The Institute of Chartered Accountants of India is fostering AI adoption by organizing numerous events, workshops, and innovation summits focused on artificial intelligence in accounting, auditing, and compliance.

Programs like the AI Innovation Summit 2025 and specialized certificate courses empower CAs to stay updated with emerging AI technologies and their practical applications.

Building on ICAI’s dedicated efforts, this blog explores how Indian Chartered Accountants can leverage AI for smarter accounting, uncovering the significant opportunities it presents and the challenges to navigate.

Staying informed and prepared is vital for CAs eager to lead in India’s rapidly evolving digital financial landscape.

Current AI Tools and Technologies for CAs

Indian Chartered Accountants have access to a powerful, evolving array of AI-driven tools designed to streamline their workflows, enhance compliance, and improve advisory services.

Leading the pack is Suvit, widely recognized for its India-specific features and ICAI endorsement under the CMP Benefits program:

Suvit

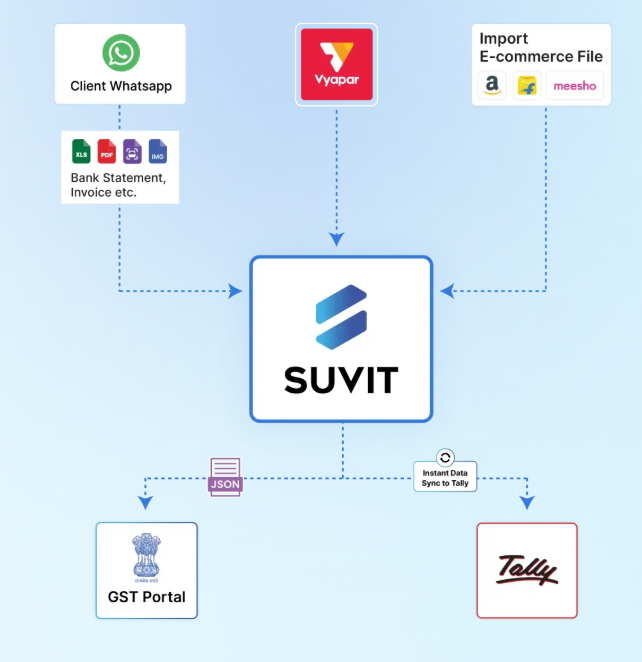

An AI-powered platform tailored for Indian CAs, Suvit automates end-to-end accounting operations, from intelligent document collection via WhatsApp reminders to seamless integration with popular accounting software like Tally and Vyapar.

It performs real-time GST reconciliation, flags compliance discrepancies, and generates audit-ready reports. Over 10,000 CAs across India trust Suvit, which includes client communication automation, workflow management, and robust security measures to protect sensitive financial data.

It significantly reduces manual bookkeeping efforts by up to 80%, enabling firms to scale easily while maintaining high accuracy and timely GST filing.

Following Suvit, other key AI and digital solutions under the ICAI CMP Benefits program include:

VIDUR AI Assistant

An AI-powered expert system covering tax, accounting, audit, corporate law, and compliance. Backed by 250+ specialists, VIDUR offers quick access to research, updates, drafting, and advisory services with source citations accessible via web, mobile, or WhatsApp, handling over 30,000 queries.

Click2Confirm

A digital app specializing in audit balance confirmation and other client communications. It automates secure confirmation requests, reducing manual interventions and expediting audit processes.

ICAI Practice Management Software

Designed to manage CA practice workflows, client data, billing, and compliance monitoring, this tool enables efficient handling of engagements and practice growth.

Anyaudit

An intelligent auditing platform that automates risk assessment, sample selection, and documentation, enhancing audit precision and efficiency.

Together, these AI platforms empower CAs in India to move beyond routine manual tasks, ensuring regulatory compliance and elevating their advisory capabilities in a rapidly digitalizing profession.

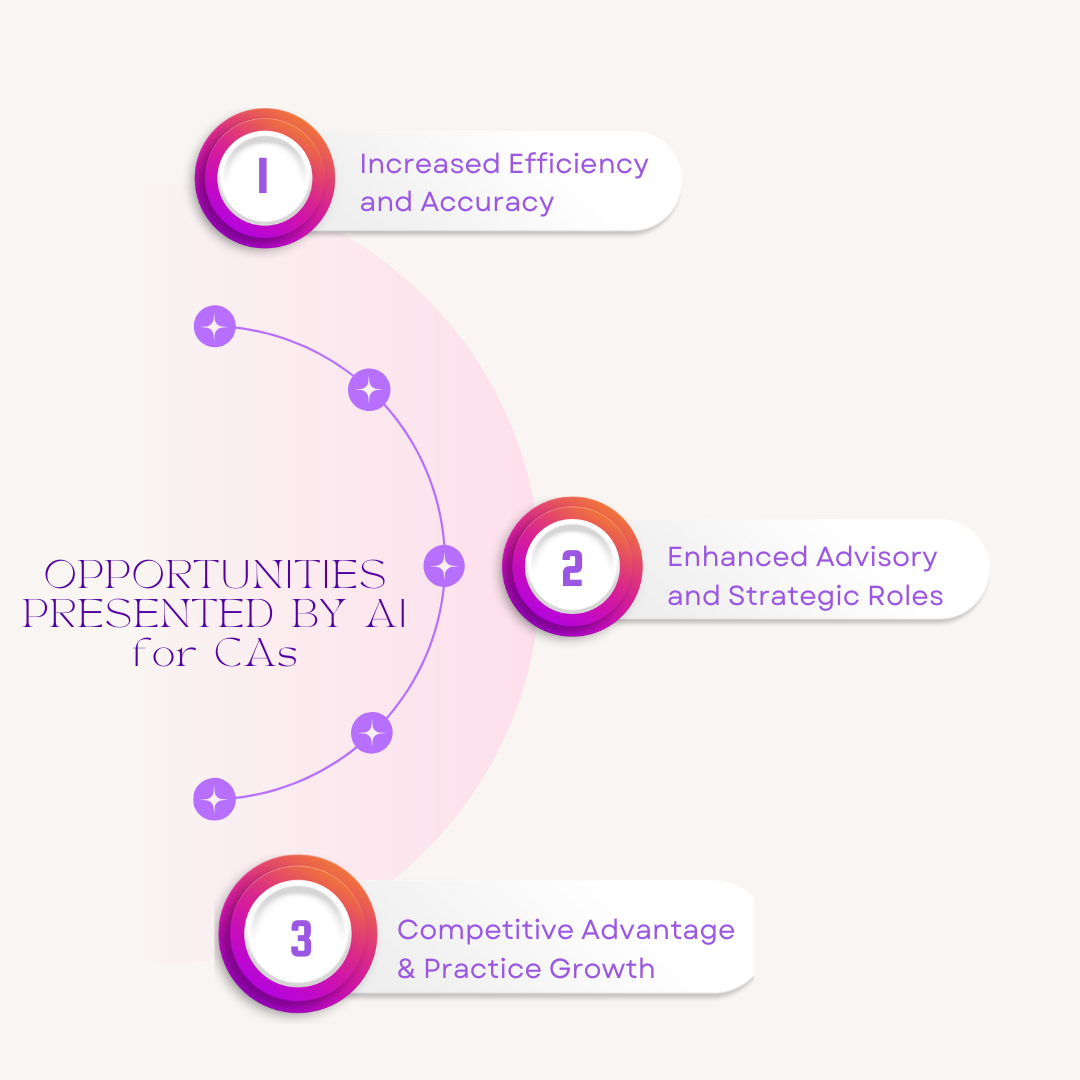

Opportunities Presented by AI for Chartered Accountants

Increased Efficiency and Accuracy

AI streamlines many repetitive accounting tasks, providing quicker and more dependable outcomes:

- Automates data entry, invoice processing, and reconciliations to save time.

- Reduces manual errors, improving the accuracy of financial records.

- Enables real-time financial reporting for timely decision-making.

- Simplifies GST compliance and audit documentation using AI-driven workflows.

Enhanced Advisory and Strategic Roles

Automating routine tasks allows CAs to concentrate on higher-value advisory work:

- Uses predictive analytics for accurate cash flow forecasting and tax planning.

- Provides data-driven insights for risk management and strategic business decisions.

- Facilitates real-time client dashboards and scenario analyses for proactive guidance.

- Strengthens client relationships through timely, personalized advisory.

Competitive Advantage and Practice Growth

Integrating AI delivers scalability and differentiation for CA firms:

- Allows handling increased client workloads efficiently without proportional resource expansion.

- Offers advanced services such as AI-enabled fraud detection and audit sampling.

- Enhances firm reputation by adopting cutting-edge technology solutions.

- Drives revenue growth through premium, tech-enabled offerings and improved client satisfaction.

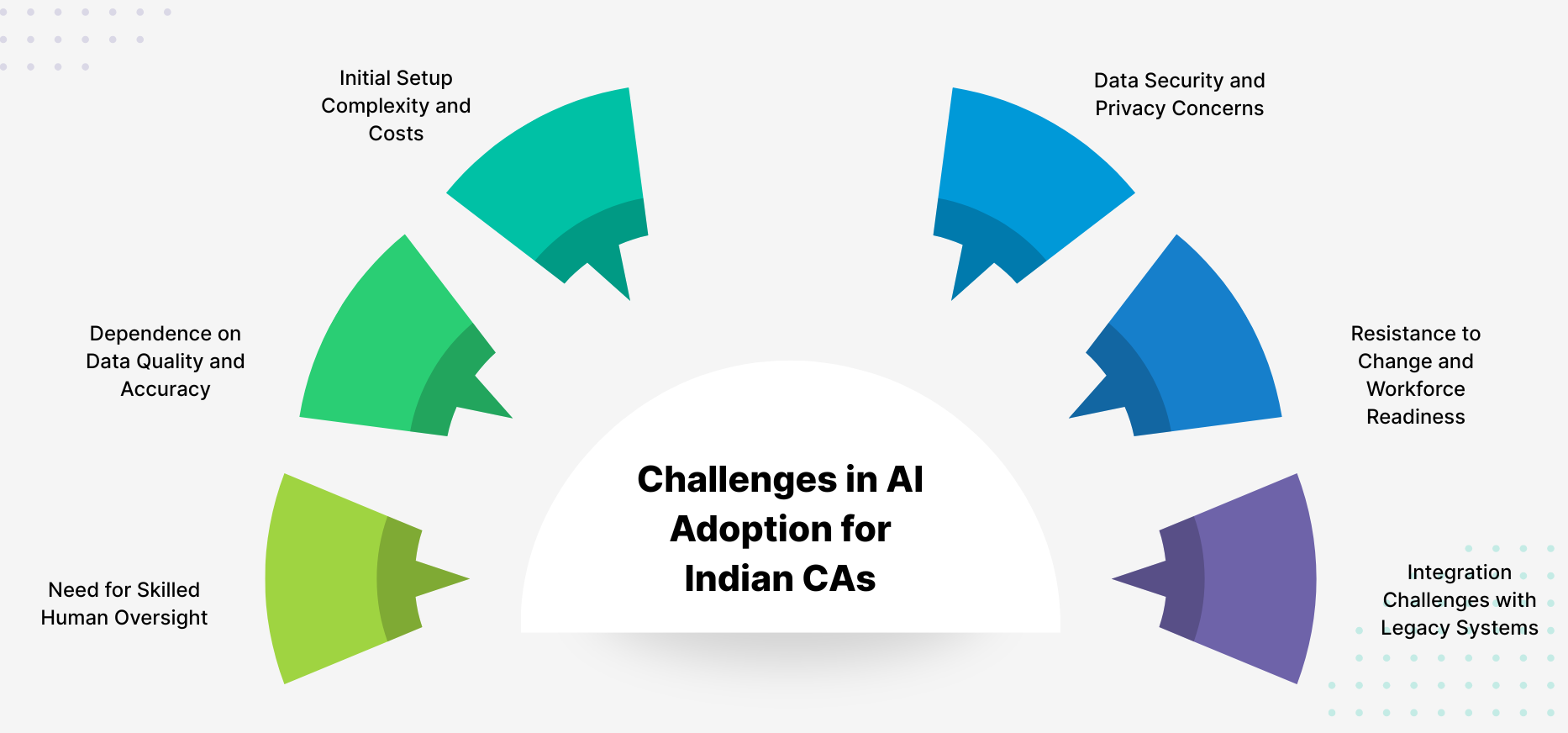

Challenges in AI Adoption for Indian CAs

Initial Setup Complexity and Costs

Implementing AI solutions requires upfront investment and process changes, which can pose challenges:

- Smaller firms, especially, may find the cost of AI tools, infrastructure upgrades, and staff training burdensome.

- Careful planning and phased implementation are essential to manage budgets and minimize disruption.

Dependence on Data Quality and Accuracy

AI systems rely heavily on high-quality, complete data inputs to deliver effective results:

- Poor or incomplete accounting records reduce AI effectiveness and increase error risks.

- Continuous data validation and cleanup are necessary for reliable AI outcomes.

Need for Skilled Human Oversight

AI cannot fully substitute professional judgment; human expertise remains essential:

- Complex accounting nuances and regulatory exceptions require CA intervention.

- Skilled personnel must interpret AI-generated insights and validate decisions.

Data Security and Privacy Concerns

Handling sensitive client financial information requires robust safeguards:

- It is essential to implement robust encryption, strict access controls, and secure audit trails.

- Compliance with Indian data protection regulations and ethical handling of AI outputs remains a top priority.

Resistance to Change and Workforce Readiness

Employees and clients may be hesitant to embrace AI technology fully:

- Common fears include job displacement and mistrust of automated processes.

- Transparent communication, training, and reassurance help ease the transition.

Integration Challenges with Legacy Systems

Legacy accounting software may not seamlessly interact with modern AI platforms:

- Technical gaps require expert support and possible infrastructure upgrades.

- Smooth integration is critical to avoid workflow disruption.

By proactively addressing these challenges, CAs can harness AI’s transformative potential while safeguarding data integrity, professional standards, and client trust.

Practical Insights and Actionable Recommendations for CAs

Steps to Start AI Integration in Your Practice

- Conduct a thorough process audit to identify repetitive tasks suited for AI automation.

- Choose ICAI-endorsed AI platforms such as Suvit that best match your practice’s needs.

- Implement AI in stages, beginning with financial reporting and GST compliance, to quickly realize benefits and gain user confidence.

Building Skills and Knowledge

- Engage in ICAI’s specialized AI workshops and certification programs to build expertise.

- Foster collaboration between finance professionals and IT experts for optimized AI implementation.

- Partner with AI vendors to secure ongoing support and timely updates.

Managing Change Effectively

- Clearly articulate AI benefits and address employee concerns through transparent communication.

- Provide continuous training and technical support to ensure smooth adoption.

AI as a Catalyst for Growth and Innovation in CA Practices

AI is no longer optional for Indian CAs; it is an essential enabler of smarter accounting and elevated advisory services. Balancing innovation with robust data security and ethical responsibility ensures sustainable growth.

By proactively integrating AI and embracing emerging technologies, CAs can secure their relevance, improve client outcomes, and thrive in a rapidly evolving financial landscape.

FAQs

Q1: What benefits does AI offer to Chartered Accountants in India?

A1: AI improves accuracy, automates routine tasks like GST filing and data entry, and enables CAs to focus on strategic advisory and client services.

Q2: Is AI suitable for small and mid-sized CA firms?

A2: Yes. Scalable AI tools are designed for practices of all sizes, offering affordable plans and easy integration with popular accounting software like Tally.

Q3: How does AI handle compliance with Indian tax laws?

A3: AI tools stay updated with GST, TDS, and other regulations, automatically applying correct rules and generating audit-ready reports for compliance assurance.

Q4: Will AI replace Chartered Accountants?

A4: No. AI augments CAs by handling repetitive tasks while enhancing decision-making, but human expertise and judgment remain essential for quality professional services.