For any business, understanding depreciation is more than just a technicality-it's an essential aspect of managing finances effectively.

Depreciation helps track the wear and tear of assets over time, providing a true reflection of a company’s financial health. In India, the Companies Act, 2013 (CA, 2013) lays down the rules for calculating depreciation, ensuring businesses follow a standard approach for accurate financial reporting.

While the Income Tax Act of 1961 sets specific depreciation rates for tax purposes, the Companies Act takes a more flexible approach. It focuses on the useful life of assets, allowing businesses to decide depreciation rates based on the asset's expected operational lifespan and residual value.

Let’s dive deeper into the depreciation rules under the CA, 2013, and explore how they help businesses manage their assets effectively.

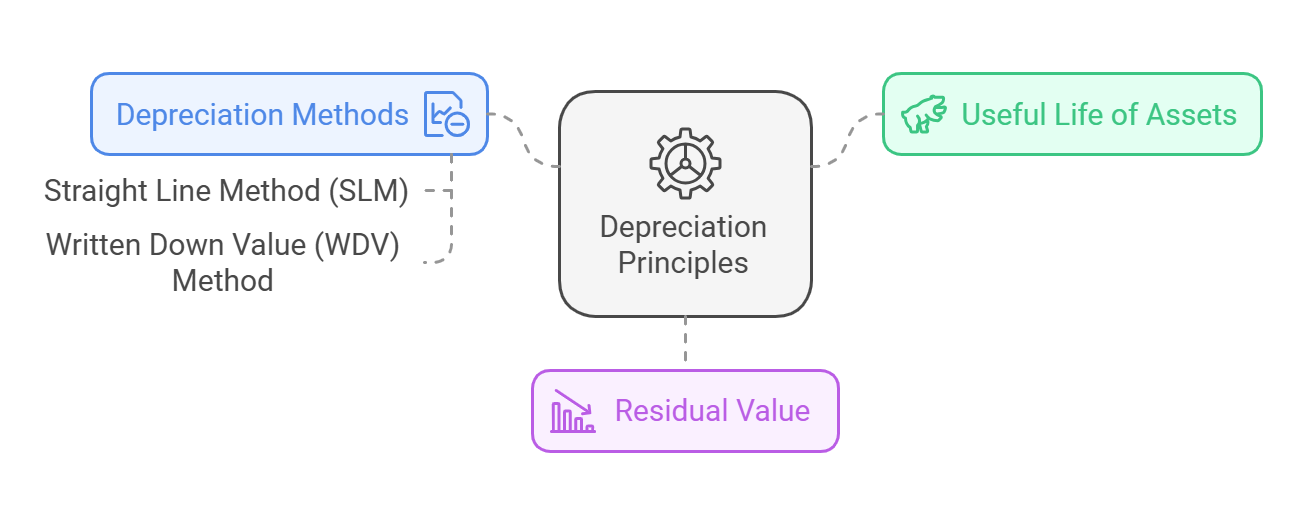

Key Principles of Depreciation under CA, 2013

Useful Life of Assets

The core principle of depreciation under the CA, 2013, is the useful life of an asset. This refers to the expected period during which the asset will generate economic benefits for the business.

Unlike the Income Tax Act, which has fixed depreciation rates for certain assets, the Companies Act allows businesses to estimate the useful life of assets based on their unique operational needs and industry standards.

Residual Value

Depreciation doesn’t just account for the decrease in an asset's value over time; it also considers its residual value. This is the estimated amount the asset can be sold for at the end of its useful life, typically a small percentage of its original cost.

The CA, 2013 allows businesses to account for this residual value while calculating depreciation, ensuring the financial statements reflect a more accurate valuation of the asset.

Depreciation Methods

Businesses under the CA, 2013 can choose from two main methods for calculating depreciation:

-

Straight Line Method (SLM): This method evenly spreads the cost of the asset over its useful life, excluding its residual value. It’s simple and ideal for assets with consistent wear and tear, such as buildings or office furniture.

-

Written Down Value (WDV) Method: This method applies a fixed depreciation rate to the asset’s carrying value, which reduces each year as depreciation accumulates. It’s more suited for assets that lose value more quickly, like machinery or technology.

Determining the Right Depreciation Rates

The CA, 2013 doesn’t specify exact depreciation rates. Instead, Schedule II provides a guideline for the useful lives of various assets, giving businesses a starting point. From there, they can fine-tune the rates based on factors such as:

-

Industry Standards: Different industries may have different expectations for asset lifespan. It’s essential to consider benchmarks to ensure your depreciation aligns with industry norms.

-

Asset Usage: How frequently and intensely an asset is used plays a big role in determining its useful life. For example, a machine in constant use may wear out faster than one used sporadically.

-

Technological Changes: Rapid advancements in technology can reduce an asset’s useful life, particularly for electronics and machinery that can become obsolete quickly.

Additional Provisions under the CA, 2013

The CA, 2013 also includes some provisions to handle unique situations, such as:

-

Double/Triple Shift Depreciation: If an asset operates beyond the standard working hours—like in a double or triple shift—the depreciation rate can increase by 50% or 100%, respectively, to reflect the additional wear and tear.

-

Depreciation on Parts of Assets: If an asset consists of multiple parts with different useful lives (like a complex machine), the CA, 2013 allows separate depreciation for each part, based on its individual lifespan.

-

Change in Asset Usage: If an asset’s usage pattern changes significantly, such as shifting from regular to intensive use, the depreciation rate may need to be adjusted accordingly.

Plant & Machinery Depreciation Calculator (CA, 2013)

The depreciation rules for companies have been in effect since the financial year 2014-15. Companies need to calculate depreciation based on asset cost, lifespan, and residual value, following the guidelines set by the CA, 2013.

Here’s a quick look at how depreciation can be calculated:

Straight Line Method (SLM):

Depreciation = [(Original Cost – Residual Value) / Useful Life] * 100

The SLM method evenly spreads the depreciation charge over the asset’s useful life.

Written Down Value (WDV) Method:

Depreciation Rate (R) = {1 - (S / C) ^1/n} x 100

R: Depreciation Rate (%) S: Scrap Value C: Cost/Written Down Value n: Remaining Useful Life (years)

Navigating the Depreciation Landscape

While depreciation might seem complex at first, it’s an essential tool for accurate financial reporting and decision-making.

Businesses should carefully consider factors like asset lifespan, usage, and industry benchmarks when determining the right depreciation method and rate.

Consulting with professionals like chartered accountants can help ensure compliance with the CA, 2013 and optimize depreciation practices for better financial transparency.

By doing so, companies can improve their financial reporting, manage their assets effectively, and make more informed business decisions that drive growth. In the ever-evolving world of business and accounting, depreciation under the CA, 2013 offers flexibility and adaptability. Understanding the rules and provisions can help businesses manage their assets effectively and stay ahead of the curve in financial planning.

Also Read: How to Claim Depreciation on Office Equipment under Income Tax Act 1961