Imagine your business as a race car. It may have a powerful engine (profit), top-of-the-line parts (valuable assets), and a skilled driver (great management team). But if the fuel tank is empty (negative cash flow), even the most impressive car won't go anywhere.

Cash flow is the lifeblood of any business. It's the constant stream of cash coming in (through sales and investments) and going out (to cover expenses and debts). While a healthy profit is important, it doesn't necessarily equate to having enough cash on hand to pay your bills and keep your operations running smoothly.

This is where cash flow analysis and forecasting come in. These financial tools are like having a pit crew for your business's race car. By analyzing your historical cash flow and predicting future needs, you can ensure you have the fuel you need to stay on track and achieve long-term success.

Cash Flow Analysis: Understanding Your Business's Financial Plumbing

Just like a well-functioning plumbing system keeps water flowing smoothly, a strong grasp of your cash flow helps you understand the financial health of your business. Let's delve into the world of cash flow analysis:

A. What is Cash Flow Analysis?

Cash flow analysis examines the movement of cash in and out of your business. It separates cash inflows (revenue from sales, investments, etc.) from cash outflows (expenses, loan payments, etc.). By analyzing these inflows and outflows, you gain a clearer picture of your business's liquidity, or its ability to meet its short-term financial obligations.

There are three main categories of cash flow to consider:

-

Operating Cash Flow (OCF): This measures the cash generated from your core business activities, essentially showing how well your day-to-day operations are turning a profit.

-

Investing Cash Flow: This tracks the cash used for acquiring or disposing of assets like equipment, buildings, or investments.

-

Financing Cash Flow: This reflects how your business raises or repays capital, including issuing new shares, taking out loans, or repaying existing debt.

Cash flow analysis also involves calculating key metrics that provide valuable insights. Some of the most important ones include:

-

Operating Cash Flow (OCF): As mentioned earlier, this metric reveals the cash generated by your core operations.

-

Free Cash Flow (FCF): This metric goes a step further by considering cash available for dividends or reinvestment after accounting for all operational expenses and capital expenditures.

-

Cash Flow Ratios: These ratios compare different cash flow components, such as OCF to debt, to assess a company's ability to service its debts and meet its financial obligations.

B. Benefits of Cash Flow Analysis

By regularly analyzing your cash flow, you unlock a treasure trove of benefits for your business:

-

Improved Financial Decision-Making: Having a clear picture of your cash flow allows you to make informed decisions about investments, borrowing, and overall financial strategy.

-

Identifying Potential Cash Flow Problems: Early detection of potential cash shortages allows you to take proactive measures like adjusting inventory levels or negotiating better payment terms with suppliers.

-

Evaluating Business Performance and Growth: Cash flow analysis reveals how efficiently your business is converting sales into cash, helping you identify areas for improvement and track your growth trajectory.

In essence, cash flow analysis is like having a financial x-ray for your business. It exposes potential issues lurking beneath the surface and empowers you to make strategic decisions that keep your company healthy and thriving.

Cash Flow Forecasting: Charting Your Course to Financial Stability

Cash flow analysis equips you with valuable insights into your business's financial past. But what about the future? Cash flow forecasting steps in to bridge that gap.

A. What is Cash Flow Forecasting?

Cash flow forecasting is the art of predicting your future cash inflows and outflows. It's like creating a roadmap that shows you where your cash is coming from and where it's going over a specific period, be it the next month, quarter, or even year.

This forecasting process relies on three key pillars:

-

Historical Data: Your past cash flow patterns provide a solid foundation for predicting future trends. By analyzing historical inflows and outflows, you can identify seasonal fluctuations or recurring expenses, allowing you to make more accurate forecasts.

-

Budgets: Your operational and sales budgets provide valuable insights into expected future income and expenses. Integrating these budgets with your historical data creates a more comprehensive picture of your future cash flow.

-

Future Plans: Do you have plans for expansion, marketing campaigns, or new product launches? Factoring in these future endeavors allows you to anticipate potential cash needs and avoid unexpected shortfalls.

B. Benefits of Cash Flow Forecasting

By proactively forecasting your cash flow, you gain a significant advantage in managing your business finances:

-

Proactive Financial Management: Forecasting empowers you to anticipate potential cash shortages well in advance. This allows you to take proactive measures, such as securing a line of credit or negotiating longer payment terms with suppliers, to ensure you have the resources needed to meet your obligations.

-

Planning for Potential Cash Surpluses: Cash flow forecasting can also reveal periods of expected surplus. This foresight allows you to plan strategically for investments, debt repayment, or even taking advantage of early payment discounts on purchases.

-

Making Informed Decisions About Borrowing, Investing, and Working Capital Management: With a clear understanding of your future cash flow needs, you can make informed decisions about borrowing and investments. Additionally, you can optimize your working capital management by ensuring you have the right amount of inventory and receivables on hand to meet your operational cash flow needs.

Cash flow forecasting is like having a GPS for your business finances. It guides you towards a future of financial stability and allows you to make strategic decisions that propel your business forward.

Putting it All Together: Cash Flow Analysis - The Fuel for Accurate Forecasting

Cash flow analysis and forecasting are like two sides of the same coin. They work hand-in-hand to ensure your business has the financial fuel it needs to thrive.

Historical Cash Flow Data: The Foundation for Future Predictions

Think of historical cash flow data as the blueprint for building your cash flow forecast. By analyzing past cash flow trends, you gain valuable insights into your business's seasonal fluctuations, recurring expenses, and overall cash flow cycle. This knowledge serves as the foundation for predicting future cash inflows and outflows.

Identifying Trends and Patterns: Sharpening Your Forecasting Accuracy

Cash flow analysis helps you identify patterns hidden within your historical data. For instance, you might discover a surge in sales during specific holidays or a dip in cash flow following a large inventory purchase. Recognizing these trends allows you to incorporate them into your forecast, making it more accurate and reliable.

Actionable Tip: Leverage Cash Flow Ratios to Strengthen Your Forecast

Cash flow ratios, like Operating Cash Flow (OCF) to Sales ratio, provide a valuable lens for analyzing your cash flow efficiency. For example, a declining OCF to Sales ratio might indicate a potential issue with collecting payments from customers. By incorporating insights from these ratios into your forecast, you can anticipate potential cash flow shortfalls arising from inefficiencies and take corrective measures beforehand.

In essence, cash flow analysis equips you with the knowledge of "where you've been" financially, while cash flow forecasting empowers you to chart a course for "where you're going." By leveraging both tools together, you gain a comprehensive understanding of your business's financial health and make informed decisions that secure a future of sustainable growth.

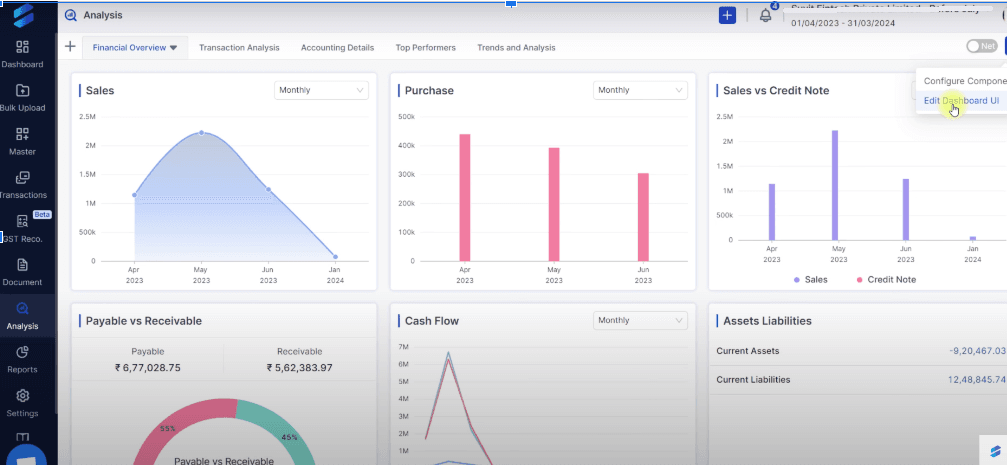

Cash Flow and Vyapar TaxOne

There should be options in the analysis module to choose the company for which you wish to create the cash flow report and to enter a date range. As needed, fill out this information.

You can toggle between which data you want to see between NET and Gross data from the top right corner:

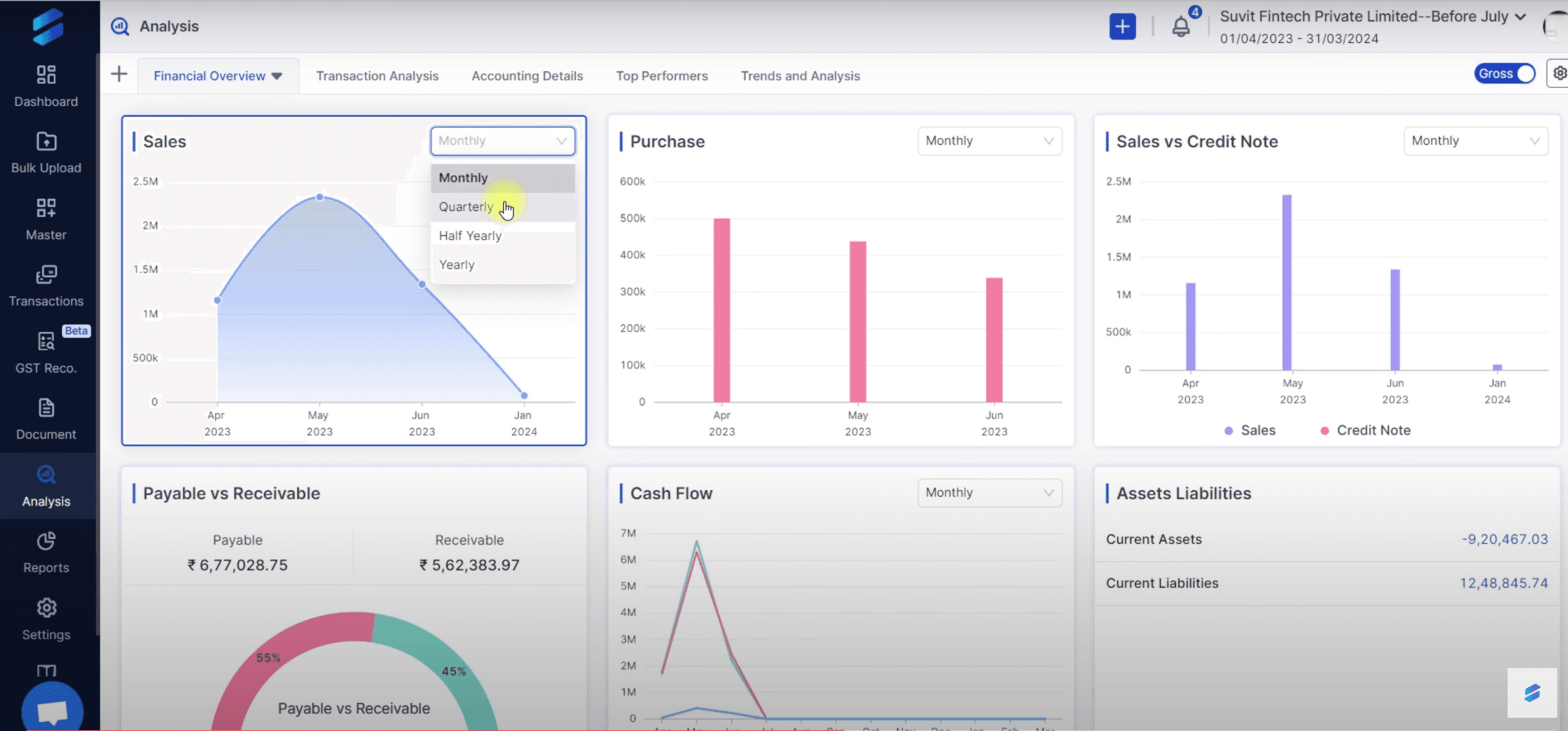

Also, you can sort your data as per your need periodically like Monthly, Quarterly, Half Yearly, and Yearly:

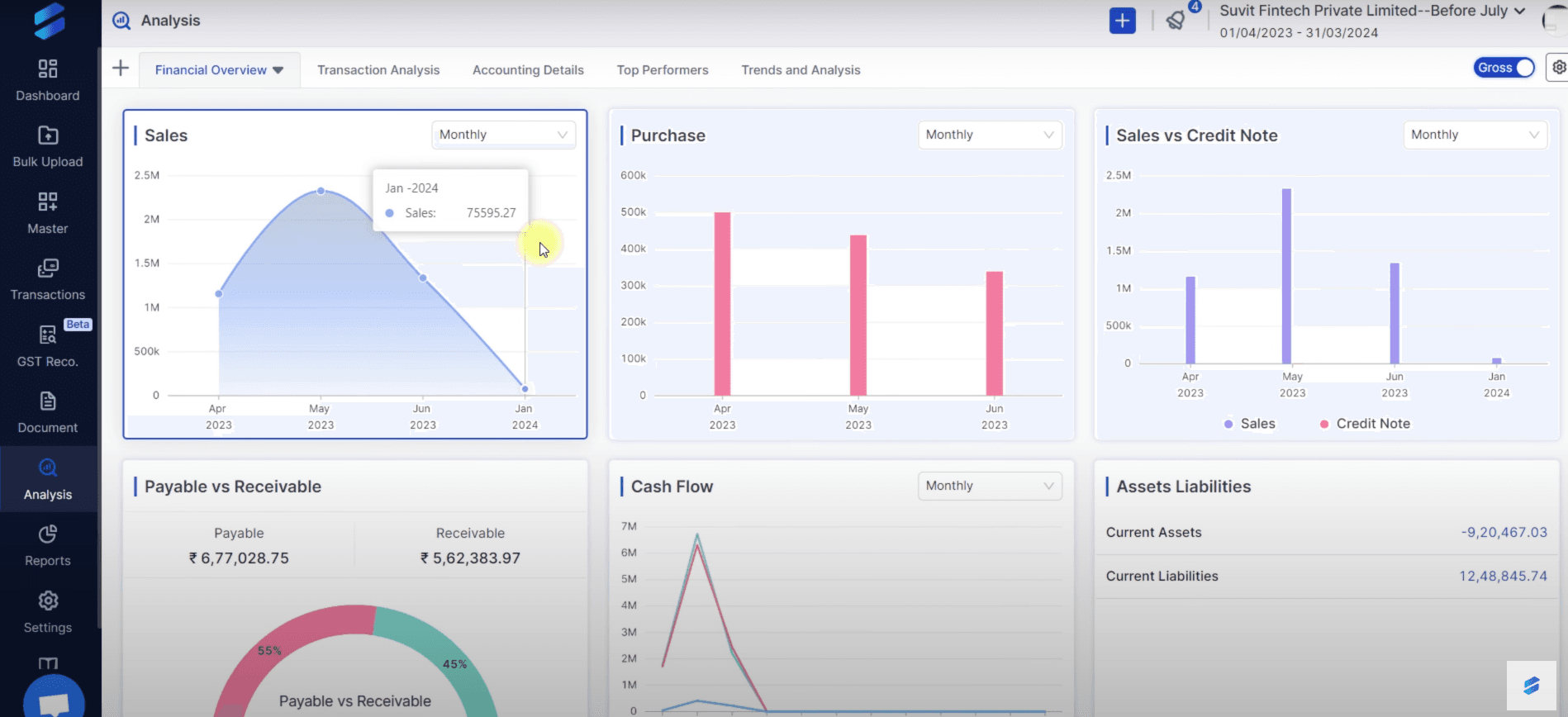

And, on clicking anywhere on the graph, detailed analysis will be open to analyze things clearly.

If you want to try it, you can start with Vyapar TaxOne’s 7 days free trial or fist can book a demo from our website.