Why are paper invoices still used?

There are a number of reasons why businesses continue to use paper invoices. Some businesses may not be aware of the benefits of automation, or they may be reluctant to change their existing processes. Others may be concerned about the cost of implementing an automation solution.

For example, a lot of businesses in the textile market of Surat still operate using paper invoices and data entry.

However, the challenges of paper invoices can have a significant impact on businesses. Manual invoice processing can be slow, inefficient, and error-prone. It can also be difficult to track the status of paper invoices and identify bottlenecks in the process.

In this blog post, we will discuss the four most common challenges of using paper invoices, and how automation can help businesses overcome them.

Let’s get started.

Steps in Paper Invoicing

1. Receiving invoices from suppliers

Invoices can be received from suppliers in a variety of ways, including mail, email, and fax. Once invoices are received, they should be logged into an invoice tracking system. This will help to ensure that no invoices are lost or misplaced.

2. Sorting and routing invoices to the appropriate departments

Once invoices have been logged, they should be sorted and routed to the appropriate departments for approval. This may involve sending invoices to the accounts payable department, the purchasing department, or other relevant departments.

3. Manually entering invoice data into the accounting system

Once invoices have been approved, they need to be entered into the accounting system. This is typically done manually, which can be a time-consuming and error-prone process.

4. Verifying the accuracy of the invoice data

Once invoices have been entered into the accounting system, it is important to verify the accuracy of the data. This includes checking the invoice amount, the invoice date, and the vendor information.

5. Obtaining approvals for payment

Once invoices have been verified, they need to be approved for payment. This may involve obtaining approval from a manager, the CFO, or other authorized personnel.

6. Processing payments

Once invoices have been approved, payments need to be processed. This may involve sending payments to suppliers by check, wire transfer, or another payment method.

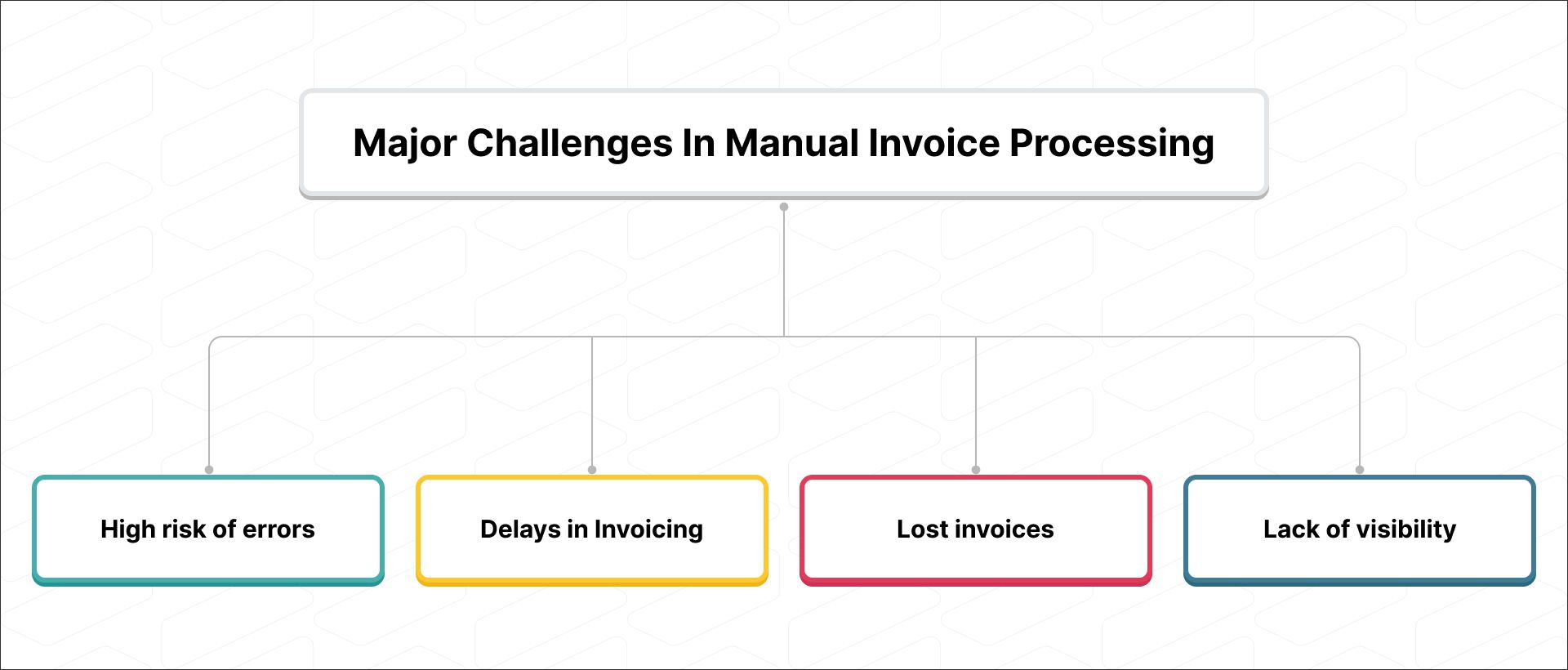

4 Major Challenges In Manual Invoice Processing

1. High risk of errors

Manual data entry is a major source of errors in invoice processing. Common errors include incorrect invoice amounts, missing data, and duplicate invoices. These errors can lead to a number of problems, including:

- Late payments to suppliers

- Overpayments or underpayments to suppliers

- Financial penalties for late or incorrect payments

- Increased workload for accounting staff to correct errors

- Damage to relationships with suppliers

Here are some specific examples of how manual data entry can lead to errors in invoice processing:

- A typo in the invoice amount

- A missing invoice number

- A duplicate entry for the same invoice

- An incorrect vendor code

- An incorrect invoice date

2. Delays

Manual invoice processing can be a slow and inefficient process. This is especially true for businesses that receive a high volume of invoices. The following factors can contribute to delays in manual invoice processing:

- The need to sort and route invoices to the appropriate departments

- The time it takes to manually enter invoice data into the accounting system

- The need to obtain approvals for payment

- The need to process payments to suppliers

Here are some specific examples of how manual invoice processing can lead to delays:

- An invoice may be lost or misplaced

- An invoice may be routed to the wrong department

- An invoice may be waiting for approval from a manager who is out of the office

- A payment may be delayed due to a technical problem with the accounting system

3. Lost invoices

Paper invoices can easily be lost or misplaced. This can lead to delays in payment and damage relationships with suppliers. Lost invoices can also result in financial penalties for late payments.

Here are some specific examples of how paper invoices can be lost or misplaced:

- An invoice may be lost in the mail

- An invoice may be misplaced in a desk drawer or filing cabinet

- An invoice may be accidentally thrown away

4. Lack of visibility

It can be difficult to track the status of paper invoices and identify bottlenecks in the invoice processing process. This can make it difficult to identify and resolve problems in the invoice processing process.

Here are some specific examples of how the lack of visibility can lead to problems in the invoice processing process:

- A manager may not be aware that an invoice is waiting for their approval

- An accounting clerk may not be aware that a payment has been delayed

- A supplier may not be aware that their invoice has been received

- The challenges of manual invoice processing can have a significant impact on businesses.

Manual invoice processing can be slow, inefficient, and error-prone. It can also be difficult to track the status of paper invoices and identify bottlenecks in the process. This can lead to late payments to suppliers, overpayments or underpayments to suppliers, financial penalties, and damage to relationships with suppliers.

Benefits of using automation and e-invoices

Automating your invoice processing and using e-invoices can provide a number of benefits for your business, including:

- Reduced errors: Automation eliminates the risk of human error in the invoice processing process. This can lead to a significant reduction in errors, such as incorrect invoice amounts, missing data, and duplicate invoices.

- Increased efficiency: Automation can help businesses to process invoices more quickly and efficiently. This can lead to significant time savings and cost reductions.

- Improved visibility: Automation provides businesses with real-time visibility into the status of their invoices. This can help businesses to identify and resolve bottlenecks in the invoice processing process.

- Enhanced supplier relationships: Automation can help businesses to improve their relationships with suppliers by reducing the time it takes to process and pay invoices.

- Reduced costs: Automation and e-invoices can help businesses to reduce their invoice processing costs. For example, businesses can save money on printing, postage, and storage costs by using e-invoices. Additionally, automation can help businesses to reduce the number of staff required to process invoices.

Here are some specific examples of how automation and e-invoices can benefit businesses:

- A business can save time and money by automating the process of sending and receiving invoices electronically.

- A business can improve its cash flow by reducing the time it takes to process and pay invoices.

- A business can reduce its risk of fraud by using e-invoices.

- A business can improve its environmental impact by reducing its paper consumption.

Improve Your Overall Accounting With Automation

The future of accounting is automation! Businesses that embrace digital accounting will be the ones that thrive in the years to come.

So, if you’re ready to embrace the new-age accounting automation, try out Vyapar TaxOne! Here are some specific features of taxone.vyapar.com that make it a great tool for accounting automation:

- Document processing: Vyapar TaxOne can automatically process documents such as invoices, receipts, and bank statements. This saves you time and effort, and it also helps to ensure that your data is accurate.

- Bank reconciliation: It can automatically reconcile your bank statements. This ensures that your records are up-to-date and that your bank balance is accurate.

- Financial reporting: Vyapar TaxOne can generate financial reports such as balance sheets, income statements, and cash flow statements. This can help you to track your financial performance and make better business decisions.

- Client management: Vyapar TaxOne can help you to manage your clients' data. This includes storing their contact information, invoices, and payments.

- Collaboration: It allows you to collaborate with your team members on accounting tasks. This can help to improve efficiency and accuracy.

Automate your accounting with Vyapar TaxOne, a free trial is available for 7 days with no need to enter your credit card information. Simply sign up and get started!