The accounting industry in India is undergoing a rapid shift, with automation emerging as a critical driver of efficiency and compliance.

Automated accounting reduces manual errors and ensures faster processing, better reporting, and seamless compliance with GST and Tax regulations.

For Chartered Accountants in India, embracing intelligent automation is no longer optional; providing timely insights, strengthening client trust, and staying competitive in a digitally driven marketplace is essential.

This blog outlines nine actionable automated accounting best practices every CA firm should adopt to optimize financial processes, enhance productivity, and future-proof their accounting workflows.

1. Understand Your Firm’s Unique Accounting Needs

Evaluate your firm's existing accounting processes before introducing automation.

- Identify tasks consuming unnecessary manual time (data entry, reconciliations, GST return preparations).

- Map accounting workflows against compliance requirements under Indian laws.

- Determine which processes benefit most from automated bookkeeping without reducing oversight.

This helps you choose the right tools and automation solutions that align with your firm's objectives.

2. Choose Robust and Scalable Accounting Software

The foundation of automation lies in selecting the right accounting software tools.

- Ensure the software complies with Indian accounting standards and supports direct integration with GST and other Tax portals.

- Look for scalability to manage diverse clients across industries, from SMEs to corporates.

- Check for integrations with banking systems, payroll, and existing ERP platforms for smooth financial data flow.

A robust platform also reduces the need for future system changes.

3. Maintain Data Accuracy with Proper Setup and Validation

Automation is only as accurate as the data it processes.

- Clean your existing databases before migrating to new systems.

- Use built-in validation features to flag discrepancies in ledgers and vouchers.

- Conduct timely reconciliations to strengthen accuracy in financial reporting.

Chartered Accountants ensure automated accounting stays compliant and reliable by performing these checks.

4. Customise Automation Workflows for Practical Relevance

Generic automation does not capture client-specific needs.

- Create custom templates for invoices, ledgers, and statutory reports.

- Configure automated workflows, such as GST due-date reminders or automated journal entries.

- Set role-based alerts for approvals, ensuring tighter process monitoring.

This level of customization saves time and standardizes outputs for consistent quality.

5. Ensure Compliance Through Real-Time Regulatory Updates

Indian taxation rules evolve frequently. A key advantage of accounting automation tools is real-time compliance.

- Automate GST calculations, return filings, and reconciliation with e-invoices.

- Link automated accounting with direct e-filing frameworks to minimize last-minute errors.

- Ensure ongoing software updates to incorporate changes under the Income Tax and Companies Act.

This not only prevents penalties but builds credibility with clients.

6. Train Your Team to Leverage Automation Effectively

Technology is only as strong as its users.

- Conduct regular training sessions so your CA teams stay updated on software upgrades.

- Encourage proactive use of dashboards and analytics reports.

- Develop internal knowledge-sharing sessions to boost adoption among junior accountants.

This ensures automation strengthens workflows rather than being underutilized.

7. Safeguard Data Security and Confidentiality

With growing cyber threats, secure accounting technology is vital.

- Implement multi-layer access controls with role-based permissions.

- Use encryption for sensitive client and financial data.

- Enable periodic backups and establish disaster recovery protocols.

Maintaining confidentiality enhances client trust and ensures adherence to data protection laws.

8. Monitor and Optimize Automated Processes Regularly

Automation requires regular monitoring to remain efficient.

- Track KPIs such as error rates, compliance turnaround, and productivity levels.

- Analyze software reports to identify bottlenecks.

- Schedule quarterly optimization reviews to align workflows with evolving client requirements.

By continuously optimizing, CAs can maximize their ROI on automation.

9. Collaborate with Technology Partners for Continuous Improvement

The best results come from strong collaborations.

- Work closely with technology partners for quick support and platform enhancements.

- Join professional networks to stay updated on emerging technologies like AI and blockchain in accounting.

- Seek early access to innovative financial automation tools to stay ahead of the competition.

Such partnerships help CA firms future-proof their practice with the latest digital advancements.

Empower Your Practice with an Automated Accounting Tool

As the accounting profession in India evolves, automation is a strategic catalyst for efficiency, compliance, and value-driven client relationships.

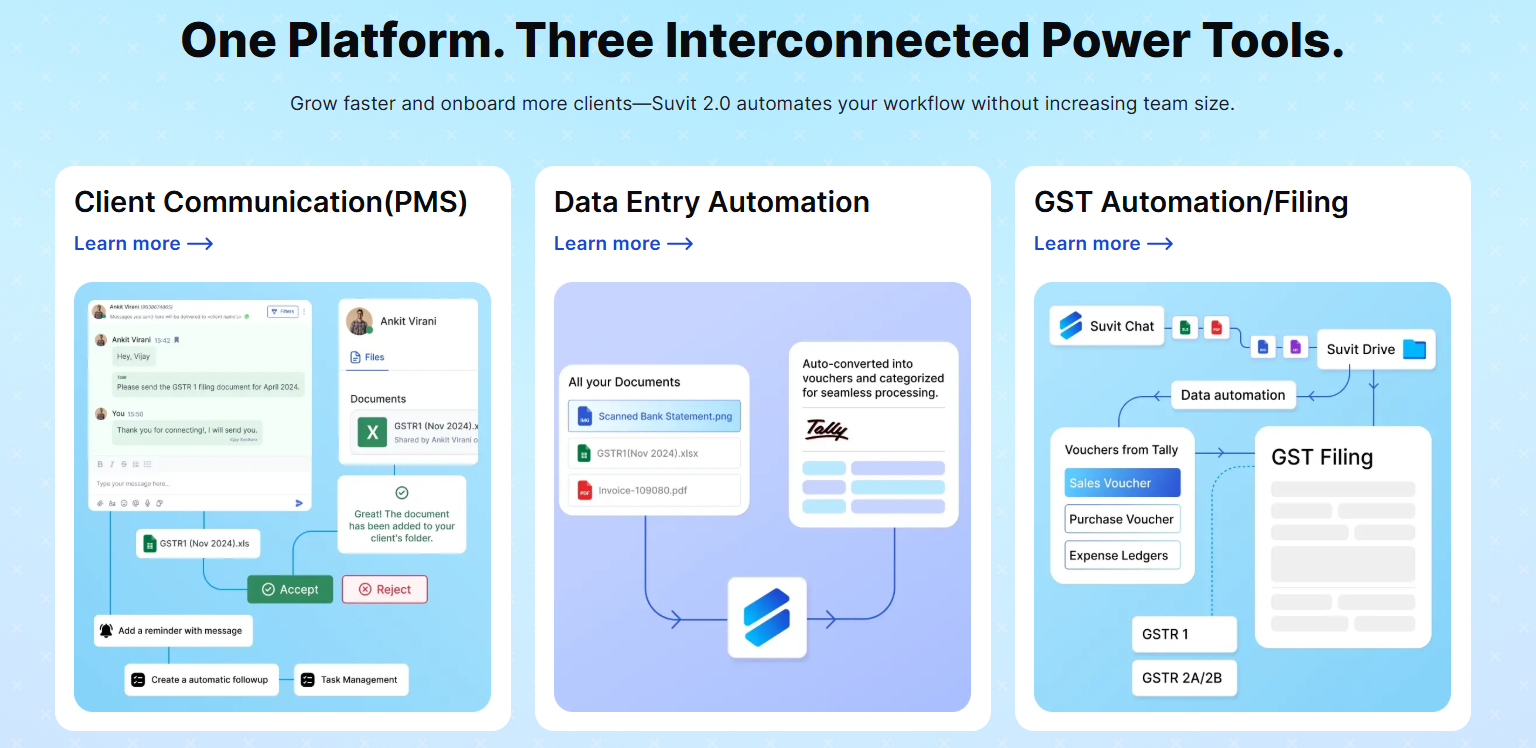

Suvit is a leading automated accounting tool designed to meet the needs of modern Chartered Accountants. With features like:

- Seamless GST compliance

- Automated data entry and reconciliation

- Real-time dashboards and reporting

- High-level data security

It helps CA professionals streamline financial workflows while focusing on advisory services that grow client businesses.

By adopting Suvit, Chartered Accountants can reduce manual workload, boost productivity, enhance compliance, and embrace a future-ready accounting practice.

FAQs

1. What is automated accounting?

Automated accounting refers to managing financial operations like recording transactions, generating invoices, filing taxes, and staying compliant, using digital tools and software, reducing the need for manual input and increasing overall efficiency. For CAs in India, automation improves accuracy, reduces manual errors, speeds up reporting, and ensures timely compliance with GST and Income Tax regulations.

2. What are the key features to consider in automated accounting software for Indian CA firms?

Essential features include adherence to Indian GST and Tax laws, scalability for different client sizes, seamless integration with banking and payroll systems, customizable workflows, real-time reporting, and robust data security measures.

3. What makes Suvit ideal for CAs?

It offers GST integration, automation, custom reports, and strong security tailored for India.

4. Can automated accounting tools handle diverse client industries?

Yes. Scalable platforms like Suvit support multiple industry sectors and client sizes with customizable features to efficiently address sector-specific accounting and compliance needs.