Accounting software is an important tool for all kinds of businesses. It helps you track your finances, manage payroll, and generate reports. The accounting software industry has been shaped by various trends in recent years. This includes the rise of cloud computing and the increasing use of artificial intelligence (AI) and machine learning (ML).

In this article, we will take a look at 10 accounting software trends for 2024. We will discuss how these trends are changing the way businesses function in their daily life and the impact they are having on the accounting profession.

We will also discuss the future of accounting software and how it is expected to change in the coming years.

Let’s dive right in!

What is accounting software?

Accounting software is a computer program that helps businesses to track their finances, manage their payroll, and generate reports. It can be used to automate many of the tasks involved in accounting, such as recording transactions, creating invoices, and paying bills.

Why is accounting software important?

There are several reasons why accounting software is essential. Businesses can first benefit from time and cost savings. By automating many of the tasks involved in accounting, accounting software can free up businesses to focus on other areas, such as growing their business or serving their customers.

Second, accounting software can help businesses to improve their accuracy and efficiency. Accounting software can help reduce the risk of errors in accounting records, and it can also help businesses generate reports more quickly and easily.

Third, accounting software can help businesses to comply with tax regulations. Accounting software can help businesses to track their income and expenses, and it can also help them to generate the reports that they need to file their taxes accurately.

What are the benefits of using accounting software?

There are many benefits to using accounting automation tools, including:

- Saved time and money: Accounting software can automate many of the tasks involved in accounting, which can save businesses a lot of time and money.

- Improved accuracy and efficiency: Accounting software can help reduce the risk of errors in accounting records, and it can also help businesses generate reports more quickly and easily.

- Compliance with tax regulations: Accounting software can help businesses track their income and expenses, and it can also help them generate the reports that they need to file their taxes accurately.

- Better insights into business performance: Accounting software can help businesses generate reports that provide them with insights into their financial performance. Applying this information will help you make wiser business decisions.

- Scalability: Accounting software can be scaled up or down as a business grows, which makes it a good choice for businesses of all sizes.

Also Read: How Vyapar TaxOne’s AI-Powered Features Can Turn Around Your Accounting Practice

10 Accounting Software Trends for 2024

1. Artificial intelligence (AI) and machine learning (ML)

AI and ML are already being used in accounting software to automate tasks such as data entry, invoice processing, and fraud detection. For example, AI could be used to:

- Generate financial forecasts and reports based on historical data and current trends.

- Identify potential accounting errors and anomalies.

- Provide personalized recommendations to accountants based on their individual needs and preferences.

- Develop new accounting methods and procedures that are more efficient and effective.

2. Cloud computing

Cloud computing is already the most popular delivery model for accounting software. Cloud accounting offers a number of advantages, including:

- Scalability: Cloud-based accounting software can be easily scaled up or down as needed, making it a good choice for businesses of all sizes.

- Accessibility: Cloud-based accounting software can be accessed from anywhere with an internet connection, making it ideal for remote work and collaboration.

- Affordability: Cloud-based accounting software is typically more affordable than on-premises accounting software, as businesses do not need to invest in expensive hardware and software licenses.

In addition to these advantages, cloud-based accounting software providers are constantly innovating and adding new features. This means that businesses can be confident that they are using the most up-to-date accounting software, without having to worry about maintaining their own hardware and software infrastructure.

3. Data analytics

Data analytics is becoming increasingly important for businesses of all sizes. Accounting software can help businesses collect and analyze their financial data, which can provide valuable insights into their performance. In 2024, we can expect to see more accounting software providers offer data analytics features such as:

- Real-time dashboards and reports that provide insights into key financial metrics such as revenue, expenses, and profitability.

- Predictive analytics can help businesses to identify potential risks and opportunities.

- Benchmarks that allow businesses to compare their performance to similar businesses in their industry.

By using data analytics features, businesses can make more informed decisions about their operations and improve their overall performance.

4. Automation

Automation is another key trend in accounting software. Accounting software can automate a wide range of tasks, such as:

- Accounts payable: Accounting software can automatically generate and send invoices, process payments, and reconcile accounts payable.

- Accounts receivable: Accounting software can automatically generate and send statements, track customer payments, and send reminders to late-paying customers.

- Payroll: Accounting software can automatically calculate employee paychecks, deduct taxes and other deductions, and file payroll taxes.

In addition to these common tasks, accounting software can also automate a variety of other accounting tasks, such as journal entry recording, financial reporting, and tax preparation. By automating accounting tasks, businesses can save time and money, and improve the accuracy and efficiency of their accounting processes.

5. Mobile accounting

Mobile accounting is becoming increasingly popular as more and more accountants and business owners work on the go. Accounting software providers are developing mobile apps that allow accountants to access their financial data and perform tasks such as:

- Approving invoices

- Paying bills

- Reviewing financial reports

- Reconciling accounts

- Entering journal entries

Mobile accounting apps give accountants the flexibility to work from anywhere and at any time. This can be especially beneficial for businesses that operate in multiple locations or have employees who travel frequently.

For example, Vyapar TaxOne is an accounting automation software that offers a mobile application, enabling you to automate and manage Tally accounts on the go!

6. Blockchain

Blockchain is a distributed ledger technology that has the potential to revolutionize the accounting industry. Blockchain can be used to create secure and transparent financial records that are tamper-proof and auditable. This blockchain integration could be used for a variety of accounting purposes, such as:

- Automating accounts payable and receivable: Blockchain can be used to automate the accounts payable and receivable processes, making them more efficient and less prone to errors.

- Reconciling accounts: Blockchain can be used to reconcile accounts automatically, saving accountants time and hassle.

- Auditing financial statements: Blockchain can be used to audit financial statements more efficiently and effectively, as all transactions are recorded on a tamper-proof ledger.

7. Cybersecurity

Cybersecurity is a top concern for businesses of all sizes, and accounting software providers are investing in new technologies to protect their customers' financial data from cyberattacks. In 2024, we can expect to see more accounting software providers offer cybersecurity features such as:

- Two-factor authentication: Two-factor authentication adds an extra layer of security to user accounts, making them more difficult to hack.

- Data encryption: Data encryption encrypts financial data at rest and in transit, protecting it from unauthorized access.

- Regular security updates: Accounting software providers should release regular security updates to fix known vulnerabilities and protect their customers from new threats.

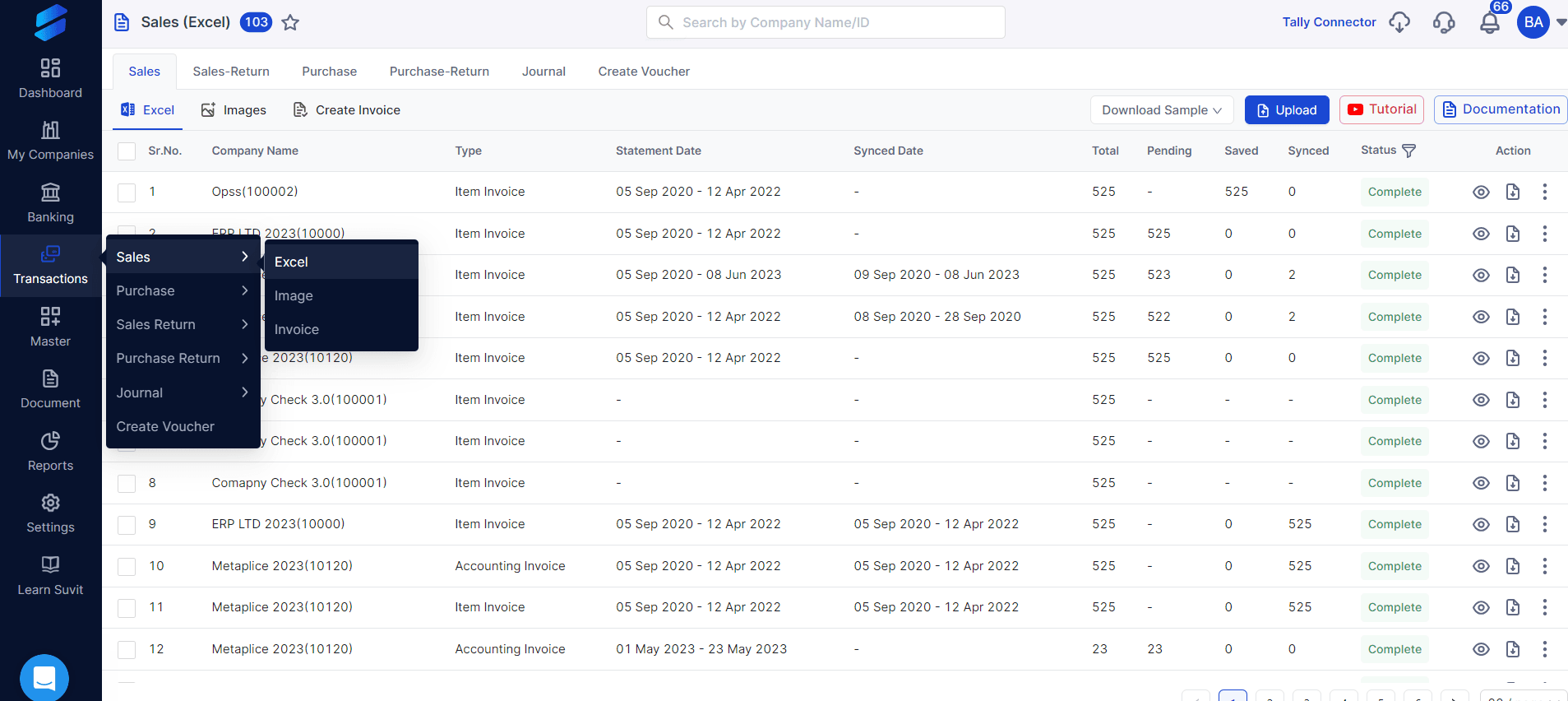

8. Integration with other business software

Accounting software is increasingly being integrated with other business software, such as CRM systems and ERP systems. This integration can help businesses to streamline their operations and improve their efficiency.

For example, an accounting software system could be integrated with a CRM system to automatically generate invoices from customer orders. Or, an accounting software system could be integrated with an ERP system to automatically update inventory levels when products are sold.

This type of integration will allow businesses to choose the accounting software system that best meets their needs, knowing that it can be integrated with their other business software systems to create a seamless workflow.

9. User-friendly interfaces

Accounting software providers are developing more user-friendly interfaces to make their software easier to use. This is especially important for small businesses that may not have a dedicated accountant.

In the years ahead, we can expect to see more accounting software providers offer user-friendly interfaces that are easy to learn and use, even for users with no prior accounting experience.

For example, Vyapar TaxOne is an accounting automation platform that easily allows you to transfer your accounting data from Excel sheets and PDFs to Tally automatically. You simply need to upload your files and it’s done!

10. Affordable pricing and global reach

Accounting software is becoming more affordable, making it accessible to businesses of all sizes. This is due to the rise of cloud computing and the increasing competition among accounting software providers.

In 2024, we can expect to see even more affordable accounting software options, making it easier for businesses to find accounting software solution that meets their needs and budget. For example, Vyapar TaxOne’s pricing plans start at just INR 5000 per year, making it perfect for small to large Indian businesses!

Also, Accounting software providers are expanding their global reach to meet the needs of businesses that operate internationally. In the upcoming years, we can expect to see even more accounting software providers offer support for multiple currencies and languages. This will make it easier for businesses to operate globally and to find accounting software that meets their specific needs.

Also Read: How Upskilling Can Save you Time and Money as a CA (and How to Do It)

How accounting software will change the way businesses operate

Accounting software is already having a major impact on the way businesses operate. By automating tasks and providing real-time insights, accounting software is helping businesses save time and money, improve their efficiency, and make better decisions.

In the upcoming future, we can expect to see accounting software play a greater role in business operations. As accounting software becomes more sophisticated and easier to use, it will be accessible to a wider range of businesses, including small businesses and start-ups. This will allow more businesses to benefit from the advantages of accounting software, such as improved efficiency and decision-making.

The impact of accounting software on the accounting profession

Accounting software is also having a significant impact on the accounting profession. As accounting software automates more and more tasks, accountants are being freed up to focus on more strategic and value-added activities. This includes tasks such as financial forecasting, risk assessment, and business advisory services.

In the years ahead, we can expect to see the role of the accountant evolve further. Accountants will need to have strong skills in data analysis, technology, and business acumen in order to be successful. They will also need to be able to provide their clients with insights and advice that can help them improve their financial performance and achieve their business goals.

Ready to dive into the future?

The future of accounting software is very bright. Accounting software is becoming more sophisticated, easier to use, and more affordable. This is making it accessible to a wider range of businesses and is having a major impact on the way businesses operate and the role of the accountant.

So, if you’re ready to embrace the future and dive into the world of better accounting, try out Vyapar TaxOne today! With its centralized ecosystem, Vyapar TaxOne automates all repetitive accounting tasks like data entry, client follow-ups, and finance data curation, freeing up accounting professionals and tax experts to concentrate on higher-value tasks like productive accounting.

You can take a free trial and try out Vyapar TaxOne for 7 days without the need to provide any credit card details. Simply sign up for your account, and you’re good to go!