The introduction of e-invoicing under India’s GST system has transformed how businesses handle invoicing. Initially voluntary, it is now mandatory for businesses exceeding a specific turnover.

Manual invoicing processes have become inefficient and error-prone, increasing the risk of penalties. Automation enhances efficiency and ensures compliance with the e-invoicing mandate.

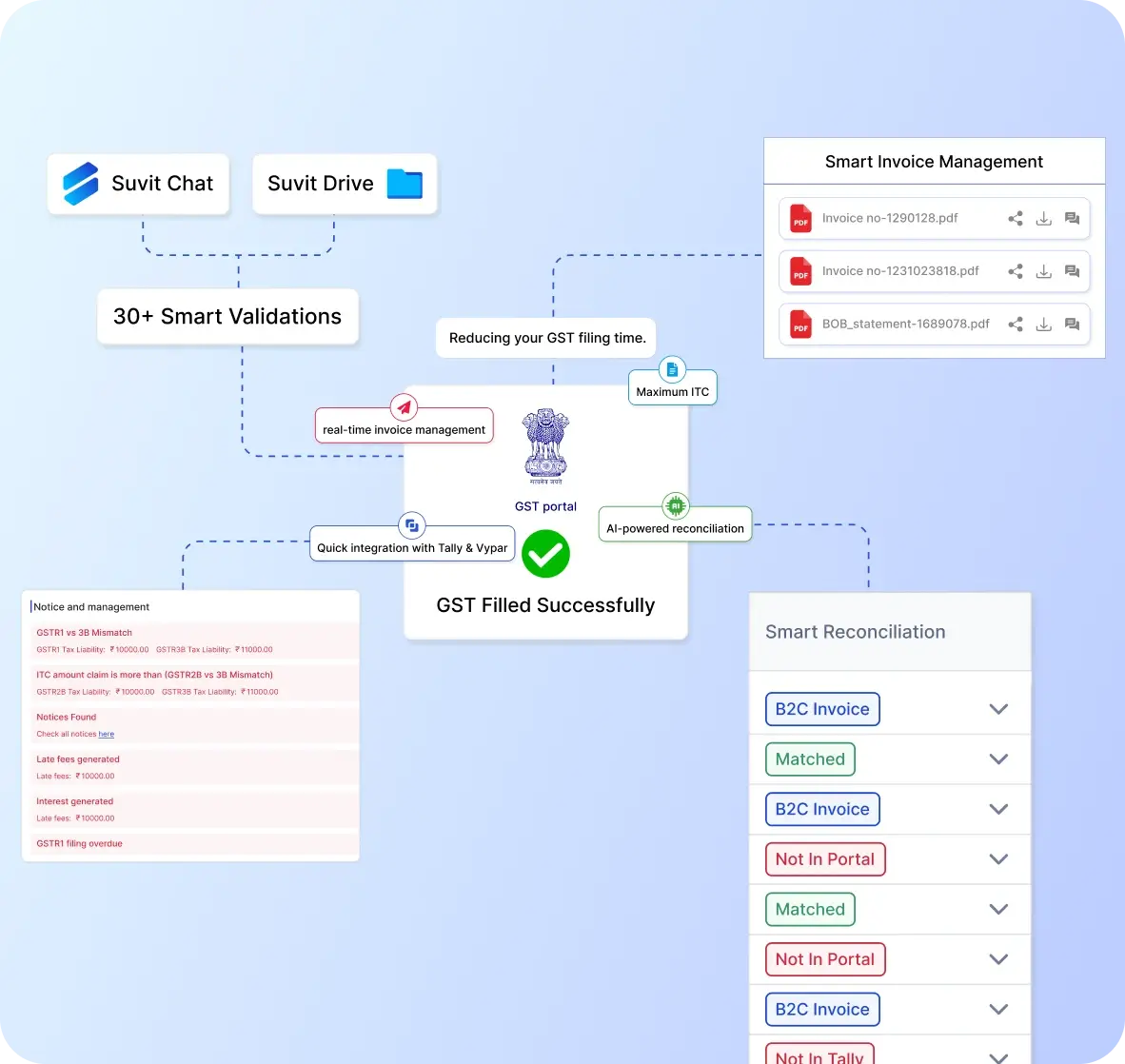

In this blog, we will explore the key aspects of e-invoicing under GST, why automation is no longer optional, and how businesses can leverage tools like Suvit’s Invoice Management System (IMS) to stay compliant and streamline their invoicing processes.

Understanding the E-Invoice Mandate

What is E-Invoicing?

E-invoicing, in the context of GST, refers to the process of generating invoices in a prescribed format that is electronically validated by the Invoice Registration Portal (IRP).

After validation, the IRP assigns an Invoice Reference Number (IRN) to the e-invoice, and a QR code is embedded in the invoice for quick verification. The main objective of e-invoicing is to ensure uniformity, transparency, and real-time data sharing with tax authorities.

Under the GST system, businesses are required to generate e-invoices for B2B transactions. These invoices must be uploaded to the IRP for validation, and businesses are required to include the IRN and QR code in all invoices issued.

Applicability of the E-Invoice Mandate

The e-invoice mandate applies to businesses whose annual turnover exceeds ₹10 crore, as of the latest updates from the GST Council. However, it’s important to stay updated with any changes in this threshold, as the government has periodically revised the turnover limits for e-invoicing applicability.

While larger businesses were the first to be mandated for e-invoicing, the scope is gradually extending to include medium and small enterprises, encouraging them to adopt the system for greater transparency and efficiency.

The e-invoicing mandate not only ensures faster and more accurate data processing but also combats tax evasion, as every transaction is reported to the government in real time.

Key Components of E-Invoicing

Invoice Reference Number

The IRN is a unique identifier that the IRP generates for each e-invoice. This number is important for tracking invoices within the GST system. Without an IRN, an invoice cannot be considered valid for GST purposes.

The generation of the IRN is linked directly to the GSTIN of the supplier and the recipient, ensuring that the transaction is authentic and traceable.

QR Code

The QR code embedded in the e-invoice serves as a quick reference tool. It includes key details such as the IRN, the GSTIN of the supplier and the recipient, and the invoice date.

This feature is particularly useful for businesses, auditors, and tax authorities to verify the authenticity of an invoice without having to search through records manually.

Invoice Validation

Once an invoice is submitted to the IRP, it undergoes validation for compliance with GST regulations; the IRP checks for common errors, such as incorrect GSTINs, mismatched amounts, or missing data.

If there are any discrepancies, the invoice will be rejected, and businesses will need to make necessary corrections before resubmission.

By automating the validation process, businesses can minimize errors and ensure their invoices meet the regulatory requirements before submission.

The Role of Automation in E-Invoicing

Streamlining Invoice Generation

E-invoicing is essential for businesses that want to stay compliant with the GST system, but generating and uploading invoices manually can be labor-intensive. Automation tools can streamline the entire process by integrating with accounting software.

This means that businesses can automatically generate e-invoices in the prescribed format, significantly reducing manual data entry and the potential for errors.

Real-Time Validation and Error Detection

Automating the e-invoicing process also allows for real-time validation. With automation tools, businesses can check for common issues such as incorrect GSTINs or mismatched amounts before the invoice is submitted to the IRP.

This reduces the chances of receiving rejection notices due to errors, ensuring smoother operations and fewer disruptions in the invoicing workflow.

Seamless Integration with GST Portal

Automated systems integrate directly with the GST portal, ensuring that invoices are uploaded on time and without manual intervention. This minimizes the risk of human error and ensures timely compliance with e-invoicing regulations.

Automation tools also help in generating and managing Invoice Reference Numbers and QR codes automatically, ensuring that each invoice meets the necessary legal requirements for GST compliance.

Suvit's Invoice Management System (IMS): A Comprehensive Solution

Overview of Suvit IMS

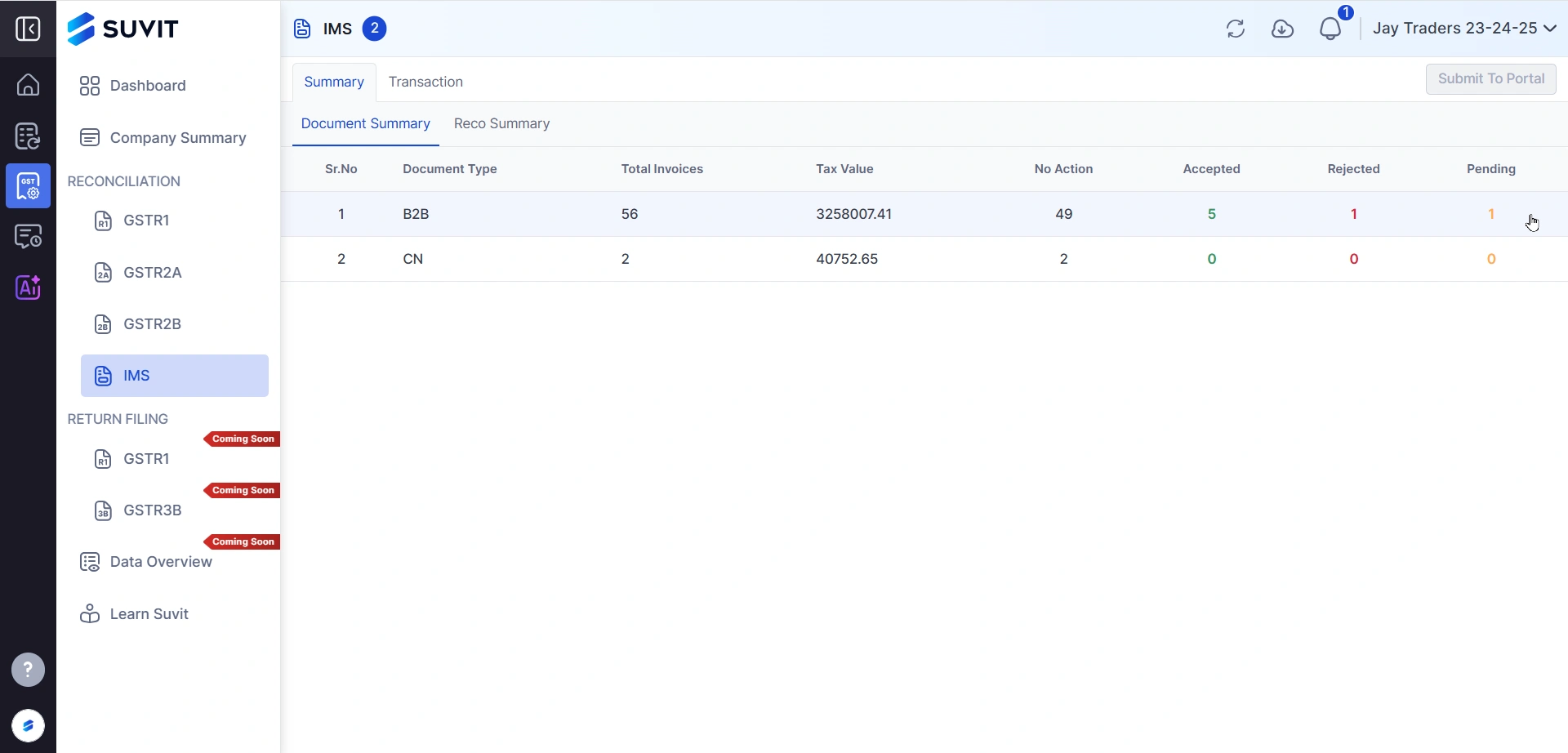

Suvit’s Invoice Management System is a tool designed to help businesses streamline the process of managing and reconciling invoices with the GST portal.

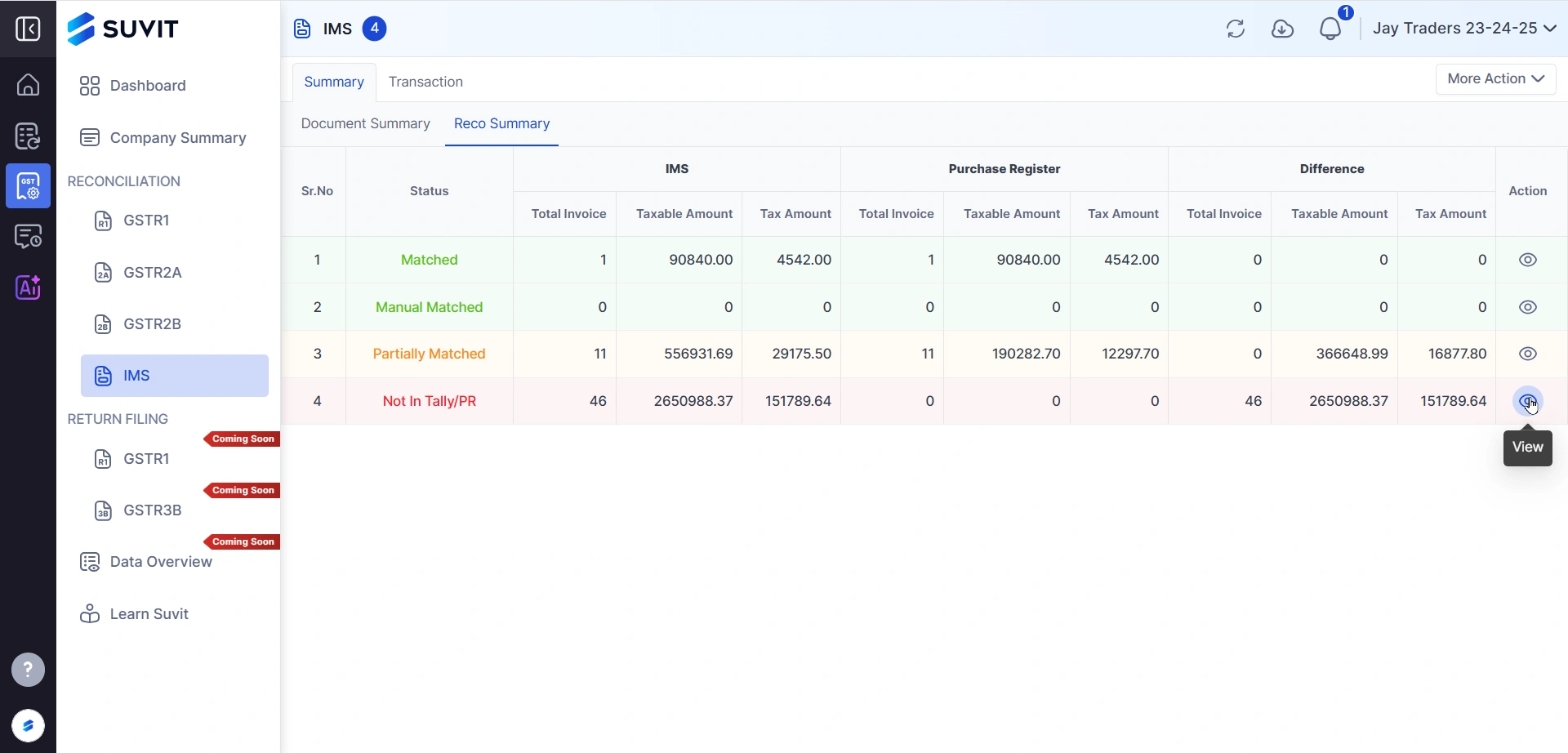

While Suvit does not directly generate e-invoices, it provides invaluable support by automating the reconciliation of invoices between a company’s Purchase Register and the GST system. Suvit’s IMS helps businesses ensure that they are fully compliant with GST regulations.

Key Features of Suvit IMS

- Automated Invoice Matching:

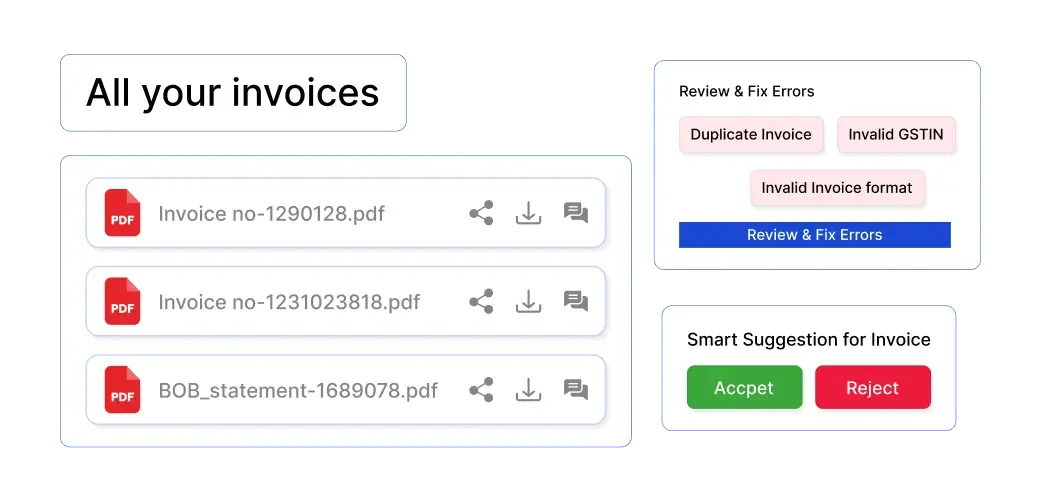

Suvit’s IMS automatically compares data from the GST portal with a company’s PR to identify discrepancies or missing invoices.

- Actionable Insights:

The system provides actionable recommendations such as accepting, rejecting, or marking invoices as pending, with an audit trail for transparency.

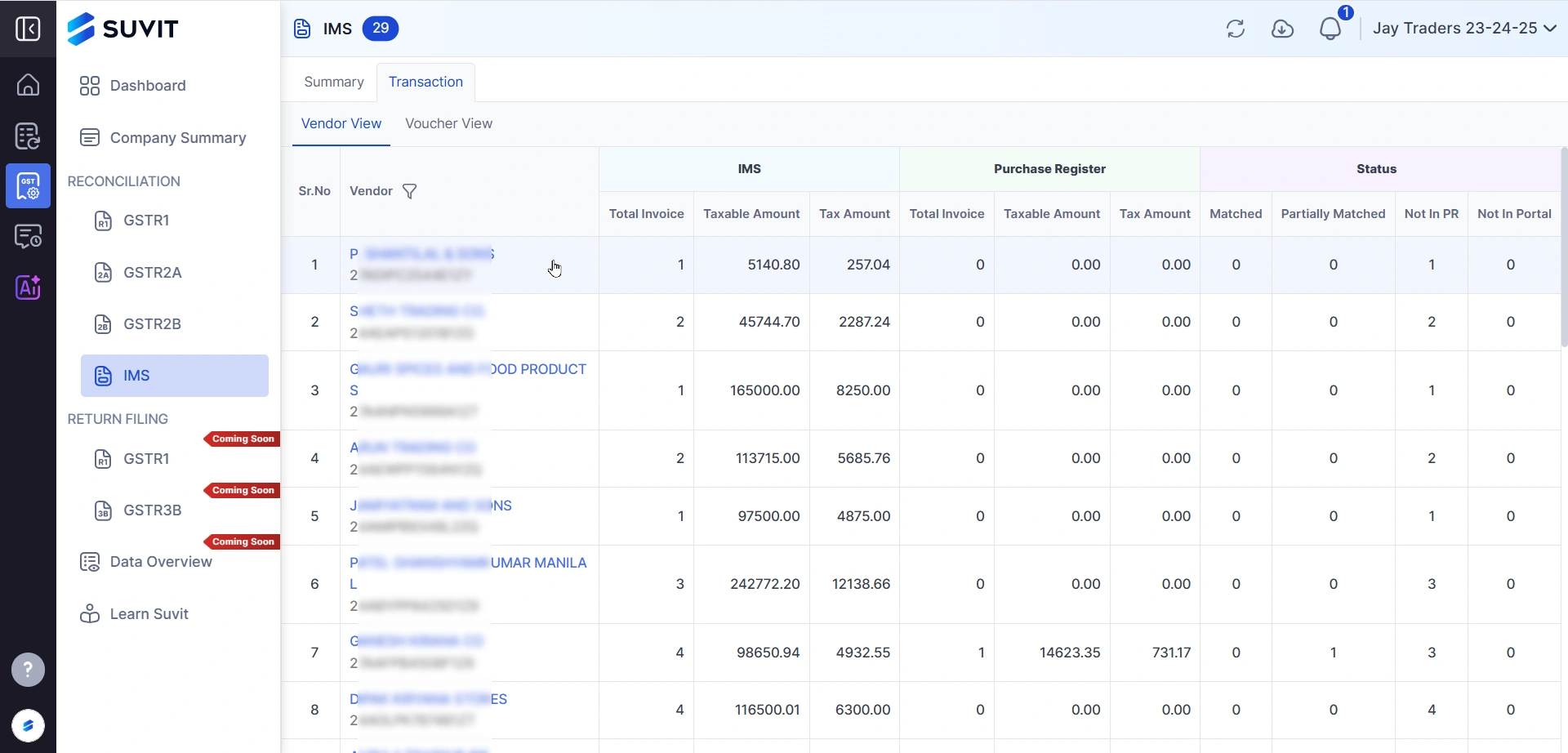

- Vendor-wise Reconciliation:

Suvit enables reconciliation on a vendor-by-vendor basis, helping businesses identify mismatches and take corrective actions.

- Integration with Accounting Software:

Suvit IMS can integrate with popular accounting software such as Tally, ensuring data consistency across all systems.

Practical Insights for Implementing E-Invoicing Automation

Assessing Business Needs

The first step in implementing e-invoicing automation is to assess the size and scope of your business's operations. Understanding the volume of invoices and the complexity of your current invoicing system will help determine the level of automation you need.

Selecting the Right Automation Tool

When choosing an automation tool, it’s crucial to select one that integrates seamlessly with your existing accounting system and complies with GST regulations. Suvit IMS is an excellent option for businesses looking to reconcile invoices and ensure compliance with the GST portal.

Training and Support

It’s essential to provide training to employees on the new automated system. Training ensures that the transition to automated e-invoicing is smooth and that your team understands how to use the tools effectively.

Continuous Monitoring and Updates

Regular monitoring of the automated system is necessary to ensure that it remains efficient and compliant. Keep an eye on updates from the GST Council and ensure that your automation tools stay current with the latest regulations.

FAQs

1. What is e-invoicing under GST?

E-invoicing under GST requires businesses to generate invoices in a prescribed digital format, which are then validated by the GST Invoice Registration Portal (IRP) before being assigned an Invoice Reference Number (IRN) and QR code.

2. Is e-invoicing mandatory for all businesses?

E-invoicing is mandatory for businesses whose annual turnover exceeds ₹10 crore. However, this threshold may change, so businesses must stay updated on GST notifications.

3. How does automation help in e-invoicing compliance?

Automation simplifies the generation, validation, and submission of e-invoices, reducing manual errors and ensuring timely compliance with GST regulations.

4. What is Suvit's IMS, and how does it assist with GST e-invoicing?

Suvit’s Invoice Management System (IMS) helps businesses reconcile their invoices with the GST portal, ensuring compliance by identifying mismatches and automating corrections.