA firms:

- Speed: Processing and reconciling returns are five times faster compared to manual methods.

- Accuracy: By reducing human error, AI strengthens compliance and prevents penalties.

- Scalability: Firms can manage a larger client base without proportionally increasing staff.

- Client Confidence: Timely filings and error-free reporting enhance trust in professional services.

- Shift to Advisory: By saving hours on repetitive compliance work, CAs can focus more on financial planning, risk management, and strategic consulting.

Latest Regulatory & Industry Updates

Staying aligned with policy changes is vital. AI solutions for GST are becoming even more relevant as:

- GSTN integrates its own AI/ML framework for fraud detection and anomaly reporting. Accountants must ensure their filings meet these enhanced scrutiny parameters.

- E-invoicing threshold reductions: From August 2023, companies with a turnover of ₹5 crore and above are required to use e-invoicing. More categories are expected to be brought under this compliance net, increasing reliance on automation.

- Digital-first policies: The government’s push towards real-time digital compliance makes manual filing unsustainable for growing businesses.

As GST regulations tighten, AI offers a smart solution for streamlined compliance management.

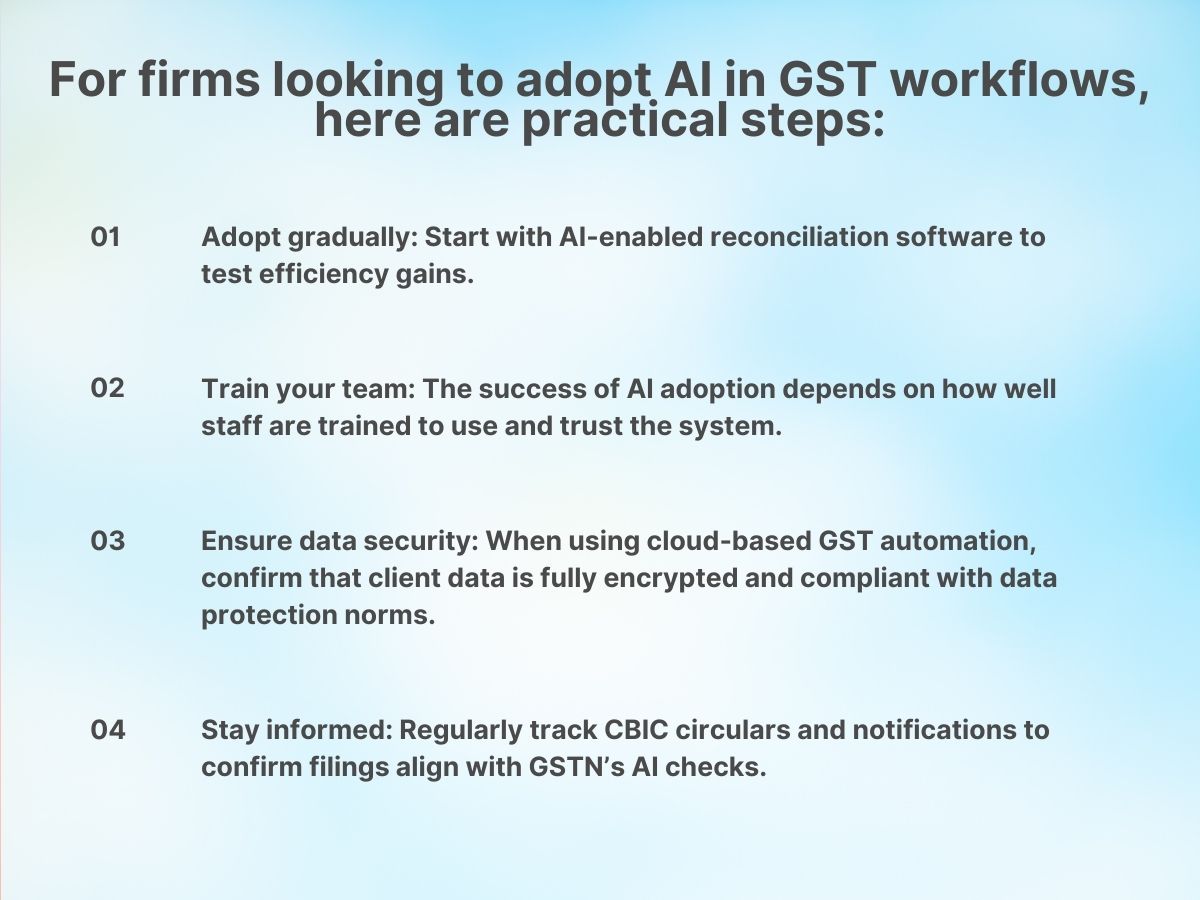

Actionable Advice for Chartered Accountants

GST Automation with Vyapar TaxOne – A Practical Solution

While the concept of AI in GST filing is gaining traction, practical tools are already available in the Indian market. Vyapar TaxOne is a growing platform trusted by several accounting firms.

- Automation-first approach: Vyapar TaxOne simplifies bookkeeping, invoice capture, and GST compliance using built-in AI features.

- GST reconciliation: The platform rapidly matches purchase registers with GSTR-2B, ensuring ITC claims are maximized without errors.

- Multi-client management: Designed for accounting professionals handling multiple businesses, Vyapar TaxOne helps scale operations efficiently.

- Real-time monitoring: Delivers dashboards and alerts on deadlines and filing status, enabling proactive compliance.

For CAs aiming to remain competitive and future-ready, embracing platforms like Vyapar TaxOne ensures 5x faster GST filing, reduced compliance stress, and enhanced client service delivery.

AI in GST Compliance: From Burden to Opportunity

Artificial Intelligence is now a practical solution to the growing GST compliance challenges for CAs. By adopting AI-led GST automation, firms can reduce errors, save time, and focus more on advisory roles.

The future of GST filing is automated, intelligent, and client-focused, and platforms like Vyapar TaxOne make that future accessible today.

FAQs

1. How is AI helping accountants in GST filing?

AI automates invoice data capture, reconciliations, and error detection, enabling accountants to file GST returns up to 5x faster with improved accuracy and compliance.

2. Can AI really reduce errors in GST compliance?

Yes. AI-powered GST software flags mismatches, duplicate entries, and missing invoices in real-time, minimizing manual errors and avoiding costly penalties.

3. What are the benefits of GST automation for Chartered Accountants?

Key benefits include faster filing, reduced workload, improved accuracy, scalability for multiple clients, and freeing up time for advisory services.

4. Is GST automation and AI safe for client data?

Most AI-driven platforms use cloud security and encryption to protect client information, but CAs should always verify a solution’s compliance with data protection standards.

5. How can tools like Vyapar TaxOne help in GST filing?

Vyapar TaxOne uses AI-led automation for reconciliation, invoice processing, and deadline reminders. It helps CAs manage multiple clients efficiently while ensuring timely, error-free GST compliance.